Escrow Agreement, is an official form from the Alabama Administrative Office of Courts, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Alabama statutes and law.

Alabama Escrow Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Escrow Agreement?

Utilizing examples of the Alabama Escrow Agreement crafted by experienced attorneys helps you avoid difficulties when completing documents.

Simply download the form from our site, complete it, and have legal advice review it.

This approach can save you significantly more time and expenses than having a lawyer draft a document tailored to your requirements.

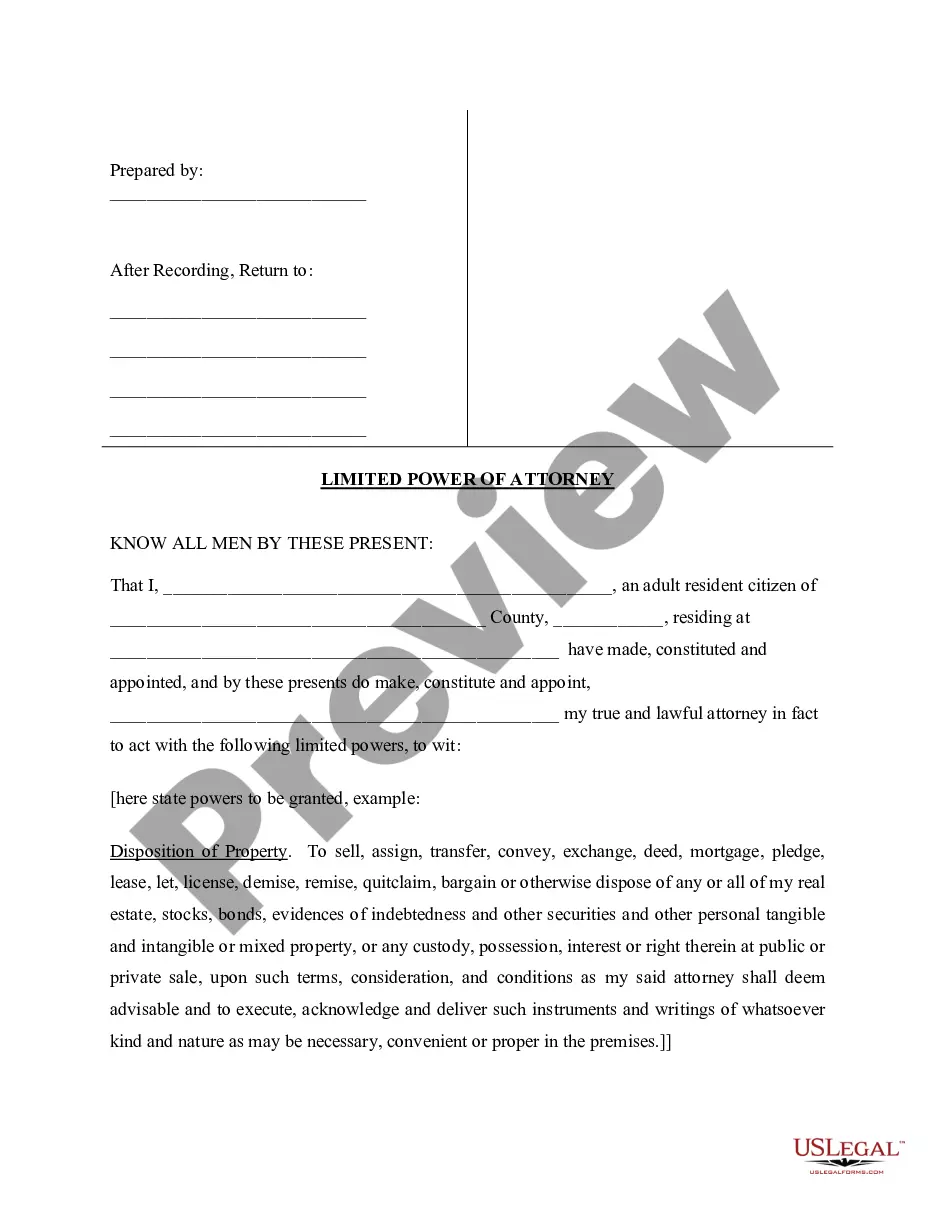

Use the Preview feature to review the description (if available) to determine if this specific sample is required, and if so, simply click Buy Now.

- If you already possess a US Legal Forms subscription, simply Log In to your account and return to the sample page.

- Locate the Download button near the template you are examining.

- After you download a document, all your saved samples can be found in the My documents tab.

- If you do not have a subscription, it's not an issue.

- Just follow the steps below to create an online account, obtain, and complete your Alabama Escrow Agreement template.

- Verify that you are downloading the correct state-specific form.

Form popularity

FAQ

Yes, escrow services are available in Alabama. An Alabama Escrow Agreement is frequently used in real estate and other transactions to ensure that funds are securely handled. By utilizing a reputable platform like US Legal Forms, you can easily access customizable escrow agreement templates tailored specifically for Alabama, simplifying the process and protecting your interests.

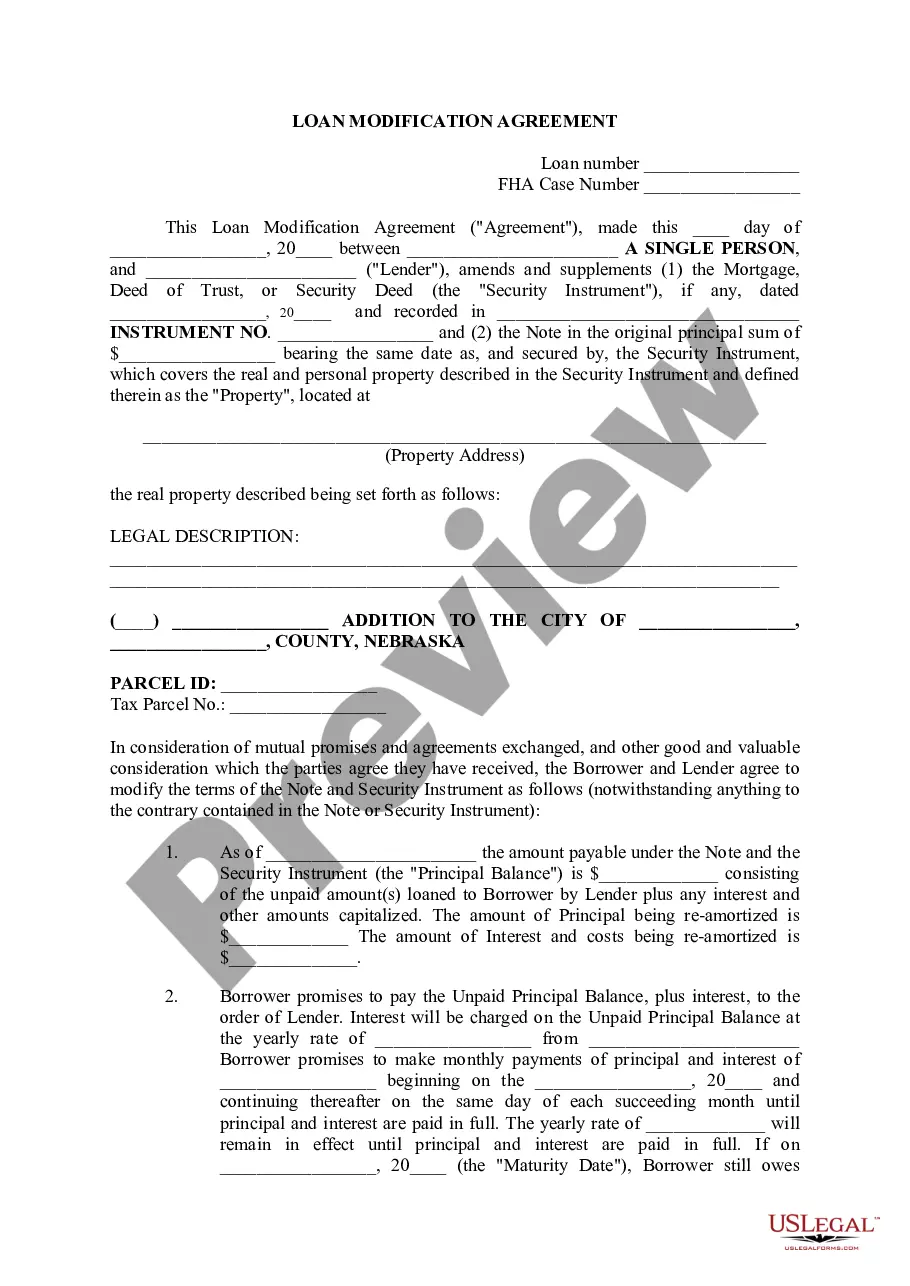

An escrow agreement is a legal document that outlines the terms and conditions for an escrow arrangement. In the context of an Alabama Escrow Agreement, it specifies the roles of the involved parties and the conditions for transferring funds or assets. This agreement protects the interests of all parties by ensuring that no funds or assets are released until all criteria are met, providing peace of mind during transactions.

A valid Alabama Escrow Agreement requires three essential components. First, there must be a clear agreement between the parties about the conditions that trigger the release of funds. Second, a neutral third party must hold the assets during the transaction. Lastly, all parties must agree to the terms outlined in the escrow agreement to ensure everyone is aligned on the process.

While escrow accounts provide many benefits, they can have disadvantages as well. For instance, there may be fees associated with maintaining the account, and funds can be held longer than expected if conditions are not met swiftly. It's important to fully understand the terms of your Alabama Escrow Agreement to ensure that you are aware of any potential costs or delays.

In simple terms, escrow refers to a financial arrangement where a third party temporarily holds funds or assets until specific conditions are met. This process helps ensure that both parties in a transaction fulfill their obligations. The Alabama Escrow Agreement outlines these conditions clearly, providing security and trust in the transaction process.

The main elements of the escrow rule in an Alabama Escrow Agreement focus on transparency and responsibility. The escrow agent must act impartially, holding the assets securely until all conditions are satisfied. Furthermore, the agreement should detail the procedures for the release of funds and the consequences for breaches of the terms, ensuring clarity for all parties involved.

When forming an Alabama Escrow Agreement, three critical elements are included. These are the escrow agent, the escrow funds or assets, and the instructions for the agent regarding the disbursement of these assets. Understanding these components is essential for ensuring that all parties meet their obligations and that the transaction proceeds smoothly.

An effective Alabama Escrow Agreement must include key components. First, identify the parties involved, such as the buyer, seller, and the escrow agent. Second, clearly outline the purpose of the escrow, including what is being held and the conditional requirements for release. Lastly, ensure that all parties sign the agreement to make it legally binding and enforceable.

Creating an Alabama Escrow Agreement involves several steps. Start by defining the terms and conditions of the agreement, including the parties involved and the purpose of the escrow. Next, outline the specific assets or funds that will be placed in escrow, and determine the conditions for release. To simplify this process, consider using the US Legal Forms platform, which provides templates and guidance tailored for Alabama escrow agreements.

The standard close of escrow refers to the point at which all funds and property titles are exchanged, finalizing the transaction. Once all conditions of the Alabama Escrow Agreement are met, this date is typically set to coincide with the completion of necessary inspections and financing arrangements.