9.38 Willful Failure to Pay Tax or File Tax Return is the intentional refusal to pay taxes or file a tax return. It is a criminal offense which is punishable by a jail sentence, hefty fines, and other penalties. It includes not paying taxes due on a return, filing a return late, underreporting income, or filing a fraudulent return. There are three types of 9.38 Willful Failure to Pay Tax or File Tax Return: 1. Failure to File: This is when a taxpayer does not file a tax return or file an extension, even if they have the money to pay the taxes due. 2. Failure to Pay: This is when a taxpayer files a return but does not pay the taxes due. 3. Fraudulent Returns: This is when a taxpayer intentionally files a false or fraudulent return in order to avoid paying taxes.

9.38 Willful Failure to Pay Tax or File Tax Return

Description

How to fill out 9.38 Willful Failure To Pay Tax Or File Tax Return?

If you’re searching for a way to properly prepare the 9.38 Willful Failure to Pay Tax or File Tax Return without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every personal and business scenario. Every piece of documentation you find on our online service is created in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Follow these simple instructions on how to acquire the ready-to-use 9.38 Willful Failure to Pay Tax or File Tax Return:

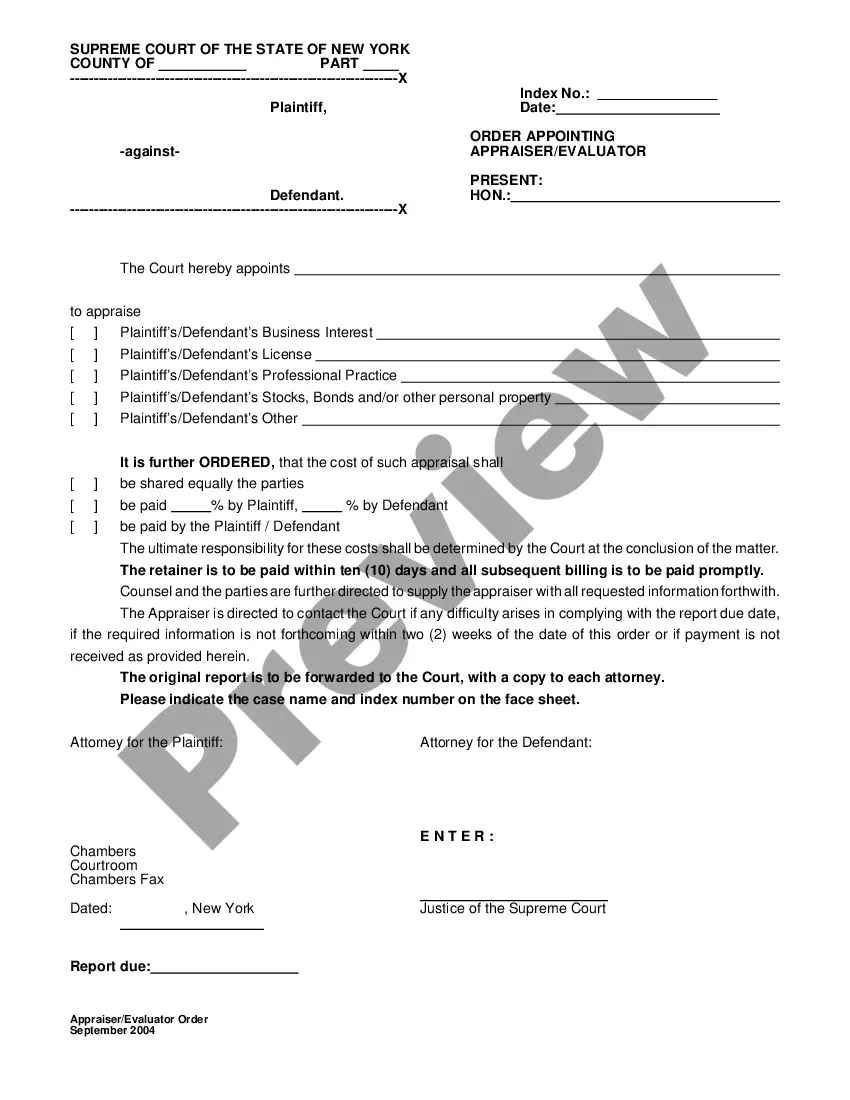

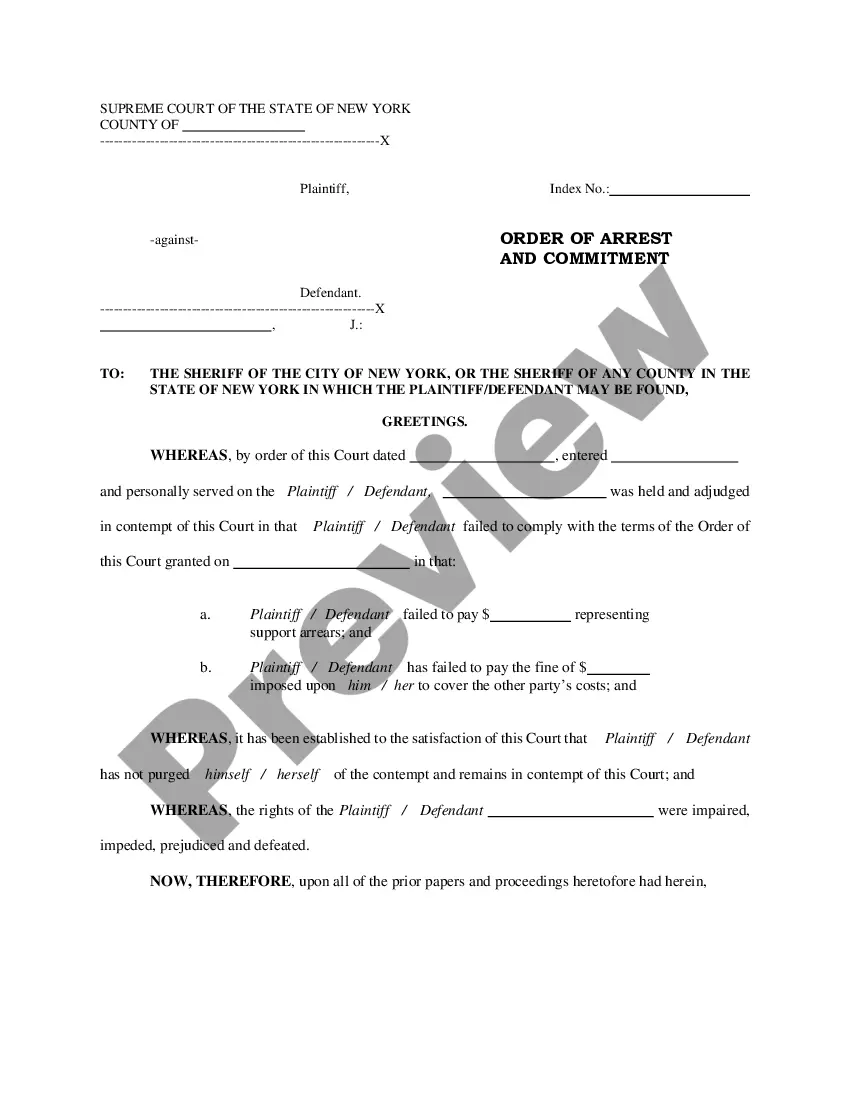

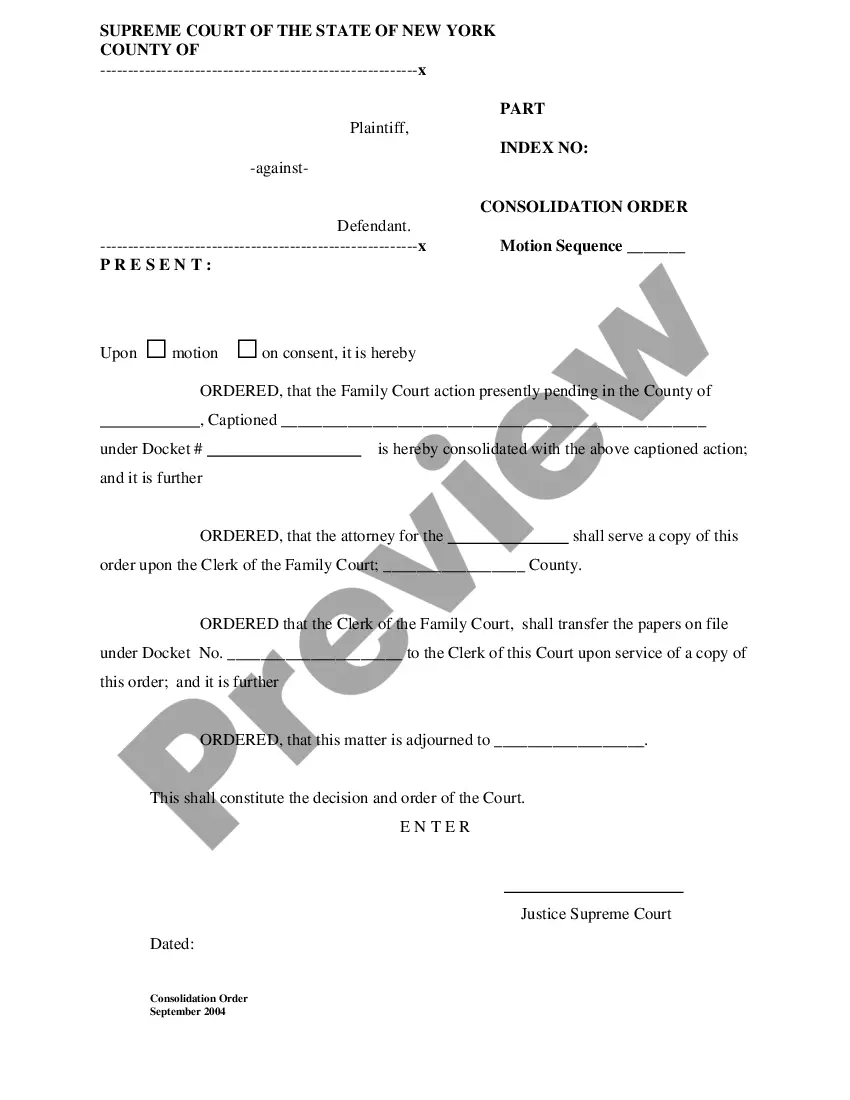

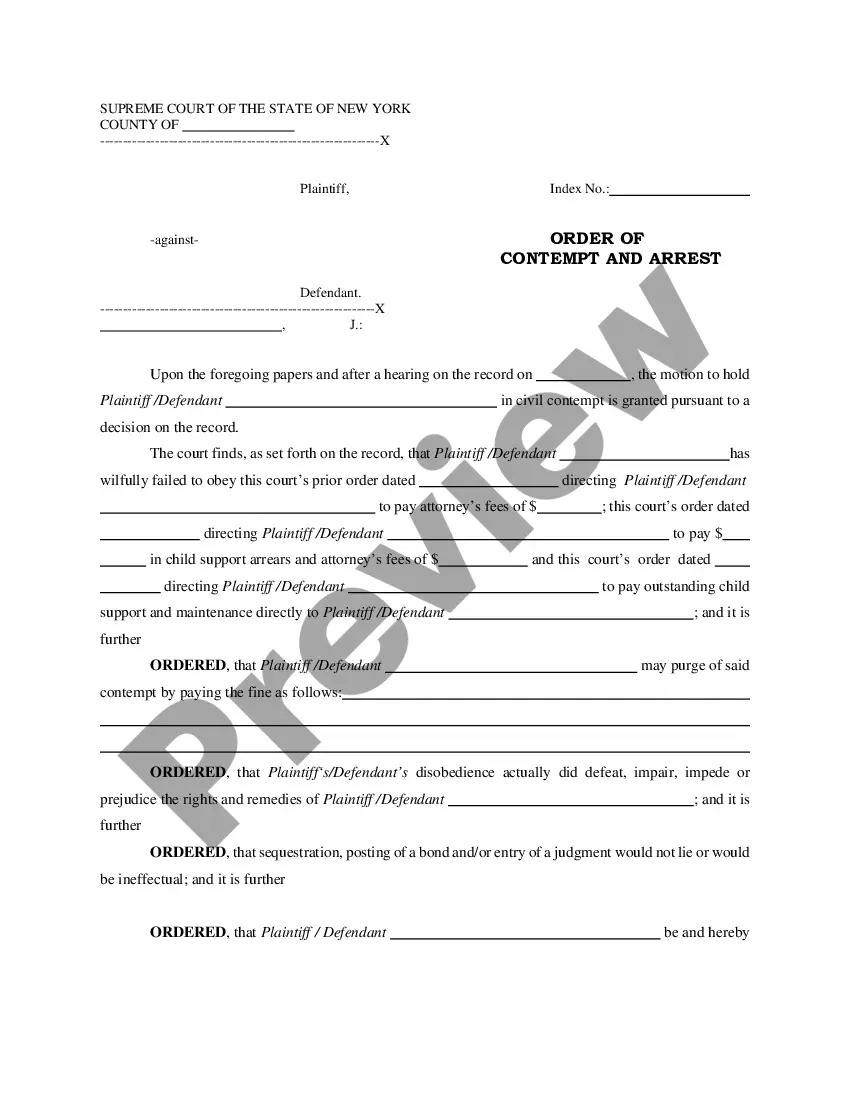

- Ensure the document you see on the page complies with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and choose your state from the list to locate another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your 9.38 Willful Failure to Pay Tax or File Tax Return and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

The penalty for not filing your return is typically 5% of the tax you owe for each month or partial month your return is late. This penalty also maxes out at 25% of your unpaid taxes. If your return was over 60 days late, the minimum penalty is $435 for 2022 or 100% of the tax on the return ? whichever is less.

Tax evasion is an illegal activity in which a person or entity deliberately avoids paying a true tax liability. Those caught evading taxes are generally subject to criminal charges and substantial penalties. To willfully fail to pay taxes is a federal offense under the Internal Revenue Service (IRS) tax code.

There is no penalty for failure to file if you are due a refund. However, you cannot obtain a refund without filing a tax return. If you wait too long to file, you may risk losing the refund altogether.

Failing to file a tax return can be classified as a federal crime punishable as a misdemeanor or a felony. Willful failure to file a tax return is a misdemeanor pursuant to IRC 7203. In cases where an overt act of evasion occurred, willful failure to file may be elevated to a felony under IRC 7201.

State tax agencies have their own rule and many have more time to collect. For example, California can collect state taxes up to 20 years after the assessment date.

There's no penalty for failure to file if you're due a refund. However, you risk losing a refund altogether if you file a return or otherwise claim a refund after the statute of limitations has expired.

Failure to File Your Taxes Can be Considered a Crime However, not filing one's taxes is one of the worst things that a taxpayer can do if they owe back taxes. Failure to file your taxes is considered by the federal government to be a crime. Refusal to file your taxes can be considered a type of tax evasion.