Utah Payroll Deduction Authorization Form

Description

How to fill out Payroll Deduction Authorization Form?

If you want to obtain, download, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are categorized by types and states, or by keywords.

Every legal document template you acquire is yours forever. You can access all forms you downloaded from your account. Visit the My documents section and select a form to print or download again.

Compete and download, and print the Utah Payroll Deduction Authorization Form with US Legal Forms. There are countless professional and state-specific forms available for your personal or business needs.

- Use US Legal Forms to access the Utah Payroll Deduction Authorization Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to receive the Utah Payroll Deduction Authorization Form.

- You can also view forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

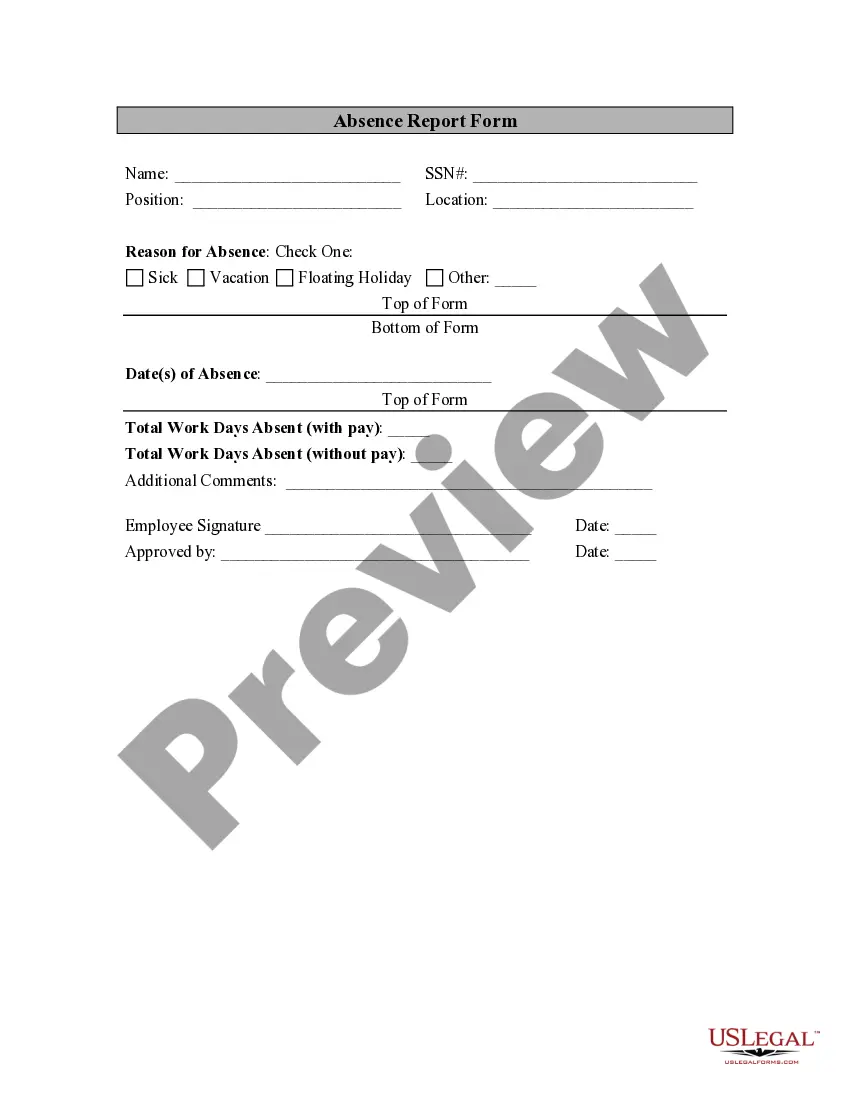

- Step 2. Use the Preview option to review the form’s contents. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you require, click on the Purchase now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Process the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Utah Payroll Deduction Authorization Form.

Form popularity

FAQ

Under California law, an employer may lawfully deduct the following from an employee's wages: Deductions that are required of the employer by federal or state law, such as income taxes or garnishments.

What Is a Wage Deduction Authorization Agreement? A wage deduction authorization agreement is a legal document that permits youthe employerto deduct the agreed-upon amount from an employee's salary. The reasons for the salary reduction vary.

Mandatory payroll deductions are the wages that are withheld from your paycheck to meet income tax and other required obligations. Voluntary payroll deductions are the payments you make to retirement plan contributions, health and life insurance premiums, savings programs and before-tax health savings plans.

The only legal option available is to demand that the employee pay the money back. Obviously, if the employee refuses to do so, the only thing the employer can do is to take the employee to court to recover the overpayment.

Can employers take back wages from overpaid employees? Both federal legislation like the Fair Labor Standards Act (FLSA) and state labor and employment laws give employers the right to recover an overpayment in full.

Rules for making deductions from your pay Your employer is not allowed to make a deduction from your pay or wages unless: it is required or allowed by law, for example National Insurance, income tax or student loan repayments. you agree in writing to a deduction.

If an employer makes an unlawful deduction from an employee's paycheck to recover a wage overpayment, the aggrieved employee can file a wage claim with the DLSE or file a lawsuit. A finding against an employer could expose the employer to penalties and the employee's attorney's fees.

No, your employer cannot legally make such a deduction from your wages if, by reason of mistake or accident a cash shortage, breakage, or loss of company property/equipment occurs.

3. Employers must absorb the cost of employees' mistakes. California law does not allow employers to make deductions from employees' wages for losses due to an employee's ordinary negligence.

Payroll Deduction Authorization Form means the form provided by the Corporation on which an Employee may elect to participate in the Plan and designate the percentage of his or her Compensation to be contributed to his or her Account through payroll deductions. Sample 1.