Utah Sale of Goods, General

Description

How to fill out Sale Of Goods, General?

If you desire to finalize, acquire, or create legal document templates, utilize US Legal Forms, the best collection of legal documents available online.

Employ the site's simple and handy search feature to locate the files you require. A variety of templates for business and personal purposes are organized by categories and states, or by keywords.

Utilize US Legal Forms to find the Utah Sale of Goods, General with just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to each form you acquired in your account. Click on the My documents section and choose a form to print or download again.

Stay competitive and download and print the Utah Sale of Goods, General with US Legal Forms. There are thousands of professional and state-specific documents you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to retrieve the Utah Sale of Goods, General.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

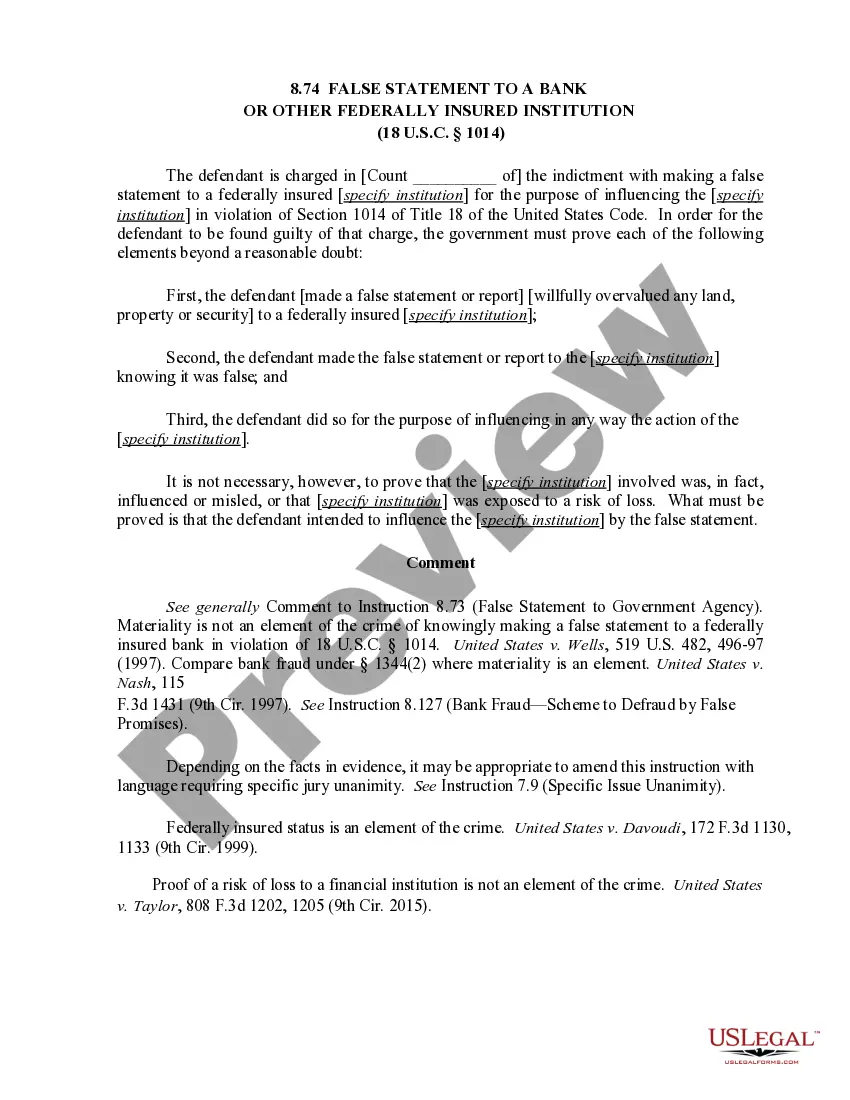

- Step 2. Utilize the Review option to examine the form's content. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you want, click on the Purchase now button. Choose your preferred pricing plan and provide your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Utah Sale of Goods, General.

Form popularity

FAQ

In the context of the Utah Sale of Goods, General, sales tax is typically based on the destination. This means that when you sell goods within Utah, you apply the tax rate applicable to the buyer's location. Understanding this can help ensure compliance with state tax laws and avoid potential issues. For accurate guidance, consider tools like uslegalforms to navigate these rules seamlessly.

To obtain a copy of your Utah sales tax license, you can request it through the Utah State Tax Commission’s website or contact their customer service. Provide the necessary details, such as your business name and registration number, to facilitate the process. Keeping a copy handy supports your operations under the Utah Sale of Goods, General laws.

To file Utah sales and use tax, you can use the Utah State Tax Commission’s online filing system. First, gather your sales records to report your taxable sales accurately. Once you complete the online forms, you can submit your payment electronically, making the process efficient and straightforward for your Utah Sale of Goods, General reporting needs.

Voluntarily filing your sales tax on a monthly basis in Utah can be a smart choice for businesses with consistent sales. This approach helps you stay on top of your tax obligations and avoid year-end surprises. By managing your Utah Sale of Goods, General tax filings regularly, you can streamline your accounting process and ensure timely payments.

Yes, if your business engages in the sale of goods in Utah, obtaining a sales and use tax license is necessary. This license allows you to collect sales tax on behalf of the state when you sell taxable goods. Without it, you may face penalties or fines, so ensure that your business complies with the Utah Sale of Goods, General regulations by applying for this license promptly.

Nexus in Utah refers to the connection between your business and the state that triggers sales tax obligations. Typically, a business has nexus if it has a physical presence in Utah, which includes offices, warehouses, or employees in the state. Additionally, any significant online sales or transactions can also establish nexus, making it essential to understand your obligations regarding Utah Sale of Goods, General.

The current Utah state tax rate is 4.85%, but remember that additional local taxes can apply. This rate is integral to the financial calculations involved in the Utah Sale of Goods, General. To ensure compliance, always check for updates on tax rates, as they can change. If you need assistance navigating tax requirements, the uslegalforms platform offers helpful resources.

The general sales tax in Utah is currently set at 4.85%, but local jurisdictions may add additional taxes. This means the effective sales tax rate can vary depending on your location within the state. It is crucial to be aware of local rates when participating in the Utah Sale of Goods, General. Keeping updated on these rates can keep your transactions compliant.

The sale of goods in Utah is governed primarily by state laws and regulations. The Uniform Commercial Code (UCC) serves as a foundation for commercial transactions, including the sale of goods. Local jurisdictions may have additional regulations affecting these transactions. For a clearer understanding of how laws apply to the Utah Sale of Goods, General, consider consulting a legal expert or using the resources available on the uslegalforms platform.

Utah resale certificates do not have a specific expiration date. However, they must be properly filled out and used within a reasonable timeframe to avoid complications. If you plan on making frequent purchases of goods for resale, it is best to keep your certificate updated. This ensures compliance with the regulations relevant to the Utah Sale of Goods, General.