Utah Payroll Deduction - Special Services

Description

How to fill out Payroll Deduction - Special Services?

Are you presently in a role where you may require documentation for potentially business or individual purposes almost every day.

There are numerous legal document templates accessible on the internet, but sourcing reliable versions can be challenging.

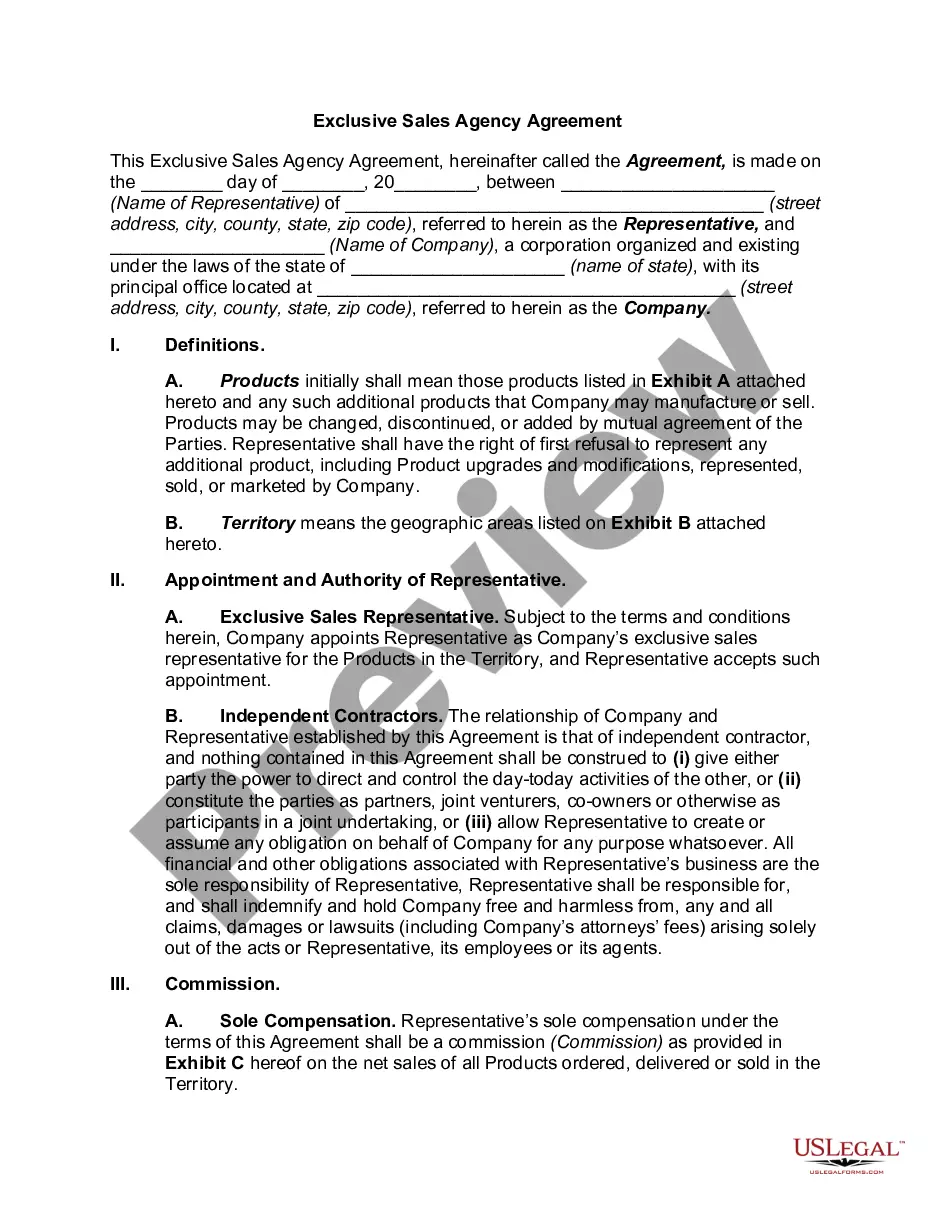

US Legal Forms offers a vast array of form templates, including the Utah Payroll Deduction - Special Services, which can be printed to comply with federal and state regulations.

Once you find the suitable form, click Acquire now.

Choose the pricing plan you prefer, enter the required information to create your account, and complete the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Utah Payroll Deduction - Special Services template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/region.

- Utilize the Preview button to view the form.

- Check the outline to confirm you have chosen the appropriate form.

- If the form does not meet your needs, use the Search section to find the form that aligns with your requirements and specifications.

Form popularity

FAQ

When hosting special events in Utah, organizers typically need to use a specific tax form to report any sales or income derived from the event. This ensures that they are compliant with state tax laws. Utilizing the correct forms allows you to leverage Utah Payroll Deduction - Special Services while managing event finances efficiently.

The 740 tax form is the primary state income tax return form used by residents in Utah. It helps individuals report their income, deductions, and tax liabilities. Understanding this form is crucial for individuals seeking to maximize their Utah Payroll Deduction - Special Services benefits and stay compliant with state laws.

Section 34-28-3 emphasizes the criteria for making payroll deductions in Utah. This includes stipulations on how employers can deduct amounts from wages for specified reasons. Knowledge of this section is crucial for any business looking to introduce Utah Payroll Deduction - Special Services while ensuring compliance with state laws.

Utah Code 34-28-19 addresses protections for employees regarding unauthorized or illegal wage deductions. This section ensures that employees are treated fairly and receive their entitled wages without improper deductions. For businesses looking to navigate payroll legally, familiarizing themselves with this code is vital to the successful implementation of Utah Payroll Deduction - Special Services.

TC40 is the name of the report that issuing banks send to Visa to report fraudulent transactions as part of its Risk Identification Service, and SAFE (System to Avoid Fraud Effectively) is Mastercard's analogous fraud monitoring program.

Form TC-941E is an Annual Employer Reconciliation report used to report wages and withholding tax returns for employees.

Utah Form TC-40 Personal Income Tax Return for Residents.

Have New Employees Complete a Federal Tax Form All new employees for your business must complete a federal Form W-4. Unlike many other states, Utah does not have a separate state equivalent to Form W-4, but instead relies on the federal form. You can download blank Forms W-4 from irs.gov.

You can find your Withholding Account ID on any mail you have received from the State Tax Commission, or or any previously filed tax forms. If you're unsure, contact the agency at (801) 297-2200.

Summary. The income tax withholding formula for the State of Utah has been updated to eliminate the withholding allowance for employees who have not filed a W-4 form. The tax withheld will be at a flat 4.95 percent for those employees. No action on the part of the employee or the personnel office is necessary.