Agreement between Retiring Partner and Remaining Partners to Dissolve and Wind up Partnership with Mutual Conveyances of Assets

Overview of this form

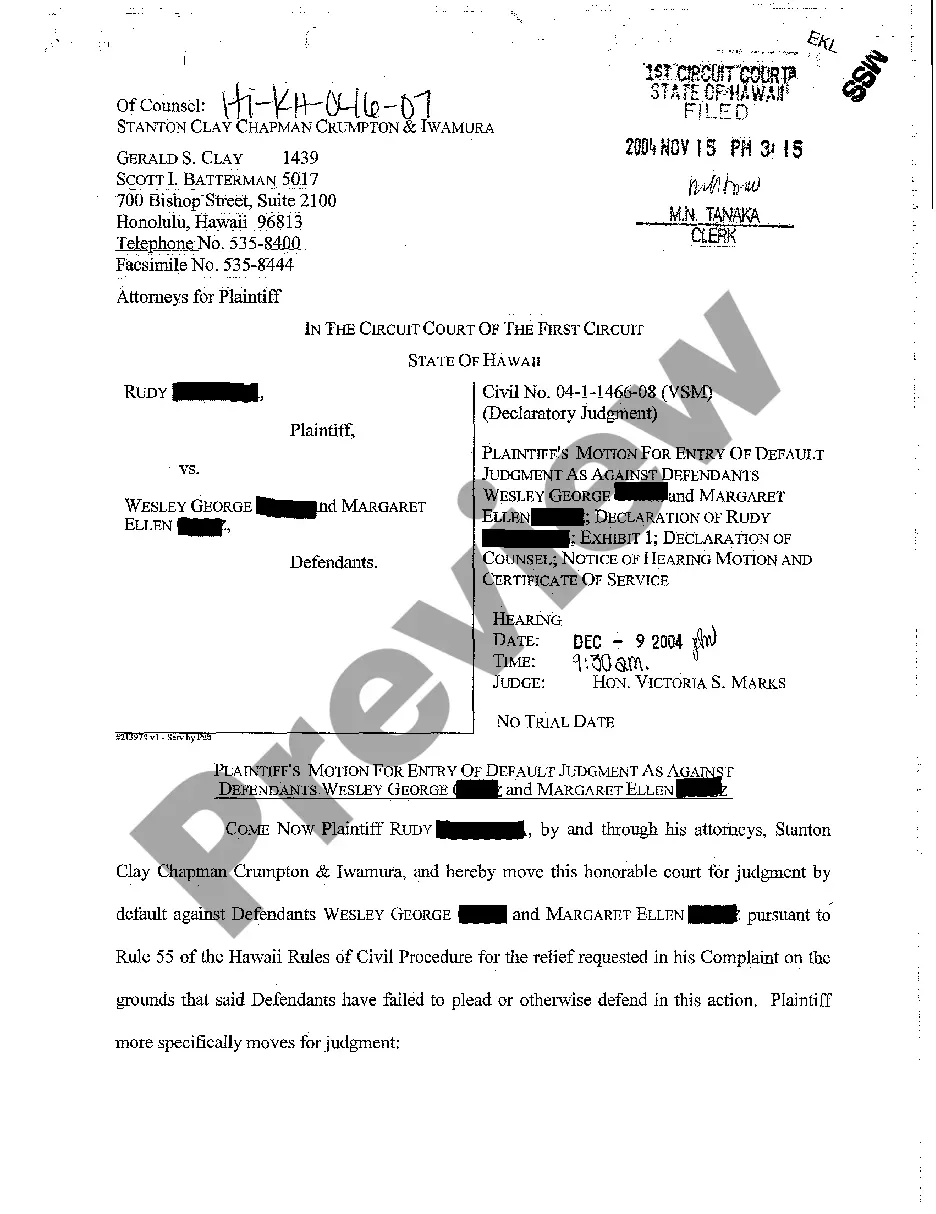

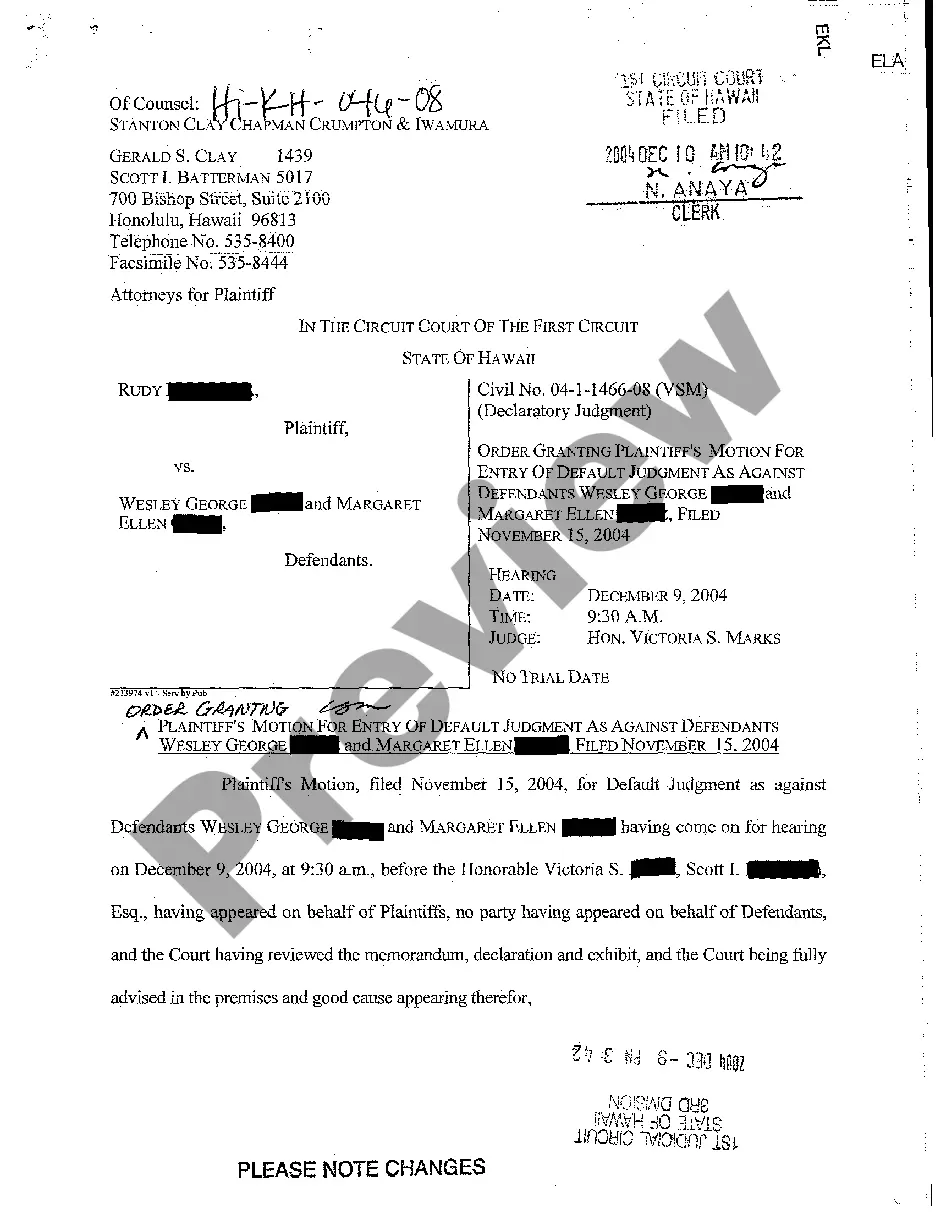

This Agreement between Retiring Partner and Remaining Partners to Dissolve and Wind up Partnership is a legal document that outlines the terms under which a partnership is dissolved. It details the mutual conveyance of the partnership's assets from the retiring partner to those who remain. Understanding the distinction between dissolution and termination is crucial; dissolution marks the end of partnership operations, while termination occurs when the partnership's affairs are settled. This Agreement serves to protect the interests of all parties involved as they navigate the dissolution process.

Key parts of this document

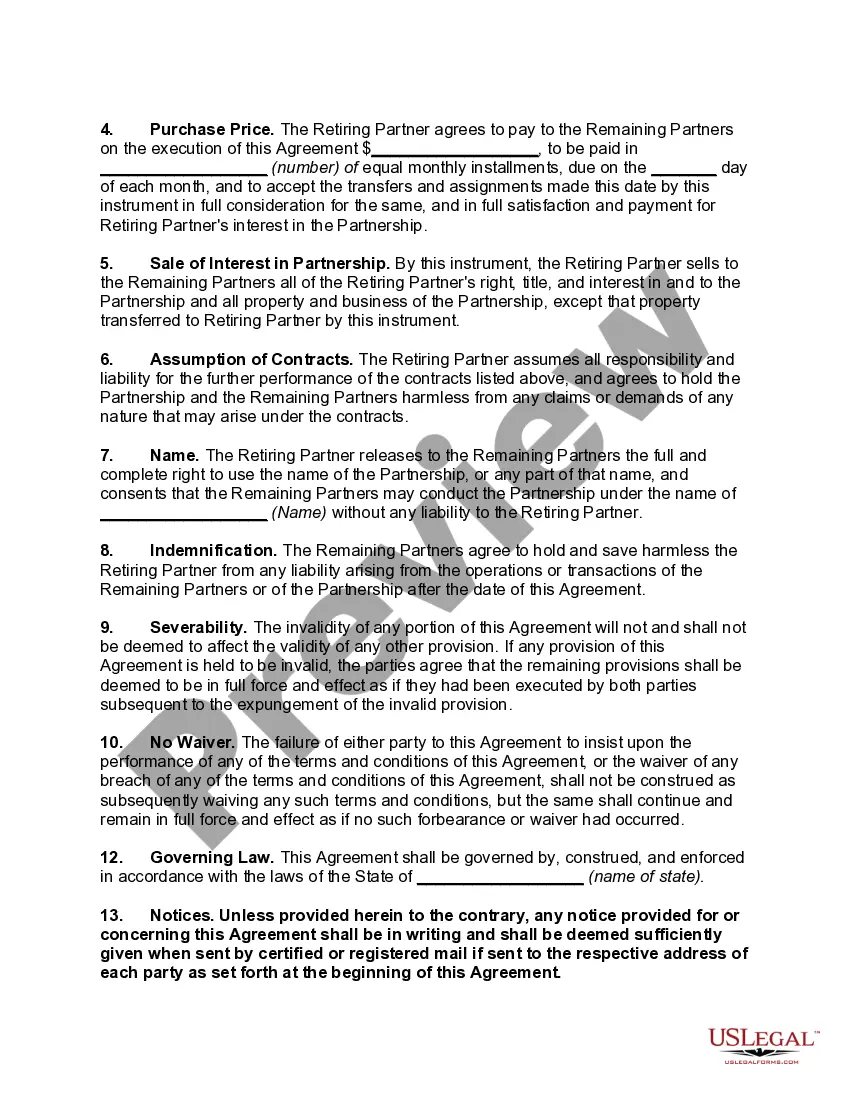

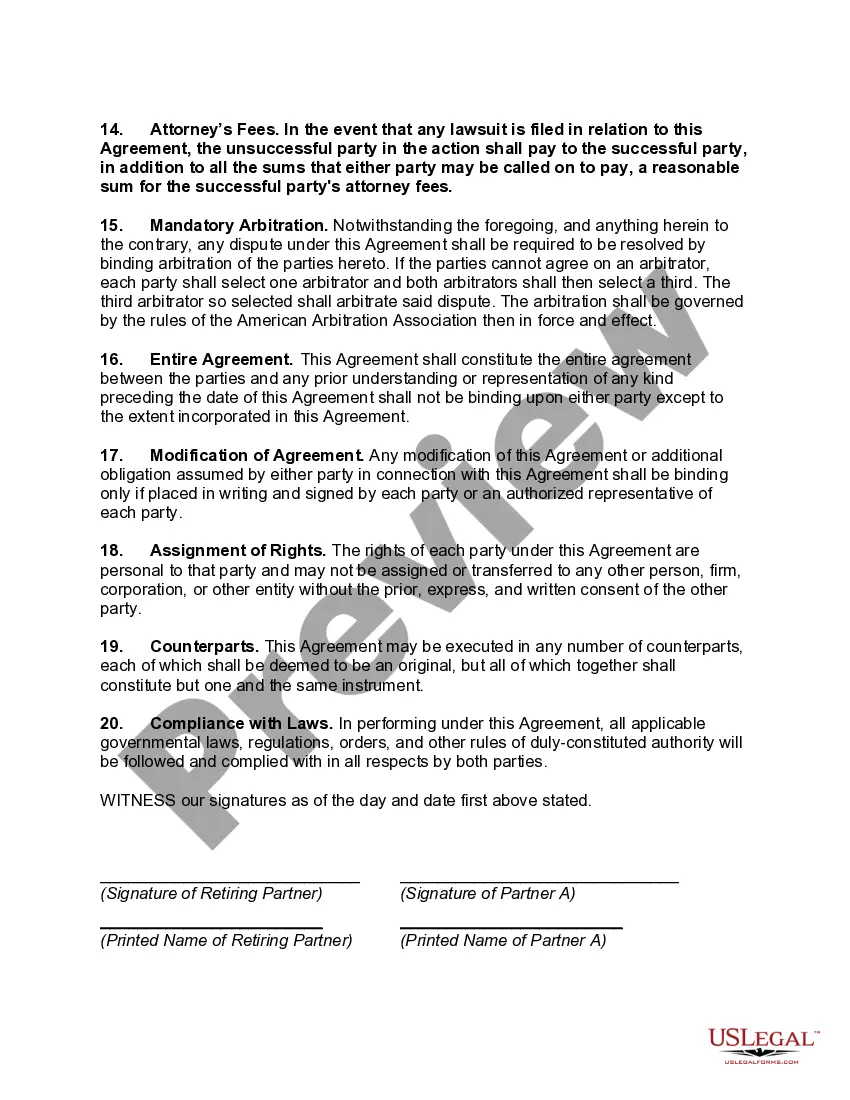

- Identification of all parties involved, including the retiring partner and the remaining partners.

- Details of the dissolution of the partnership, including the name and purpose of the partnership.

- Provisions for the sale of contracts and real estate interests from the remaining partners to the retiring partner.

- Agreement on the purchase price and payment terms for the retiring partner's interests.

- Indemnification clauses protecting both parties from future liabilities.

- Governing law and arbitration requirements for dispute resolution.

Common use cases

This form is essential when a partner in a business partnership decides to retire and the remaining partners wish to continue the business. It ensures the formal and legal handling of asset distribution and responsibilities for existing contracts, protecting all parties' interests. Use this form in situations where clear agreements are needed about how to manage the partnershipâs dissolution and the transition of assets.

Intended users of this form

This form is intended for:

- Partners in a business partnership who are considering or in the process of dissolving their partnership.

- The retiring partner who wants to ensure their rights and interests are noted in the dissolution process.

- The remaining partners who will continue the business and need to formalize the transfer of contracts and assets.

Completing this form step by step

- Identify and list all parties involved, including full names and addresses.

- State the name and address of the partnership being dissolved.

- Clearly outline the terms for the sale of contracts and property being transferred to the retiring partner.

- Specify the purchase price and the schedule for payment by the retiring partner.

- Have all parties review the agreement to ensure accuracy and understanding, then sign and date the document.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Forgetting to include all parties' names and contact information, which can lead to legal complications.

- Neglecting to specify the details of asset transfer can result in disputes later on.

- Failing to have all parties sign and date the agreement, which may render it unenforceable.

Advantages of online completion

- Convenient access to a professionally drafted document that meets legal standards.

- Editable format allows for customization to fit specific partnership needs and terms.

- Instant download ensures you can begin the dissolution process without delays.

Looking for another form?

Form popularity

FAQ

The test of good faith as required for expulsion as stated under Section 33(1) includes three aspects. The expulsion must be in the best interest of the partnership. The partner that is to be expelled must be served with a notice. The partner has to be given the opportunity of being heard.

On retirement of a partner : On retirement of the partner the partnership the partnership firm gets dissolved to form new partnership deed and form new partnership.

If it's a business partnership with two partners, the exit of one partner will result in the collapse of the partnership. The exit terms will be detailed in the partnership agreement which is a legally binding document signed by all participating partners when entering a partnership.

On retirement of the partner, the reconstituted firm continues and the retiring partner is to be paid his dues in terms of Section 37 of the Partnership Act. In case of dissolution, accounts have to be settled and distributed as per the mode prescribed in Section 48 of the Partnership Act.

A Deed of Retirement from Partnership is an Agreement entered into between the Retiring Partner (the Partner who intends to leave the Partnership) and the Continuing Partners (the Partners who will continue to work as Partners of the existing Firm with updated terms).

A Partnership Dissolution Agreement is an agreement between two or more partners to end a business partnership. Signing a Partnership Dissolution Agreement will not immediately end the partnership.

The retirement of a partner extinguishes his interest in the Partnership firm and this leads to dissolution of the firm or reconstitution of the Partnership. A partner, who goes out of a firm, is called retiring partner or outgoing partner.

On retirement of the partner, the reconstituted firm continues and the retiring partner is to be paid his dues in terms of Section 37 of the Partnership Act. In case of dissolution, accounts have to be settled and distributed as per the mode prescribed in Section 48 of the Partnership Act.