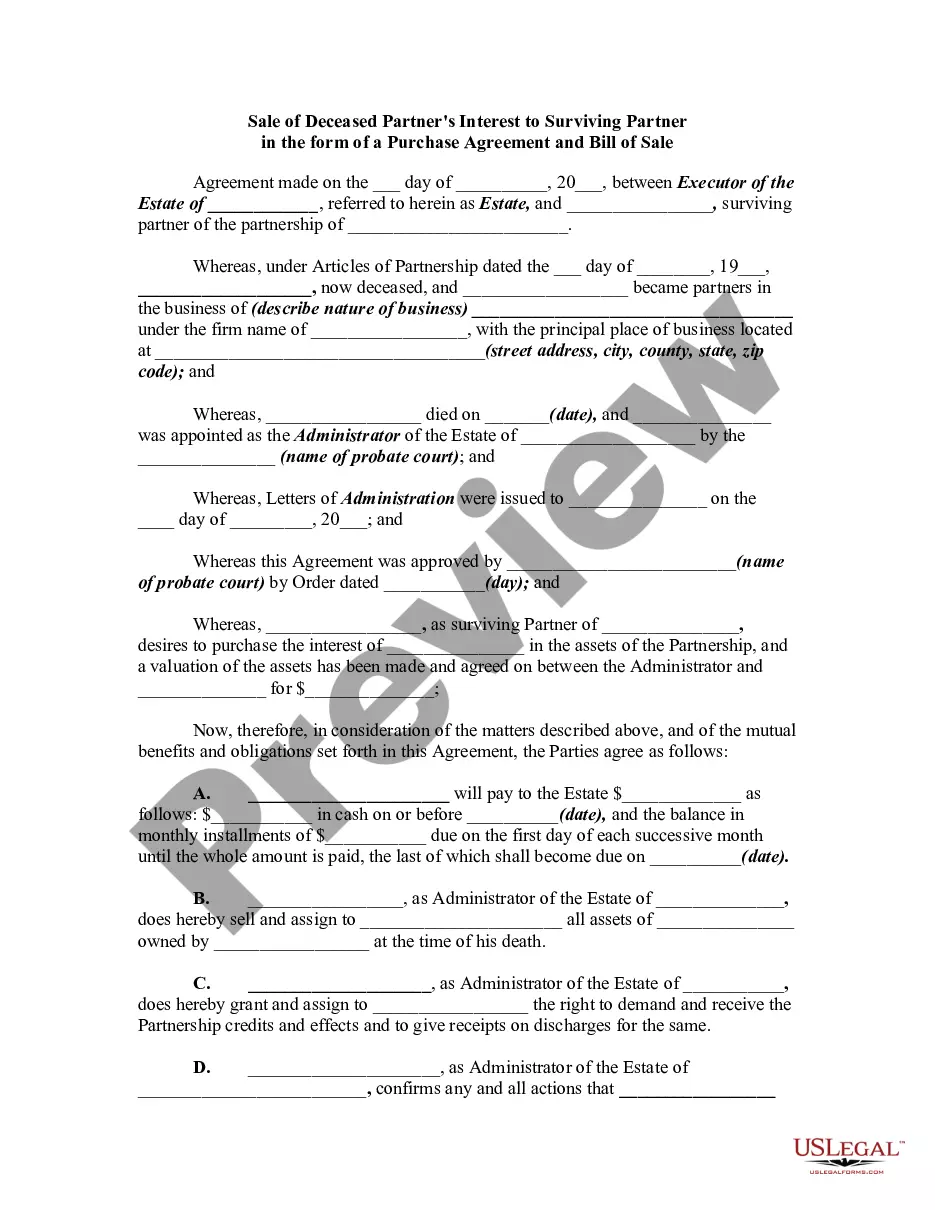

Virginia Sale of Deceased Partner's Interest

Description

How to fill out Sale Of Deceased Partner's Interest?

If you wish to obtain, acquire, or print official document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Leverage the site's straightforward and user-friendly search to locate the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords. Utilize US Legal Forms to find the Virginia Sale of Deceased Partner's Interest with just a few clicks.

Every legal document template you obtain is yours forever. You have access to every form you downloaded within your account. Select the My documents section and choose a form to print or download again.

Complete and download, and print the Virginia Sale of Deceased Partner's Interest with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to download the Virginia Sale of Deceased Partner's Interest.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form's details. Remember to check the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search field near the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit and print or sign the Virginia Sale of Deceased Partner's Interest.

Form popularity

FAQ

Key Takeaways. Interest from Treasury bills (T-bills) is subject to federal income taxes but not state or local taxes. The interest income received in a year is recorded on Form 1099-INT. Investors can opt to have up to 50% of their Treasury bills' interest earnings automatically withheld.

Federal law generally exempts interest on state and local government bonds and securities from income tax. Since Virginia law exempts only income from Virginia state and local obligations, an addition is required to bring interest income from obligations of other states into Virginia taxable income.

Income from bonds issued by the federal government and its agencies, including Treasury securities, is generally exempt from state and local taxes.

Explanation: The deceased partner's share in profit up to the date of his death will be credited to his capital account, as the amount is required to be paid to him. Thereafter, this amount is transferred to his Executors' Loan Account.

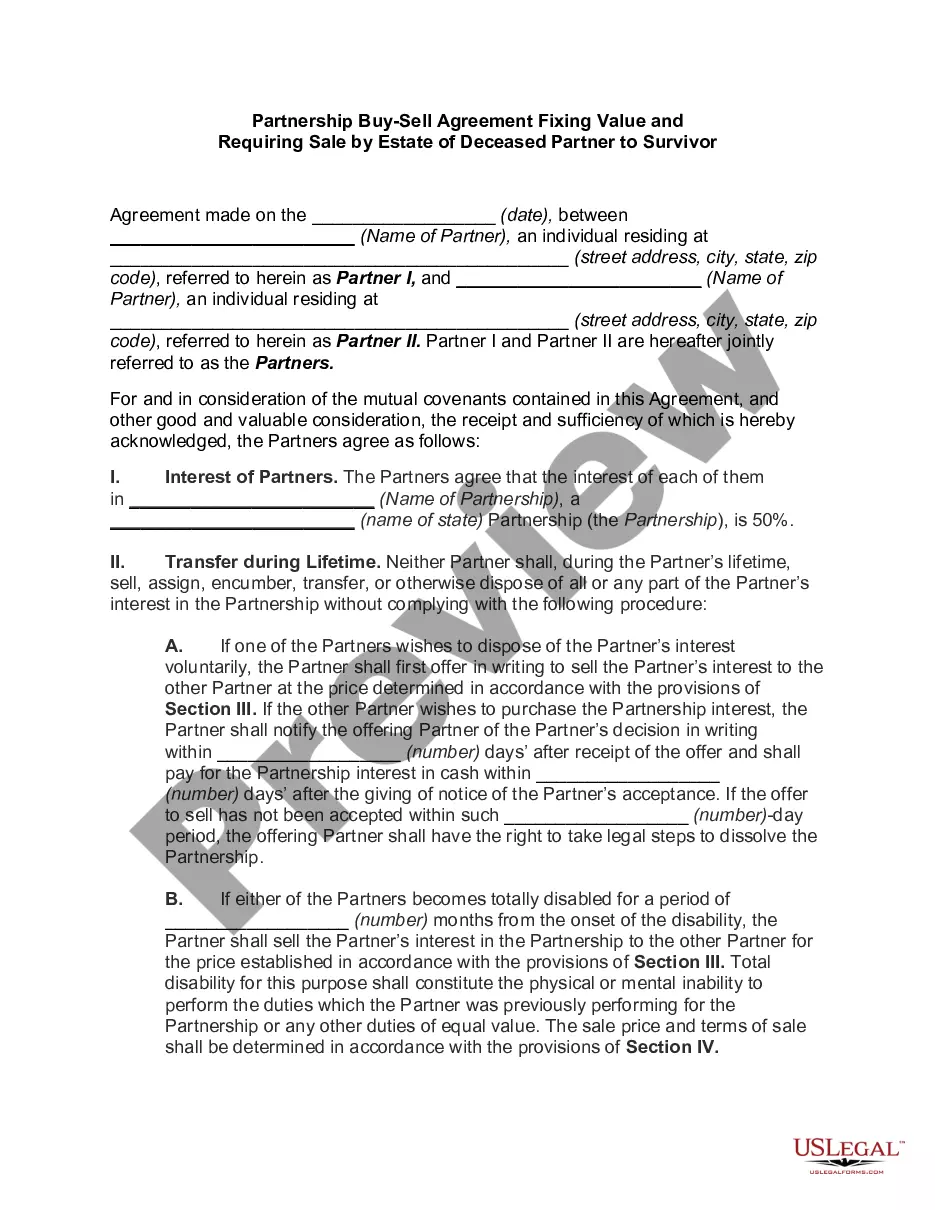

Keeping it successful is even harder, and coping with the death of a partner may be the hardest situation of all. When that happens, your deceased partner's share in the business usually passes to a surviving spouse, either by terms of a will or simply by default as the primary heir.

The adjustments to be done in the accounts incase of death of a partner is the same as in the case of retirement of a partner except settlement of the amount due to the deceased partner. Incase of retirement, the amount due from the firm is paid to the partner himself.

Section 42(c) of the partnership Act can appropriately be applied to a partnership where there are more than two partners. If one of them dies, the firm is dissolved; but if there is a contract to the contrary, the surviving partners will continue the firm.

Is savings bond interest taxable? The interest that your savings bonds earn is subject to: federal income tax, but not to state or local income tax. any federal estate, gift, and excise taxes as well as any state estate or inheritance taxes.

Explanation: The deceased partner's share in profit up to the date of his death will be credited to his capital account, as the amount is required to be paid to him. Thereafter, this amount is transferred to his Executors' Loan Account.

Business partnership agreement. A properly arranged and funded agreement is a legally binding contract that spells out exactly what is to happen if one of the business's owners dies. It generally calls for the survivors to buy the deceased owner's share in the business from his or her heirs.