Utah Restricted Endowment to Religious Institution

Description

How to fill out Restricted Endowment To Religious Institution?

If you need to finalize, obtain, or print sanctioned document templates, utilize US Legal Forms, the finest collection of legal documents, available online. Leverage the site’s simple and user-friendly search to find the paperwork you need.

A selection of templates for commercial and personal purposes are organized by categories and regions, or keywords.

Use US Legal Forms to find the Utah Restricted Endowment to Religious Institution in just a few clicks.

Every legal document template you download is yours permanently. You will have access to all forms you saved in your account. Click on the My documents section and select a form to print or download again.

Be proactive and obtain, and print the Utah Restricted Endowment to Religious Institution with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms client, Log In to your account and click on the Download button to receive the Utah Restricted Endowment to Religious Institution.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct area/state.

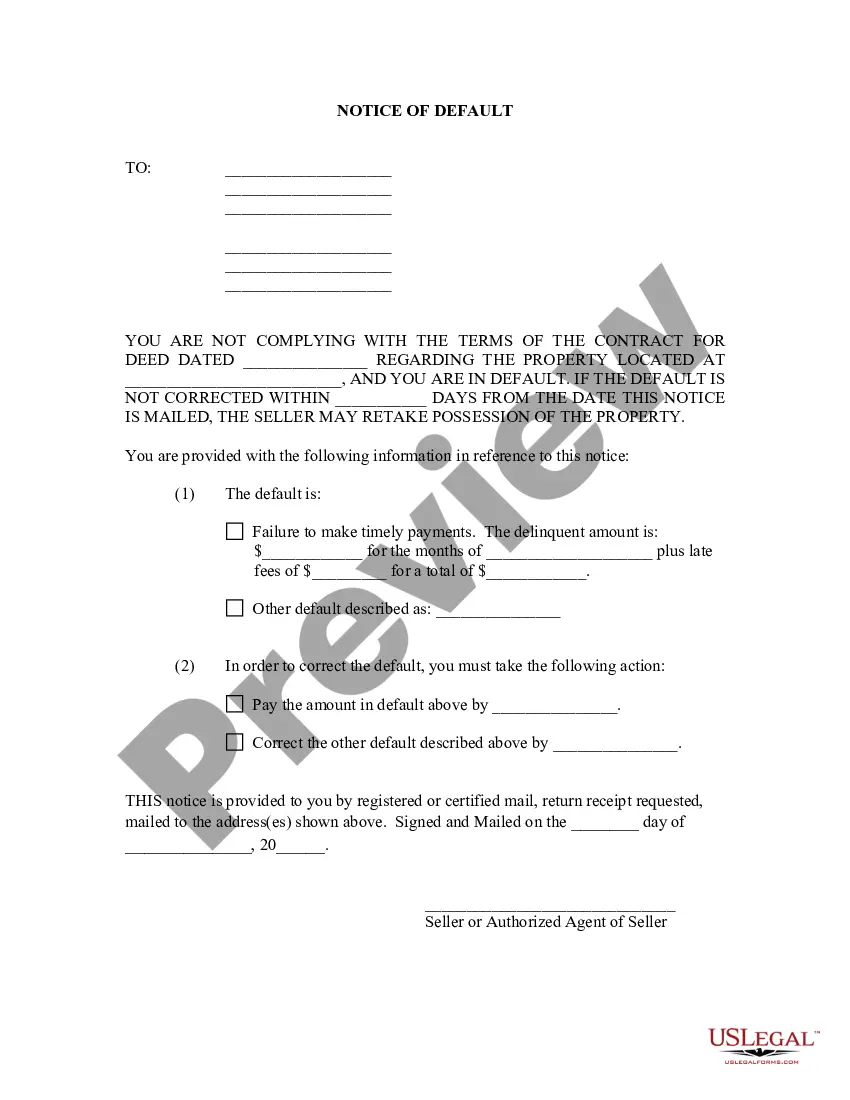

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of your legal form template.

- Step 4. Once you have found the form you need, click on the Buy Now option. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Utah Restricted Endowment to Religious Institution.

Form popularity

FAQ

Withdrawing from a Utah Restricted Endowment to Religious Institution policy can be complex. Generally, these policies are not designed for withdrawal, as they serve as a sustainable funding source for the future of the institution. If you find yourself needing to access these funds, it is crucial to review the specific terms and consult with financial professionals. Using platforms like US Legal Forms can help you navigate these processes and understand your options.

Typically, withdrawals from a Utah Restricted Endowment to Religious Institution are not allowed as the funds are meant to support the institution in the long term. Endowment funds are designed to grow over time, and their structure often restricts access to the principal amount. However, depending on the rules set forth by the managing board, certain conditions may allow for limited withdrawals. It's essential to consult with your institution's financial team to understand these policies thoroughly.

In the case of a Utah Restricted Endowment to Religious Institution, endowment funds are typically managed by a board or committee appointed by the religious institution. This board is responsible for overseeing the investment strategies and disbursement of funds. They work to ensure that the endowment aligns with the institution's mission and financial goals. If you are interested in starting an endowment, platforms like US Legal Forms can provide guidance and resources.

The University of Utah endowment refers to the total funds earmarked to support the university's educational and operational costs. This endowment includes various types of funds, some of which may follow the principles of the Utah Restricted Endowment to Religious Institution, supporting specific programs over time. The growth and management of this endowment are crucial for the university to maintain its high standards of education and community service.

Different types of endowments can include unrestricted, restricted, permanent, temporary, and quasi-endowments. Each type serves a unique purpose, helping organizations achieve their missions in various ways. For example, the Utah Restricted Endowment to Religious Institution specifically designates funds for religious purposes, highlighting the importance of aligning financial resources with organizational goals.

The 4% rule for endowments suggests that organizations should withdraw about 4% of their endowment balance each year to balance sustainability and growth. In the context of the Utah Restricted Endowment to Religious Institution, this rule helps ensure that the principal remains largely intact over time while providing enough income for institutional needs. Following this guideline allows for consistent funding without jeopardizing long-term financial health.

An endowment is a fund designated for long-term financial support to a specific purpose, while a foundation is an organization that manages these funds. The Utah Restricted Endowment to Religious Institution would be an example of an endowment under the umbrella of a larger religious foundation, which may use its financial resources to fund various initiatives. Understanding this distinction helps donors decide how best to support their preferred causes.

The four endowments typically refer to the main types of endowments used by organizations: permanent, temporary, quasi, and unrestricted endowments. Each type varies in how funds are managed and utilized. For example, the Utah Restricted Endowment to Religious Institution is a permanent endowment designed to support religious activities by ensuring the principal remains intact while generating income for ongoing needs.

The three main types of endowments are permanent, term, and quasi-endowments. A permanent endowment, as seen with the Utah Restricted Endowment to Religious Institution, requires that the principal amount remains intact, with only the income available for spending. Term endowments allow for the use of principal after a specified time, while quasi-endowments provide more flexibility in spending the principal as needed.

An example of an endowment is a financial donation given to a non-profit organization, typically for the purpose of supporting specific programs or initiatives. When discussing the Utah Restricted Endowment to Religious Institution, this may involve funds allocated to a religious institution to support its mission over the long term. This financial mechanism ensures that the institution can maintain its operations sustainably while adhering to its core values.