Receipt and Release Personal Representative of Estate Regarding Legacy of a Will

About this form

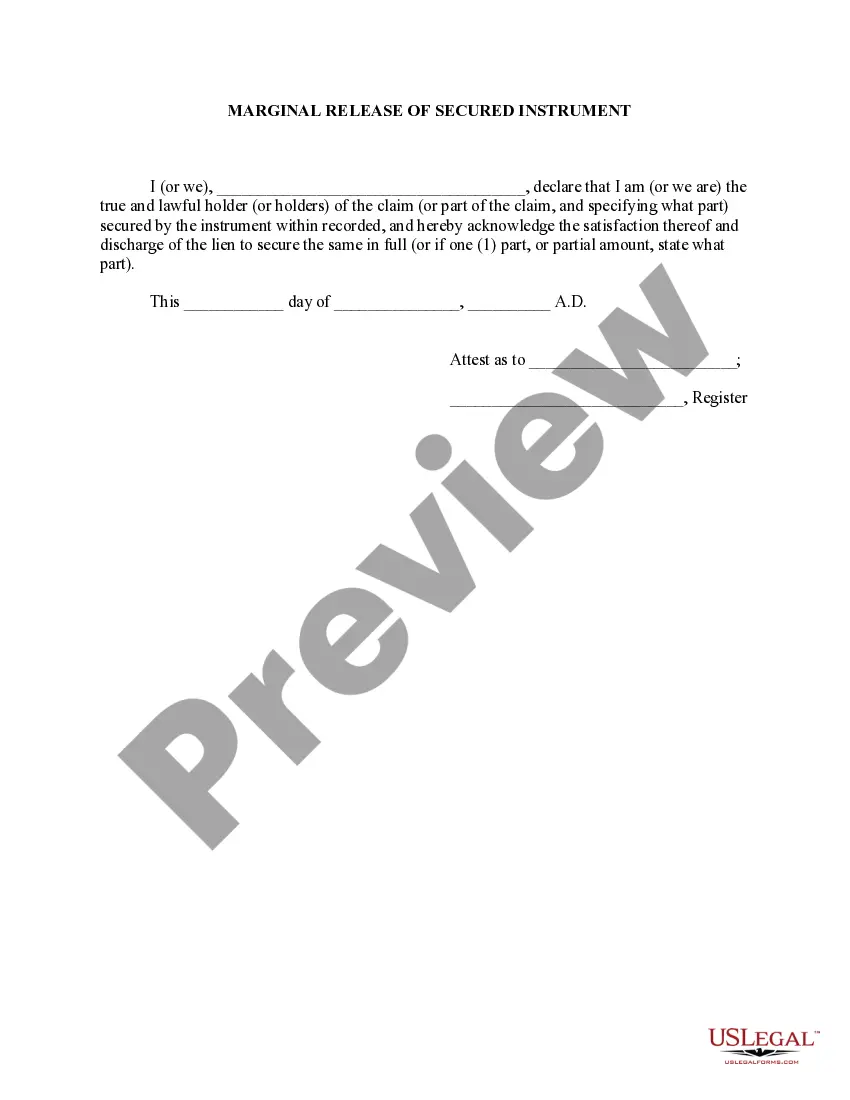

The Receipt and Release Personal Representative of Estate Regarding Legacy of a Will is a legal document that beneficiaries use to acknowledge receipt of their share of an estate. This form serves as both a receipt and a release for the personal representative of the estate, protecting them from future claims by the beneficiary. It differs from other estate documents by specifically addressing the acknowledgment of payments made and the release of any further claims against the personal representative regarding estate actions.

Key parts of this document

- Name and address of the beneficiary.

- Amount received from the personal representative.

- Name of the personal representative and the deceased estate.

- Release of claims against the personal representative.

- Signature of the beneficiary and the date of signing.

Situations where this form applies

This form is necessary when a beneficiary has received their inheritance payment from the personal representative of an estate. It is typically used after the distribution of assets has been finalized and serves to document the beneficiary's acknowledgment of receipt and willingness to release any future claims against the personal representative for actions related to the estate.

Who should use this form

- Beneficiaries receiving distributions from an estate.

- Personal representatives managing the distribution of estate assets.

- Heirs or legatees looking to formally acknowledge their received payments.

Instructions for completing this form

- Identify and enter the name of the beneficiary and their address.

- Specify the amount received and the name of the personal representative.

- Fill in the name of the deceased and state the full payment acknowledgment.

- Include a release statement to protect the personal representative from future claims.

- Sign, print your name, and enter the date at the designated fields.

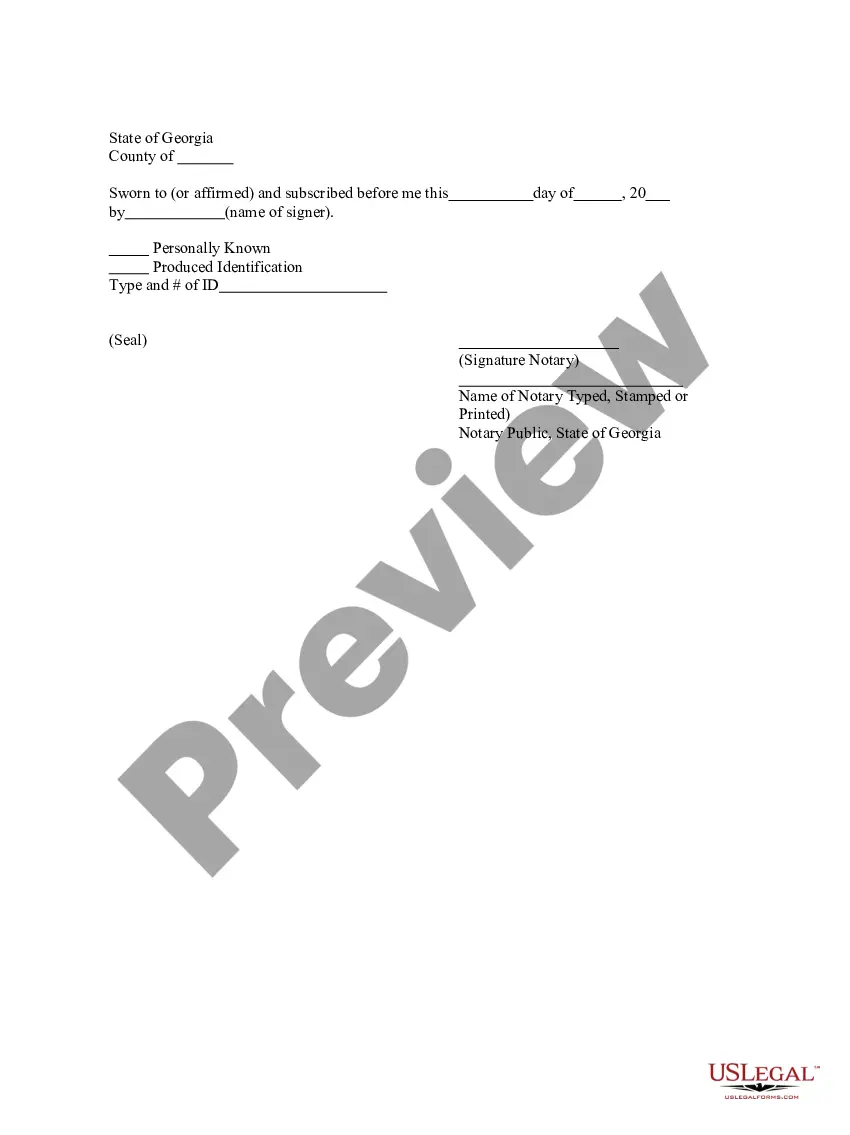

Notarization guidance

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to accurately fill all required fields.

- Not including the date of signing.

- Omitting the release clause, which may leave the personal representative unprotected.

- Forgetting to sign or print the name in the appropriate sections.

Why use this form online

- Convenience of downloading and completing the form at your own pace.

- Easy editability to ensure all information is accurate before submission.

- Reliable legal language drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

Beneficiaries are entitled to receive a financial accounting of the trust, including bank statements, regularly. When statements are not received as requested, a beneficiary must submit a written demand to the trustee.The court will review the trust account for any discrepancies or irregular activity.

This four-month period must pass before the estate can be closed. Even under the best of circumstances, a simple estate will usually take at least six months to close.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Beneficiaries often must sign off on the inheritance they receive to acknowledge receipt of the distribution. For example, if you inherit a portion of real estate from the decedent, you must sign a deed accepting that real estate.

A Receipt, Release, Refunding and Indemnification Agreement is a probate tool that allows the executor to distribute estate funds to a beneficiary with the promise from the beneficiary to return the funds if it later turns out they were distributed in error.

A Receipt and Release Agreement is the means by which a beneficiary of an estate may acknowledge receipt of the property to which he is entitled, and agree to release the executor from any further liability with respect thereto.

Length and Commitment of Process. A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.