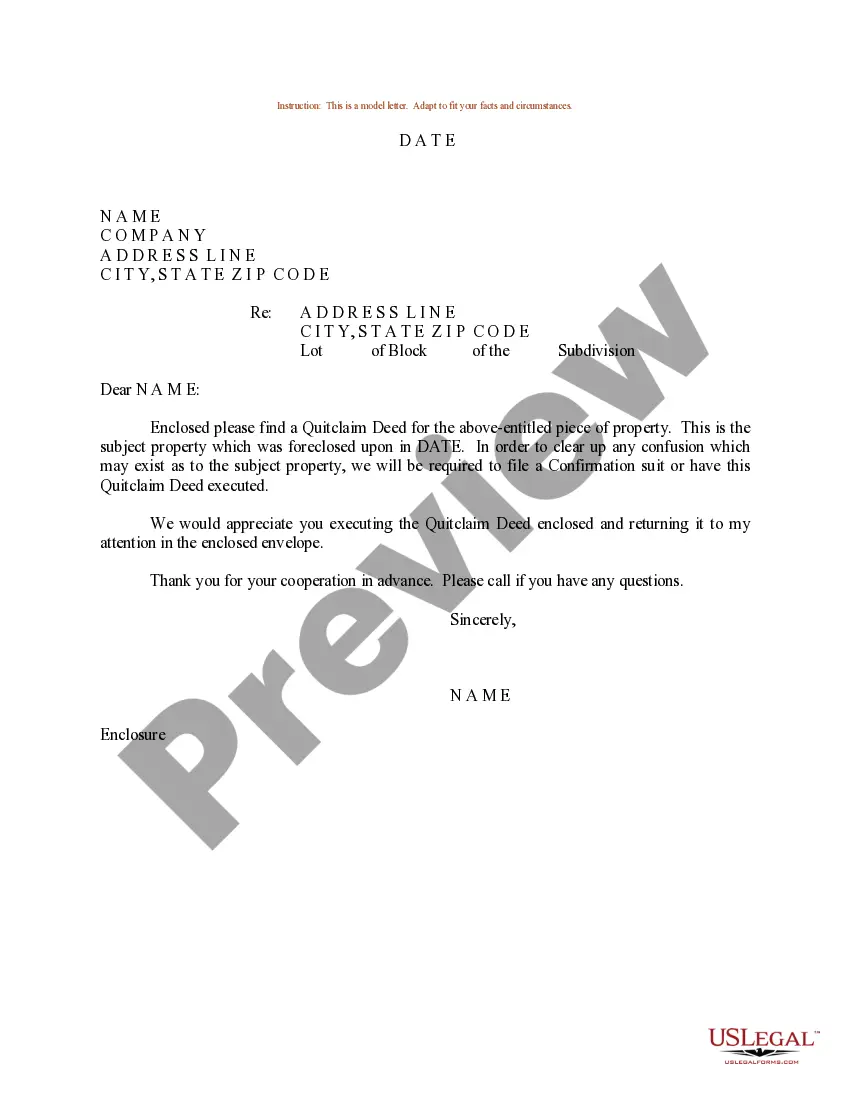

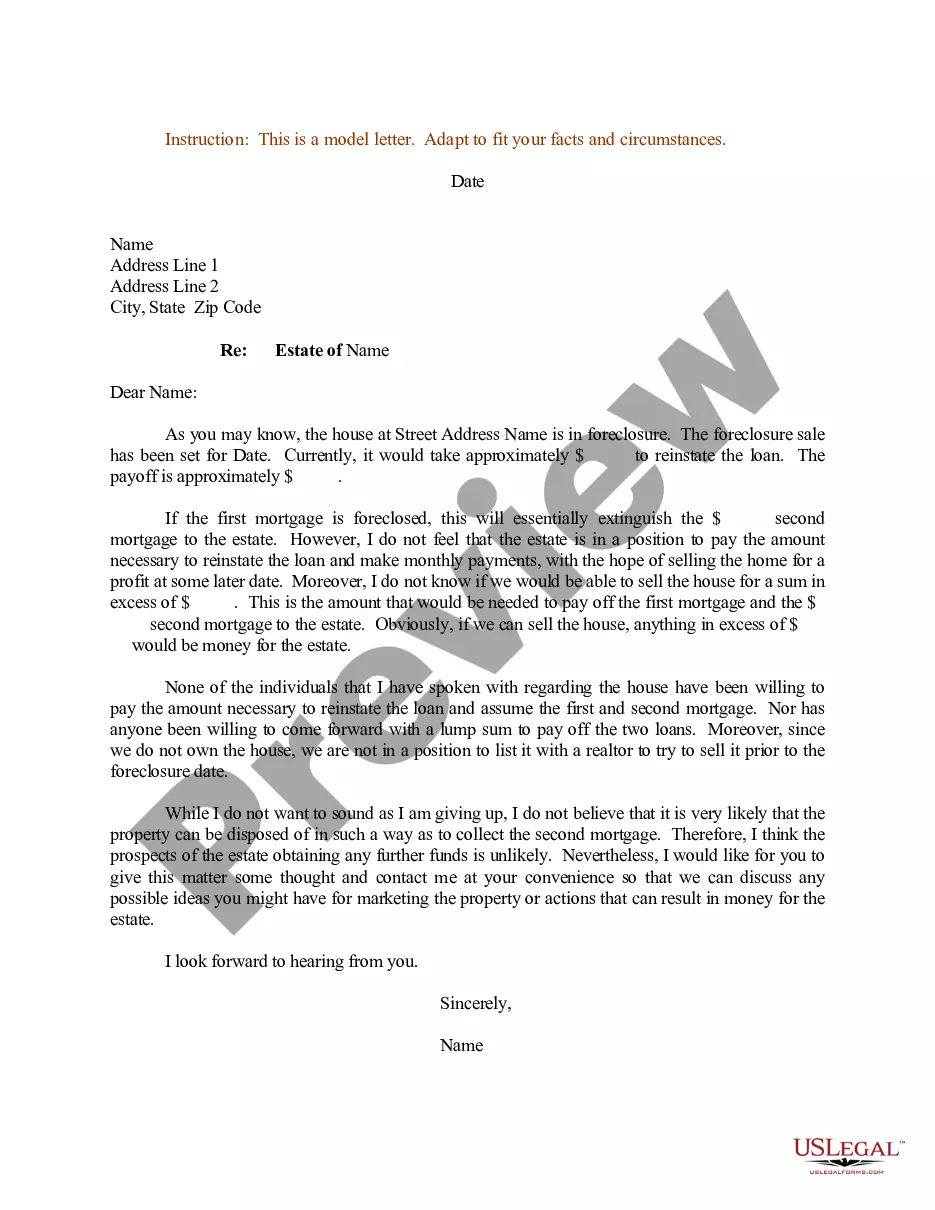

Virginia Sample Letter for Judicial Foreclosure

Description

How to fill out Sample Letter For Judicial Foreclosure?

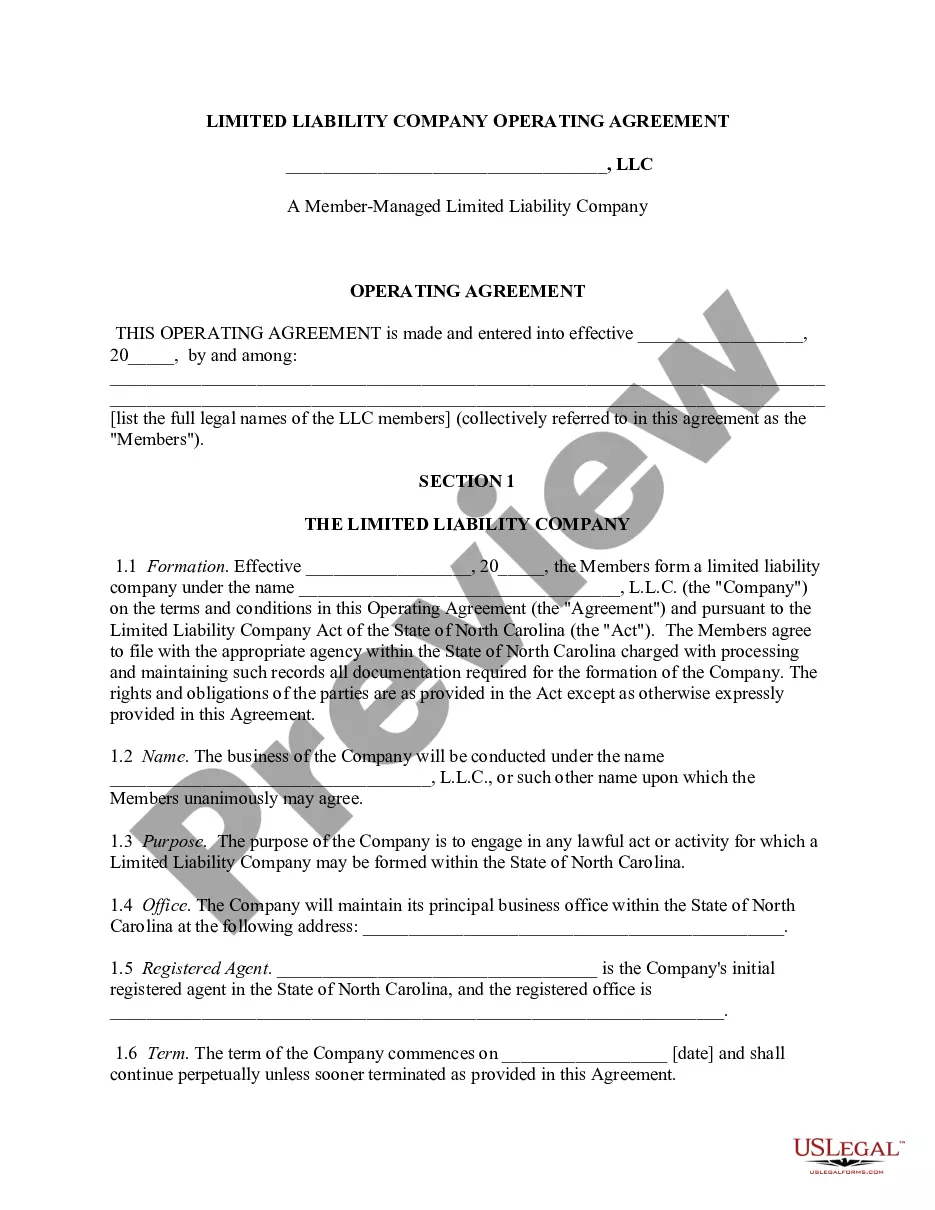

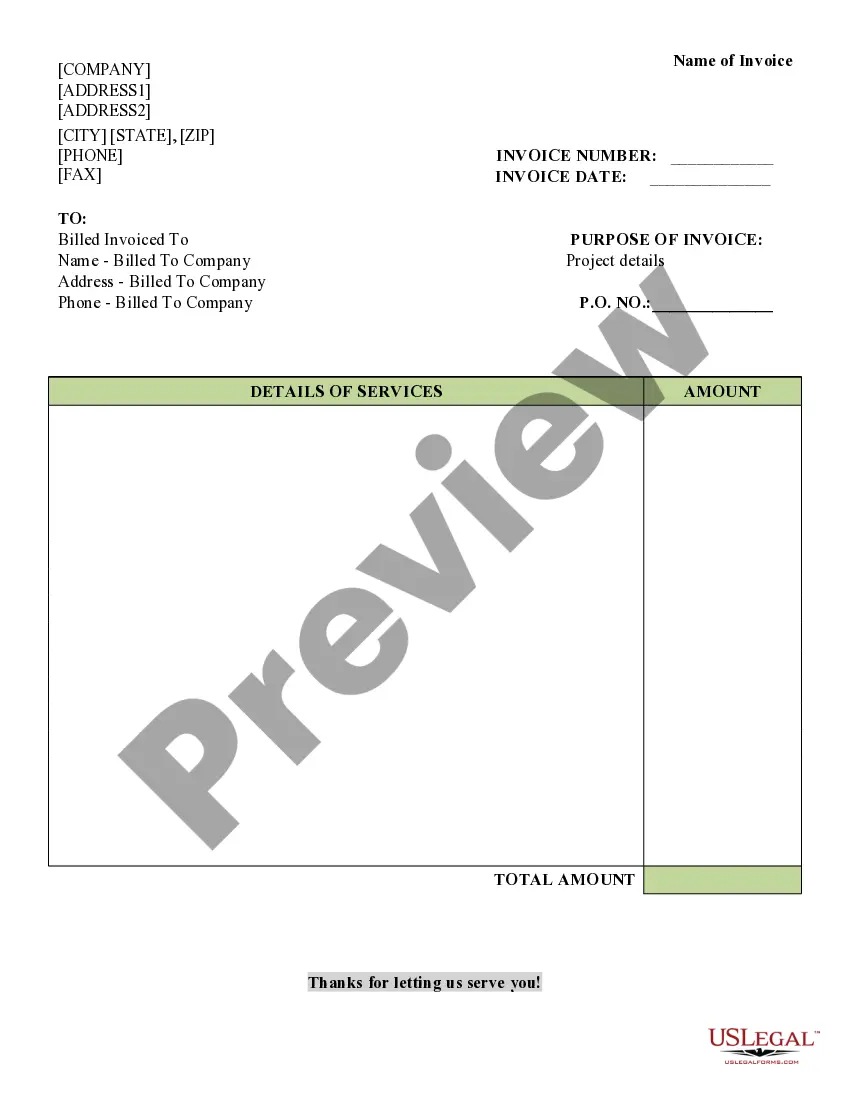

It is possible to invest hrs on-line looking for the legal file web template which fits the federal and state needs you want. US Legal Forms provides a large number of legal forms which can be evaluated by pros. It is simple to download or produce the Virginia Sample Letter for Judicial Foreclosure from our service.

If you currently have a US Legal Forms bank account, you can log in and click on the Down load button. Following that, you can full, revise, produce, or sign the Virginia Sample Letter for Judicial Foreclosure. Every single legal file web template you purchase is yours forever. To obtain another version for any bought form, proceed to the My Forms tab and click on the related button.

If you are using the US Legal Forms site for the first time, follow the easy directions beneath:

- Initial, make sure that you have chosen the correct file web template to the county/city of your choice. Look at the form outline to make sure you have chosen the proper form. If accessible, utilize the Review button to look with the file web template as well.

- If you wish to locate another version of the form, utilize the Research industry to obtain the web template that meets your requirements and needs.

- Upon having located the web template you need, click Acquire now to continue.

- Pick the prices plan you need, type in your references, and sign up for an account on US Legal Forms.

- Total the financial transaction. You may use your credit card or PayPal bank account to fund the legal form.

- Pick the structure of the file and download it for your gadget.

- Make adjustments for your file if required. It is possible to full, revise and sign and produce Virginia Sample Letter for Judicial Foreclosure.

Down load and produce a large number of file layouts while using US Legal Forms site, which provides the biggest collection of legal forms. Use skilled and state-particular layouts to take on your organization or person requirements.

Form popularity

FAQ

While the process varies by state, in general lenders pursue the following course of action to initiate a judicial foreclosure: Notice of intent: Once a mortgage is unpaid for 120 days, the lender informs the borrower by mail that foreclosure proceedings will begin.

Chapter 13 bankruptcy in Virginia: It is a common option to go for to stop foreclosure. ing to chapter 13 bankruptcy, you are given a payment plan of 3 or 5 years to catch up with the payment in arrears. The lenders will be given orders to stop going forward with the foreclosure process.

Non-judicial foreclosures do not involve courts, but require what is known as a ?sale under the power of sale.? When a mortgage is first signed, it typically contains language called a ?power of sale clause.? This lets an attorney foreclose on a property once defaulted on, in an attempt to pay off the defaulted loan ( ...

Is a foreclosure done through court? No. Under Virginia law, foreclosures are done outside of court. Virginia is a non-judicial state therefore the Trustee simply sells your property, usually at a public auction to the highest bidder.

How to improve your credit scores after an eviction or foreclosure Monitor your credit reports and credit scores. Keep a careful eye on your credit reports and scores as you work to rebuild your credit history. ... Work on your payment history. ... Lower your credit utilization ratio. ... Consider a secured credit card.

You can potentially file for bankruptcy or file a lawsuit against the foreclosing party (the "bank") to possibly stop the foreclosure entirely or at least delay it. If you have a bit more time on your hands, you can apply for a loan modification or another workout option.

In Virginia, a creditor (someone to whom you owe money) may not foreclose unless you're more than 10 days late with a payment. If you make all missed payments and any late fees, within 10 days of the due date, a creditor may not foreclose.

You should confirm that the option of your choice is available and that you qualify for the option. REINSTATE YOUR MORTGAGE ? ... REFINANCE ? ... REPAYMENT PLAN ? ... FORBEARANCE ? ... LOAN MODIFICATION ? ... BANKRUPTCY (Chapter 13) ? ... SELL THE PROPERTY ? ... SHORT SALE ?