Sample Letter for Garnishment

About this form

The Sample Letter for Garnishment is a customizable document designed to notify a debtor of a garnishment action. This letter outlines the intent to garnish wages or other assets due to unpaid debts. It serves as a formal communication, distinguishing itself from other types of legal notices by specifically addressing garnishment proceedings.

Form components explained

- Date of the letter

- Debtor's name and contact information

- Company or creditor's name and contact information

- Details explaining the garnishment action

- Instructions for the debtor regarding next steps

Situations where this form applies

This form should be used in situations where a creditor has obtained a court order to garnish a debtor's wages or bank account. It is particularly relevant for creditors who need to formally inform the debtor about the garnishment, ensuring compliance with legal requirements for notice. Using this letter helps clarify the amount owed and lays out the creditor's intent to collect the debt through garnishment.

Intended users of this form

- Creditors seeking to collect unpaid debts

- Business owners who have delinquent accounts

- Individuals who have been granted a court order for garnishment

- Professionals managing collections or debt recovery

How to prepare this document

- Insert the date at the top of the letter.

- Fill in the debtor's full name and contact details.

- Provide your or the company's name and address.

- Clearly state the reason for the garnishment, including the amount owed.

- Include instructions for the debtor on how to respond or pay the debt.

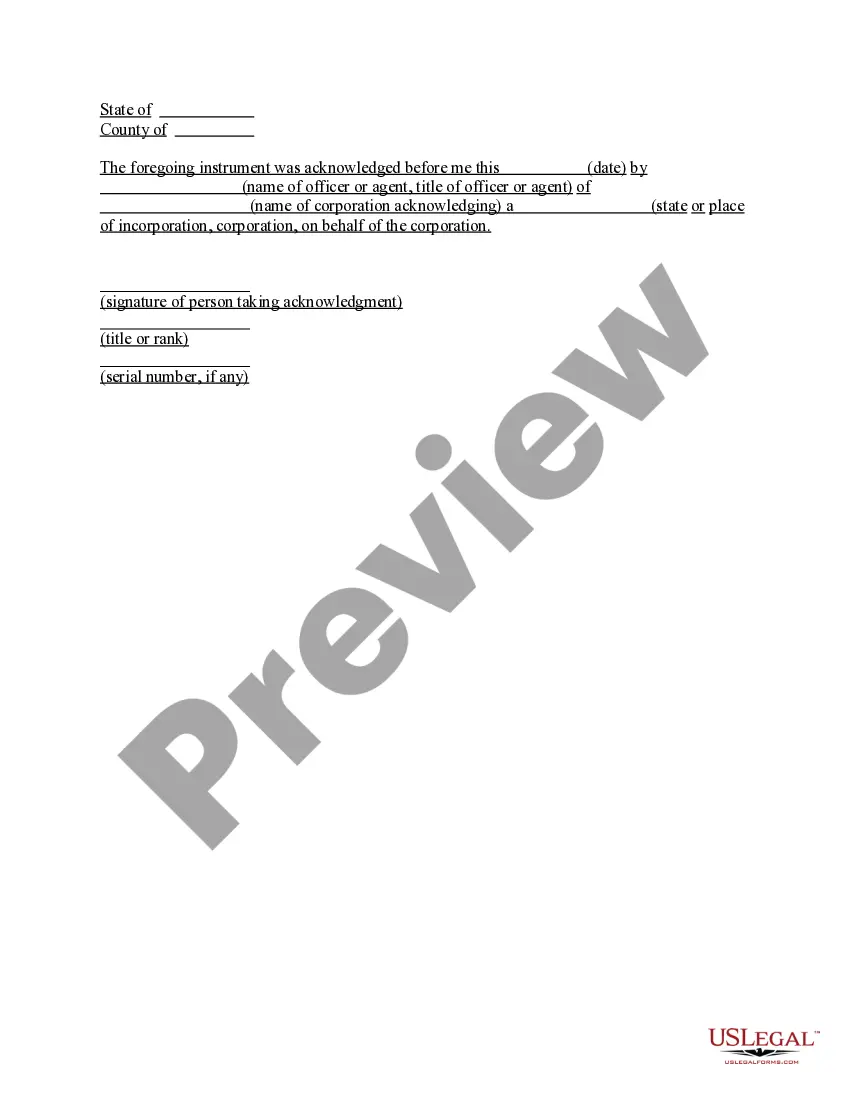

Does this document require notarization?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include the correct debtor information

- Not providing sufficient details about the garnishment order

- Ignoring state-specific garnishment rules

Advantages of online completion

- Convenience of customization to fit specific situations

- Easy download and immediate access to forms

- Reliable templates drafted by licensed attorneys

Key takeaways

- The Sample Letter for Garnishment is crucial for notifying a debtor of garnishment actions.

- Customizing the letter is essential to fit individual circumstances.

- Understanding state-specific requirements is key to legal compliance.

Looking for another form?

Form popularity

FAQ

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

Make it clear to the creditor that you intend to pay the debt. Explain that you are unable to pay the debt due to (detail your hardship). or, if you are lucky, might accept it. Get your terms in writing before you send any payments.

Judgment proof is a description of a person who does not have enough assets for a creditor to seize when a court order requires debt repayment. A debtor who is broke and unemployed can be considered judgment proof, as can a debtor who only has certain legally protected types of assets or income.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

Make sure you state you are exercising your rights under the Fair Debt Collection Practices Act. Include a sentence or two describing why you are judgment-proof For example: I am judgment proof because I am living only on Social Security benefits, own limited exempt property, and cannot meet current expenses.

A judgment is a court order that is the decision in a lawsuit. If a judgment is entered against you, a debt collector will have stronger tools, like garnishment, to collect the debt.You are likely to have a judgment entered against you for the amount claimed in the lawsuit if you: Ignore the lawsuit, or.

If your income is protected from garnishment and you have no assets (house, property, savings etc.) with which to pay your debt, you may be 'Judgment Proof'. Income that can NOT be garnished: TANF, GAU, SSI, SSDI, SSA, Food Stamps, child support, pension, etc. Income that can be garnished is wages from employment.

Garnishment, or wage garnishment, is when money is legally withheld from your paycheck and sent to another party. It refers to a legal process that instructs a third party to deduct payments directly from a debtor's wage or bank account. Typically, the third party is the debtor's employer and is known as the garnishee.

If you are collection proof you can write a letter to the debt collector that tells them it is not worth taking you to court. The letter also tells them not to harass you. If you are collection proof use the collection proof letter.