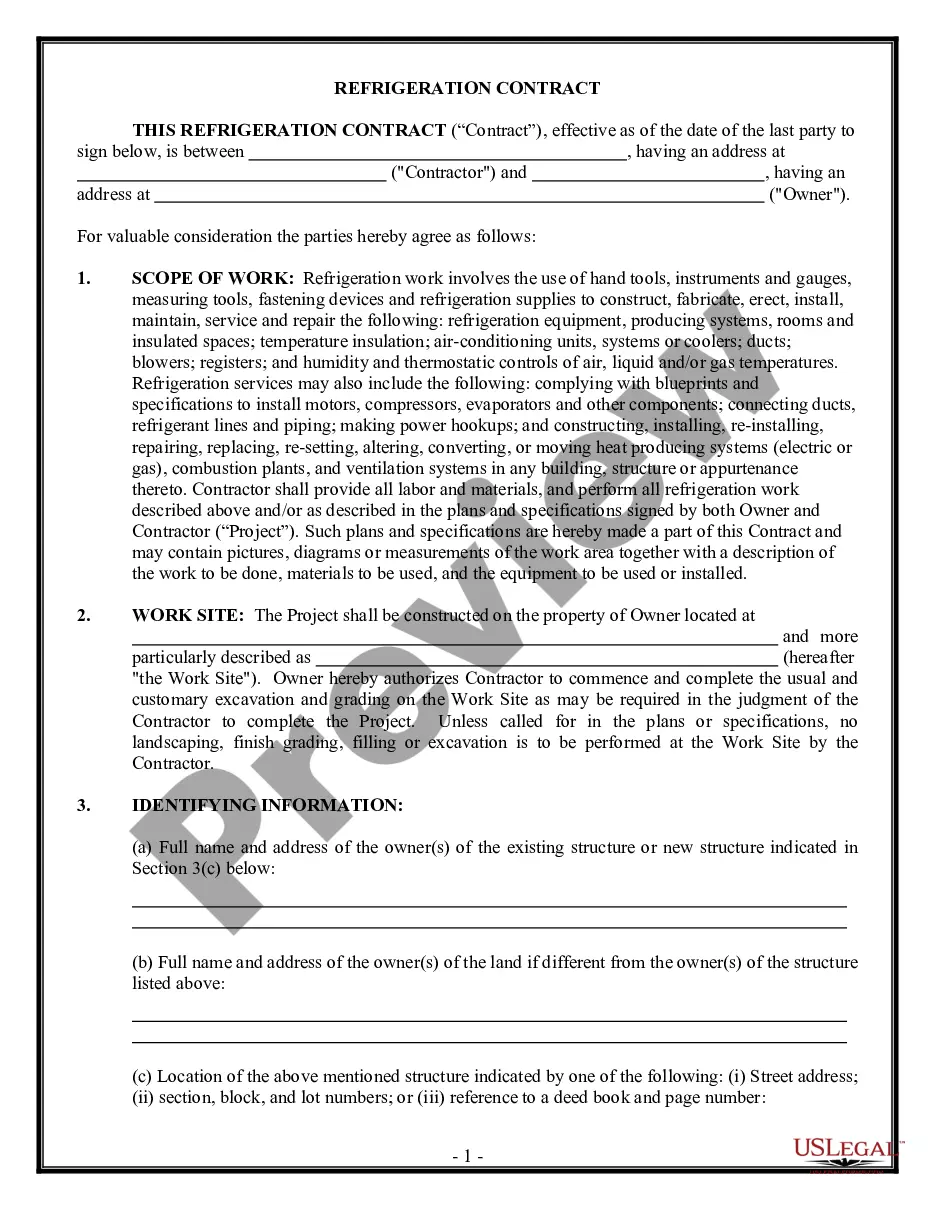

This form can be used for sales planning.

Twelve Month Sales Forecast

Description

How to fill out Twelve Month Sales Forecast?

Aren't you tired of choosing from hundreds of templates every time you need to create a Twelve Month Sales Forecast? US Legal Forms eliminates the wasted time countless American people spend surfing around the internet for appropriate tax and legal forms. Our professional crew of attorneys is constantly changing the state-specific Templates catalogue, to ensure that it always provides the right documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

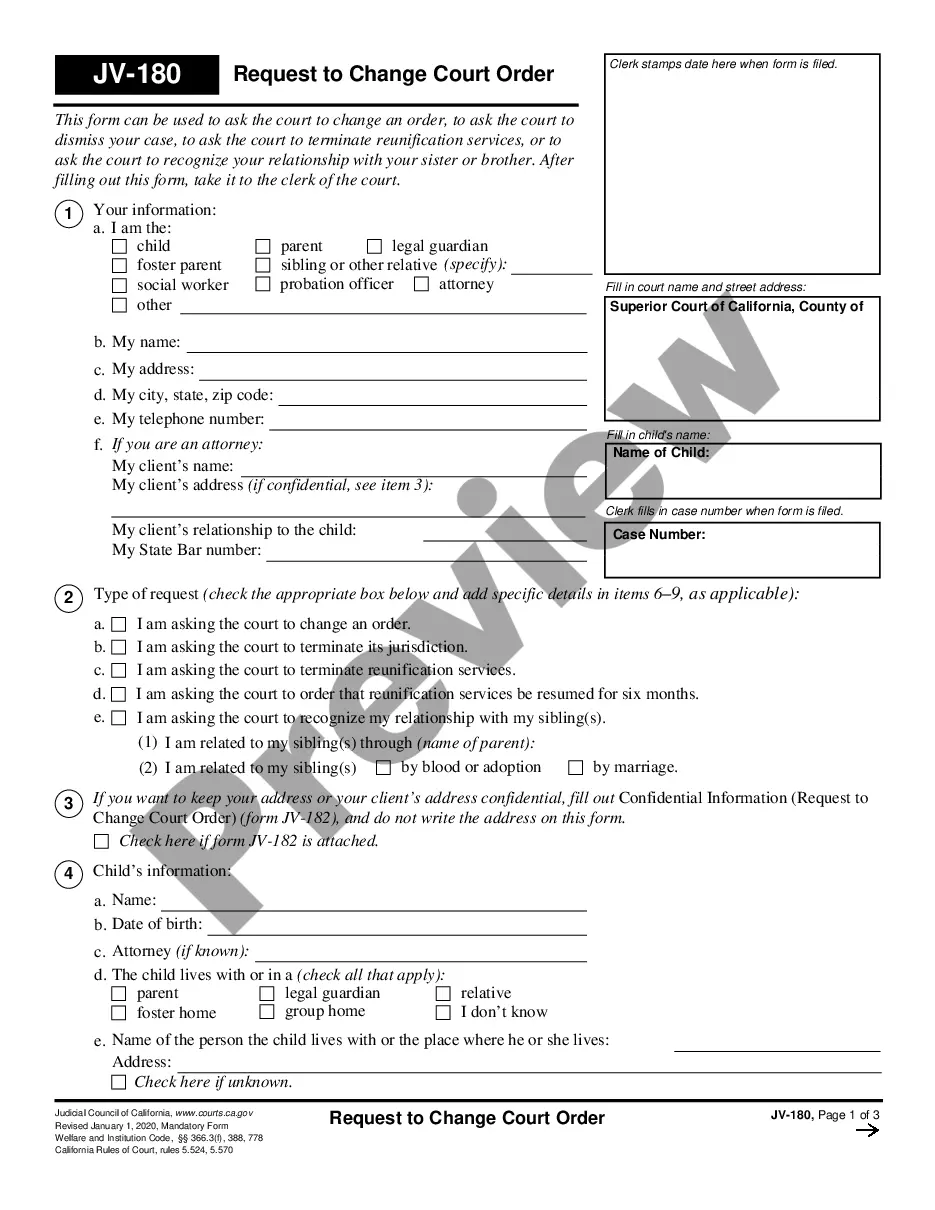

Visitors who don't have a subscription need to complete simple steps before having the ability to download their Twelve Month Sales Forecast:

- Utilize the Preview function and read the form description (if available) to make certain that it is the proper document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate example to your state and situation.

- Make use of the Search field on top of the web page if you need to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your file in a required format to finish, print, and sign the document.

When you’ve followed the step-by-step guidelines above, you'll always have the capacity to log in and download whatever file you require for whatever state you require it in. With US Legal Forms, completing Twelve Month Sales Forecast templates or any other official paperwork is simple. Get going now, and don't forget to double-check your samples with certified attorneys!

Form popularity

FAQ

Find your business's cash for the beginning of the period. Estimate incoming cash for next period. Estimate expenses for next period. Subtract estimated expenses from income. Add cash flow to opening balance.

Step 1: Define the Terms. Step 2: Clarify and Communicate Your Sales Stages. Step 3: Make Sure CRM is THE Only Source for the Forecast. Step 4: Go Beyond Pipeline and Bookings.

In a worksheet, enter two data series that correspond to each other: Select both data series. On the Data tab, in the Forecast group, click Forecast Sheet. In the Create Forecast Worksheet box, pick either a line chart or a column chart for the visual representation of the forecast.

In its simplest form, a financial projection is a forecast of future revenues and expenses. Typically the projection will account for internal or historical data and will include a prediction of external market factors. In general, you will need to develop both short- and mid-term financial projections.

A cash flow projection estimates the money you expect to flow in and out of your business, including all of your income and expenses. Typically, most businesses' cash flow projections cover a 12-month period.

Examples of quantitative forecasting methods are last period demand, simple and weighted N-Period moving averages, simple exponential smoothing, poisson process model based forecasting and multiplicative seasonal indexes.

To forecast by units, you predict how many units you're going to sell each monthusing the bottom-up method of course. Then, you figure out what the average price is going to be for each unit. Multiply those two numbers together and you have the total sales you plan on making each month.

Map Your Sales Process and Pipeline. Separate Individual Lines of Sale. Draw from Past Data. Create a Unit Sales Projection. Project Prices and Calculate Sales. Calculate Average Unit Costs. Crunch the Numbers. Expect Ongoing Adjustment.

Start with the goals of your forecast. Understand your average sales cycle. Get buy-in is critical to your forecast. Formalize your sales process. Look at historical data. Establish seasonality. Determine your sales forecast maturity.