Self-Employed Tennis Professional Services Contract

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

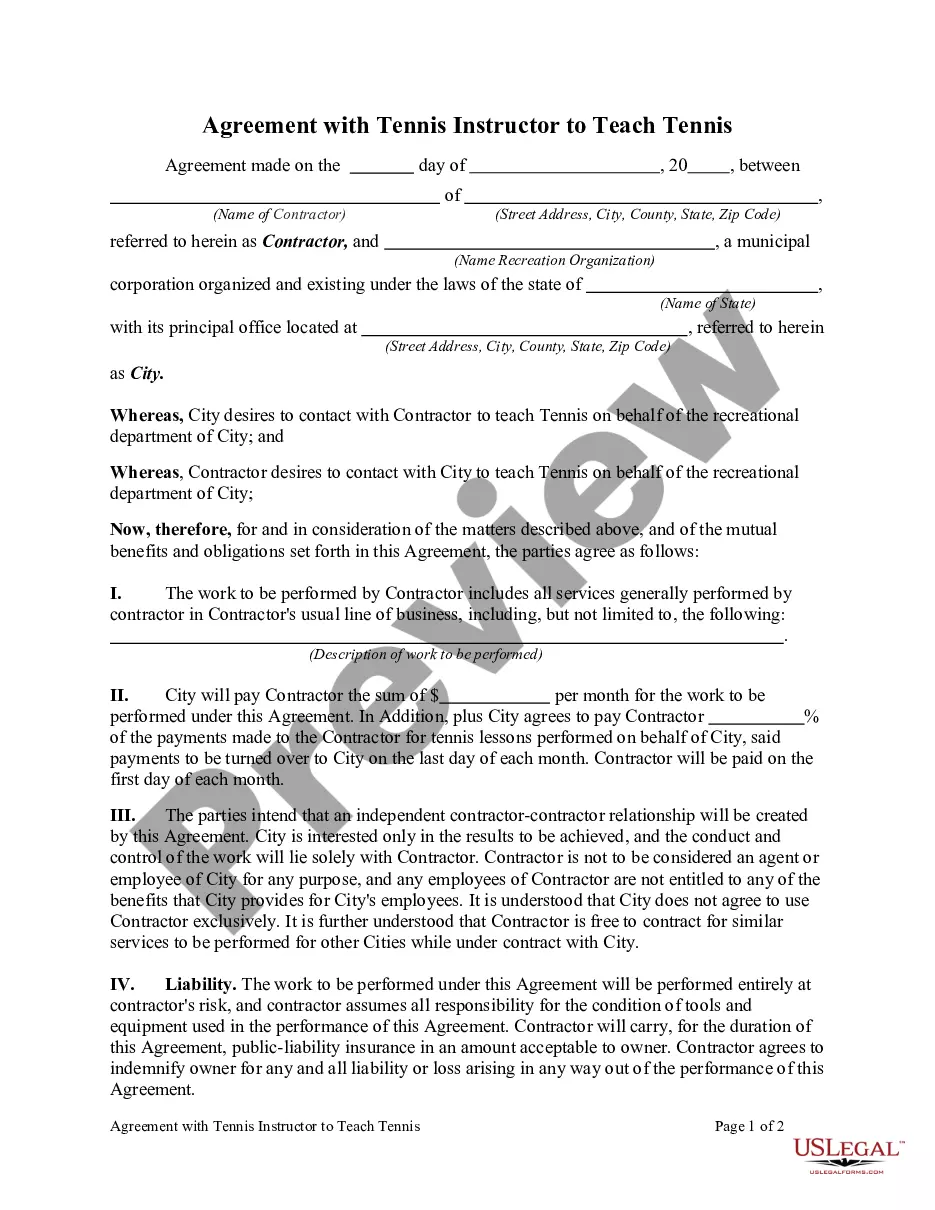

How to fill out Self-Employed Tennis Professional Services Contract?

Among lots of free and paid templates that you find on the net, you can't be sure about their reliability. For example, who made them or if they are competent enough to deal with what you need these to. Keep calm and utilize US Legal Forms! Get Self-Employed Tennis Professional Services Contract samples made by professional legal representatives and get away from the high-priced and time-consuming process of looking for an lawyer and after that having to pay them to write a papers for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you are looking for. You'll also be able to access all of your earlier downloaded templates in the My Forms menu.

If you’re using our service the very first time, follow the guidelines below to get your Self-Employed Tennis Professional Services Contract quick:

- Ensure that the document you find applies where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering process or find another example using the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

When you’ve signed up and purchased your subscription, you can utilize your Self-Employed Tennis Professional Services Contract as often as you need or for as long as it remains valid in your state. Change it in your favorite editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

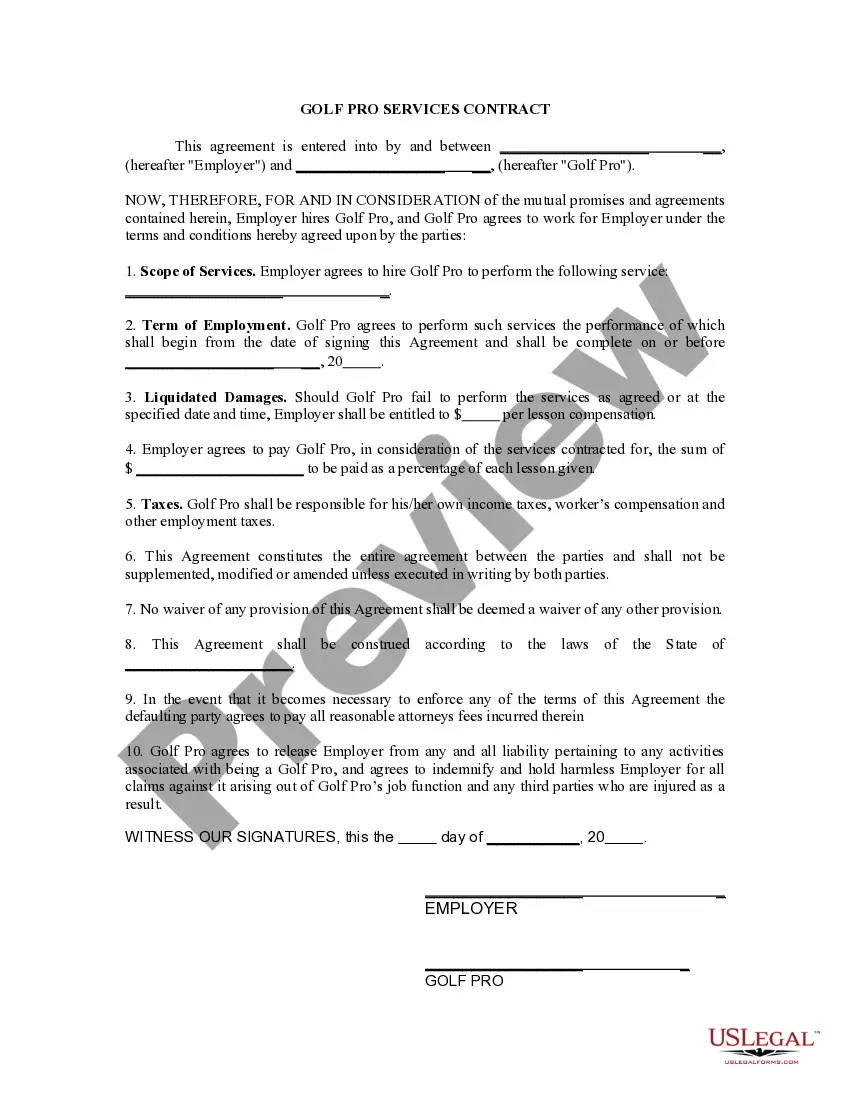

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.

Form W-9. The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

1. Not Having a Written Contract.The taxing, labor and employment, and insurance authorities expect a written contract that states that the worker is an independent contractor and will be paid as such with no tax withholding, no benefits, etc.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Get it in writing. Keep it simple. Deal with the right person. Identify each party correctly. Spell out all of the details. Specify payment obligations. Agree on circumstances that terminate the contract. Agree on a way to resolve disputes.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

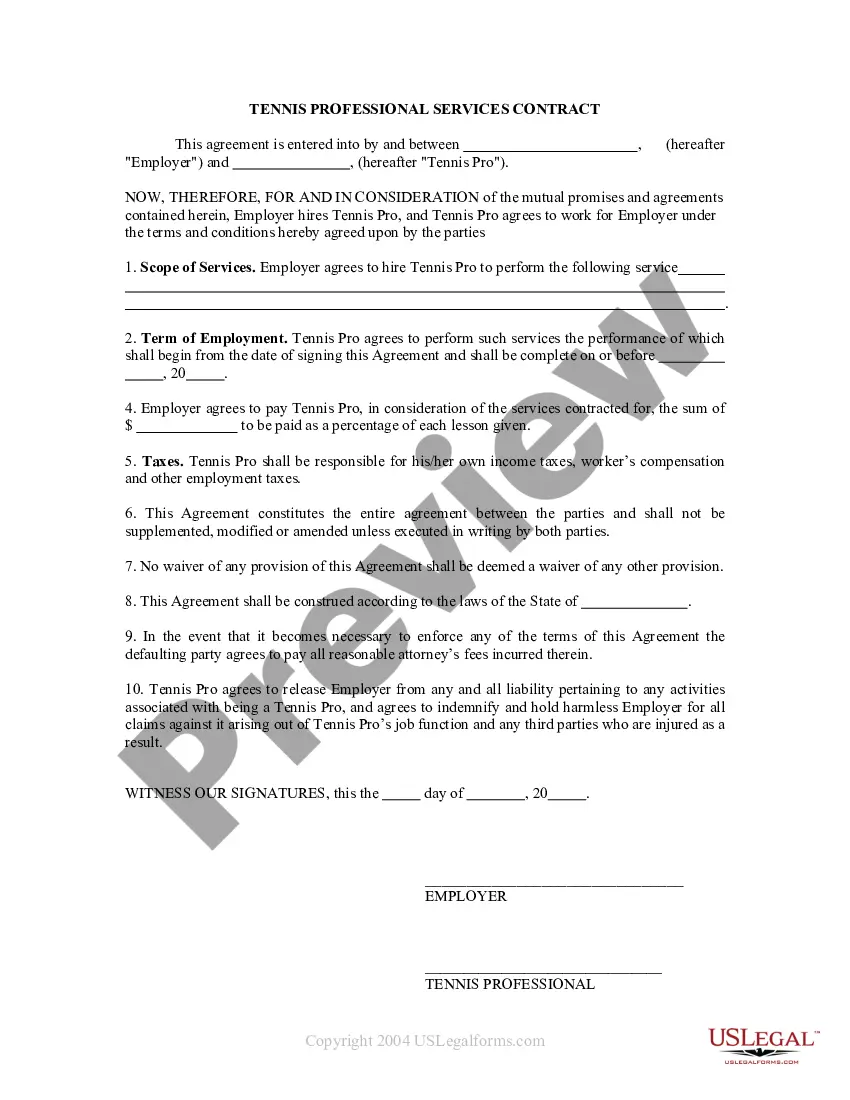

Depending on the method by which amateur athletic officials perform their services and the circumstances of their relationship, these workers may perform services as employees or independent contractors.

Do employers need to complete employment verification checks for independent contractors? No.However, it is important to note that businesses and individuals may not hire independent contractors if they are aware that the independent contractor is not authorized to work in the United States.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.