In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Utah Security Agreement with Farm Products as Collateral

Description

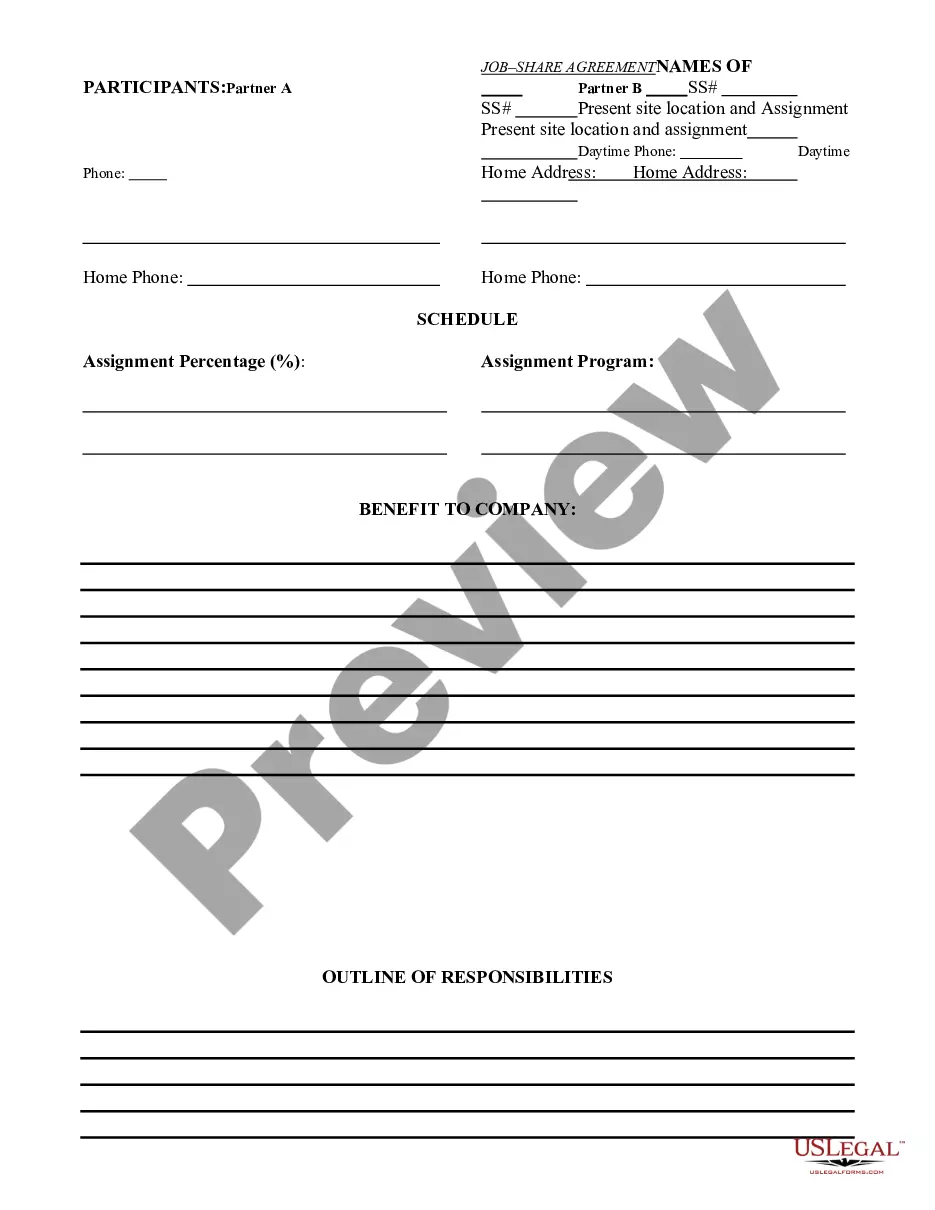

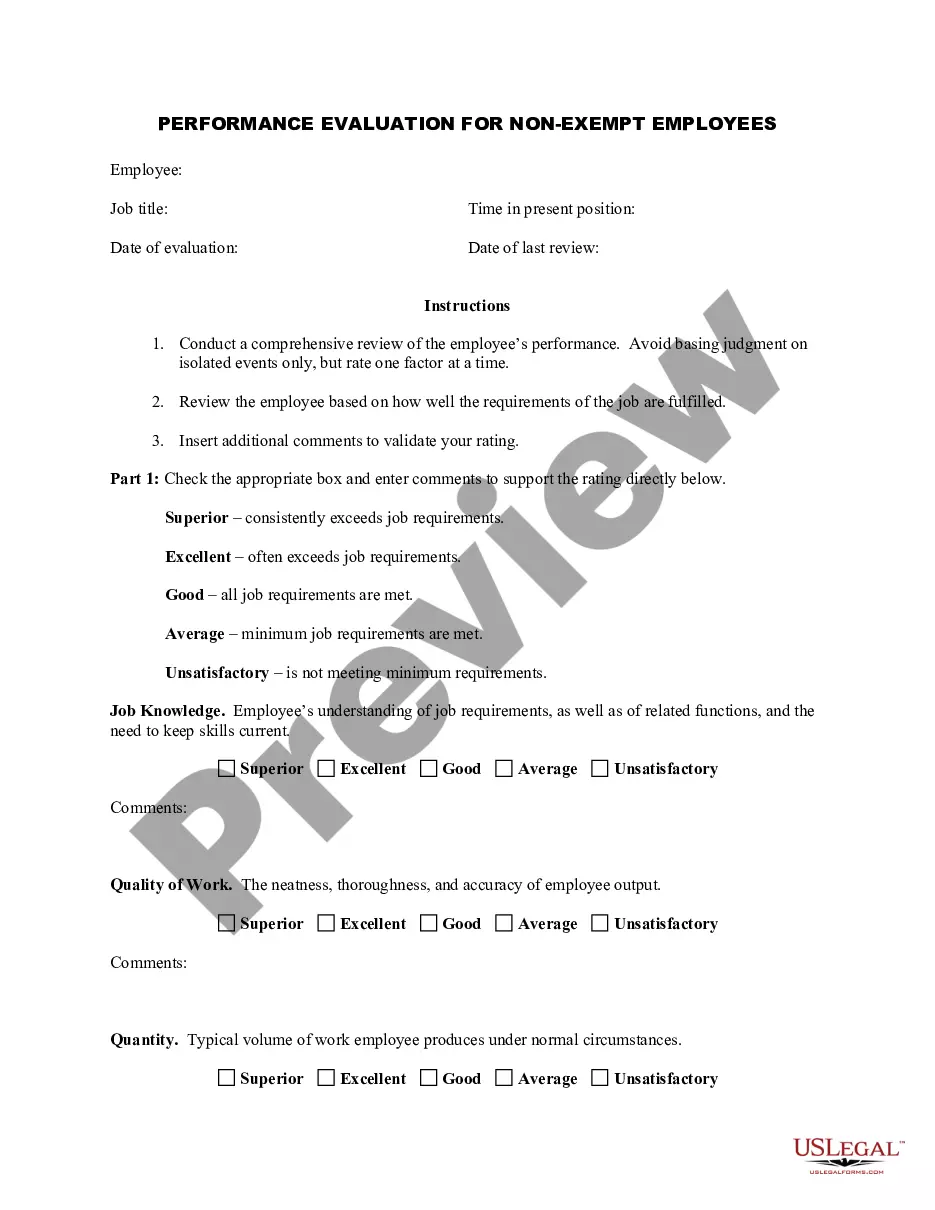

How to fill out Security Agreement With Farm Products As Collateral?

Have you ever found yourself in a situation where you need documents for either professional or personal reasons almost daily.

There are numerous legitimate template documents available online, but locating ones you can trust isn't easy.

US Legal Forms offers thousands of document templates, such as the Utah Security Agreement with Farm Products as Collateral, designed to meet state and federal requirements.

When you find the correct form, click on Get now.

Select the pricing plan you wish, complete the required information to create your account, and process the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Utah Security Agreement with Farm Products as Collateral template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is appropriate for your specific city/region.

- Utilize the Preview button to review the document.

- Check the description to confirm you have chosen the correct form.

- If the form isn’t what you're looking for, use the Search bar to find the document that meets your needs and criteria.

Form popularity

FAQ

A security agreement establishes the rights and obligations regarding collateral between a lender and a borrower. In contrast, a financing statement is the document filed to publicly declare the lender's interest in that collateral. While the Utah Security Agreement with Farm Products as Collateral outlines the specific terms, the financing statement secures the lender's position against other creditors. Both documents are essential, but they serve distinct purposes in the financing process.

The term financing statement refers to a record used by creditors to declare their interest in a debtor's collateral. In a Utah Security Agreement with Farm Products as Collateral, the financing statement ensures that the lender's claim is publicly recorded. This step is essential for any creditor wanting to establish a legal right to collect on that collateral in case of the borrower's failure to meet their obligations. Properly filing this document not only protects the lender but also provides transparency to all parties involved.

A financing statement is a legal document that outlines the secured interests in a debtor's collateral. In the context of a Utah Security Agreement with Farm Products as Collateral, this document needs to be filed to perfect the security interest. It serves as public notice to other creditors about the lender's right to the specified collateral. This is crucial for protecting the lender's interests and establishing priority in case of default.

The attachment of a security interest occurs when the lender's rights to the collateral become enforceable against the borrower. Under a Utah Security Agreement with Farm Products as Collateral, this process involves the borrower granting rights to specific farm products. Once attachment is complete, the lender can assert a claim on the collateral if necessary, thus solidifying their security interest.

Attachment refers to the establishment of a security interest in collateral, while perfection is the legal step taken to protect that interest from third parties. In a Utah Security Agreement with Farm Products as Collateral, attachment ensures that the lender has a claim to the products, while perfection makes that claim enforceable against other creditors. Both steps are vital in securing the lender’s position and ensuring the agreement is upheld.

To establish a security interest, three key components must be satisfied: a valid security agreement, the creation of a security interest, and the debtor’s rights to the collateral. In a Utah Security Agreement with Farm Products as Collateral, these elements ensure that the lender has enforceable rights over the specific farm products. Meeting these conditions is crucial for the security interest to be legally upheld.

Assigning a security interest involves transferring the rights to a security interest from one party to another. In the context of a Utah Security Agreement with Farm Products as Collateral, this can occur when a lender sells their security interest to another party or when obligations are reassigned. This action allows for flexibility in financial arrangements and can provide opportunities for capital flow.

A security interest refers to a legal claim on collateral that a lender can seize if the borrower defaults. For those dealing with a Utah Security Agreement with Farm Products as Collateral, this means that the lender secures rights to the farm products if the borrower fails to meet their obligations. This concept provides protection and assurance for lenders while also giving borrowers access to necessary financing.

To register your business in Utah, visit the Utah Department of Commerce’s Division of Corporations and Commercial Code. They provide services ranging from business name registration to filing security agreements, including a Utah Security Agreement with Farm Products as Collateral. Proper registration sets the foundation for a successful business while ensuring legal compliance.

You need to file a UCC-1 financing statement at the Utah Division of Corporations and Commercial Code. This filing is important if you are entering a Utah Security Agreement with Farm Products as Collateral, as it establishes your lender's interest in the collateral. Filing can typically be done online, ensuring a streamlined process for your legal needs.