Pledge of Shares of Stock

Definition and meaning

A Pledge of Shares of Stock is a legal document used to secure a loan or debt by pledging shares of stock as collateral. This arrangement allows the lender, known as the pledgee, to have a claim on the stock if the borrower, referred to as the pledgor, defaults on the obligation. The shares pledged can be used to mitigate the risks associated with extending credit, providing assurance to the lender.

Key components of the form

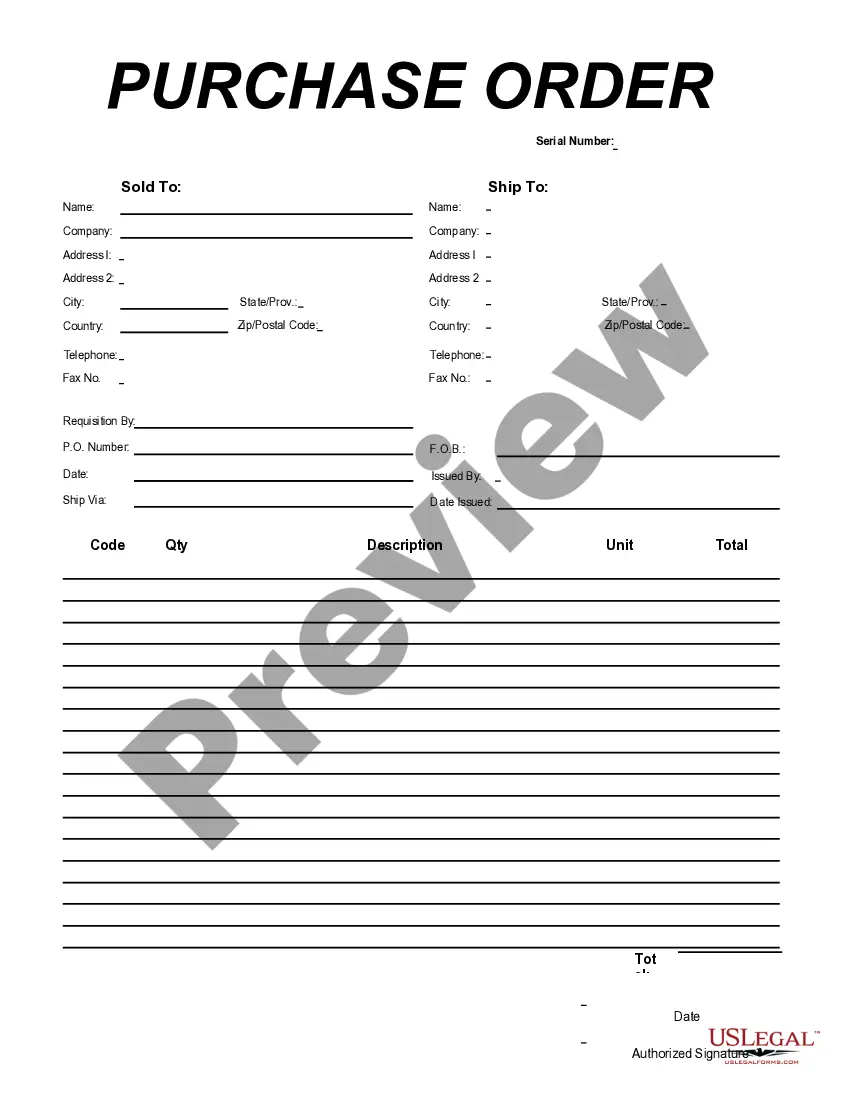

The Pledge of Shares of Stock typically includes several essential elements that outline the terms of the pledge. These components include:

- Identification of parties: Information about the pledgor and pledgee.

- Description of pledged shares: A clear statement of the number and type of shares being pledged.

- Debt secured: Details regarding the obligation the pledge is securing.

- Terms of the agreement: Provisions related to voting rights, dividends, default, and foreclosure rights.

Understanding these components is crucial for both parties to ensure they fulfill their obligations under the agreement.

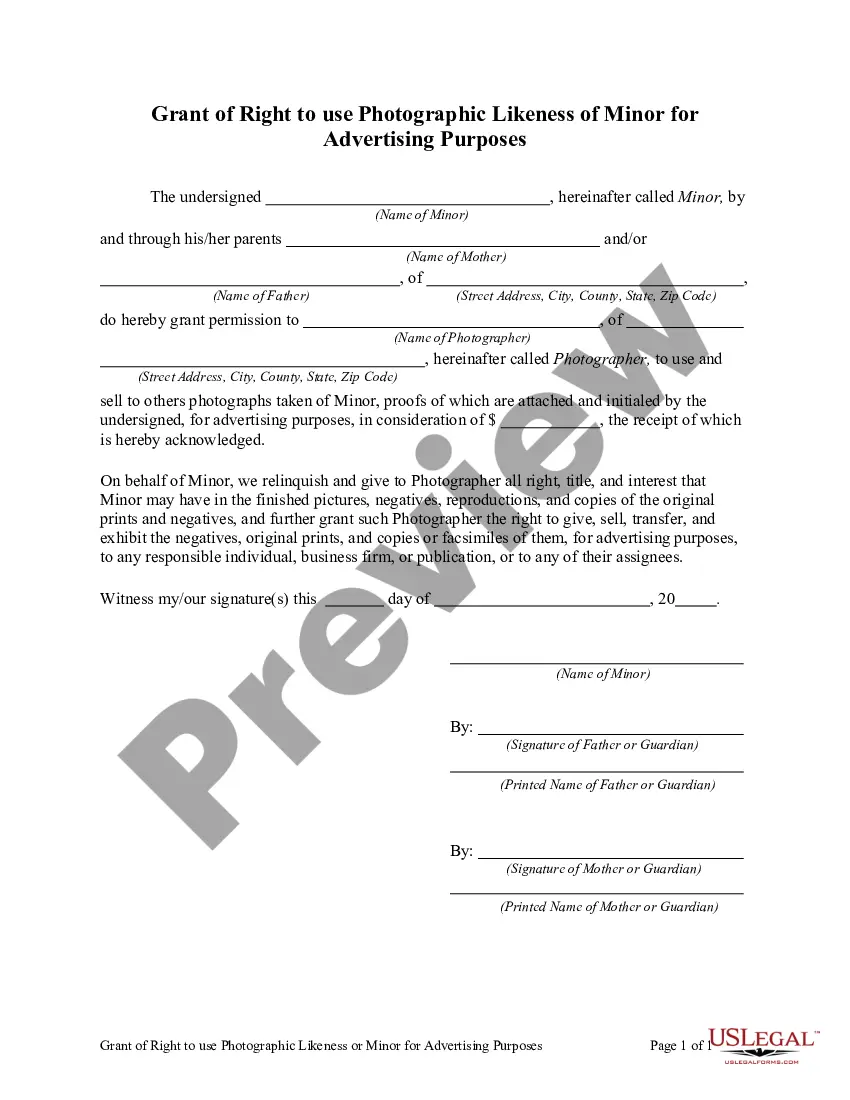

How to complete a form

To complete a Pledge of Shares of Stock, follow these steps:

- Provide pledgor details: Enter the full legal name and address of the pledgor.

- Provide pledgee details: Enter the pledgee's full legal name and address.

- Describe the shares: State the number of shares and the corporation they are associated with, including stock certificate numbers if applicable.

- Specify the debt: Clearly outline the debt that is secured by the pledged shares.

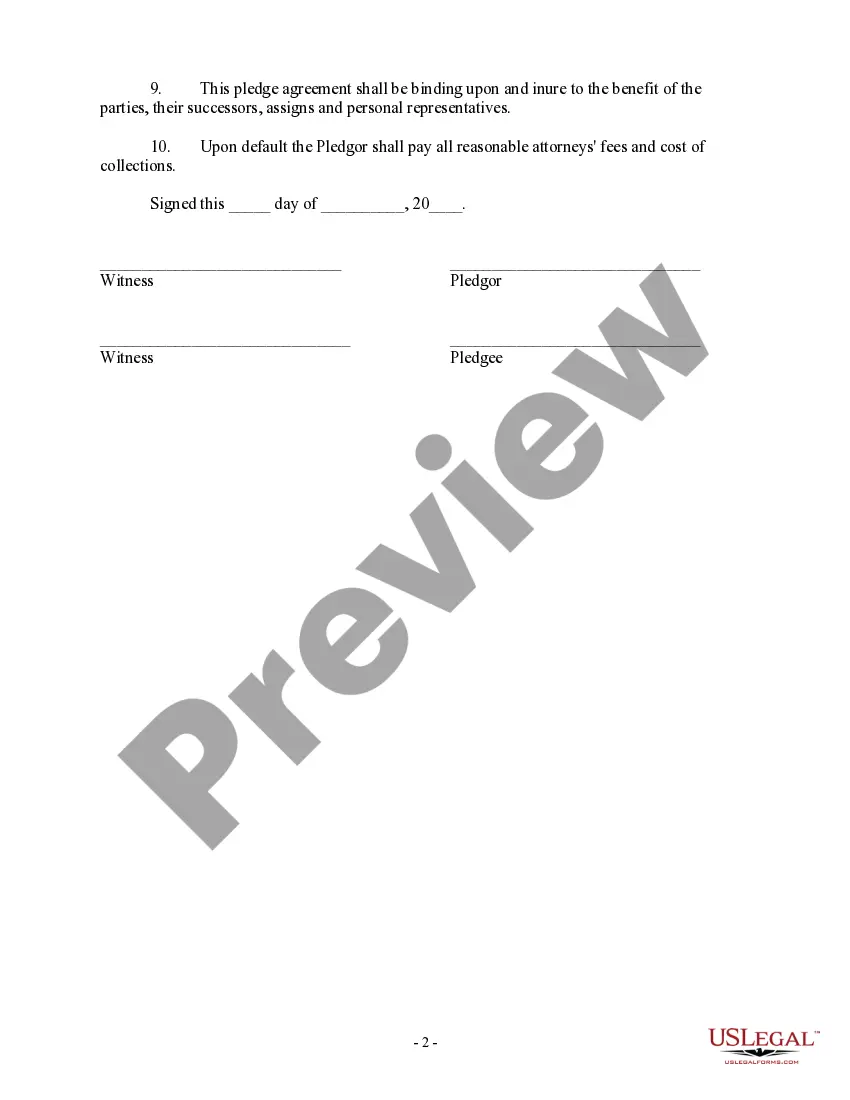

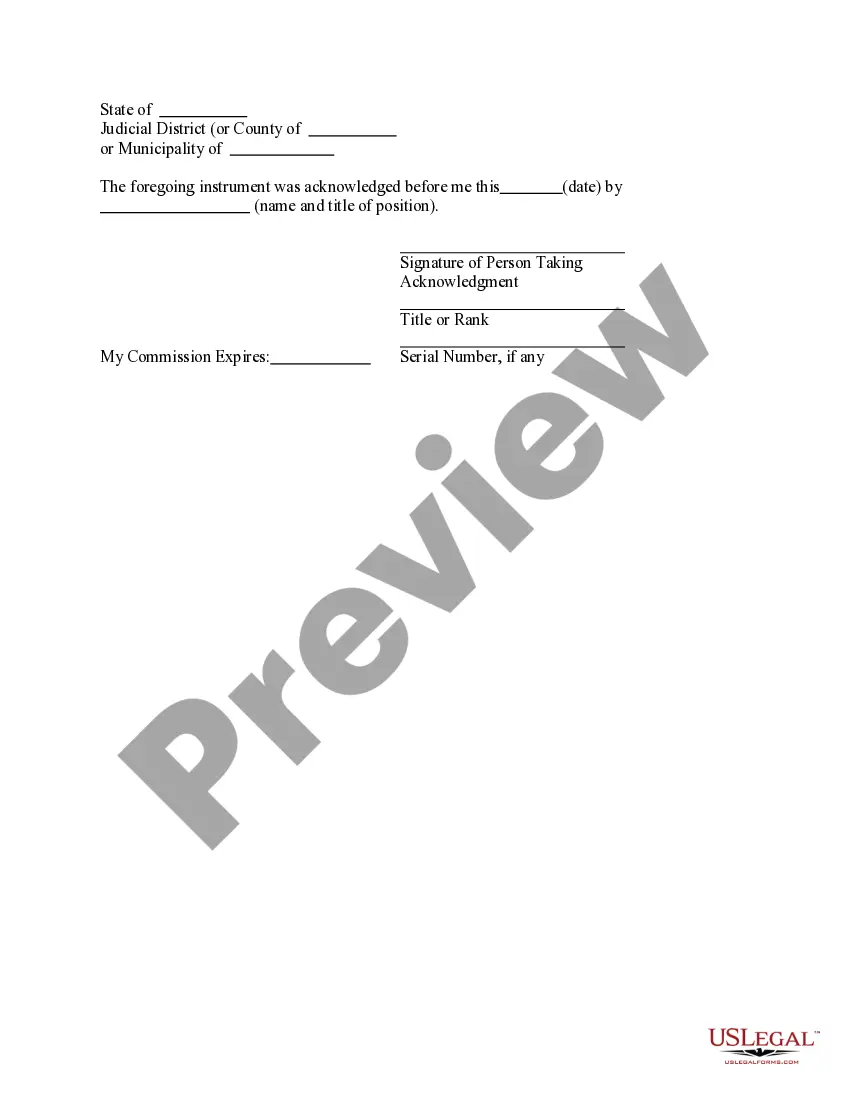

- Sign the agreement: Ensure all parties, including witnesses, sign the document at the bottom.

After completing the form, review it to ensure accuracy and completeness before submission.

Who should use this form

The Pledge of Shares of Stock is suitable for individuals or entities that need to secure a loan with shares of stock as collateral. This could include business owners seeking financing, investors looking to leverage their stock holdings, or anyone who wants to provide a lender with added assurance regarding the repayment of a debt. If you have valuable stock assets and require funding, this form may be beneficial.

Common mistakes to avoid when using this form

When using a Pledge of Shares of Stock, be aware of frequent errors that may undermine the document's effectiveness:

- Inaccurate details: Ensure that all names, addresses, and stock descriptions are correct.

- Missing signatures: All required parties, including witnesses, must sign the document.

- Neglecting collateral rights: Clearly define the rights of both pledgee and pledgor regarding stock voting and dividends.

By avoiding these mistakes, you can enhance the validity and security of your pledge agreement.

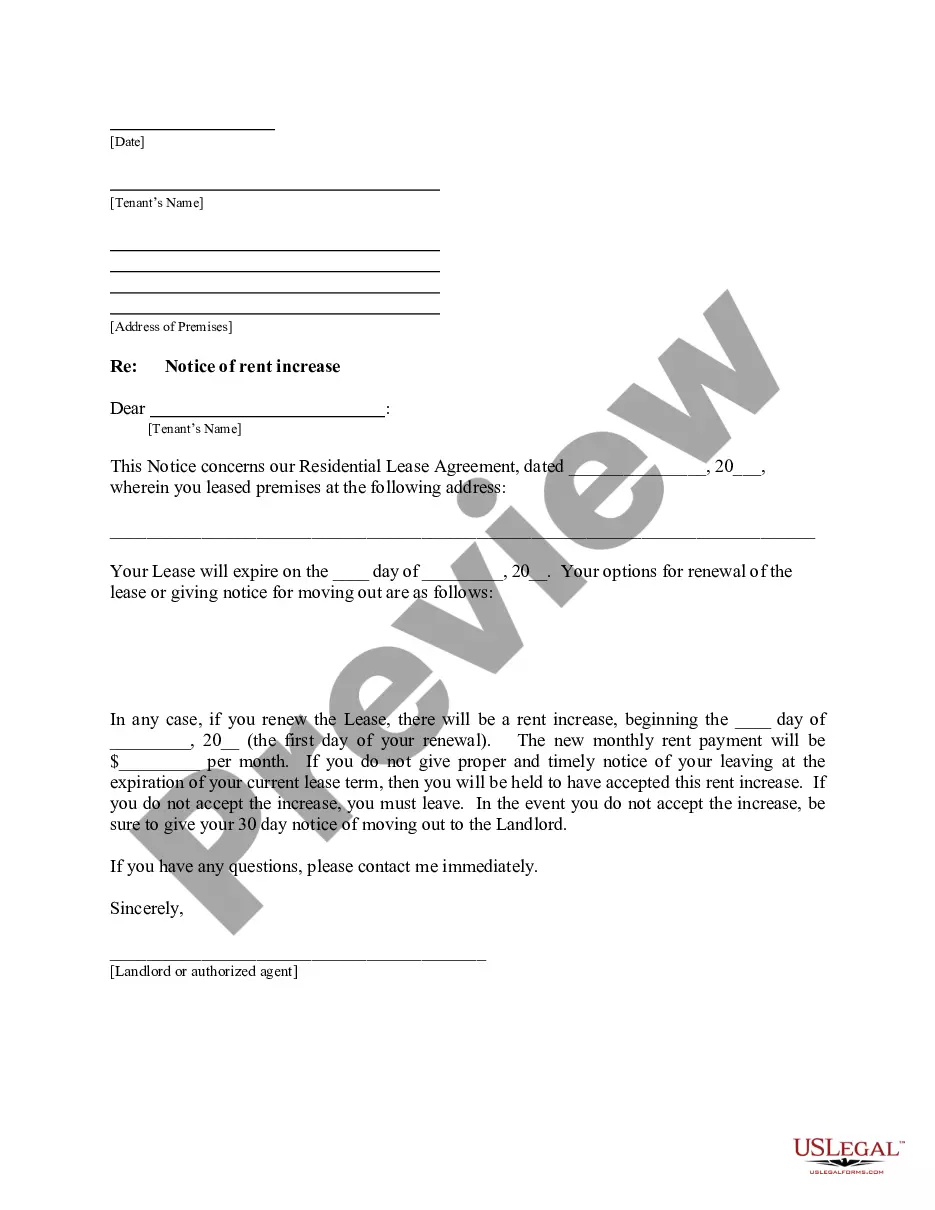

Benefits of using this form online

Utilizing an online template for a Pledge of Shares of Stock offers several advantages:

- Convenience: Users can complete the form at their own pace and from anywhere.

- Accessibility: Online forms are typically easily accessible and can be downloaded quickly.

- Guidance: Many online templates include instructions, helping users navigate the completion process.

These benefits streamline the process of securing a loan with stocks and reduce the risk of errors.

Form popularity

FAQ

Facility to sell pledged stocks: This is a feature we're working on making available, allowing you to sell pledged stocks without having to request for unpledge and wait until they are received to your demat account.

Pledging of shares has been made mandatory in the capital markets effective September 1, 2020.

An investor can keep extra cash/pledge other holdings for the stipulated margin required. In addition, the shares bought one day cannot be sold the next day. So, if an investor bought shares on, say, Monday, then he can only sell them after receiving the delivery of shares. So, in T+2, they can sell these on Wednesday.

An investor can keep extra cash/pledge other holdings for the stipulated margin required. In addition, the shares bought one day cannot be sold the next day. So, if an investor bought shares on, say, Monday, then he can only sell them after receiving the delivery of shares. So, in T+2, they can sell these on Wednesday.

Remember, the pledging of promoter's shares is not necessarily bad. Even if a company has a high percentage of promoter's shares being pledged, if its operating cash flow is constantly increasing and the company has good prospects, it can be worth investing in.

Promoters can pledge their shares to avoid losing trade opportunities due to low cash margins. They can get a loan after haircut deduction. The collateral margin received from these pledged shares can be used for equity trading, futures, and options writing.

If you fail to initiate the Pledge request or clear the debit balance by making the requisite payment, then the debit balance will be cleared by us on T+7day by selling the shares from our CUSA account.

Definition: Pledging of shares is one of the options that the promoters of companies use to secure loans to meet working capital requirement, personal needs and fund other ventures or acquisitions.In case promoters fail to make up for the difference, lenders can sell the shares in the open market to recover the money.