Utah Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

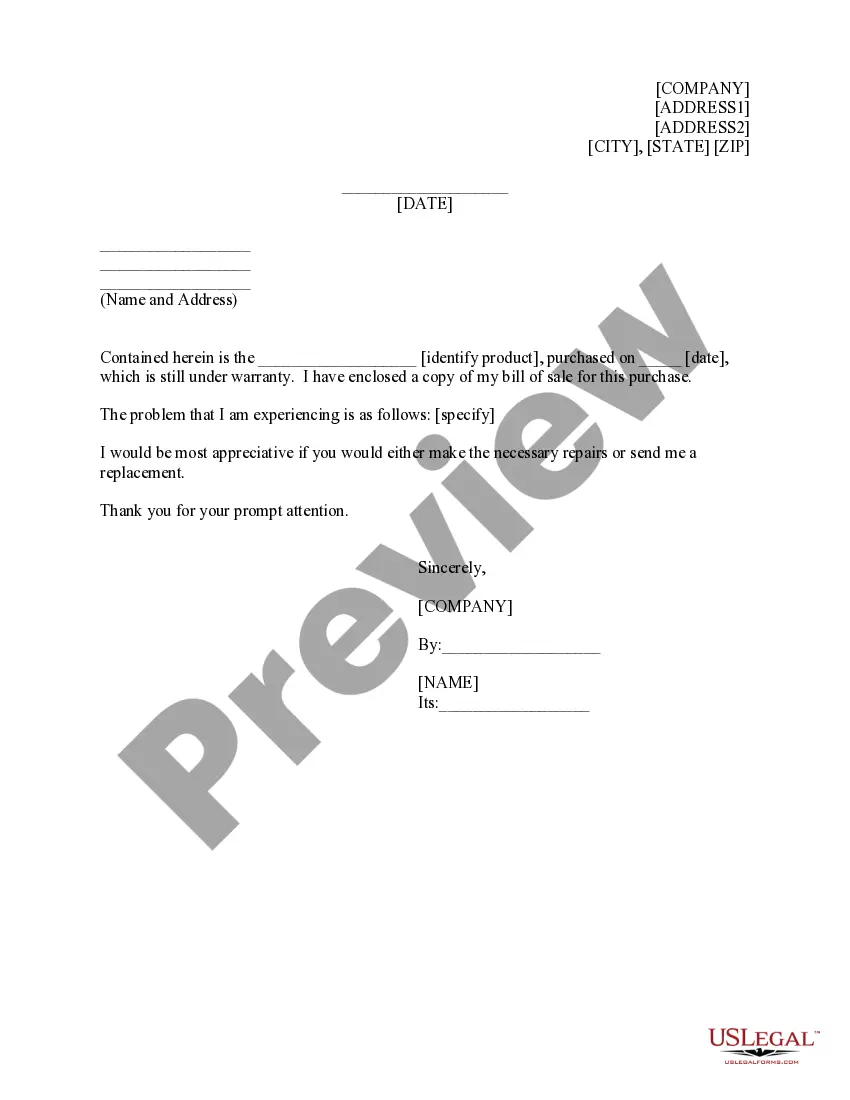

How to fill out Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

Choosing the best legal record web template might be a have difficulties. Needless to say, there are plenty of web templates available on the net, but how will you get the legal kind you need? Use the US Legal Forms site. The service offers 1000s of web templates, such as the Utah Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan, which you can use for company and private requirements. All the kinds are inspected by specialists and satisfy state and federal demands.

In case you are already signed up, log in for your bank account and click on the Download key to get the Utah Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan. Make use of your bank account to check through the legal kinds you may have purchased formerly. Proceed to the My Forms tab of your respective bank account and obtain an additional copy of your record you need.

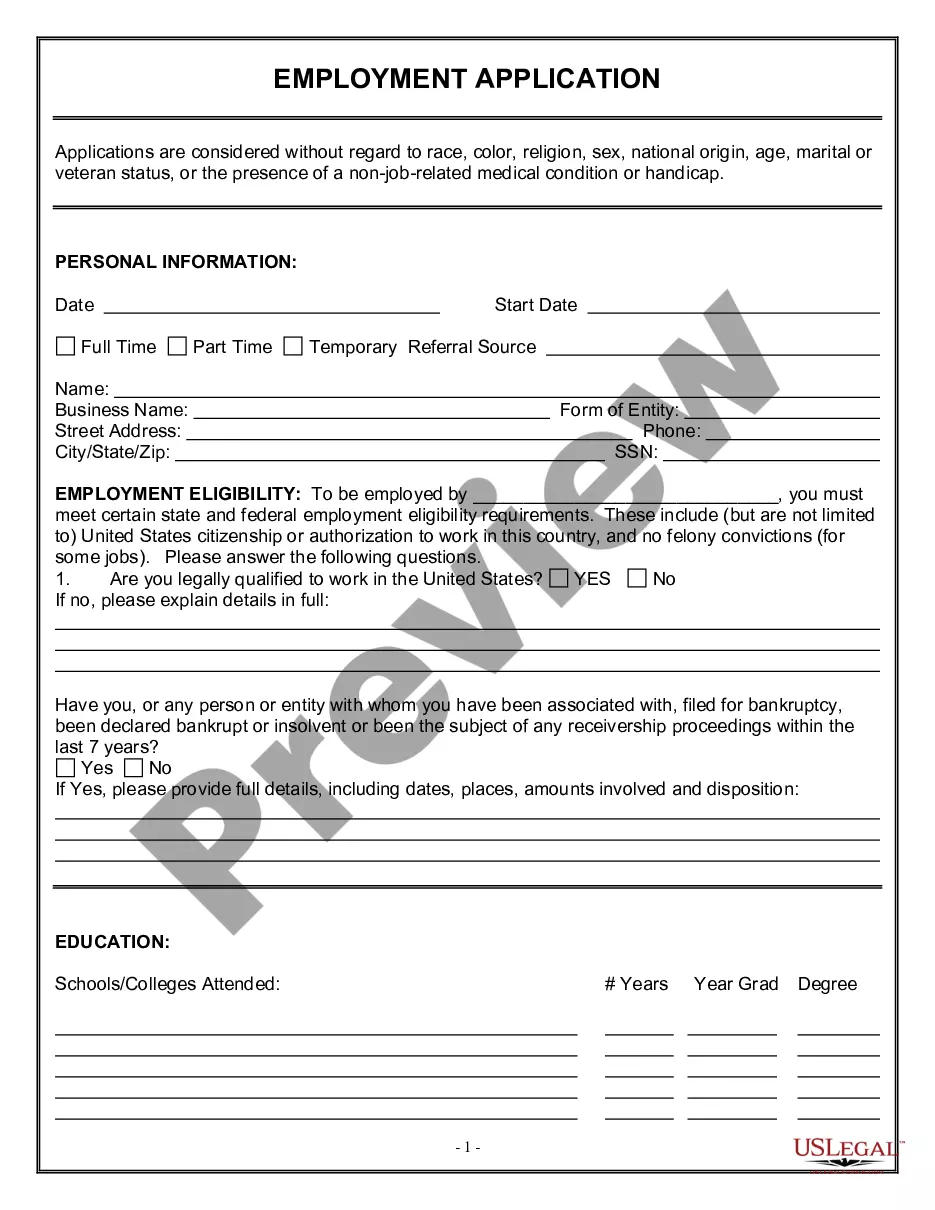

In case you are a new customer of US Legal Forms, listed below are easy recommendations for you to adhere to:

- Very first, make certain you have selected the right kind for the city/state. You are able to look over the form making use of the Preview key and study the form outline to ensure it is the best for you.

- In case the kind does not satisfy your requirements, take advantage of the Seach industry to discover the right kind.

- Once you are certain that the form is acceptable, click on the Purchase now key to get the kind.

- Choose the rates plan you need and enter in the required information and facts. Design your bank account and pay money for your order making use of your PayPal bank account or Visa or Mastercard.

- Pick the submit structure and acquire the legal record web template for your device.

- Total, modify and print out and indicator the received Utah Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan.

US Legal Forms will be the most significant collection of legal kinds for which you can see different record web templates. Use the company to acquire professionally-made files that adhere to state demands.

Form popularity

FAQ

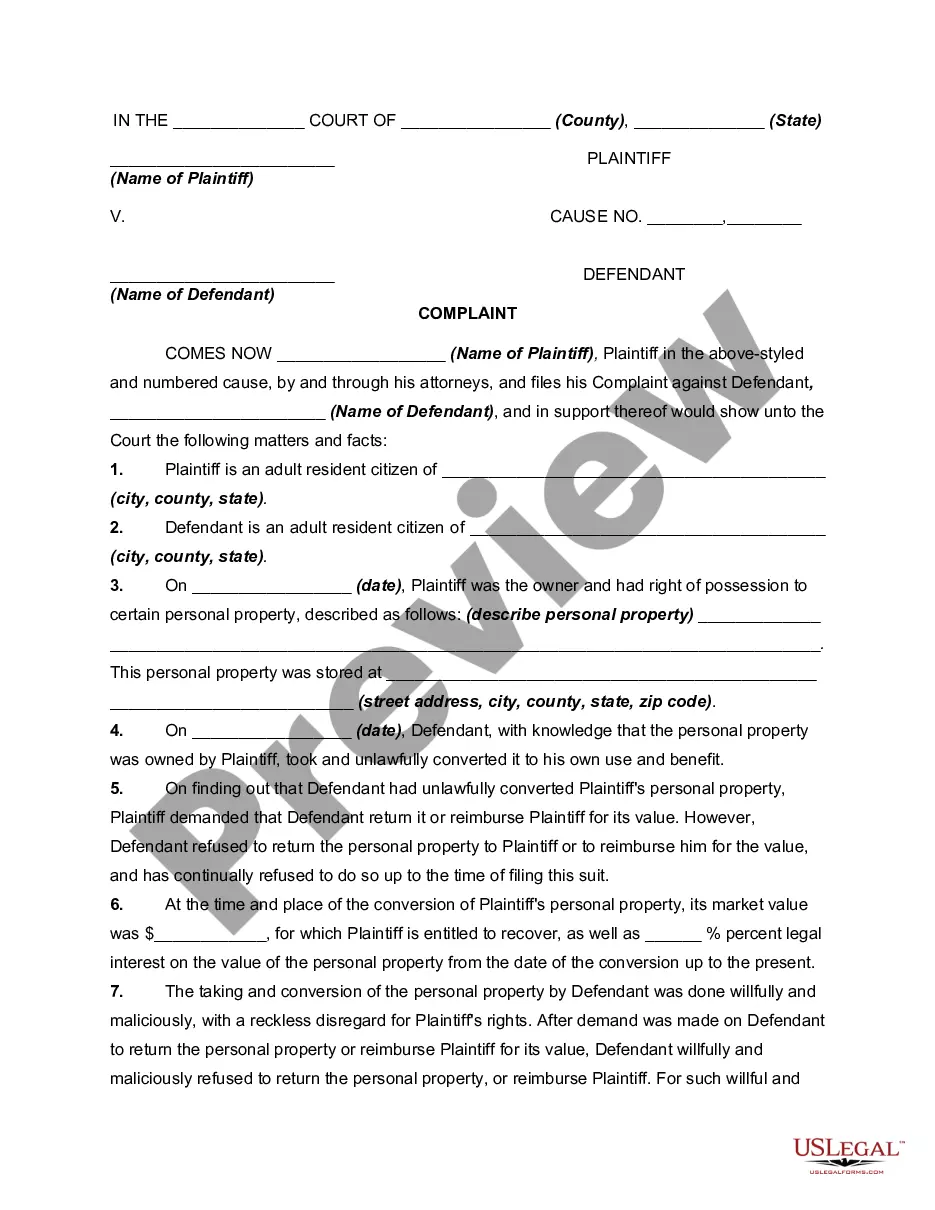

Below are common types of security interests that apply to land. Mortgage. This is a loan instrument where an individual acquires a loan to buy a house. ... Deed of Trust. In the US, a deed of trust is a legal instrument used to create security interests. ... A contract for the sale of land.

Creating a security agreement Some key provisions in a security agreement include: Describing the collateral as accurately and as detailed as possible, so both the borrower and the lender agree upon the secured property. How to determine whether and when the borrower is in default under the loan.

As discussed above, all the requirements for a security interest must be met: a valid security agreement, rights in the collateral, and value given. Here, as set out above, there is a valid security agreement between bank and the man covering the man's equipment, and including an after-acquired property clause.

At a minimum, a valid security agreement consists of a description of the collateral, a statement of the intention of providing security interest, and signatures from all parties involved. Most security agreements, however, go beyond these basic requirements.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

There are three requirements for attachment: (1) the secured party gives value; (2) the debtor has rights in the collateral or the power to transfer rights in it to the secured party; (3) the parties have a security agreement ?authenticated? (signed) by the debtor, or the creditor has possession of the collateral.

A "deed of trust" also pledges real property to secure a loan. This document is usually used instead of a mortgage in some states.

Below are the primary methods for perfecting a security interest: Filing a financing statement in the appropriate public office; Take or retain possession of the collateral; Obtain or retain control of the collateral over the collateral; or.