Utah Assumption and Loan Modification Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Utah Assumption And Loan Modification Agreement?

Among countless paid and free examples that you can get online, you can't be sure about their accuracy. For example, who made them or if they are qualified enough to deal with what you require those to. Always keep calm and make use of US Legal Forms! Find Utah Assumption and Loan Modification Agreement samples developed by professional lawyers and avoid the expensive and time-consuming procedure of looking for an attorney and then having to pay them to write a document for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the form you’re looking for. You'll also be able to access all of your previously downloaded samples in the My Forms menu.

If you’re using our service the first time, follow the instructions below to get your Utah Assumption and Loan Modification Agreement quick:

- Ensure that the document you discover applies in the state where you live.

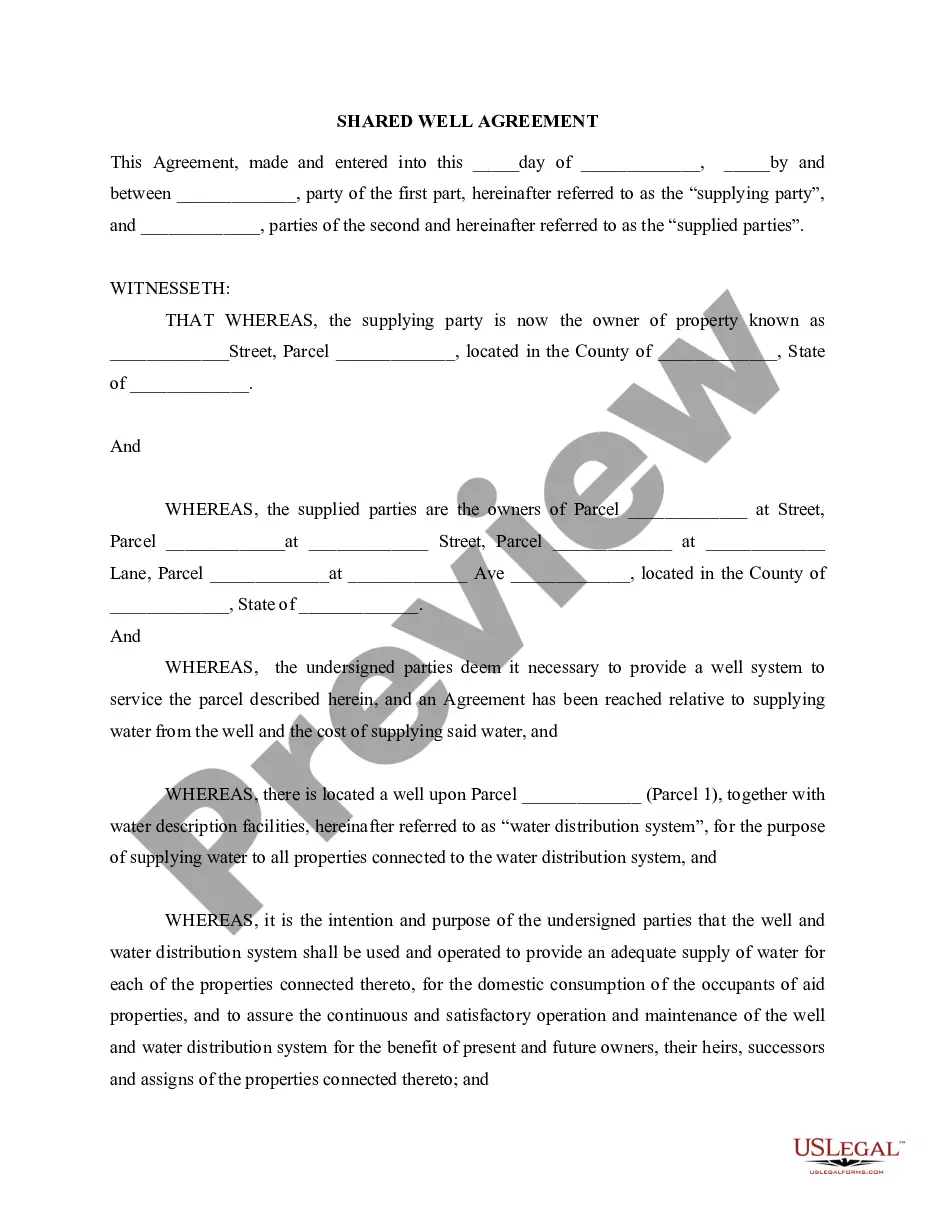

- Review the template by reading the information for using the Preview function.

- Click Buy Now to start the purchasing process or look for another template using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

When you have signed up and paid for your subscription, you may use your Utah Assumption and Loan Modification Agreement as many times as you need or for as long as it remains active in your state. Change it in your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

Having an assumable loan might give a seller a marketing edge, particularly if mortgage rates have risen since the seller got the loan. For a buyer, assuming a mortgage can save thousands of dollars in interest payments and closing costs but it could require making a big down payment.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

A mortgage modification is a significant change your lender makes to your loan terms when you are about to miss a payment or after you've missed one or more mortgage payments.Qualifying for a mortgage modification typically requires that you demonstrate a significant hardship.

An income and expenses financial worksheet. tax returns (often, two years' worth) recent pay stubs or a profit and loss statement. proof of any other income (including alimony, child support, Social Security, disability, etc.) recent bank statements, and.

The loan modification underwriter will analyze and review the particular circumstances which justify a loan modification. The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay.

You have to be suffering a financial hardship. You have to show you cannot afford your current mortgage payments. You have to be able to show that you can stay current on a modified payment schedule.

You should contact the lender's loss and mitigation department to discuss the reason of you loan modification rejection. Possible reasons for a modification rejection include insufficient income, high debt-to-income ratio, missing documents, or delinquent credit history.

When you've successfully completed your trial modification payments, your mortgage loan servicer will send you a loan modification agreement. That agreement needs to be signed by you, stamped and signed by a notary, and sent back to your servicer.Some banks even offer a notary who will come to your home.