Subcontractor's Performance Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Subcontractor's Performance Bond?

Employ the most complete legal catalogue of forms. US Legal Forms is the perfect place for finding updated Subcontractor's Performance Bond templates. Our service offers thousands of legal forms drafted by licensed legal professionals and categorized by state.

To get a sample from US Legal Forms, users simply need to sign up for a free account first. If you’re already registered on our service, log in and choose the document you need and purchase it. Right after purchasing forms, users can find them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines listed below:

- Find out if the Form name you have found is state-specific and suits your needs.

- When the form features a Preview function, utilize it to review the sample.

- If the template doesn’t suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the sample corresponds to your needs.

- Choose a pricing plan.

- Create your account.

- Pay via PayPal or with the debit/bank card.

- Choose a document format and download the template.

- As soon as it is downloaded, print it and fill it out.

Save your effort and time using our platform to find, download, and complete the Form name. Join a huge number of delighted customers who’re already using US Legal Forms!

Form popularity

FAQ

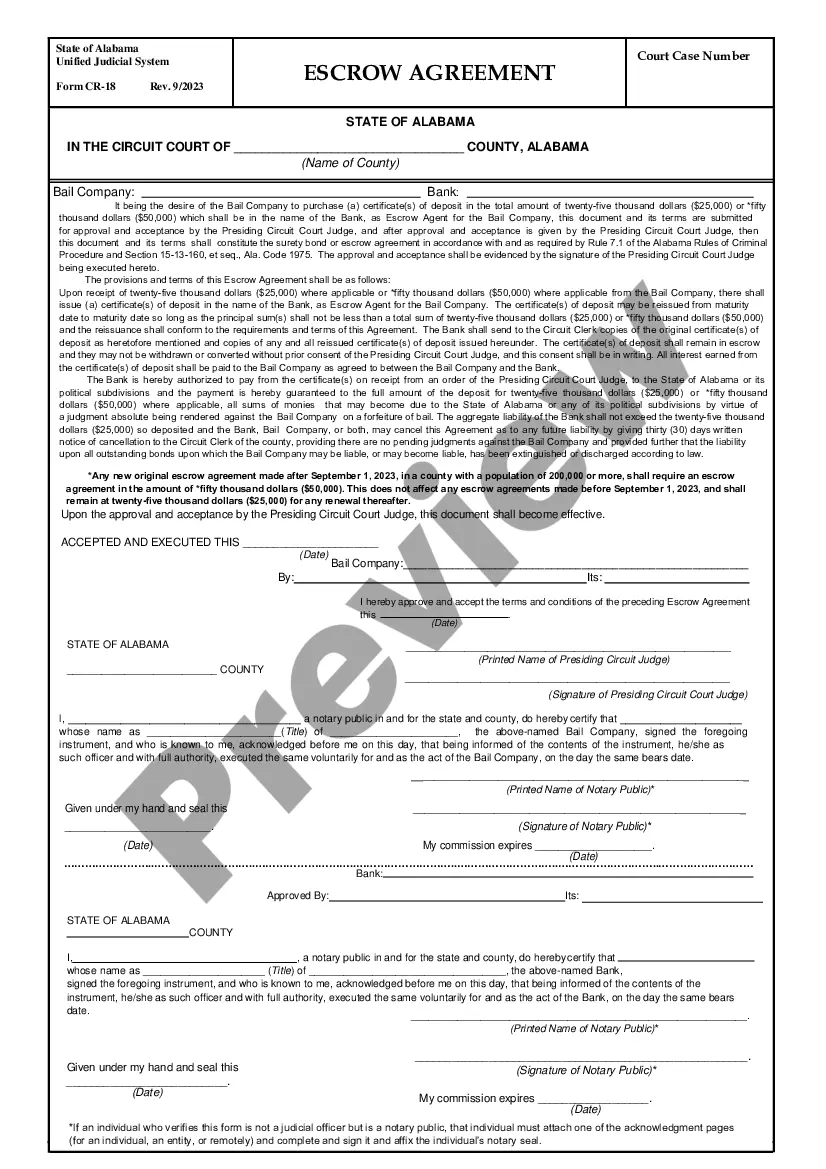

A subcontractor performance bond is a project-specific agreement between the GC, the subcontractor, and a surety company (similar to an insurance company). It will typically be required by the construction contract. The performance bond ensures that the sub's work will be completed on the project.

A subcontractor performance bond is a project specific contractual agreement between a subcontractor and a surety by which the surety guarantees to arrange for the completion of a subcontract if the subcontractor runs into trouble and fails to complete its scope of work on the project.

In order to get a performance bond, contractors must usually pay a premium on the bond amount as well as interest on the bond. Again, the price will depend on the cost of the bond and the risk (creditworthiness) the principal presents. In most cases, you will first need to obtain a bid bond before bidding on a project.

The Performance Bond secures the contractor's promise to perform the contract in accordance with its terms and conditions, at the agreed upon price, and within the time allowed. The Payment Bond protects certain laborers, material suppliers and subcontractors against nonpayment.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet obligations specified in the contract.A performance bond is usually provided by a bank or an insurance company to make sure a contractor completes designated projects.

A performance bond is a bond that guarantees that the bonded contractor will perform its obligations under the contract in accordance with the contract's terms and conditions. Performance bonds are typically in the amount of 50% of the contract amount, but can also be issued for 100% of the contract amount.

This may mean that if the contractor is incapacitated to complete the job, the client suffers a financial loss and cannot be covered. It is also impossible for the investor to place a claim to any company for the loss incurred. Therefore, bonding indemnifies the owner of the project against such.

Unlike prime contracts, bonds typically are not required for subcontracts by law on public works. Instead, each general contractor decides whether to require their subcontractors to bond.

You will need to be bonded if your state or municipality requires it. In addition, if your business frequently performs services in customer's homes or on the premises of other businesses, you should strongly consider getting bonded to protect your customers and your business's financial health.