Utah Self-Employed Route Sales Contractor Agreement

Description

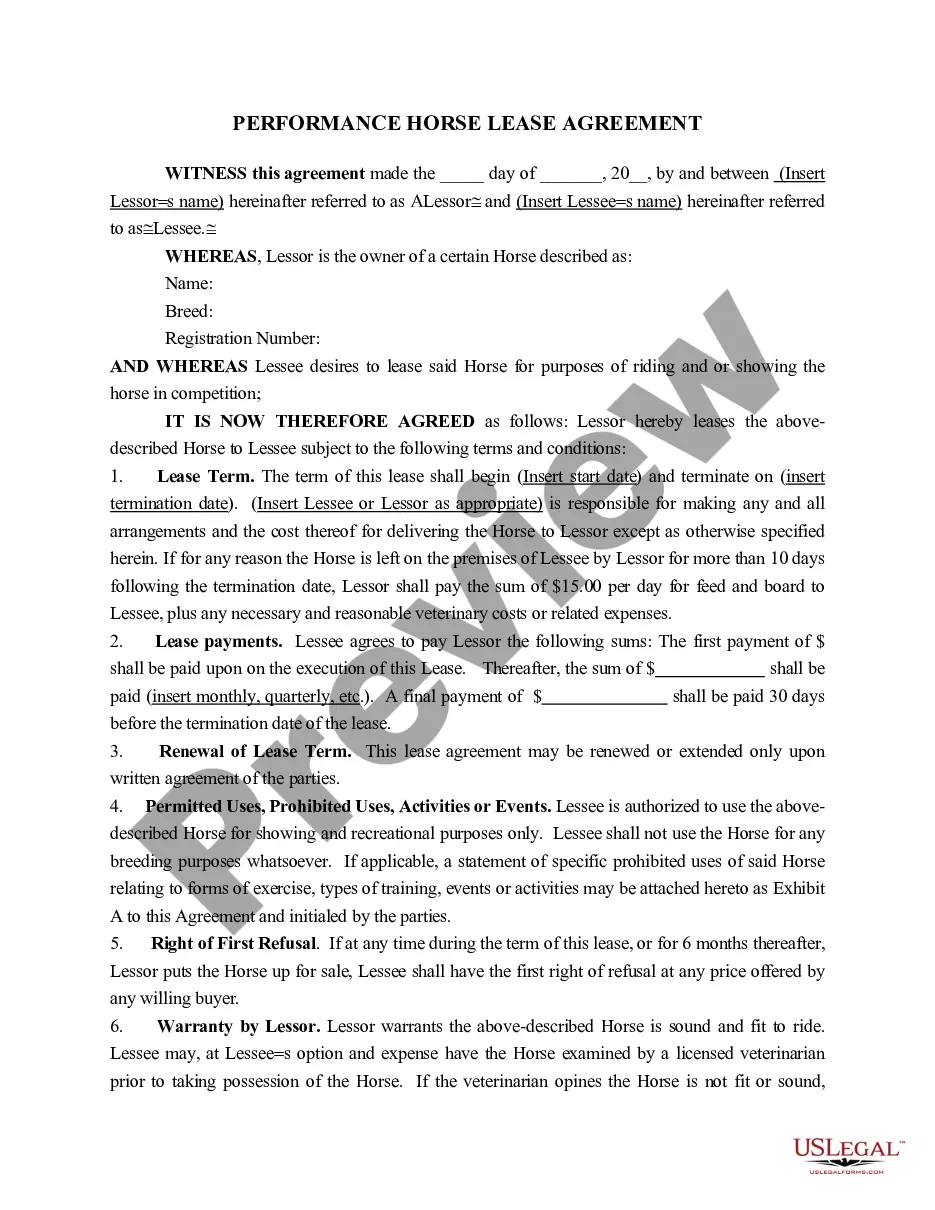

How to fill out Self-Employed Route Sales Contractor Agreement?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a diverse selection of legal form templates that you can download or create.

By utilizing the website, you can access thousands of forms for both business and personal use, categorized by types, states, or keywords. You can find the most recent forms such as the Utah Self-Employed Route Sales Contractor Agreement within minutes.

If you have a monthly subscription, Log In to retrieve the Utah Self-Employed Route Sales Contractor Agreement from your US Legal Forms library. The Download button will be available on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the payment.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Utah Self-Employed Route Sales Contractor Agreement.

Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or create another copy, simply navigate to the My documents section and click on the form you desire. Access the Utah Self-Employed Route Sales Contractor Agreement with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- If this is your first time using US Legal Forms, here are simple instructions to help you get started.

- Make sure you have selected the correct form for your city/state. Click the Preview button to review the form’s details.

- Check the form description to confirm you have selected the right one.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose your preferred pricing plan and provide your information to create an account.

Form popularity

FAQ

Yes, an independent contractor may need a business license in Utah, depending on the nature of their work and location. If you operate as a self-employed route sales contractor, it is essential to check local regulations to ensure compliance. Additionally, securing a Utah Self-Employed Route Sales Contractor Agreement can provide clarity on your responsibilities and rights. For further assistance, consider using the US Legal Forms platform to access the necessary templates and resources.

Writing an independent contractor agreement involves outlining the roles, responsibilities, and payment details between the contractor and the client. Begin with the basic information, then detail the work expectations, deadlines, and any confidentiality clauses. For a streamlined process, you can refer to uslegalforms for a Utah Self-Employed Route Sales Contractor Agreement template that meets your needs.

To fill out an independent contractor form, start by entering your personal and business information, including contact details and the nature of your work. Clearly outline the services you will provide and the compensation structure. For accuracy and legal compliance, consider using resources like uslegalforms to obtain a reliable Utah Self-Employed Route Sales Contractor Agreement template.

Filling out an independent contractor agreement involves including essential details such as the names of both parties, the scope of work, payment terms, and duration of the contract. You should ensure that each section is clear and comprehensive to avoid misunderstandings. Utilizing templates from uslegalforms can guide you in completing a Utah Self-Employed Route Sales Contractor Agreement effectively.

The independent contractor agreement can be written by either party, but it's often best to have a legal professional draft it. This ensures that the terms comply with Utah law and protect both parties. You can also use platforms like uslegalforms to access templates for a Utah Self-Employed Route Sales Contractor Agreement, which can simplify the process.

Yes, as an independent contractor in Utah, you typically need a business license to operate legally. This requirement helps ensure that you comply with local regulations. Depending on your specific business activities, you may also need additional permits. It’s wise to check with your local government for precise requirements regarding your Utah Self-Employed Route Sales Contractor Agreement.

To create a solid independent contractor agreement, start by outlining the key terms of the relationship. Include details such as the scope of work, payment terms, and duration of the contract. It's vital to ensure that both parties understand their obligations and rights under the agreement. For a comprehensive solution, consider using the Utah Self-Employed Route Sales Contractor Agreement available on US Legal Forms, which provides a structured template to guide you through the process.