Request for Verification of Deposit

About this form

The Request for Verification of Deposit is a legal document used when applying for a loan. It allows the lender to verify the applicant's account balances with their financial institution. This form helps streamline the loan application process by providing essential financial information directly from the bank or other financial entities, ensuring that the data is accurate and confidential.

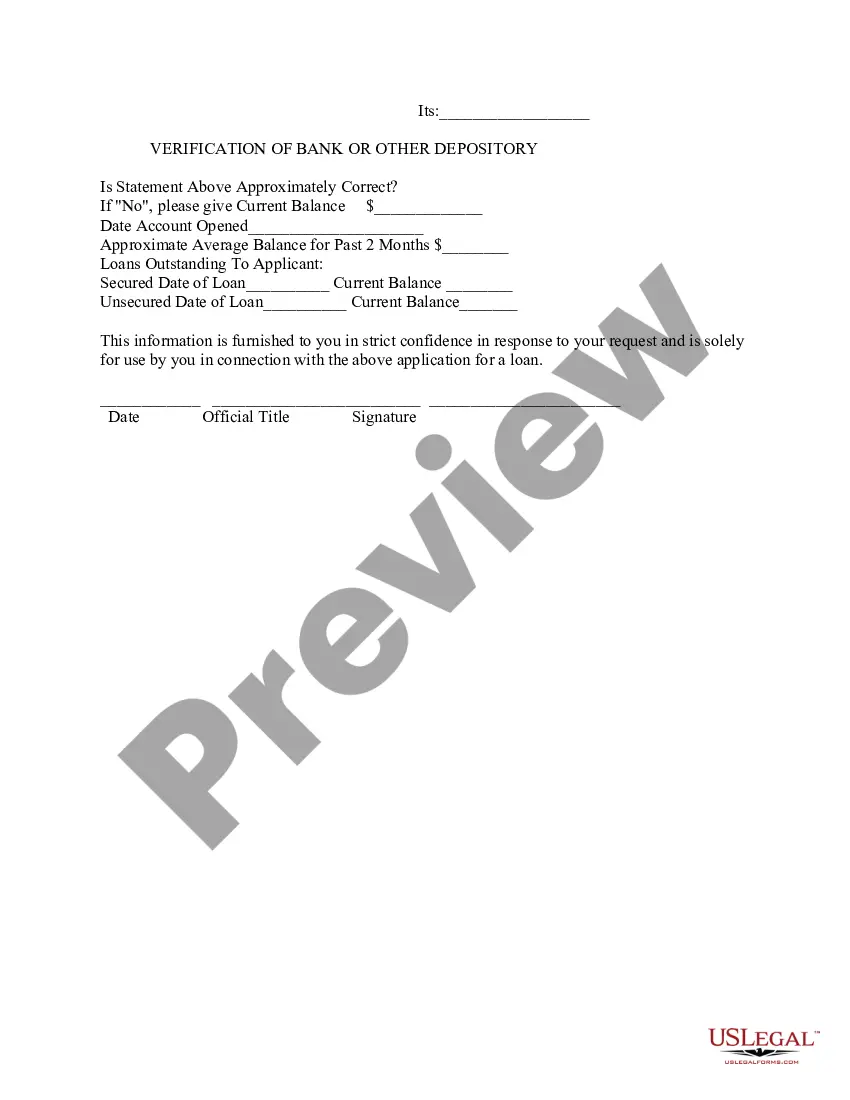

Key parts of this document

- Applicant information: Includes the name, address, and loan number of the applicant.

- Loan details: Specifies the type of loan being requested and the lending institution.

- Deposit verification section: Requires the financial institution to confirm account balances and details.

- Current balance and date: Fields to provide real-time financial information about the applicant's account.

- Signature line for official verification: Confirms the identity and authority of the person providing the information.

Situations where this form applies

This form is typically used when applying for a mortgage, personal loan, or other types of financing that require verification of financial stability. It is essential to provide this document to lenders to expedite the approval process and ensure that all financial information is accurate and up-to-date.

Who should use this form

- Individuals applying for a mortgage or personal loan.

- Business owners seeking financing that requires personal financial verification.

- Borrowers who need to demonstrate their financial standing to lending institutions.

How to complete this form

- Enter the applicant's personal information, including name and address.

- Specify the type of loan and the lending institution's name.

- Provide account details such as the type of account and financial institution.

- Request the bank to fill in the current balance and date of verification.

- Ensure the form is signed by an authorized representative of the financial institution.

Does this form need to be notarized?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Not providing complete and accurate applicant information.

- Using outdated or incorrect financial institution details.

- Failing to include necessary signatures or verification from the bank.

- Leaving sections blank that could delay the loan approval process.

Why use this form online

- Convenience of downloading and completing the form from home.

- Editable fields allow for quick updates to personal or financial information.

- Access to professional templates crafted by licensed attorneys ensures legal compliance.

Looking for another form?

Form popularity

FAQ

Bank account verification can take as little as a few seconds and as many as 10 days, depending on the method used. Open banking verification and credit checks each involve electronic checks against accounts in real time.

A verification of deposit typically includes information such as current balance, average balance for the previous six months and the date the account was opened.

U.S. Bank processes the Verification of Deposit (VOD) you need within three business days.

A verification of deposit is a document through which a mortgage lender obtains proof from a borrower's banking institution of his or her balances. Upon a lender's request, a banking institution will fulfill this inquiry by providing current data as well as two months' worth of the borrower's average bank balances.

Verification. Request. Purpose: To verify an applicant's/resident's checking, savings, or other accounts. Note: This form must be mailed or faxed to the financial institution.

This is called the micro-deposit verification process. This process can take up to three (3) business days to complete.

Mortgage companies looking to obtain balance information to determine customer eligibility for a loan should use our Verfiication of Deposit (VOD) for mortgage companies service.