Virginia Revocable Living Trust for Single Person with Special Needs

Description

A Revocable Living Trust is designed to allow a Settlor (person establishing the Trust) to ensure that his/her estate does not require court-supervised probate.

How to fill out Virginia Revocable Living Trust For Single Person With Special Needs?

Searching for a Virginia Revocable Living Trust for Single Person with Special Needs on the internet might be stressful. All too often, you find papers which you think are alright to use, but find out afterwards they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional legal professionals in accordance with state requirements. Have any form you’re searching for within a few minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll instantly be included to your My Forms section. If you do not have an account, you need to sign-up and pick a subscription plan first.

Follow the step-by-step recommendations below to download Virginia Revocable Living Trust for Single Person with Special Needs from the website:

- See the document description and press Preview (if available) to check if the template meets your requirements or not.

- In case the form is not what you need, find others with the help of Search engine or the listed recommendations.

- If it is appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the template in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms library. In addition to professionally drafted templates, users will also be supported with step-by-step guidelines regarding how to find, download, and fill out forms.

Form popularity

FAQ

Failure to set up a special needs trust might affect them, even if not as much as another person who receives, say, SSI and Medicaid. Even someone receiving Medicare will have some effect from having a higher income.

Well, they are both trusts. They are two different types of trusts.So the special-needs trust is a type of trust that is used to provide assets and resources to take care of a person with a disability, while the living trust is a will substitute that I might use in place of having a will for my estate plan.

The Special Needs Trust Fairness Act inserts language into the Social Security Act to give individuals with special needs the same right to create a trust as a parent, grandparent, guardian, or court. If competent to do so, they can now create a trust on their own behalf using their own assets.

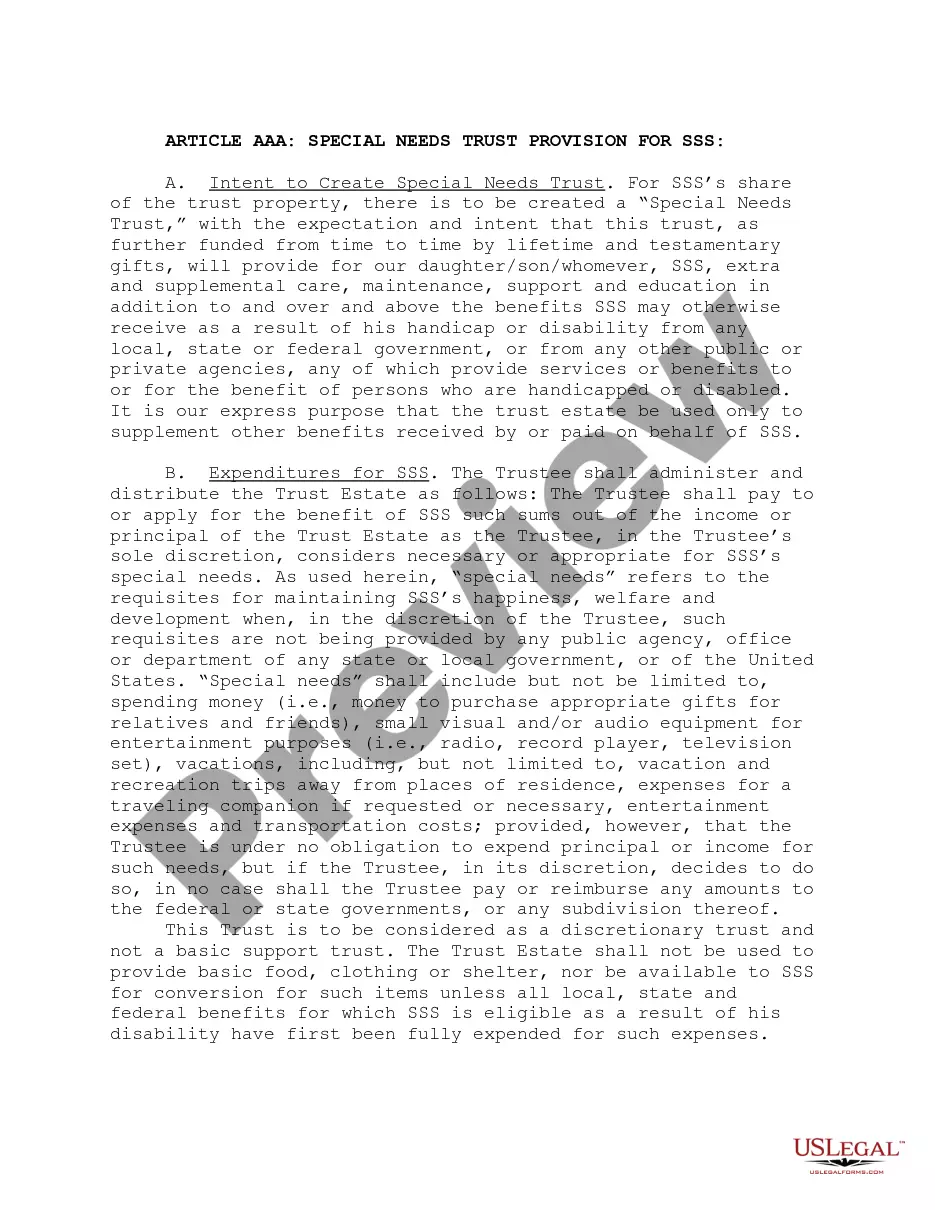

Special needs trust are trusts designed to improve the quality of life of a person with special needs, without affecting that person's eligibility for government benefits. To be effective, a special needs trust must be irrevocable.

Special needs trusts pay for comforts and luxuries special needs that could not be paid for by public assistance funds. This means that if money from the trust is used for food or shelter costs on a regular basis or distributed directly to the beneficiary, such payments will count as income to the beneficiary.

The SNT Trustee may reimburse third parties for items purchased for trust beneficiary. Purchase of personal items such as clothing, a computer, paying a phone bill or income taxes, would have no impact on SSI. But if food or shelter items are purchased, it is deemed ISM.

Special needs trusts pay for comforts and luxuries -- "special needs" -- that could not be paid for by public assistance funds. This means that if money from the trust is used for food or shelter costs on a regular basis or distributed directly to the beneficiary, such payments will count as income to the beneficiary.

All first-party SNTs must be irrevocable. A third-party SNT can be either irrevocable or revocable. Revocable A revocable trust is a trust in which the grantor can revoke or change the trust terms at any time. Only third-party SNTs can be revocable.

Special Needs Trusts can also pay for home and vehicle maintenance along with a variety of other items like a vacation, a computer, electronic equipment, educational expenses, and ongoing monthly bills such as phone, cable, and internet services.