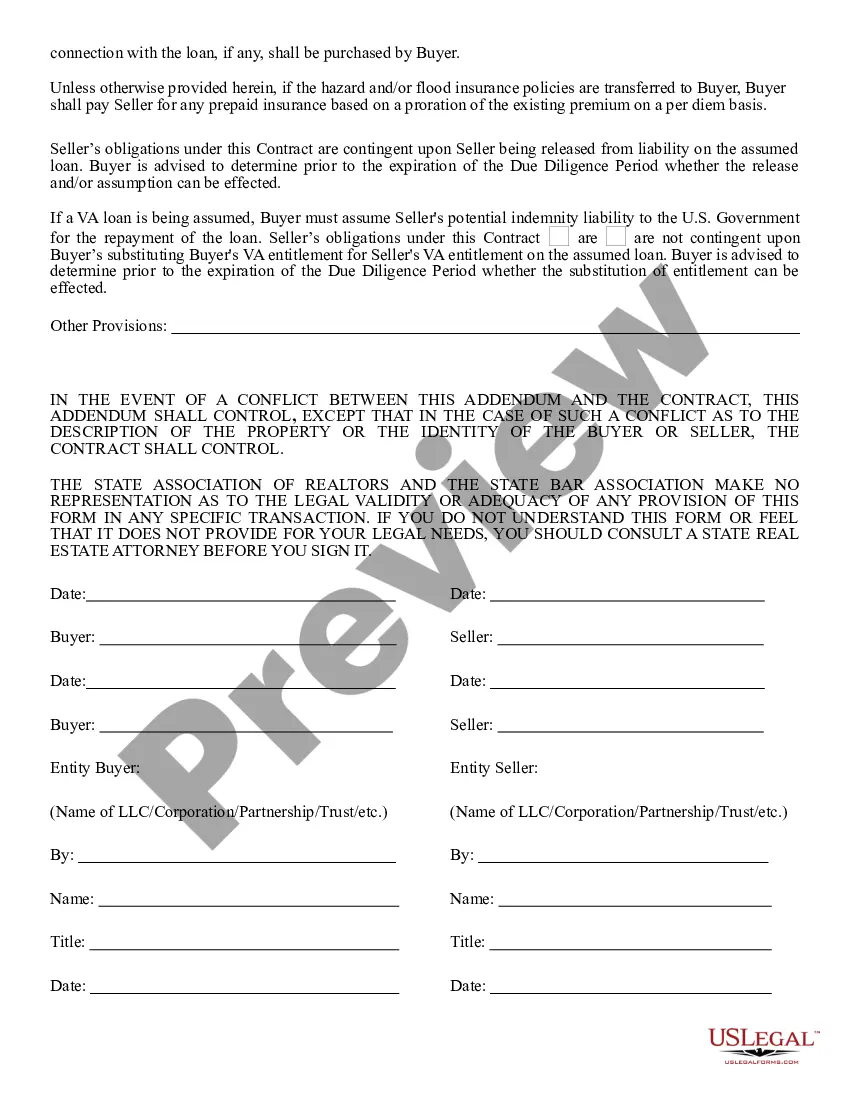

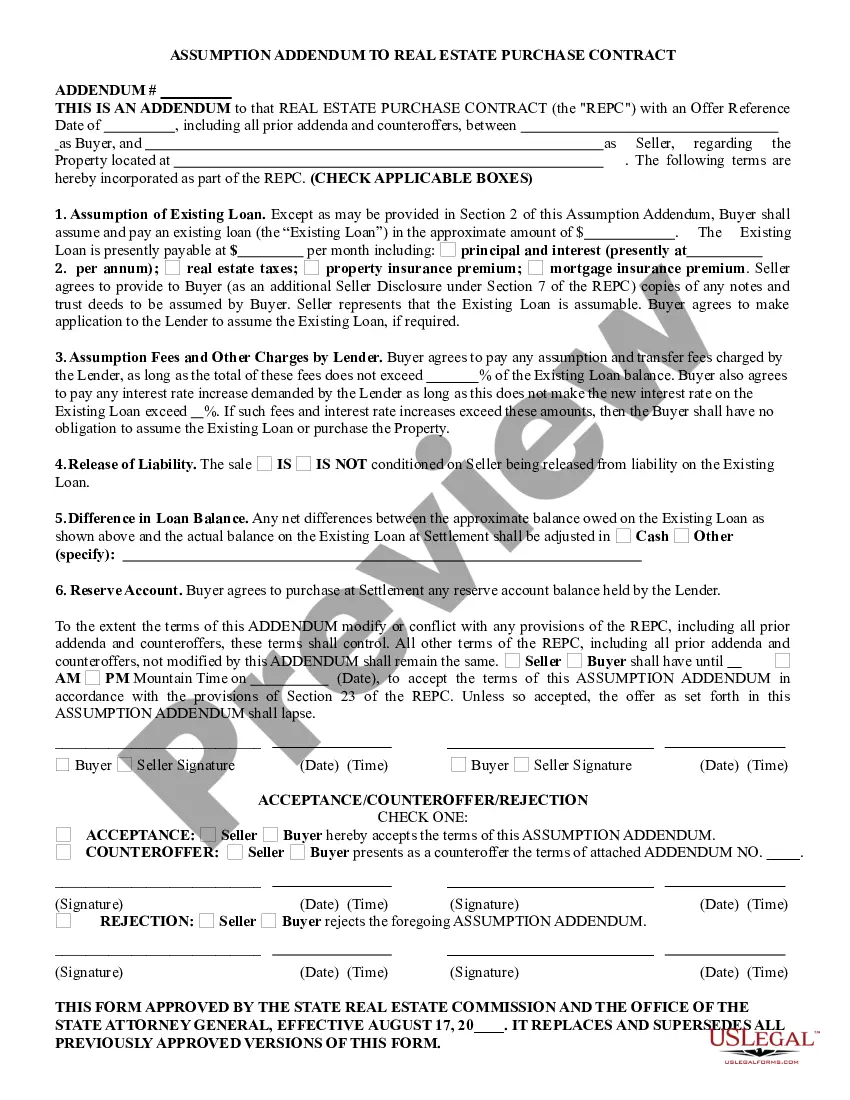

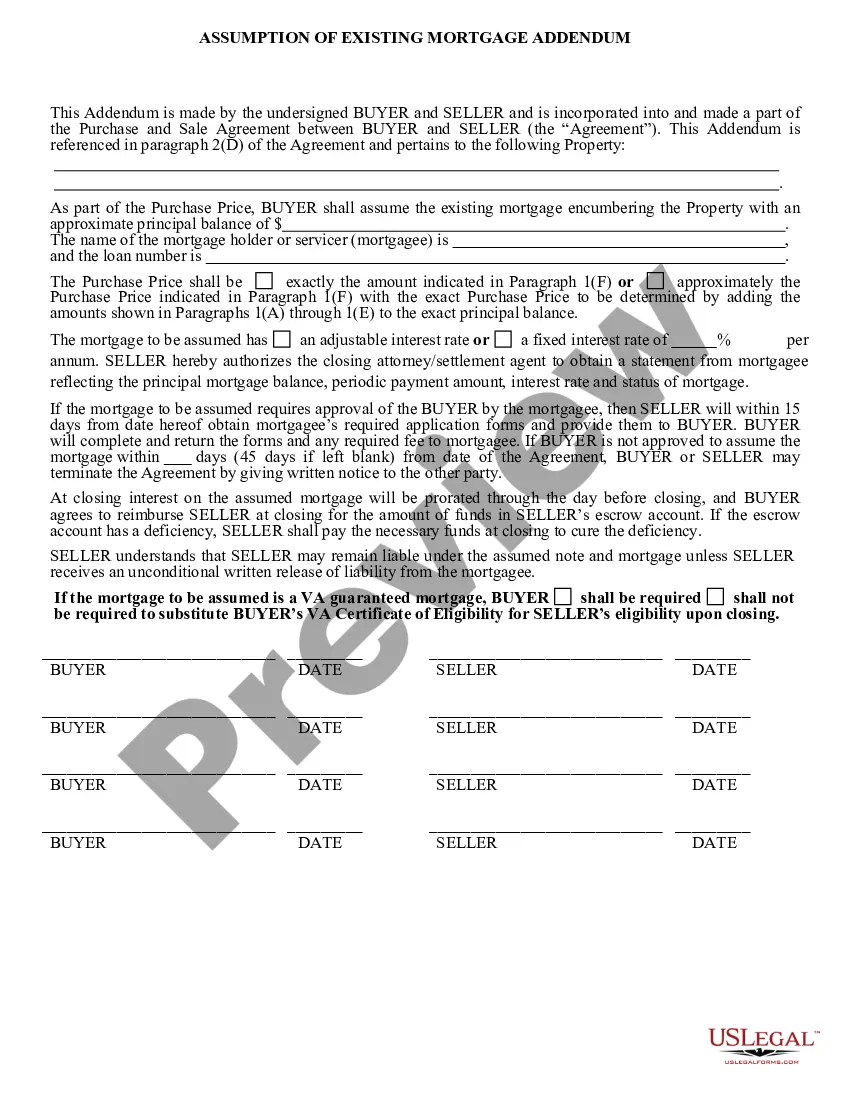

A Loan Assumption Addendum is a legal document that allows the transfer of a loan from the current borrower to a new one. This document is usually signed by both parties, the current borrower and the new borrower, in order to confirm that the new borrower agrees to assume the outstanding debt and the current borrower agrees to release them from any future liabilities. There are typically two types of Loan Assumption Addendums: a Voluntary Loan Assumption Addendum and an Involuntary Loan Assumption Addendum. A Voluntary Loan Assumption Addendum is used when the current borrower willingly transfers the loan to the new borrower. An Involuntary Loan Assumption Addendum is used when the current borrower is unable to continue paying the loan and the lender transfers the loan to another borrower in order to recoup the debt. Both types of Loan Assumption Addendums include information about the loan being transferred, including the amount, interest rate, and terms. In addition, both parties must sign the document in order to validate the agreement.

Loan Assumption Addendum

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Loan Assumption Addendum?

How much time and resources do you often spend on drafting official paperwork? There’s a better way to get such forms than hiring legal specialists or spending hours browsing the web for a proper blank. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, such as the Loan Assumption Addendum.

To acquire and prepare a suitable Loan Assumption Addendum blank, adhere to these simple steps:

- Look through the form content to make sure it complies with your state requirements. To do so, read the form description or use the Preview option.

- If your legal template doesn’t meet your needs, find a different one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Loan Assumption Addendum. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely secure for that.

- Download your Loan Assumption Addendum on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously downloaded documents that you securely store in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most reliable web services. Join us now!

Form popularity

FAQ

An assumable mortgage works much the same as a traditional home loan, except the buyer is limited to financing through the seller's lender. Lenders must approve an assumable mortgage. If done without approval, sellers run the risk of having to pay the full remaining balance upfront.

You will need to complete an application, provide documents, and meet the lender's credit, income, and financial requirements to get the loan assumption approved. Lenders often have stricter mortgage underwriting standards for loan assumptions than they do for new loans.

When a buyer buys property and assumes a mortgage, the buyer becomes primarily liable for the debt and the seller becomes secondarily liable for the debt. "Assume" means the buyer takes on liability, and the seller is no longer primarily liable. "Subject to" means the seller is not released from responsibility.

Although the buyer agrees to make payments on the home loan during a simple assumption, the seller still remains responsible for the mortgage. Any delinquencies or defaults incurred by the buyer will also appear on the credit report of the the seller.

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower. These agreements are commonly seen in mortgages and real estate.

Loan assumption can be a powerful enticement for these buyers as they shop for houses, because it would allow them to pay lower interest rates even as the housing market becomes more expensive.

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement. Do yourself a favor and get the necessary criteria organized in advance.

In a properly done assumption, the new borrower must jump through some of the same hoops it would take to qualify for a new loan. The loan's servicer requests the borrower's credit report, plus financial and employment information. Finally, the lender releases the original borrower's liability for the debt.