Gift Deed of Mineral Interest with No Warranty

Description

How to fill out Gift Deed Of Mineral Interest With No Warranty?

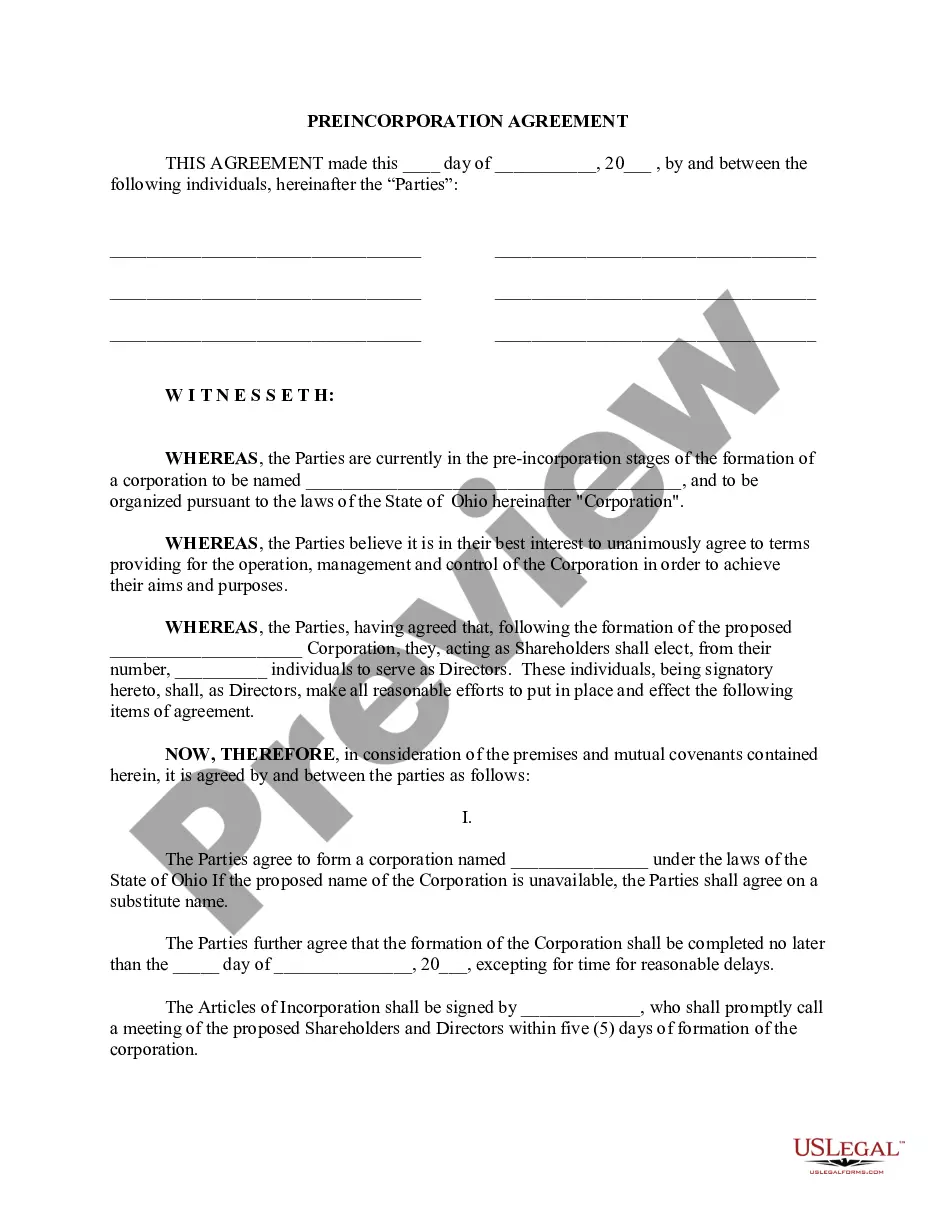

When it comes to drafting a legal document, it’s better to delegate it to the professionals. However, that doesn't mean you yourself cannot find a template to use. That doesn't mean you yourself can’t find a template to utilize, nevertheless. Download Gift Deed of Mineral Interest with No Warranty from the US Legal Forms web site. It provides numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. When you’re signed up with an account, log in, search for a certain document template, and save it to My Forms or download it to your gadget.

To make things easier, we’ve incorporated an 8-step how-to guide for finding and downloading Gift Deed of Mineral Interest with No Warranty promptly:

- Make confident the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Click Buy Now.

- Choose the suitable subscription for your needs.

- Create your account.

- Pay via PayPal or by credit/credit card.

- Choose a needed format if a number of options are available (e.g., PDF or Word).

- Download the document.

Once the Gift Deed of Mineral Interest with No Warranty is downloaded you may fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

In a Non-Warranty Deed, the seller gives no warranties.In a Non-Warranty or Quitclaim Deed, the seller merely is giving the buyer whatever rights, if any, that the seller has in the property and the seller makes no warranties of any nature about the seller's rights in the property.

A deed that names the seller/donor and the purchaser/donee. It states and describes the rights being sold or given. Filing of the notarized conveyance in the county government office which is generally the county clerk's office.

Date and Place where the deed is to be executed. Information about Donor and Donee like Name, Residential Address, Relationship among them, Date of Birth, etc. Details about the property. Two Witnesses. Signatures of Donor and Donee along with the witnesses.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court. Registration of gift deed is not required in case of transfer of moveable property.Gift of immovable property which is not registered is not a valid as per law and cannot pass any title to the donee.

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).

Let's start with the definition of a deed: DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

Mineral rights are automatically included as a part of the land in a property conveyance, unless and until the ownership gets separated at some point by an owner/seller.Conveying (selling or otherwise transferring) the land but retaining the mineral rights.

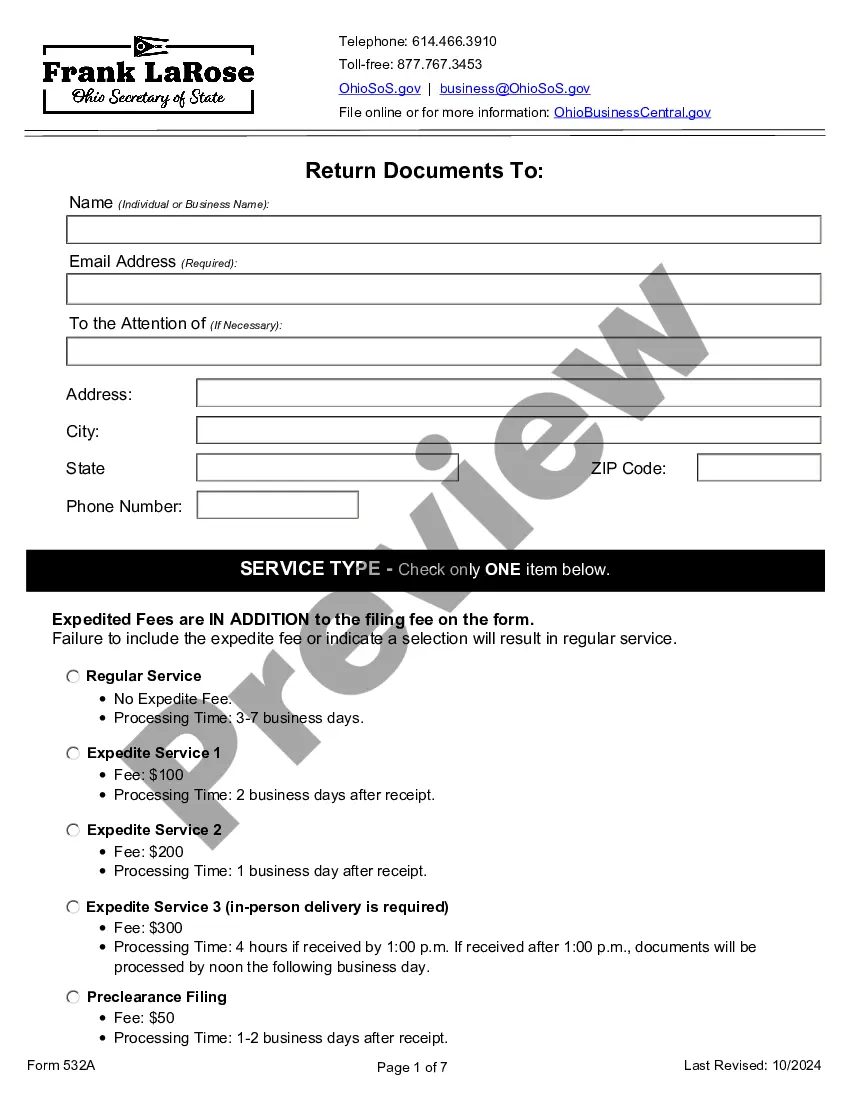

If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.