Agreement for Purchase and Sale of Rights to Cooperative Apartment

Definition and meaning

The Agreement for Purchase and Sale of Rights to Cooperative Apartment is a legal document that facilitates the transfer of rights associated with a cooperative apartment from the seller to the purchaser. This agreement outlines the terms under which the purchaser agrees to buy the shares in a cooperative corporation and the transferable lease of a specific apartment unit.

In simpler terms, this document serves to formalize the transaction between two parties—typically involving a seller who currently holds ownership rights and a buyer who wishes to acquire those rights, often as part of apartment ownership in a cooperative housing arrangement.

Who should use this form

This agreement should be used by individuals or entities looking to purchase a cooperative apartment. Specifically, it is designed for:

- Prospective buyers of cooperative apartments.

- Current owners of cooperative apartment shares wishing to sell.

Using this form ensures that all parties are aware of their rights and obligations and that the transaction adheres to relevant laws and regulations.

Key components of the form

When completing the Agreement for Purchase and Sale of Rights to Cooperative Apartment, several key components must be included to ensure clarity and legality:

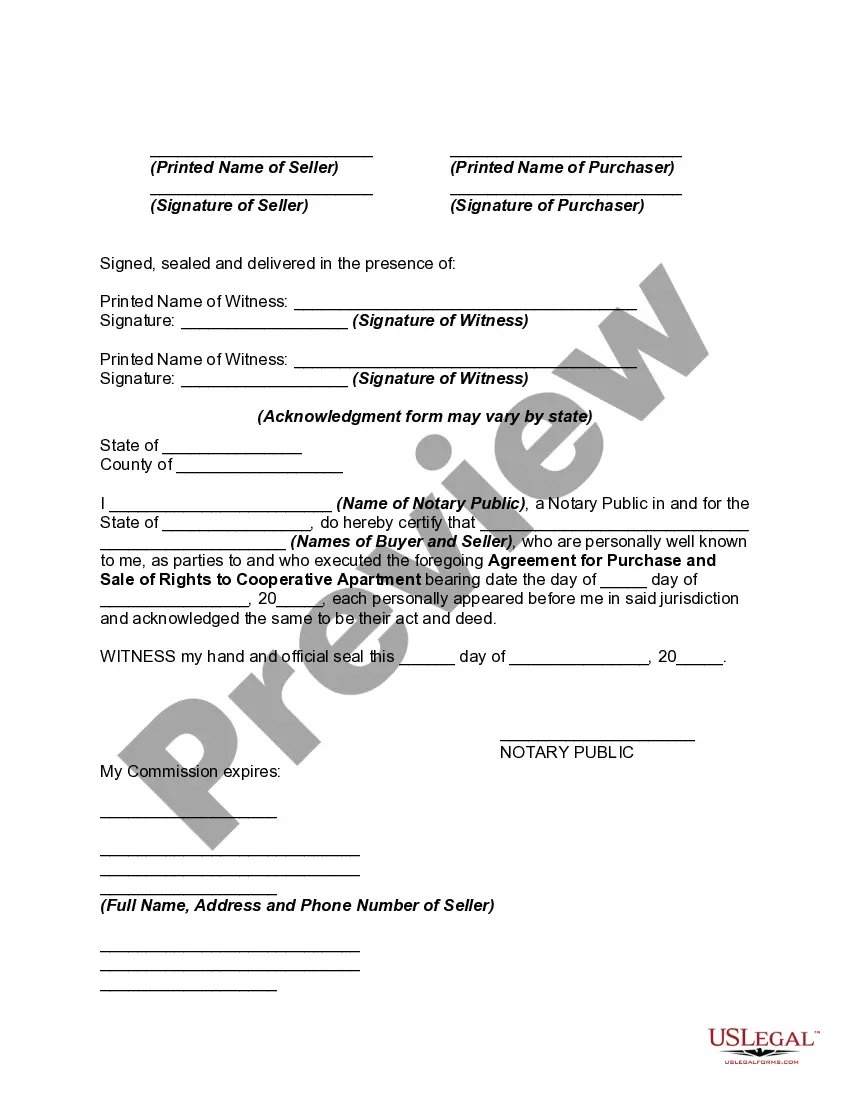

- Parties' information: Names and addresses of both the purchaser and seller.

- Apartment and building details: Specific identification of the apartment being sold and details about the cooperative building.

- Definition of shares: Number of shares being transferred in relation to the cooperative.

- Terms of payment: Stipulations on the purchase price and payment schedule.

- Closing details: Information regarding the date and place of the closing, including any additional requirements.

These components are essential to creating a binding contract that protects both parties.

How to complete a form

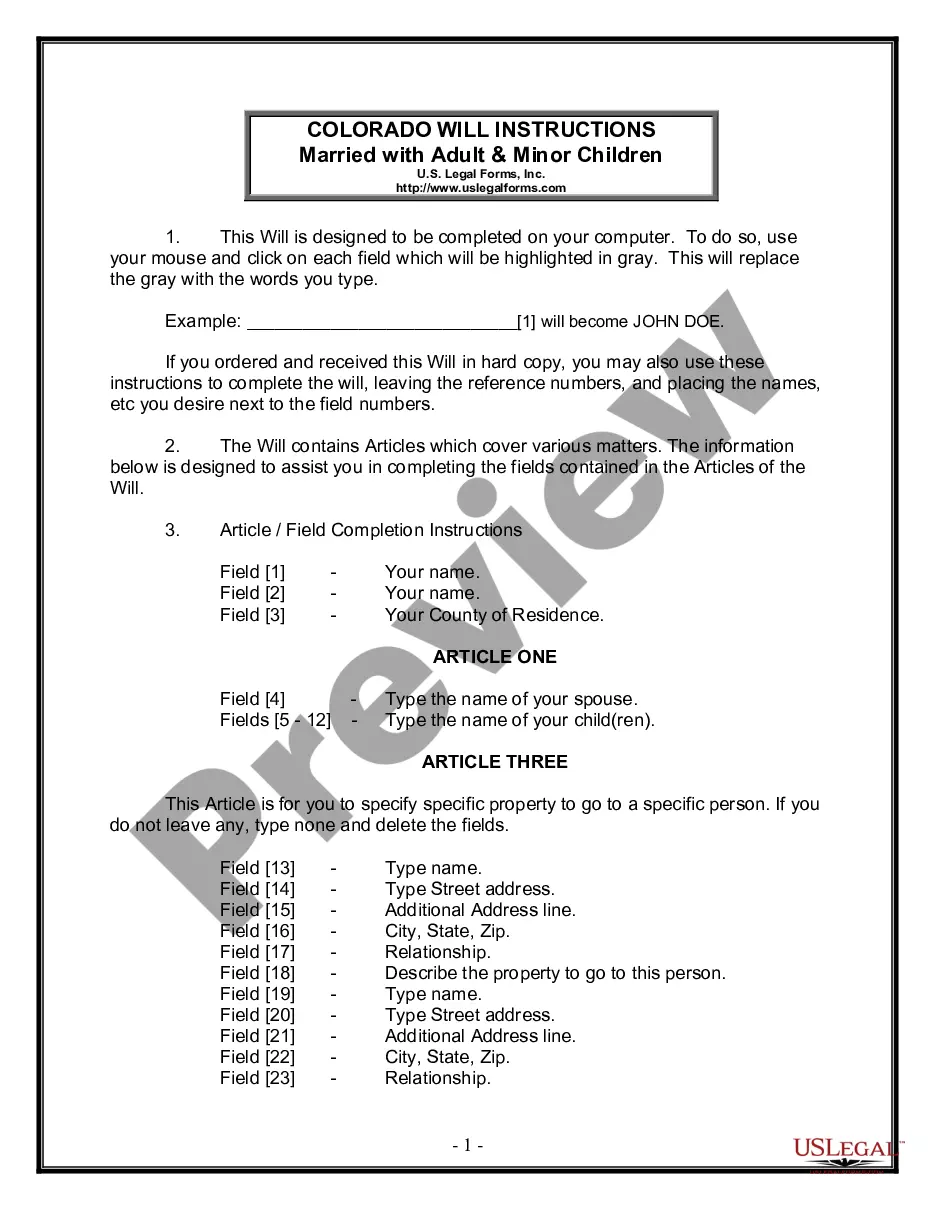

Completing the Agreement for Purchase and Sale of Rights to Cooperative Apartment involves several important steps:

- Gather necessary information: Collect details about both parties, the apartment, and the cooperative corporation.

- Fill in the form: Accurately enter the required information in the appropriate sections of the agreement.

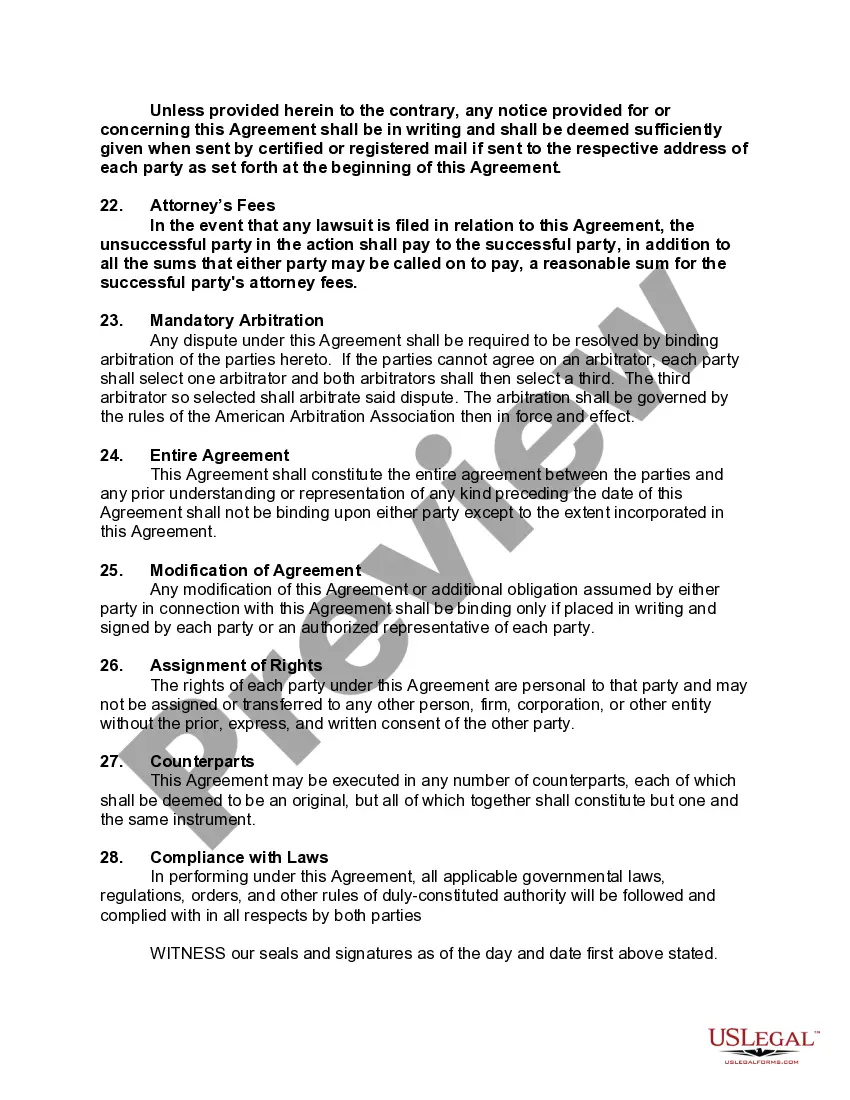

- Review all terms: Carefully check the terms of the sale, including the payment schedule and closing details.

- Sign and date: Both parties must sign and date the agreement to make it enforceable.

- Witness and notarize: In many cases, the agreement must be witnessed and notarized to validate the transaction legally.

By following these steps, users can ensure that their agreement is correctly completed and legally binding.

Common mistakes to avoid when using this form

To ensure a smooth transaction, avoid the following common mistakes when filling out the Agreement for Purchase and Sale of Rights to Cooperative Apartment:

- Incomplete information: Ensure all sections are filled out completely and accurately.

- Missing signatures: Both parties must sign the agreement; failing to do so can invalidate it.

- Not conducting due diligence: Prior to the sale, both parties should confirm ownership and understand any obligations related to the cooperative.

- Ignoring local laws: Be aware of and comply with state-specific regulations regarding cooperative transfers.

By being mindful of these common pitfalls, users can protect their interests and facilitate a successful transaction.

What documents you may need alongside this one

In addition to the Agreement for Purchase and Sale of Rights to Cooperative Apartment, you may need to prepare and attach several other documents:

- Copy of the lease: Provides evidence of the terms governing the cooperative apartment.

- Share certificate: Confirms the seller's ownership of the cooperative shares being sold.

- Board approval documents: Required for cooperative ownership transfers; check if the cooperative corporation mandates board approval.

- Proof of identity: Valid ID for both parties to confirm their identities.

Having these documents on hand helps ensure the transaction is legally sound and goes smoothly at closing.

Form popularity

FAQ

Cooperative Agreements are legal instruments that facilitate the transfer of something of value from federal executive agencies to states, local governments, and private recipients for a public purpose or benefit.In many respects, Cooperative Agreements are similar to federal grants.

1 Access The Desired Real Estate Template To Record A Purchase Agreement. 2 Introduce The Agreement, Seller, Buyer, And Concerned Property. 3 Define The Basic Terms Of The Real Estate Purchase. 4 Record Any Property The Buyer Must Sell To Complete This Purchase.

A real estate deal can take a turn for the worst if the contract is not carefully written to include all the legal stipulations for both the buyer and seller.You can write your own real estate purchase agreement without paying any money as long as you include certain specifics about your home.

Buyer's Inspection Contingency. Essentially, this contingency conditions the closing on the buyer receiving and being happy with the result of one or more home inspections. Financing Contingency. Insurance-Related Contingencies. Appraisal Contingency. Other Contingencies.

At the top of the page, you should center the title between the left- and right-hand margins. Title your document something like Purchase and Sale Agreement or Agreement to Purchase Real Estate. Identify the parties to the sale. You need to identify the purchaser and the seller at the start of your agreement.

A real estate deal can take a turn for the worst if the contract is not carefully written to include all the legal stipulations for both the buyer and seller.You can write your own real estate purchase agreement without paying any money as long as you include certain specifics about your home.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

A purchase agreement is a legal document that is signed by both the buyer and the seller. Once it is signed by both parties, it is a legally binding contract. The seller can only accept the offer by signing the document, not by just providing the goods.

Buyer and seller information. Property details. Pricing and financing. Fixtures and appliances included/excluded in the sale. Closing and possession dates. Earnest money deposit amount. Closing costs and who is responsible for paying.