Utah Sale of Goods, Short Form

Description

How to fill out Sale Of Goods, Short Form?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can acquire or generate.

While navigating the site, you can discover thousands of forms for organizational and personal purposes, organized by categories, states, or keywords. You can find the latest types of forms such as the Utah Sale of Goods, Short Form in just moments.

If you currently possess a monthly subscription, Log In to retrieve the Utah Sale of Goods, Short Form from the US Legal Forms library. The Obtain button will be visible on every form you view. You have access to all previously saved forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill, edit, and print, and sign the saved Utah Sale of Goods, Short Form. Each template you add to your account does not expire and is yours indefinitely. So, if you wish to download or print another copy, just navigate to the My documents section and click on the form you desire. Access the Utah Sale of Goods, Short Form with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/county.

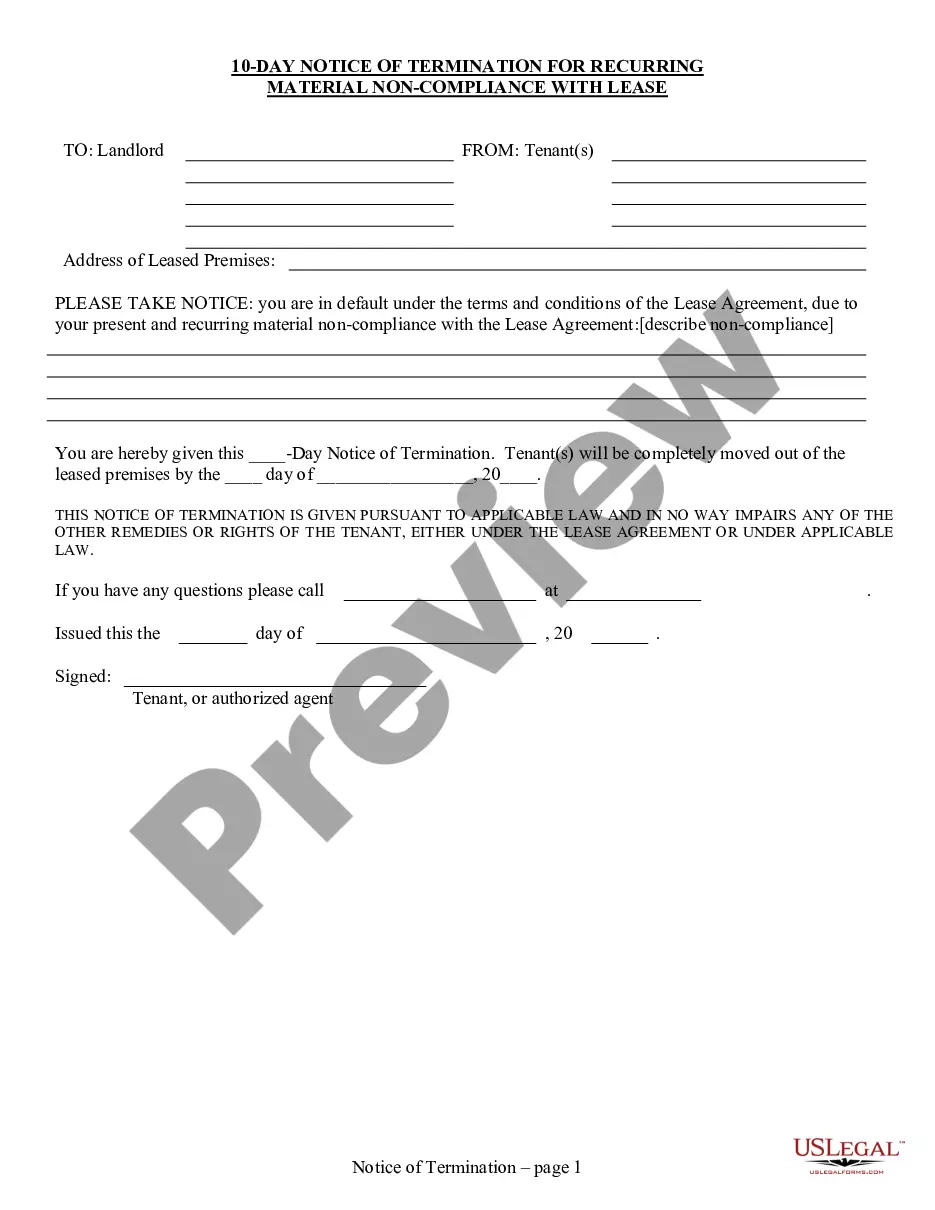

- Click the Review button to check the form's content.

- Examine the form details to confirm that you have chosen the right one.

- If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose your desired pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

You can file the Utah TC 65 form with the Utah State Tax Commission. Ensure that you include all necessary information pertaining to your sales transactions involving the Utah Sale of Goods, Short Form. Filing online can expedite the process, reducing delays and ensuring that your information is submitted accurately. Uslegalforms offers step-by-step instructions on how to file this form correctly.

Sales tax in Utah applies to transactions when goods are sold, while use tax comes into play when goods are used, stored, or consumed in the state but were purchased elsewhere. Understanding this distinction is vital for maintaining compliance with the Utah Sale of Goods, Short Form. In simpler terms, sales tax is collected at the point of sale, whereas use tax must be reported by the buyer. Uslegalforms can help clarify these concepts for you.

Yes, obtaining a sales and use tax license in Utah is necessary if you are engaged in selling goods or services. This license ensures compliance with state regulations concerning the Utah Sale of Goods, Short Form. Without this license, you may face penalties or fines for non-compliance. Uslegalforms provides guidance on how to apply for this license effectively.

If you choose to file your sales tax voluntarily on a monthly basis in Utah, it can streamline your tax compliance process. This option allows you to stay up-to-date with your obligations related to the Utah Sale of Goods, Short Form. Additionally, consistent filing helps you avoid larger payments later. Our platform, uslegalforms, offers templates and resources to assist you with the filing process.

Many states require W-4 forms or similar documents to manage state income tax withholdings. Each state has specific guidelines on how to fill out these forms, reflecting their unique tax structures. If you’re operating a business under the Utah Sale of Goods, Short Form, you'll want to be aware of how these forms work across different states. It's beneficial to consult your state's tax authority or a tax professional for accurate information.

Utah's sales tax rate is generally 4.85%, though local jurisdictions can add additional taxes, resulting in a combined rate that may exceed 8%. Knowing the correct sales tax number is vital for businesses engaging in the sale of goods within the state. If you are managing sales under the Utah Sale of Goods, Short Form, ensure that you stay informed on the latest tax rates to maintain compliance. Check with the Utah State Tax Commission for the most current figures.

Some states do not have their own Form W-4 due to varied income tax laws and regulatory frameworks. In these cases, residents must refer to federal guidelines or alternative state-specific forms for tax withholdings. Clearly understanding these differences can help you navigate the complexities of the Utah Sale of Goods, Short Form. It is essential to consult with a tax professional if you operate in multiple states.

Utah indeed has a state W-4 form which residents use to inform employers of their tax withholding preferences. This form accommodates various situations and helps ensure accurate withholdings for state sales tax obligations. If you operate under the Utah Sale of Goods, Short Form, understanding the state W-4 process is crucial for compliance. You can find the form online to complete your tax planning.

Yes, Utah does have a W-4 form that taxpayers must use to instruct their employer on withholding state income tax. This form is essential for managing your state tax responsibilities effectively. By utilizing the Utah Sale of Goods, Short Form, you can ensure that your sales processes align with state regulations. To access the Utah W-4 form, visit the official state tax website.

Utah does not impose a specific service tax but does tax certain services related to the sale of goods. For instance, taxable transactions may include install services or repair work. Understanding which services are taxable is crucial for anyone involved in the Utah Sale of Goods, Short Form. Our resources can help clarify the nuances of these tax regulations.