Nonqualified Defined Benefit Deferred Compensation Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

A nonqualified defined benefit deferred compensation plan is a type of retirement plan usually offered by employers to high-earning executives as an incentive beyond traditional qualified plans like 401(k). Unlike qualified plans, these plans are exempt from many requirements of the Employee Retirement Income Security Act (ERISA) and can offer tailored benefits to a selective group of employees.

Step-by-Step Guide

- Plan Design: The employer designs the plan with specific features tailored to meet the needs of the selected employees.

- Funding: Decide on funding options either through employer contributions, employee deferrals, or both.

- Communicate: Clearly communicate the plan specifics to eligible employees, including benefits and potential risks.

- Implement: Establish administrative procedures and ensure legal compliance for implementing the plan.

- Monitor: Regularly review the plan to ensure it meets its financial goals and obligations.

Risk Analysis

- Legislative Risk: Changes in tax laws or other regulations could affect the tax deferral benefits.

- Market Risk: Investment losses can affect the plan's ability to deliver promised benefits.

- Liquidity Risk: Nonqualified deferred compensation may not be accessible in times of financial need as they typically are inaccessible until a predetermined date or event.

- Creditor Risk: In case of bankruptcy, these plans are often subject to creditors' claims as they are not ERISA protected.

Best Practices

- Legal Compliance: Ensure the plan complies with all applicable laws and regulations to prevent legal complications.

- Clear Communication: Provide clear, understandable explanations of the plan to eligible employees to ensure they are fully informed.

- Regular Review: Conduct regular reviews and adjustments of the plan in response to changing market conditions and company objectives.

- Risk Management: Implement strategies to mitigate associated risks, including diversifying investments and securing insurances.

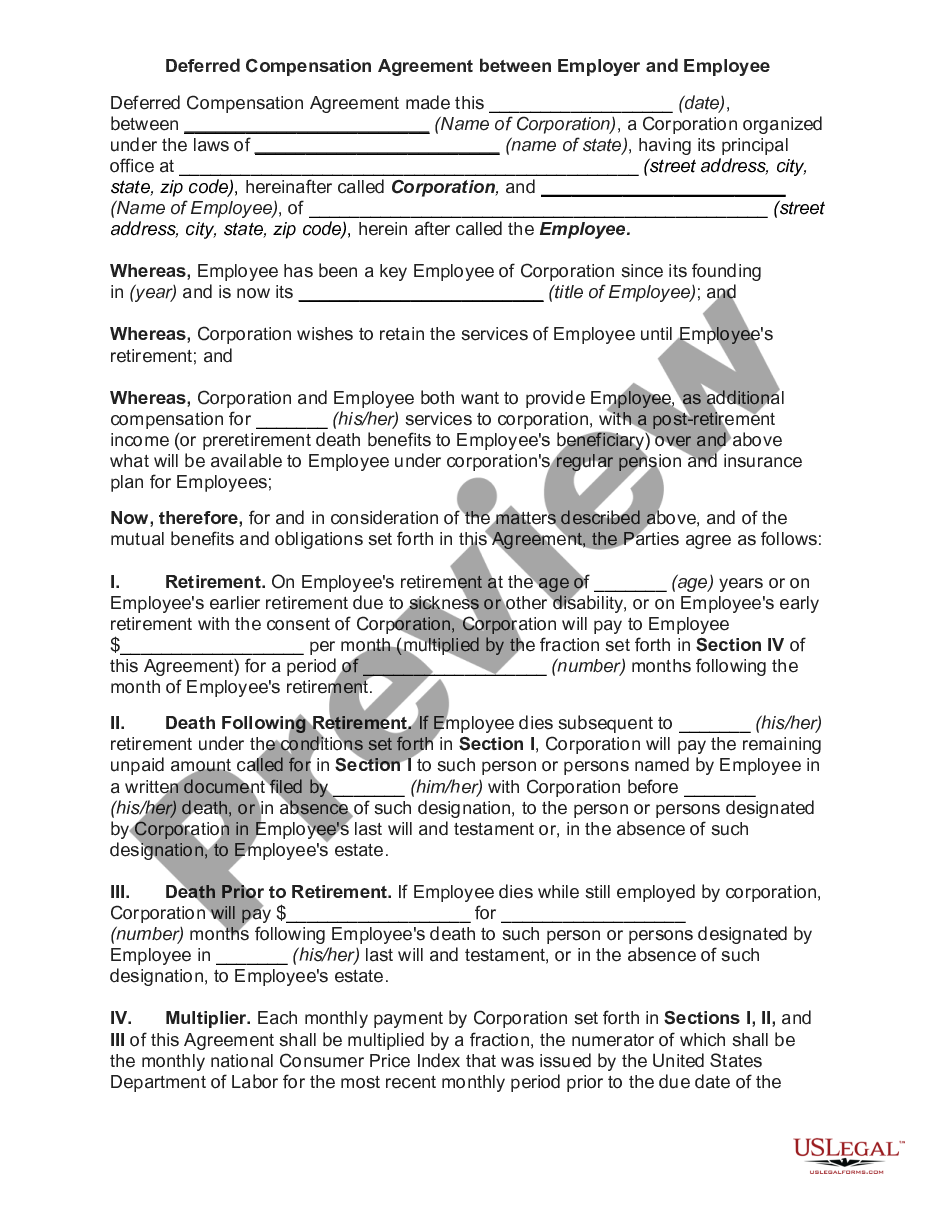

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

When it comes to drafting a legal document, it is easier to delegate it to the experts. Nevertheless, that doesn't mean you yourself cannot get a sample to utilize. That doesn't mean you yourself cannot find a sample to utilize, however. Download Nonqualified Defined Benefit Deferred Compensation Agreement right from the US Legal Forms site. It provides a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. When you are signed up with an account, log in, search for a particular document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we’ve incorporated an 8-step how-to guide for finding and downloading Nonqualified Defined Benefit Deferred Compensation Agreement fast:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Hit Buy Now.

- Select the suitable subscription to meet your needs.

- Make your account.

- Pay via PayPal or by credit/bank card.

- Choose a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

Once the Nonqualified Defined Benefit Deferred Compensation Agreement is downloaded you may complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

A deferred comp plan is most beneficial when you're able to reduce both your present and future tax rates by deferring your income.The key is, the longer you have until receiving the deferred income, the smaller amount you should defer unless it's apparent there is a tax benefit to deferring more significant amounts.

A non-qualified deferred compensation (NQDC) plan allows a service provider (e.g., an employee) to earn wages, bonuses, or other compensation in one year but receive the earningsand defer the income tax on themin a later year.

Generally speaking, the tax treatment of deferred compensation is simple: Employees pay taxes on the money when they receive it, not necessarily when they earn it.The year you receive your deferred money, you'll be taxed on $200,000 in income10 years' worth of $20,000 deferrals.

NQDC plans allow corporate executives to defer a much larger portion of their compensation, and to defer taxes on the money until the deferral is paid. You should consider contributing to a corporate NQDC plan only if you are maxing out your qualified plan options, such as a 401(k).

A non-qualified deferred compensation (NQDC) plan allows a service provider (e.g., an employee) to earn wages, bonuses, or other compensation in one year but receive the earningsand defer the income tax on themin a later year.

A non-qualified deferred compensation (NQDC) plan allows a service provider (e.g., an employee) to earn wages, bonuses, or other compensation in one year but receive the earningsand defer the income tax on themin a later year.

Qualified plans have tax-deferred contributions from the employee, and employers may deduct amounts they contribute to the plan. Nonqualified plans use after-tax dollars to fund them, and in most cases employers cannot claim their contributions as a tax deduction.

Deferred compensation plans can be a great savings vehicle, especially for employees who are maximizing their 401(k) contributions and have additional savings for investment, but they also come with lots of strings attached.

A nonqualified deferred compensation (NQDC) plan is an elective or non-elective plan, agreement, method, or arrangement between an employer and an employee (or service recipient and service provider) to pay the employee or independent contractor compensation in the future.