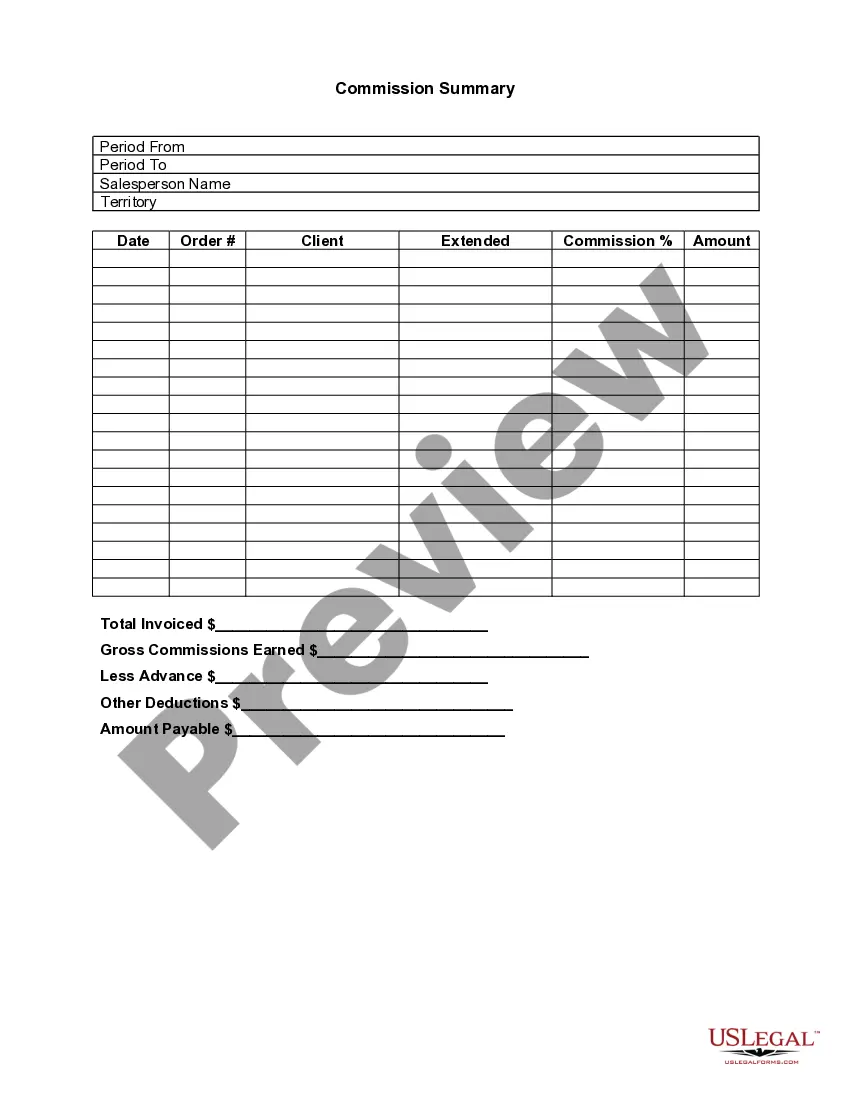

Commission Summary

Understanding this form

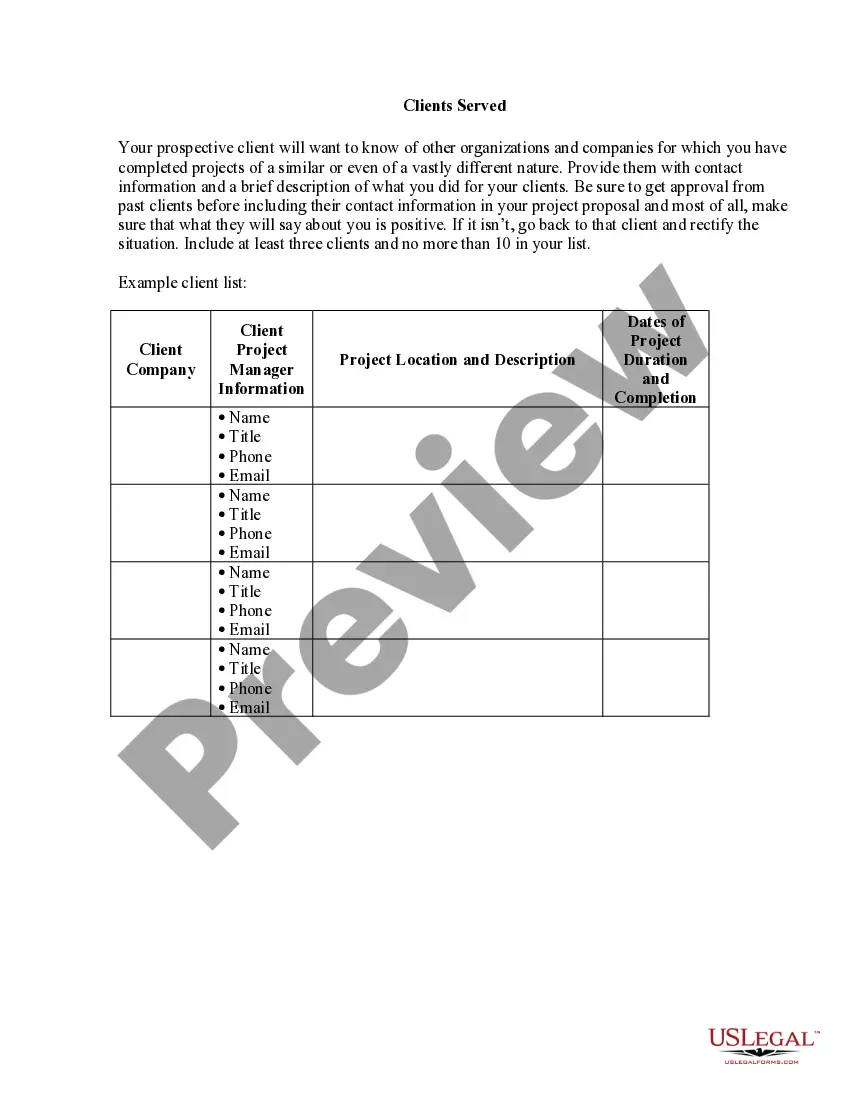

The Commission Summary form is a tool designed for tracking sales commissions in a detailed manner. This form provides a clear breakdown of commissions earned by salespersons, including various deductions. Unlike general commission agreements, the Commission Summary focuses specifically on summarizing financial transactions related to commissions, ensuring accuracy and transparency in sales records.

Key parts of this document

- Period from: Indicates the start date of the commission period.

- Period to: Indicates the end date of the commission period.

- Salesperson name: Identifies the individual earning the commission.

- Territory: Specifies the sales area covered by the salesperson.

- Date of order: Records the date each relevant sale was made.

- Client: Names the client associated with the sales order.

- Extended commission amount: Details the total commission for each sale.

- Total invoiced: Summarizes the total amount billed to the client.

- Gross commissions earned: Total commissions before any deductions.

- Less advance: Any advances paid against commissions.

- Other deductions: Any additional deductions applicable.

- Amount payable: Final amount due to the salesperson after deductions.

When this form is needed

This form is particularly useful for businesses that pay commissions to sales staff. It is ideal for tracking commissions over a specific period, managing ongoing commissions for multiple salespersons, or reconciling payments made against sales. Use this form whenever you need to maintain a clear overview of sales and ensure all commissions are calculated and documented correctly.

Who this form is for

- Sales managers overseeing commission payouts.

- Business owners who want to track sales performance accurately.

- Independent sales representatives managing their commission records.

- Organizations with a sales team requiring structured commission documentation.

Steps to complete this form

- Identify the period by filling in the start and end dates for the commission cycle.

- Enter the salesperson's name and associated territory to clarify the commission's context.

- List the date of each order, along with the client's name to provide clear references for each commission.

- Fill in the extended commission amount for each sale, summarizing the earnings.

- Calculate and place the total invoiced amount along with any advances or deductions.

- Finally, determine the total amount payable to the salesperson after all deductions are accounted for.

Is notarization required?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to accurately record the dates for the commission period.

- Not entering the correct commission amounts, leading to discrepancies.

- Omitting deductions, which can result in overpayment to salespersons.

- Using outdated or incorrect client information for sales records.

Advantages of online completion

- Convenient access from any location, allowing for quick updates and reviews.

- Editable formats that can easily adapt to changes in commission structures.

- Reliable documentation, ensuring all commission records are accurately maintained.

- Easy downloading and printing for physical records or submission.

Looking for another form?

Form popularity

FAQ

In terms of structure, a commission is money paid by an employer to an employee on a regular basis, in payment for services rendered on the job. Upon being established as a for-commission worker, fully or partially, that employee will receive his or her paycheck, either via regular paycheck or automatic deposit.

A fee paid for services, usually a percentage of the total cost. Example: City Gallery sold Amanda's painting for $500, so Amanda paid them a 10% commission (of $50).

The Commission Summary report summarizes the compensation for all salespeople for the period you specify and year-to-date.If you run this report in salesrep currency, then the amounts reflect the currency associated with the value in the Rep Name field (the salesperson's name).

Under the cash basis of accounting, you should record a commission when it is paid, so there is a credit to the cash account and a debit to the commission expense account. You can classify the commission expense as part of the cost of goods sold, since it directly relates to the sale of goods or services.

Just take sale price, multiply it by the commission percentage, divide it by 100. An example calculation: a blue widget is sold for $70 . The sales person works on a commission - he/she gets 14% out of every transaction, which amounts to $9.80 .