Ratification or Confirmation of an Oral Amendment to Partnership Agreement

Description

How to fill out Ratification Or Confirmation Of An Oral Amendment To Partnership Agreement?

Aren't you tired of choosing from numerous samples every time you need to create a Ratification or Confirmation of an Oral Amendment to a Partnership Agreement? US Legal Forms eliminates the wasted time an incredible number of American citizens spend browsing the internet for ideal tax and legal forms. Our skilled team of attorneys is constantly updating the state-specific Samples collection, to ensure that it always has the right files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have an active subscription should complete simple actions before having the capability to get access to their Ratification or Confirmation of an Oral Amendment to a Partnership Agreement:

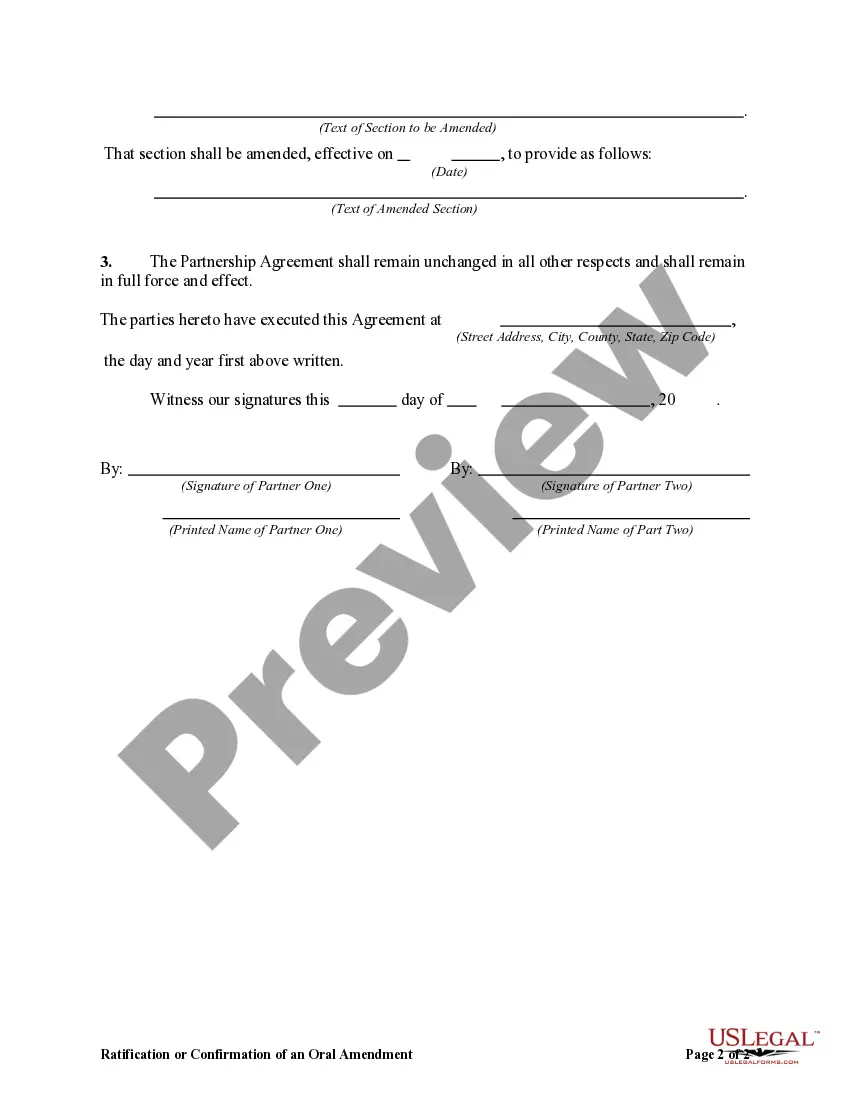

- Make use of the Preview function and read the form description (if available) to make sure that it is the proper document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right template for the state and situation.

- Use the Search field on top of the web page if you want to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your document in a needed format to finish, print, and sign the document.

As soon as you’ve followed the step-by-step recommendations above, you'll always have the capacity to sign in and download whatever document you will need for whatever state you want it in. With US Legal Forms, completing Ratification or Confirmation of an Oral Amendment to a Partnership Agreement templates or other legal paperwork is simple. Get going now, and don't forget to recheck your examples with accredited attorneys!

Form popularity

FAQ

Although each partnership agreement differs based on business objectives, certain terms should be detailed in the document, including percentage of ownership, division of profit and loss, length of the partnership, decision making and resolving disputes, partner authority, and withdrawal or death of a partner.

Most typically, the partnership agreement will be altered to amend the profit and loss sharing ratios for the prior year.Such a change can also have other ancillary effects, such as changing the way nonrecourse liabilities may be shared among the partners under Sec.

A partnership agreement is a contract that defines each partner's role, liability, and profit distribution.Because it is a legally binding document, you should consult a lawyer before drafting your partnership contract. You are not required to create a partnership agreement.

Ask yourself if your potential new partner shares your vision. Conduct a SWOT on them and yourself. Address what your exit strategy will be in the partnership agreement. Decide between offering equity versus non-equity distribution.

Understand the Uniform Partnership Act. Discuss With Other Partners. Assign the Drafting Task to Someone. Consult an Attorney. Title the Agreement. List out All the Partners Along With Their Residences. Other Provisions to Include in the Agreement.

Having a partnership change in ownership can mean adding or withdrawing partners. Partners can agree to add new partners in two different ways. The partner who's new could buy out part or all of the interest of the current partner or partners.

Deciding to end a partnership is never easy, and to further complicate matters, there are a lot of steps involved in dissolving one."Instead, the partnership's assets must be liquidated 2026 an accounting made and the assets used to pay all outstanding partnership debts, including those owed to the partners."

A Partnership Agreement may be amended in accordance with the terms of that agreement.