Utah General Release of all Claims by an Individual

Description

Form popularity

FAQ

The statute of limitations for filing a car accident claim in Utah is also three years. From the date of the car accident, you have three years to pursue legal action against the responsible party. If a Utah General Release of all Claims by an Individual is involved, it is critical to understand how this document can impact your rights. Consulting with a professional can help you navigate the process efficiently.

In Utah, the statute of limitations for most insurance claims is typically around three years. This means you have three years from the date of the incident to file a claim against an insurance provider. If you plan to utilize a Utah General Release of all Claims by an Individual, understanding this timeframe is crucial. By acting promptly, you can protect your rights and ensure your claim is processed effectively.

Utah Code 57-9-4 refers to the statutes governing the implications of releases and waivers of liability in the state. This code outlines how individuals may give up certain rights through formal agreements. If you are considering a Utah General Release of all Claims by an Individual, it is prudent to understand this code to ensure you are fully aware of the consequences and protections provided.

The duration an insurance claim can take varies significantly based on its complexity, the parties involved, and the nature of the claim. While most claims resolve within months, particularly those with a signed Utah General Release of all Claims by an Individual, some can extend for years if disputes arise. It's important to stay in touch with your insurer to monitor the progress of your claim.

Utah Code 77-7-13 relates to the laws governing the release of claims and the execution of written contracts. It provides clarity on the implications of signing a general release in various contexts, ensuring individuals are aware of their rights. Understanding this code is essential when dealing with legal matters, particularly when drafting a Utah General Release of all Claims by an Individual.

In Utah, an insurance company generally has 30 days to investigate a claim after it is submitted. This period allows the insurer to gather relevant information, assess the claim's validity, and determine any potential payouts. If your claim is straightforward, such as one covered under a Utah General Release of all Claims by an Individual, the investigation might be resolved much faster.

In Utah, an insurance company typically has a reasonable time frame to settle a claim, often around 30 days after receiving all necessary information. However, this can vary based on the specifics of the case and the terms of your policy. Having a signed Utah General Release of all Claims by an Individual may expedite the settling process, as it clarifies the conclusion of disputes.

In general, it can take anywhere from a few days to several weeks for an insurance company to make a settlement offer after a claim is filed. The timeline often depends on the complexity of the case and the amount of information required to evaluate the claim. If you have a signed Utah General Release of all Claims by an Individual, it can encourage a quicker resolution, as it simplifies negotiations between parties.

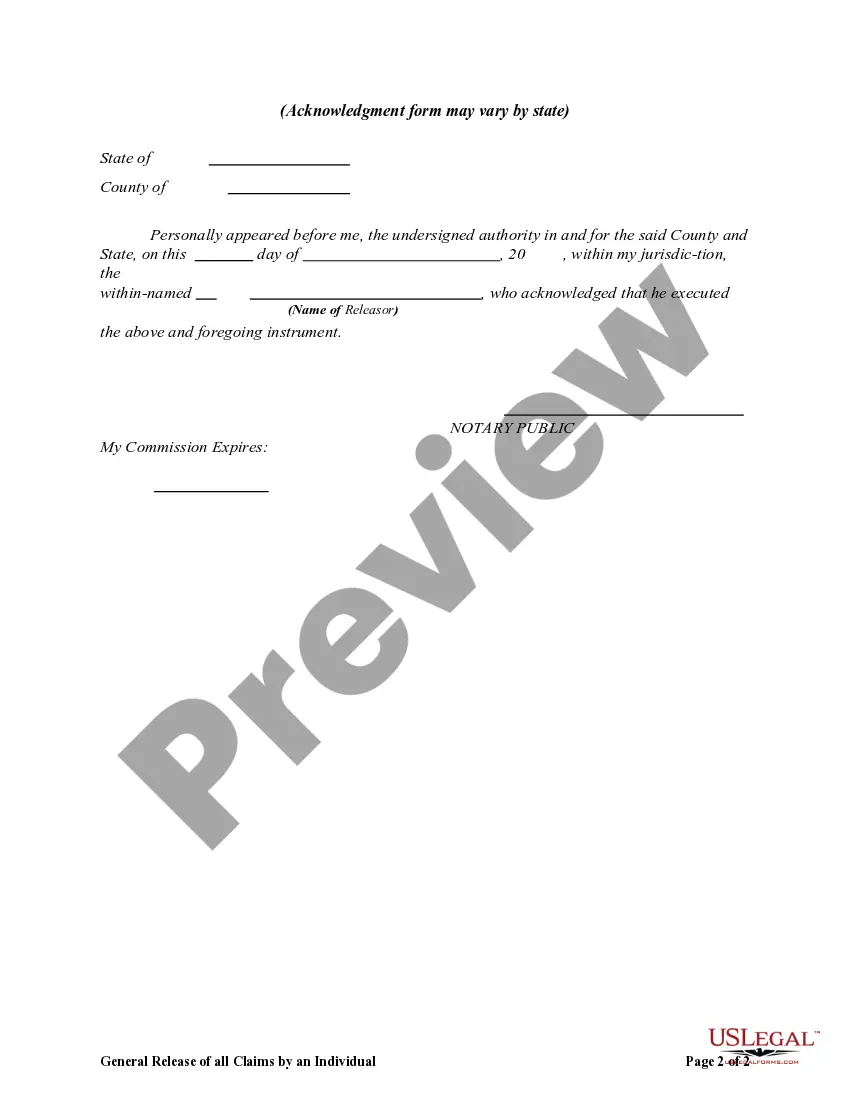

A general release of all claims is a legal document in which an individual agrees to relinquish any further claims or legal actions against another party. By signing this document, you acknowledge that you have settled any disputes and agree not to pursue further legal action related to the matter. In Utah, this release protects the other party from future claims, ensuring both sides can move forward with certainty.

The no-fault statute in Utah is outlined in Title 31A of the Utah Code, which mandates that drivers carry personal injury protection (PIP) coverage. This insurance helps cover medical expenses up to a certain limit, irrespective of who caused the accident. Additionally, the statute establishes conditions under which individuals can pursue legal action outside the no-fault system. A Utah General Release of all Claims by an Individual might be necessary in these cases to finalize any claims or settlements.