Utah Employment Application for CEO

Description

How to fill out Employment Application For CEO?

Are you presently in a situation where you need documentation for either business or personal purposes on a daily basis? There are numerous legitimate document templates available on the web, but finding ones you can trust isn't simple.

US Legal Forms provides a vast array of form templates, including the Utah Employment Application for CEO, which can be crafted to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Utah Employment Application for CEO template.

- Locate the form you require and ensure it is for the correct city/area.

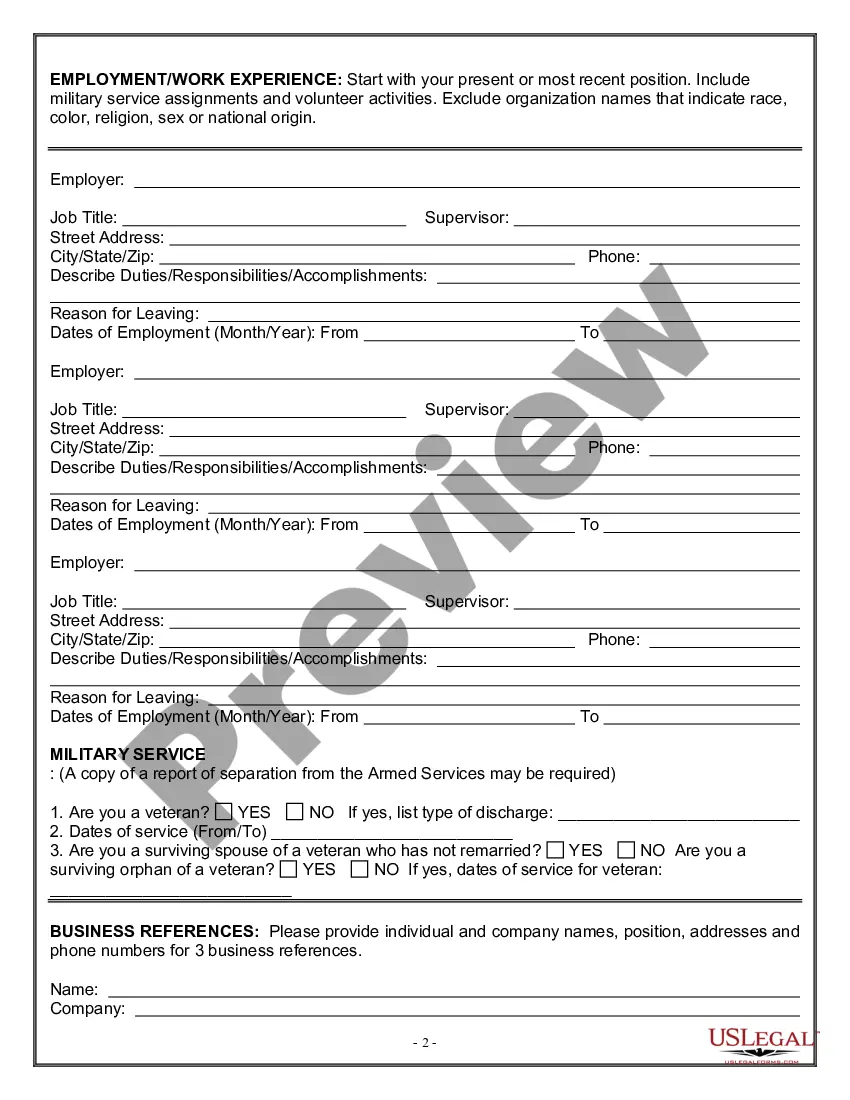

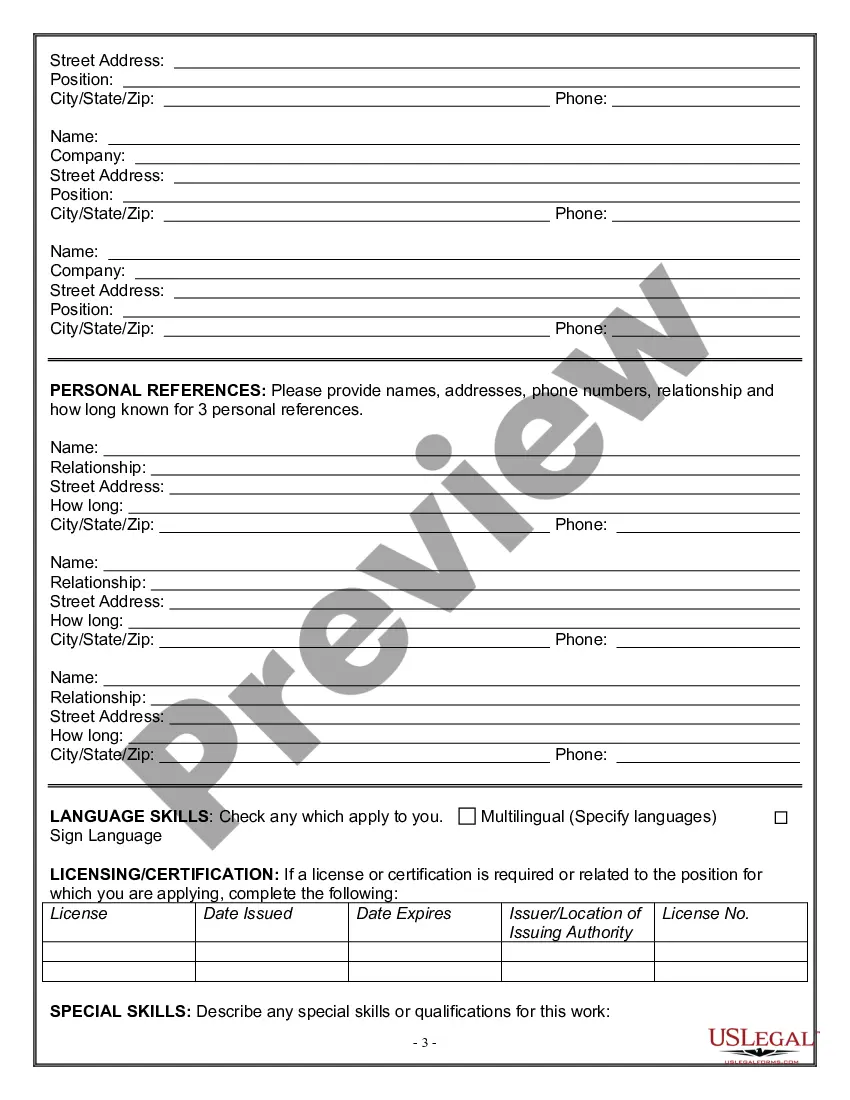

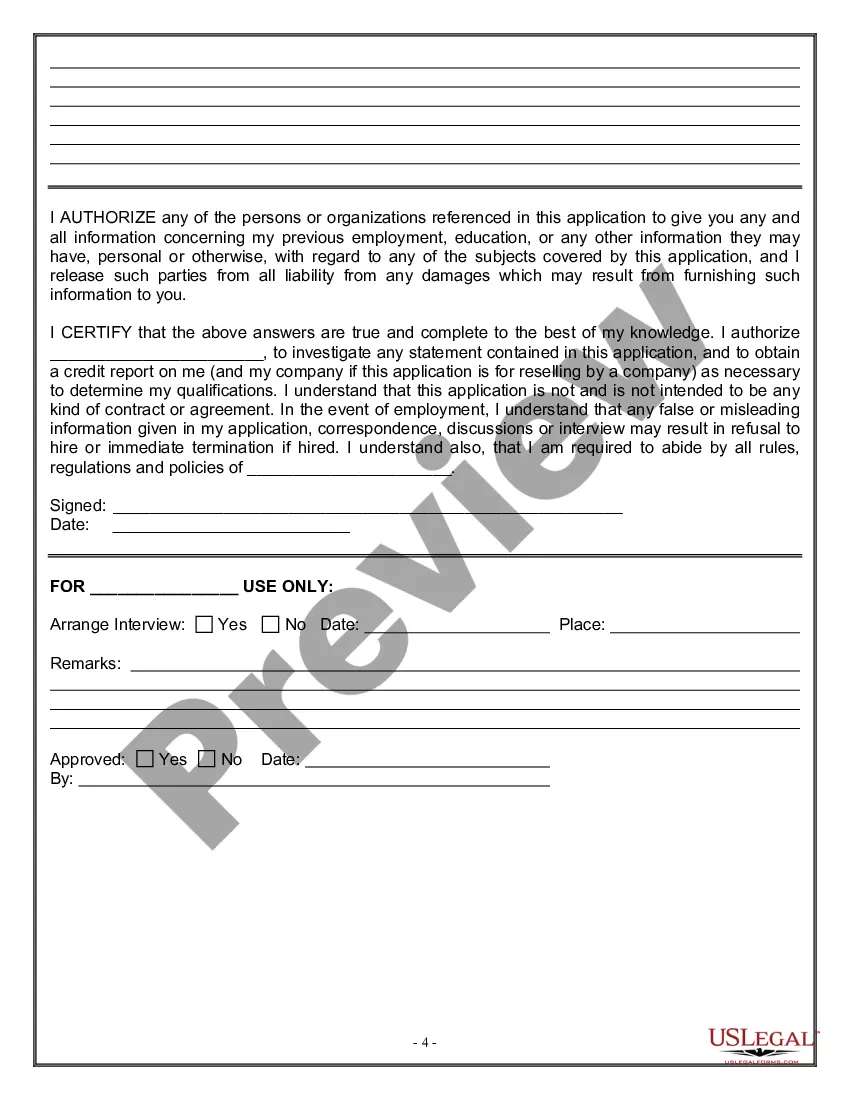

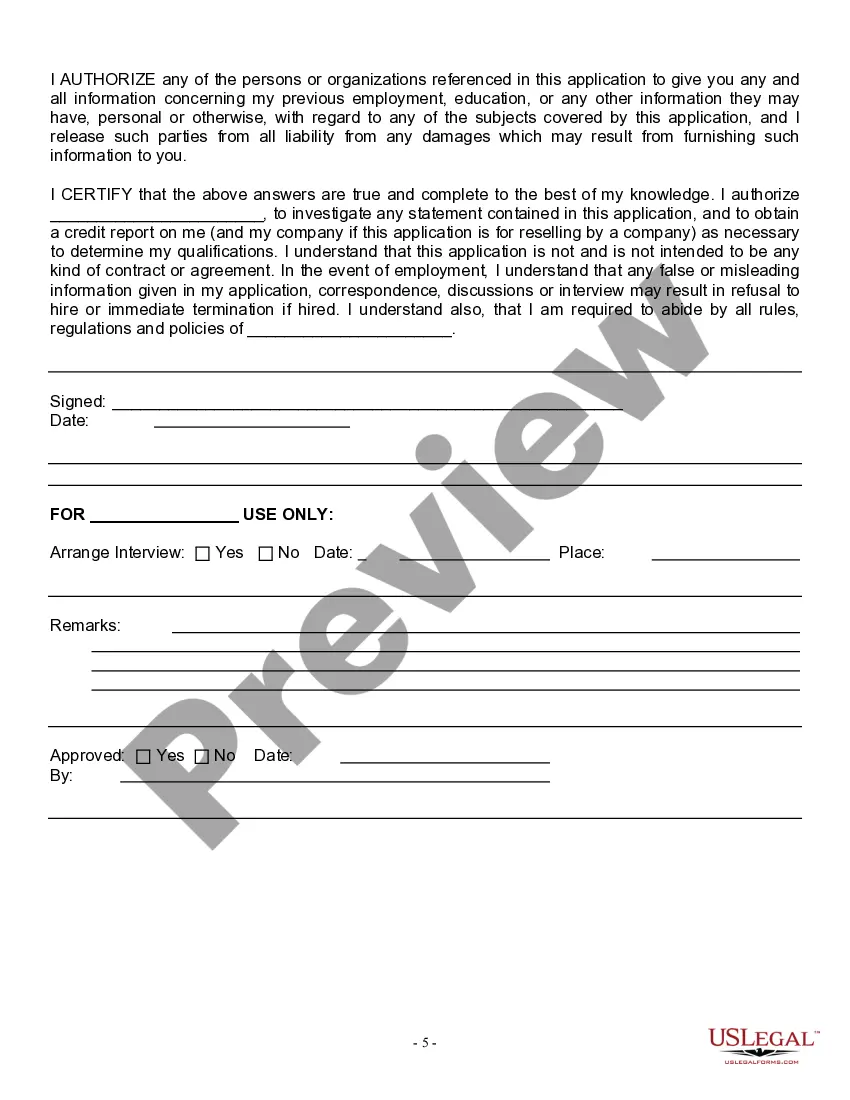

- Utilize the Review button to inspect the form.

- Read the description to confirm you have chosen the right form.

- If the form isn’t what you need, use the Lookup section to find the form that meets your wants and needs.

- Once you find the appropriate form, click Purchase now.

- Select the pricing plan you prefer, fill out the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Utah's law calls for a benefit ratio to be determined for each qualifying employer. This means that unemployment insurance benefits paid to your former employees will be used as the primary factor in calculating your contribution rate. These payments are known as benefit costs.

Employers pay all costs of the unemployment insurance program. Benefits are paid to eligible workers who (1) have sufficient wages during the base period, (2) are unemployed through no fault of their own, (3) are able to work full-time and (4) are available for and actively seeking full-time work.

How to2026 FILL OUT A JOB APPLICATIONBe Prepared. Make sure you know the correct names, dates, places and other information you will need.Ask If You May Take A Blank Application Home.Read The Form.Be Neat.Answer All Questions Completely And Correctly.Be Positive.Be Clear.Alert References Beforehand.More items...

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Each new employee will need to fill out the I-9, Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

The Utah employer contribution rate is calculated annually by the Unemployment Insurance Division. In 2022, more than 67% of Utah's employers qualified for the minimum contribution rate of approximately $124 per employee per year.

Online Filing Employers may submit New Hire data electronically: Online Data Entry at jobs.utah.gov/employer. Select Report New Hires at the bottom left. Telephone Employers may call during business hours ( a.m. to p.m., Monday-Friday) to report up to three individual new hires.

9. Additional information. For questions about new hire reporting you can contact the Utah New Hire Registry by telephone between am and pm MST by dialing (801) 526-4361 or toll free at (800) 222-2857.

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?