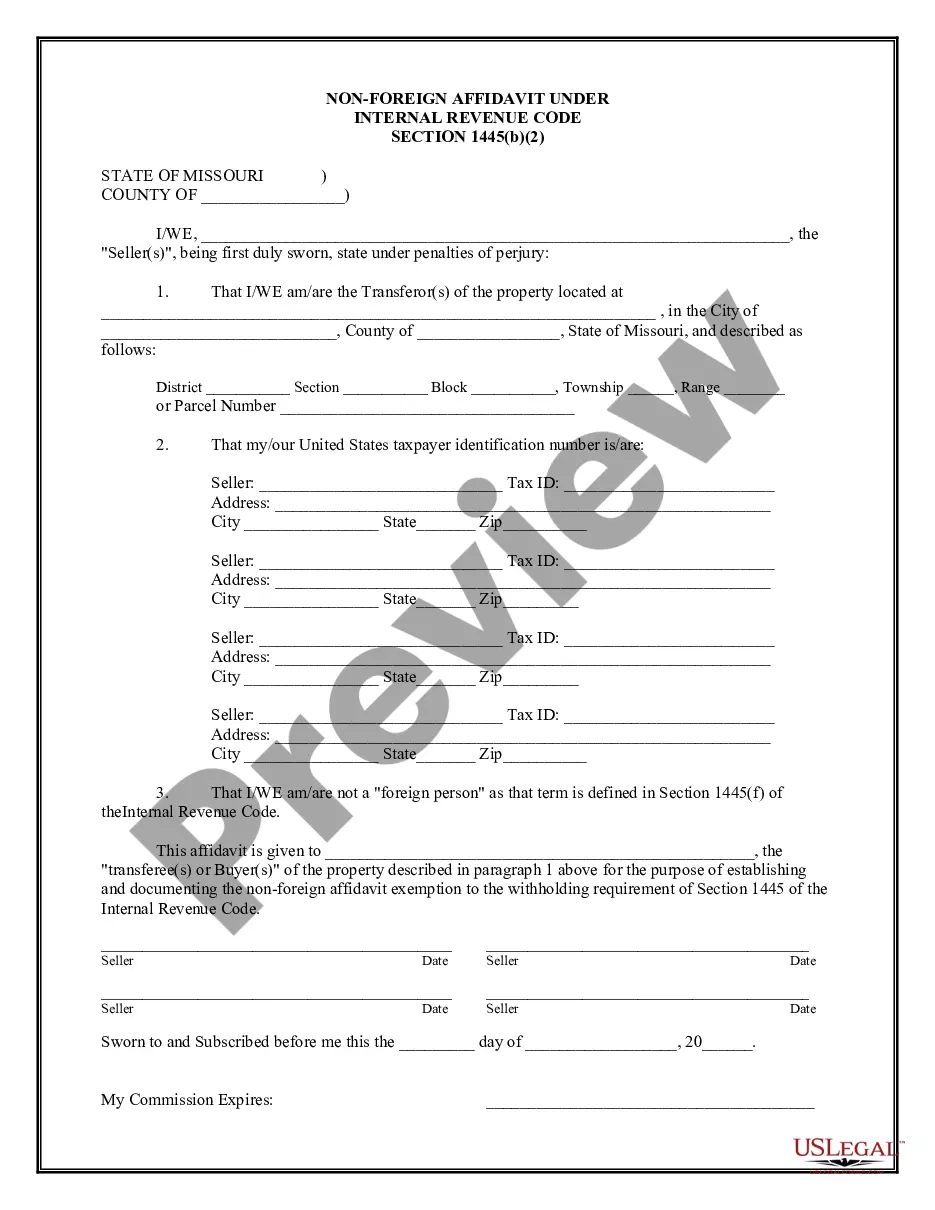

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Missouri Non-Foreign Affidavit Under IRC 1445

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Non-Foreign Affidavit Under IRC 1445?

Obtain any variety from 85,000 legal documents including Missouri Non-Foreign Affidavit Under IRC 1445 online with US Legal Forms. Each template is crafted and revised by state-authorized legal experts.

If you already possess a subscription, Log In. When you are on the form’s page, click the Download button and navigate to My documents to access it.

In case you haven’t subscribed yet, follow the instructions below.

With US Legal Forms, you will always have immediate access to the appropriate downloadable sample. The platform provides you with access to forms and categorizes them to streamline your search. Use US Legal Forms to acquire your Missouri Non-Foreign Affidavit Under IRC 1445 easily and swiftly.

- Verify the state-specific prerequisites for the Missouri Non-Foreign Affidavit Under IRC 1445 you need to utilize.

- Examine the description and preview the template.

- Once you’re assured the template meets your requirements, click Buy Now.

- Choose a subscription plan that fits your budget effectively.

- Establish a personal account.

- Make payment in either of two convenient methods: by credit card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- When your reusable template is prepared, print it out or save it to your device.

Form popularity

FAQ

According to FIRPTA, a foreign person includes non-resident aliens, foreign corporations, and foreign partnerships. If an individual or entity does not meet the criteria for U.S. residency, they are classified as a foreign person. This classification impacts tax obligations related to real estate transactions in Missouri. To ensure clarity in your transactions, consider using US Legal Forms to prepare the necessary documentation, including the Missouri non-foreign affidavit under IRC 1445.

Yes, Missouri requires nonresident withholding for property sales involving foreign sellers. This rule is part of the IRS regulations under FIRPTA, which mandates withholding a portion of the sales proceeds to ensure tax compliance. However, if a seller submits a Missouri non-foreign affidavit under IRC 1445, they can prove their non-foreign status and avoid this withholding. You can find templates and guidance on US Legal Forms to navigate this process effectively.

A FIRPTA statement is a declaration made by the seller of real estate, confirming their status as a foreign or non-foreign person. For instance, a Missouri non-foreign affidavit under IRC 1445 might state that the seller is a U.S. citizen or resident, thereby exempting the buyer from certain withholding requirements. This statement protects both parties in the transaction and ensures compliance with IRS regulations. Utilizing a service like US Legal Forms can help generate an accurate FIRPTA statement quickly.

foreign affidavit is a legal document that certifies the seller of a property is not a foreign person, as defined under the Internal Revenue Code. This affidavit is crucial for real estate transactions to ensure compliance with the Foreign Investment in Real Property Tax Act (FIRPTA). In Missouri, the nonforeign affidavit under IRC 1445 helps avoid unnecessary withholding taxes on property sales. By using a reliable platform like US Legal Forms, you can easily create and file the necessary affidavit.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.

The Foreign Investment in Real Property Tax Act of 1980, also known as FIRPTA, may apply to your purchase. FIRPTA is a tax law that imposes U.S. income tax on foreign persons selling U.S. real estate.If the law applies to your purchase, then within 20 days of the sale, you are required to file Form 8288 with the IRS.