Preferred Stock Certificate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Preferred Stock Certificate?

Use the most complete legal catalogue of forms. US Legal Forms is the best place for finding updated Preferred Stock Certificate templates. Our service provides thousands of legal forms drafted by certified lawyers and sorted by state.

To obtain a sample from US Legal Forms, users only need to sign up for an account first. If you’re already registered on our platform, log in and select the template you need and purchase it. Right after buying templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the steps listed below:

- Find out if the Form name you have found is state-specific and suits your requirements.

- In case the form features a Preview function, use it to review the sample.

- In case the template does not suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the template meets your expections.

- Choose a pricing plan.

- Create your account.

- Pay with the help of PayPal or with the debit/bank card.

- Select a document format and download the template.

- When it’s downloaded, print it and fill it out.

Save your effort and time with the service to find, download, and fill out the Form name. Join thousands of happy customers who’re already using US Legal Forms!

Form popularity

FAQ

Locate the Company. The first step is making sure the company is still in business. Find the CUSIP Number. The secretary of state's office in the state of incorporation must be listed on the stock certificate. Contact the Transfer Agent. Complete the Transfer Form. Place an Order. Keep Old Certificates.

Preferred stock is equity. Just like common stock, its shares represent an ownership stake in a company. However, preferred stock normally has a fixed dividend payout as well. That's why some call preferred stock a stock that acts like a bond.

An old stock or bond certificate may still be valuable even if it no longer trades under the name printed on the certificate. The company may have merged with another company or simply changed its name.

For example, the holder of 100 shares of a corporation's 8% $100 par preferred stock will receive annual dividends of $800 (8% X $100 = $8 per share X 100 shares) before the common stockholders are allowed to receive any cash dividends for the year.

An old stock or bond certificate may still be valuable even if it no longer trades under the name printed on the certificate. The company may have merged with another company or simply changed its name.

Stock shares do not have an expiration date.This may be the case with an old stock certificate you found in a trunk, but it will not hurt to check it out.

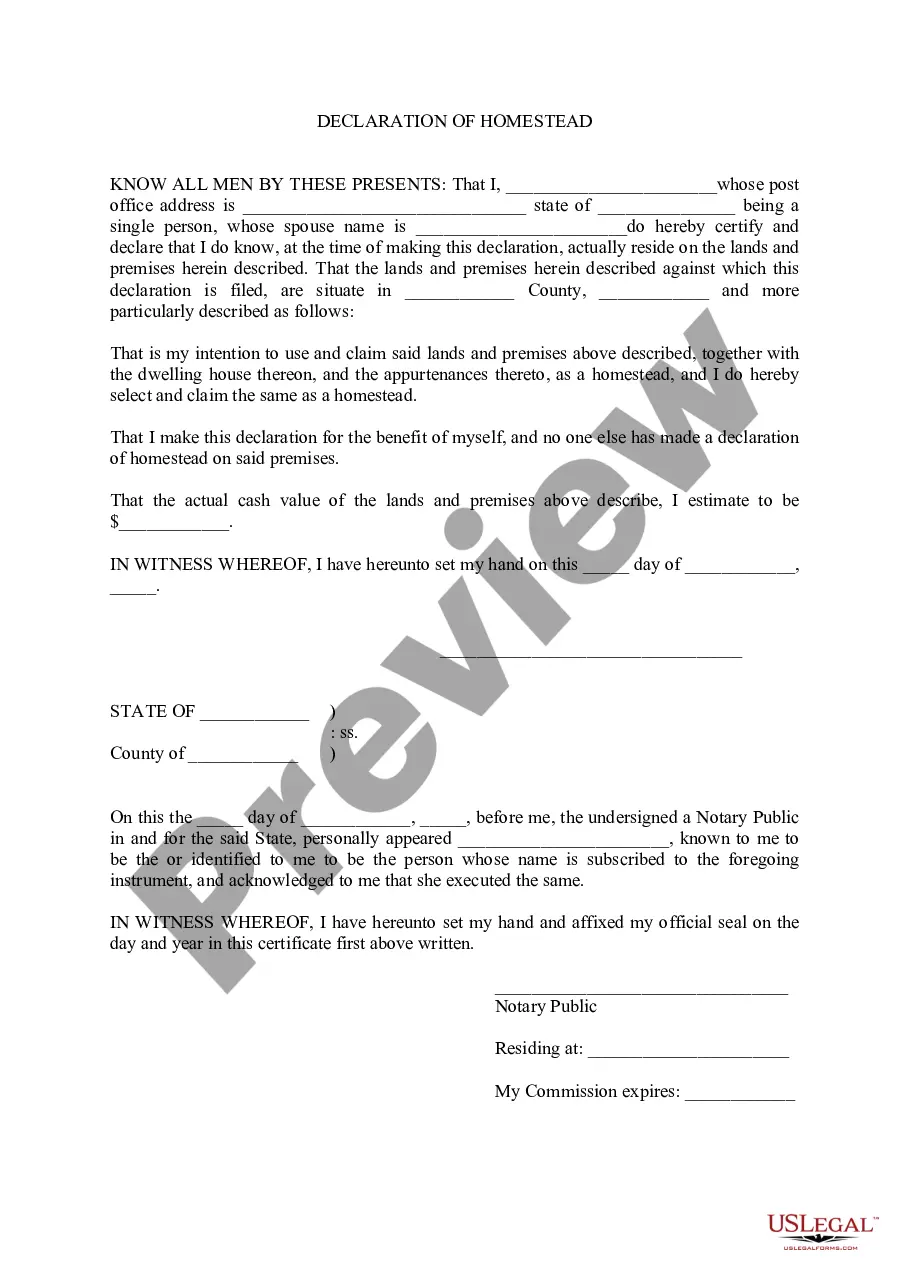

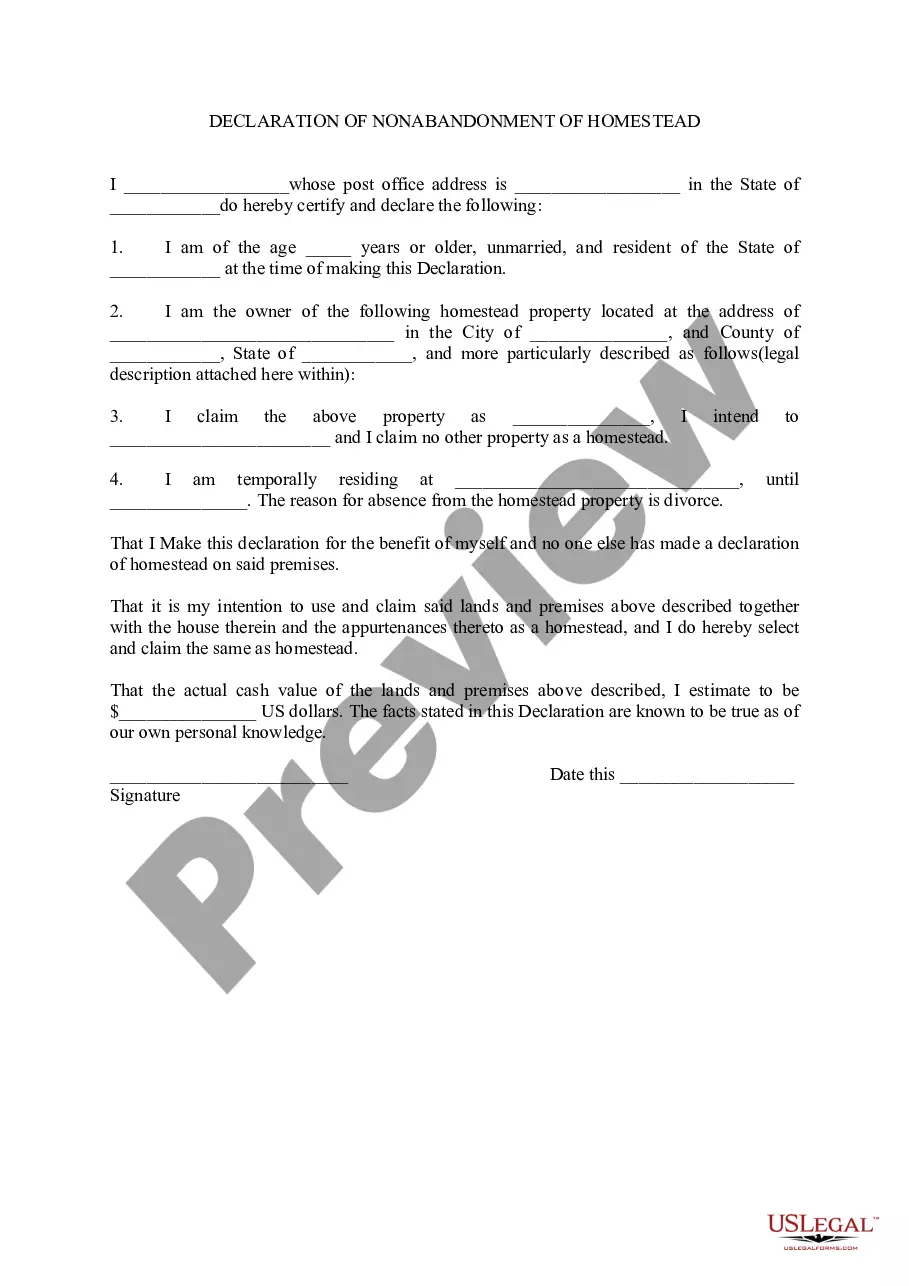

A certificate which contains a copy of the board resolution setting out the powers, designations, preferences or rights of a class or series of a class of stock of a corporation (typically a series of preferred stock) if they are not already contained in the certificate of incorporation of the corporation.

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.

Contact your stockbroker to search the stock's worth via its CUSIP number if the steps given earlier yield no results. This number is printed on the back of the stock certificate. Use a fee-based service to search your stock's history if the earlier steps come up empty. Fees can range from $40 to $85 or more.