Agreement for Purchase of Business Assets from a Corporation

Description

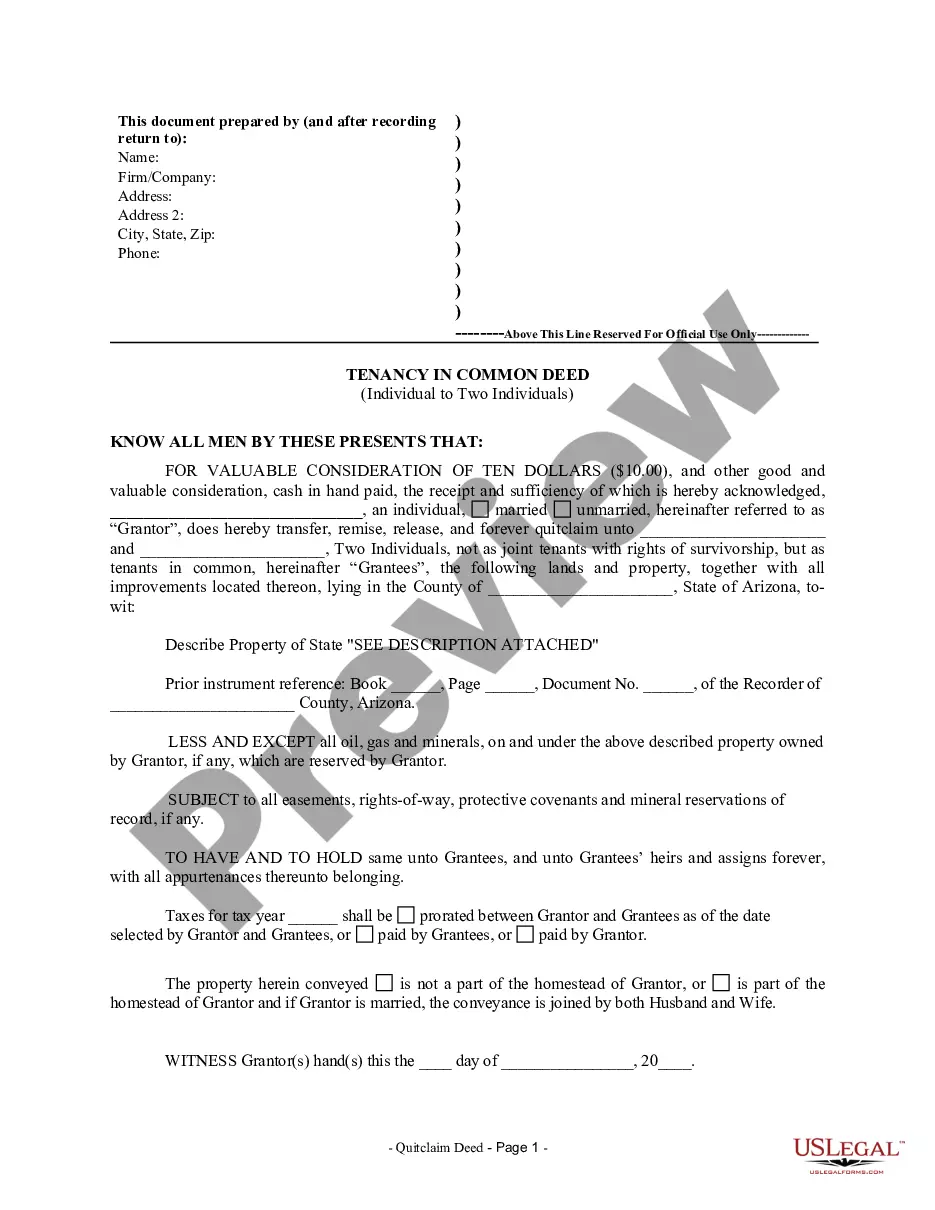

How to fill out Agreement For Purchase Of Business Assets From A Corporation?

Aren't you sick and tired of choosing from numerous samples each time you require to create a Agreement for Purchase of Business Assets from a Corporation? US Legal Forms eliminates the lost time countless American citizens spend surfing around the internet for ideal tax and legal forms. Our professional crew of lawyers is constantly changing the state-specific Forms collection, so it always has the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have a subscription should complete easy actions before having the capability to get access to their Agreement for Purchase of Business Assets from a Corporation:

- Use the Preview function and look at the form description (if available) to make sure that it is the best document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the proper template to your state and situation.

- Make use of the Search field at the top of the webpage if you want to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your file in a convenient format to finish, create a hard copy, and sign the document.

As soon as you have followed the step-by-step recommendations above, you'll always be able to log in and download whatever file you want for whatever state you need it in. With US Legal Forms, finishing Agreement for Purchase of Business Assets from a Corporation samples or any other official files is not hard. Get started now, and don't forget to double-check your samples with certified attorneys!

Form popularity

FAQ

A Purchase Sale Agreement is the legal document that specifies all of the terms and conditions associated with the purchase and sale of a company or the assets. The document outlines the price, the payment method (For example, cash or debt), the representations and warranties, and any conditions.

Identity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties. Description of Goods and/or Services. A sales contract should also address what is being bought or sold. Payment. Delivery. Miscellaneous Provisions. Samples.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

The more common form of structuring payments in a business purchase is for you to make a down payment of perhaps 20% or 25% and then sign a promissory note agreeing to pay the balance to the seller over a number of years, in regular installments.

Buyer and seller information. Property details. Pricing and financing. Fixtures and appliances included/excluded in the sale. Closing and possession dates. Earnest money deposit amount. Closing costs and who is responsible for paying.

Get it in Writing. Use Language You Can Understand. Be Detailed. Include Payment Details. Consider Confidentiality. Include Language on How to Terminate the Contract. Consider State Laws Governing the Contract. Include Remedies and Attorneys' Fees.