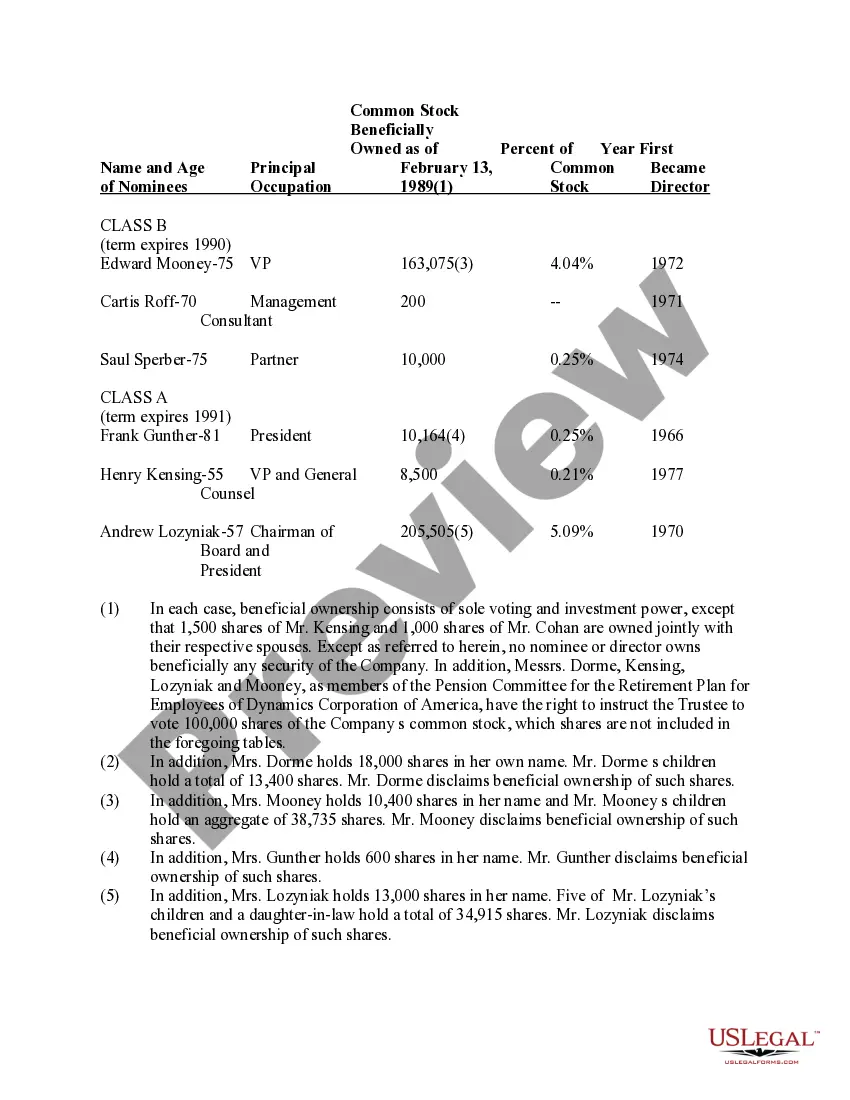

Election of Directors of Dynamics Corporation of America

Description

How to fill out Election Of Directors Of Dynamics Corporation Of America?

When it comes to drafting a legal document, it is better to delegate it to the specialists. Nevertheless, that doesn't mean you yourself can’t get a sample to utilize. That doesn't mean you yourself can not get a sample to utilize, however. Download Election of Directors of Dynamics Corporation of America straight from the US Legal Forms site. It offers numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. When you’re registered with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things easier, we’ve provided an 8-step how-to guide for finding and downloading Election of Directors of Dynamics Corporation of America fast:

- Make sure the document meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the suitable subscription for your needs.

- Make your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

Once the Election of Directors of Dynamics Corporation of America is downloaded you are able to complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant files in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Call the IRS Business Assistance Line at 800-829-4933. The IRS can review your business file to see if your company is a C corporation, S corporation, partnership, single-member LLC, or sole proprietor based on any elections you may have made and the type of income tax returns you file.

A. Employer identification number (EIN): Put your company's EIN here. B. Date incorporated: Write the date your business was incorporated or registered. C. State of incorporation: Enter the state where you formed your business. D. Check if:

Filing options for IRS Form 2553 include mail and fax filing. You cannot file this form online.

The corporation should generally receive a determination on its election within 60 days after it has filed Form 2553. If the corporation is not notified of acceptance or nonacceptance of its election within 2 months of the date of filing the taxpayer should take follow-up action by calling IRS at 1-800-829-4933.

You can check your S corp status relatively easily by contacting the IRS. If you have properly submitted your S corporation form to the IRS and have not heard back, you can call the IRS at (800) 829-4933 and they will inform you of your application status.

No, there is no way to see if an LLC has elected to file its taxes as an S-corp (meaning, elected to be treated like an association, with taxation as an S-corp) with the IRS online. However, if you have the LLC's relevant information, you can call the IRS at 1-800-829-4933 and ask them.

This may take more time if you do not use the calendar year as your tax year. There is no fee to file Form 2553. However, special conditions may dictate a fee. For example, some businesses may be charged for using a non-traditional tax year.

Filing options for IRS Form 2553 include mail and fax filing. You cannot file this form online.