Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

Aren't you tired of choosing from countless samples every time you require to create a Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner? US Legal Forms eliminates the wasted time an incredible number of American citizens spend surfing around the internet for perfect tax and legal forms. Our professional team of lawyers is constantly changing the state-specific Forms library, so it always has the right documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have an active subscription should complete simple actions before being able to get access to their Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner:

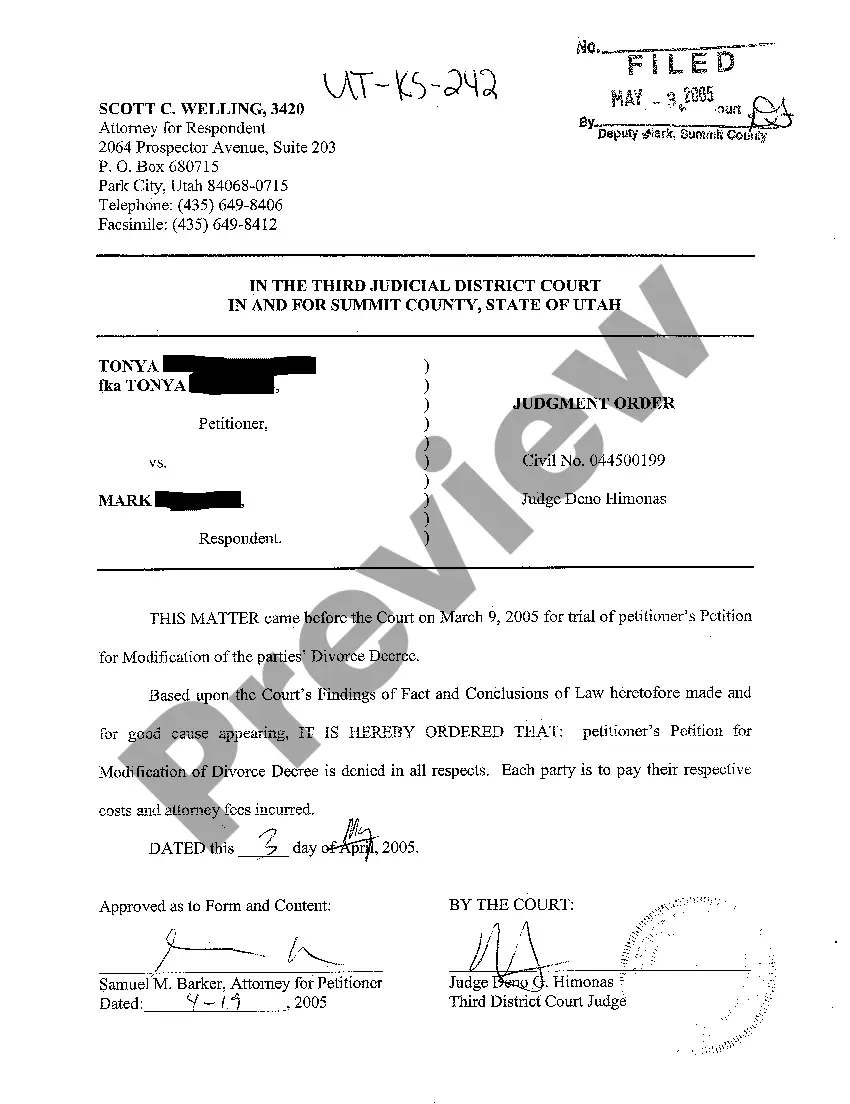

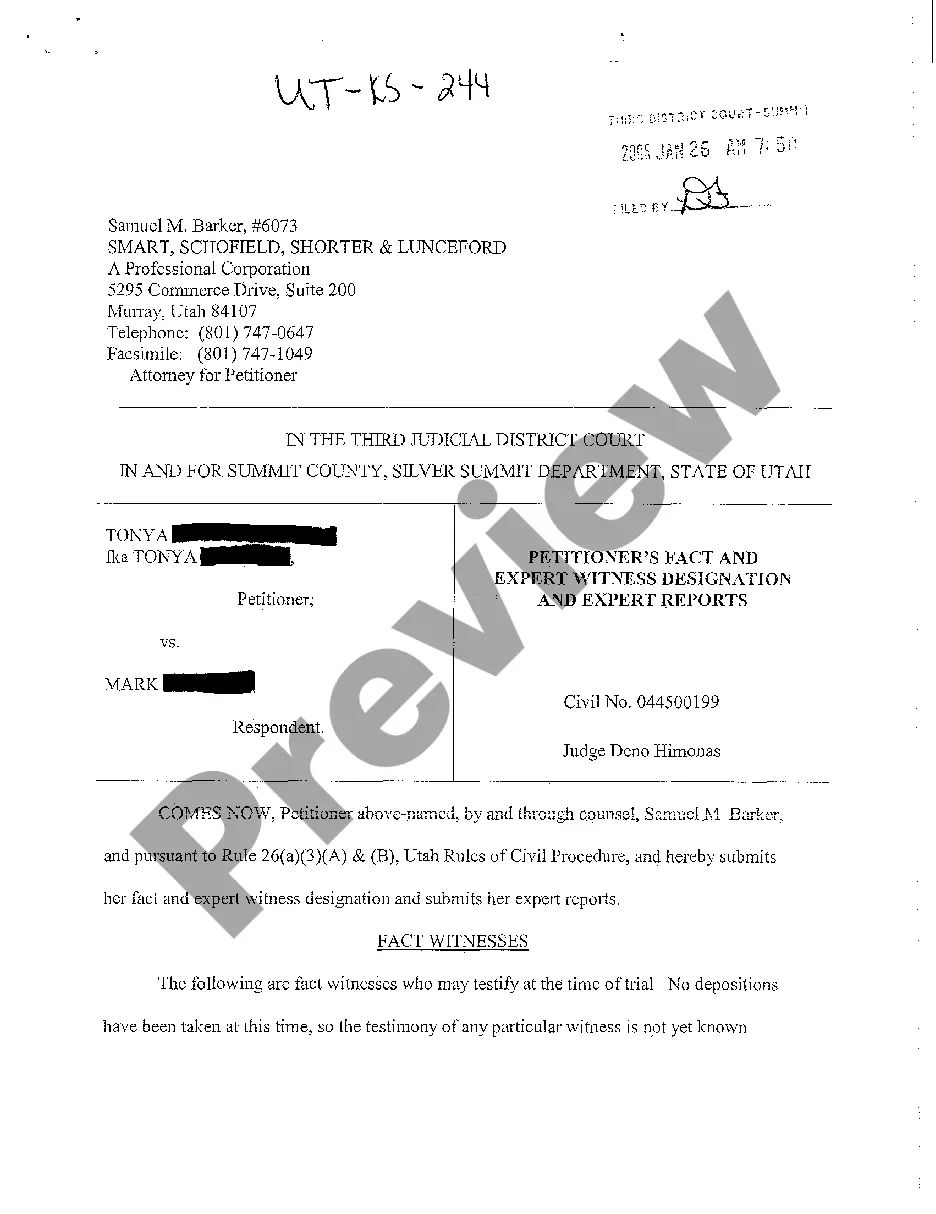

- Make use of the Preview function and read the form description (if available) to ensure that it is the proper document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the proper example for the state and situation.

- Utilize the Search field at the top of the site if you need to look for another document.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your template in a needed format to complete, print, and sign the document.

After you have followed the step-by-step recommendations above, you'll always be capable of log in and download whatever document you will need for whatever state you want it in. With US Legal Forms, finishing Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner templates or other official files is not difficult. Begin now, and don't forget to look at your examples with accredited attorneys!

Form popularity

FAQ

3 attorney answers A general partnership can be dissolved when a partner withdraws or dies. However, dissolution is only the beginning of the winding up process. Assets must be divided and liabilities paid.

When one of the partners or all the partners is insolvent then dissolution can take place. Even the insolvency of one partner can dissolve the firm. Dissolution can also take place if any one of the partners resigns.

When can the dissolution take place according to the Indian Partnership Act, 1932? a) The partnership can be terminated by mutual agreement without the intervention of the court by: Dissolution by mutual consent of all partners (Section 40) Compulsory dissolution due to any unlawful business activities (Section 41)

To close their business account, partnerships need to send the IRS a letter that includes the complete legal name of their business, the EIN, the business address and the reason they wish to close their account.

When partners mutually agreed. Compulsory dissolution. Dissolution depending on certain contingent events. Dissolution by notice. Dissolution by Court. Transfer of interest or equity to the third party.

Review Your Partnership Agreement. Discuss the Decision to Dissolve With Your Partner(s). File a Dissolution Form. Notify Others. Settle and close out all accounts.

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

In a General Partnership, all partners are financially obligated to any debts incurred by the partnership. When a partner leaves, the partnership dissolves and the partners equally split debts and assets.