A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept of an estate which has been conveyed to him. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Disclaimer by Beneficiary of all Rights in Trust

Description

How to fill out Disclaimer By Beneficiary Of All Rights In Trust?

Aren't you sick and tired of choosing from numerous samples every time you require to create a Disclaimer by Beneficiary of all Rights in Trust? US Legal Forms eliminates the wasted time countless American citizens spend browsing the internet for perfect tax and legal forms. Our expert crew of lawyers is constantly modernizing the state-specific Forms library, to ensure that it always offers the right files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription need to complete easy steps before having the ability to get access to their Disclaimer by Beneficiary of all Rights in Trust:

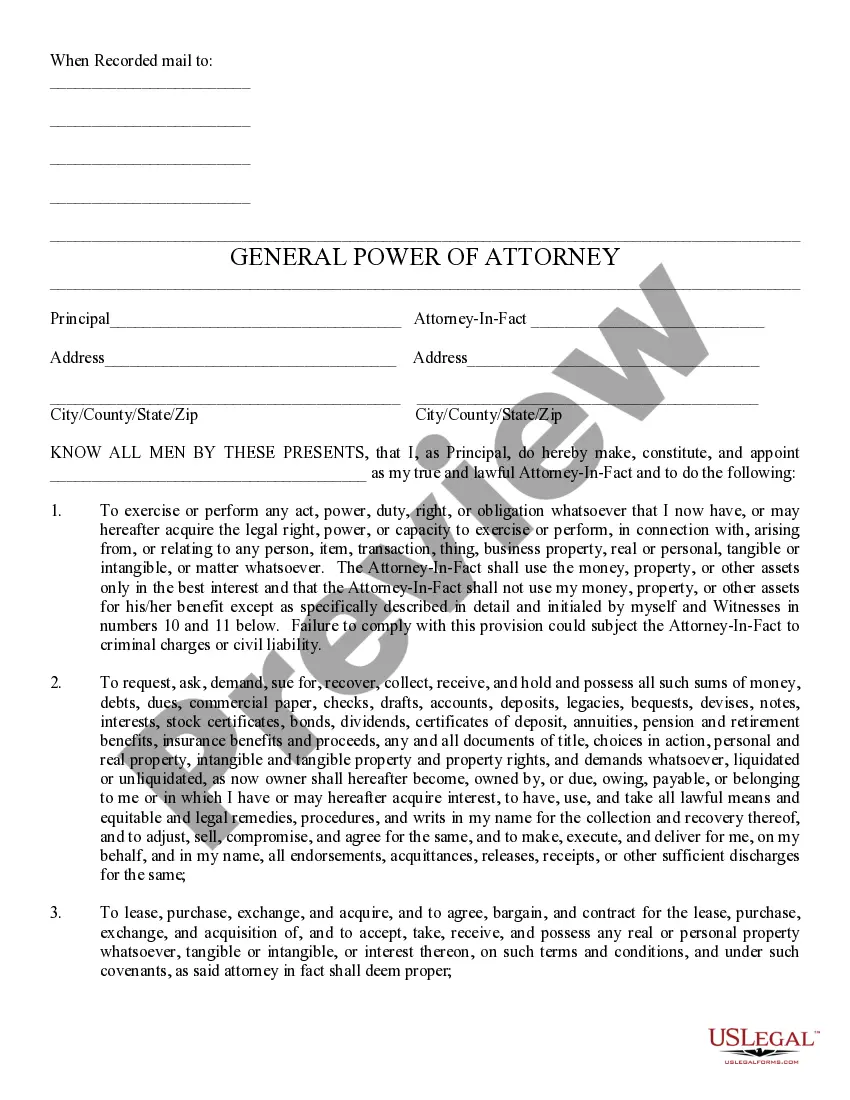

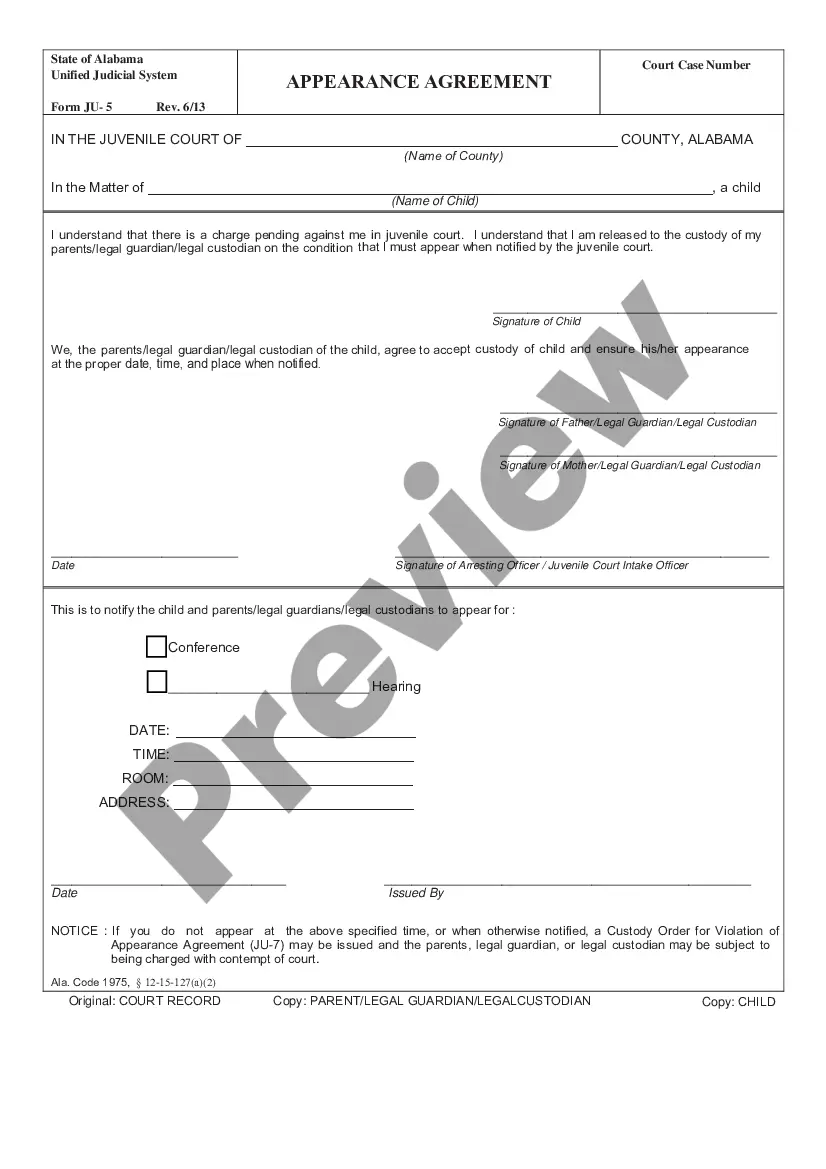

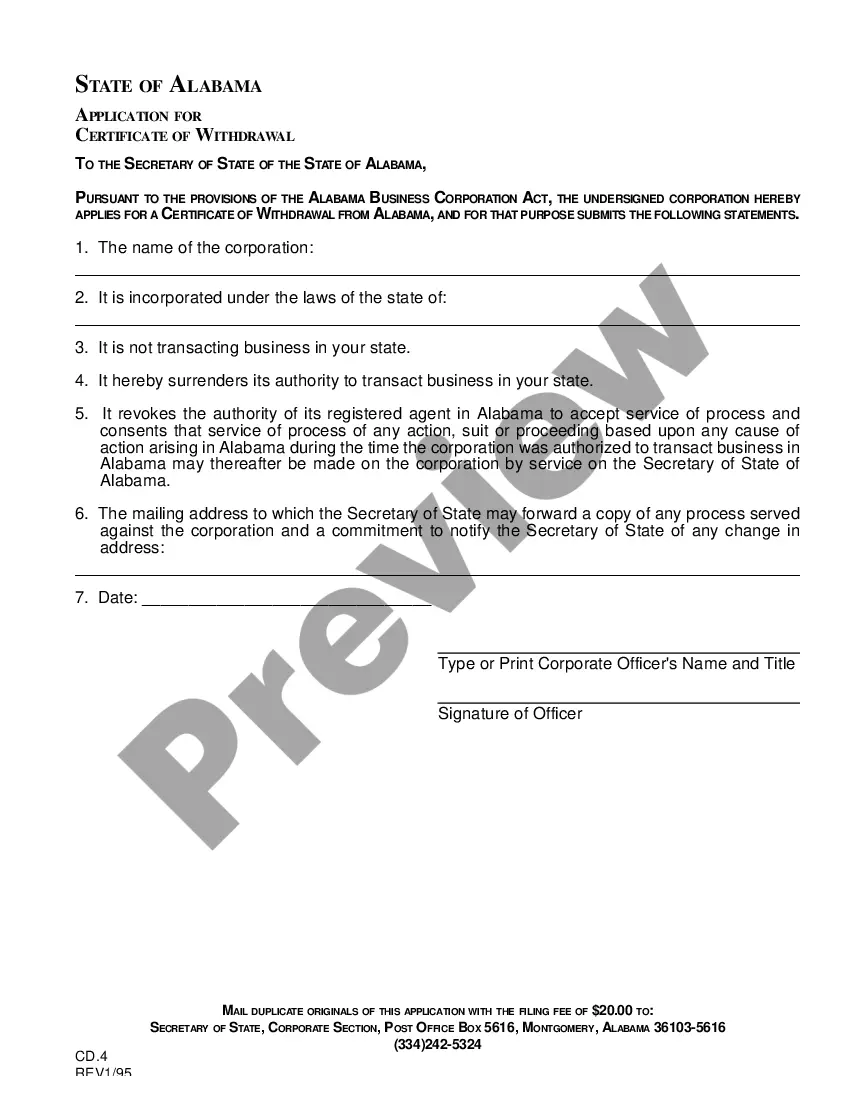

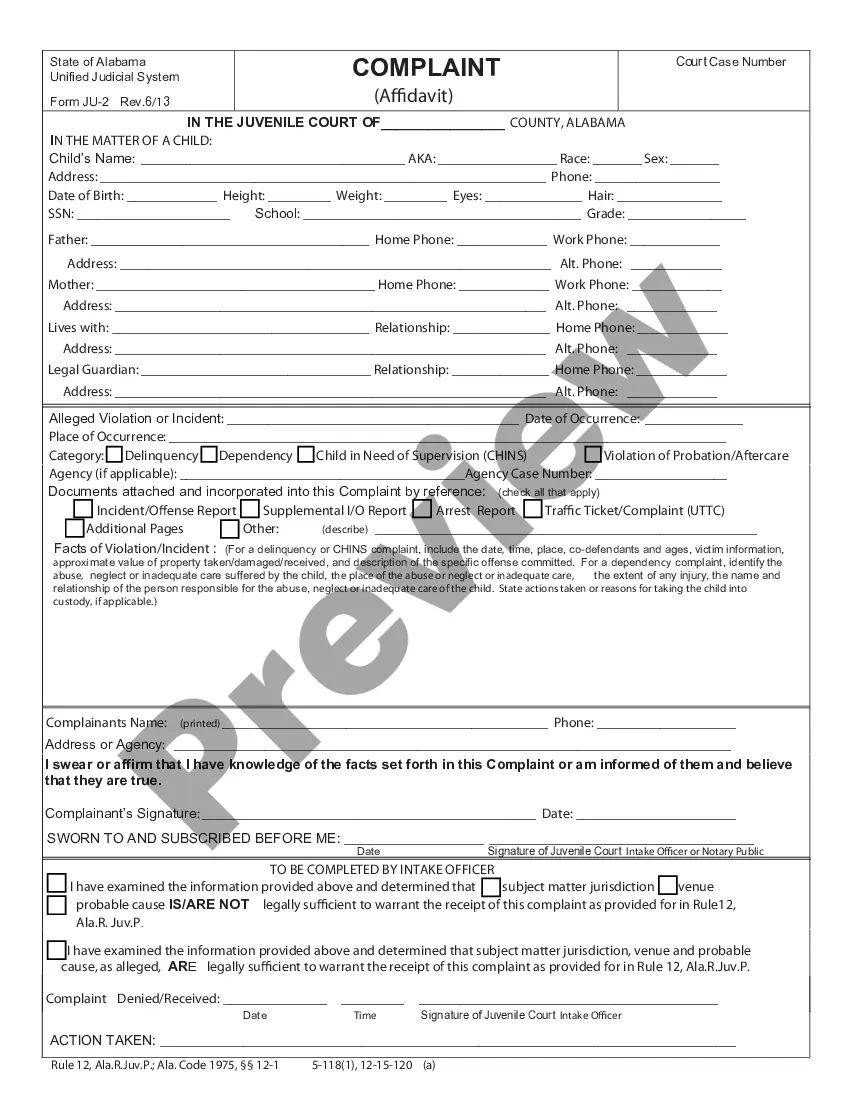

- Make use of the Preview function and read the form description (if available) to be sure that it is the right document for what you’re looking for.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate template for the state and situation.

- Use the Search field at the top of the page if you have to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your sample in a required format to finish, create a hard copy, and sign the document.

As soon as you’ve followed the step-by-step recommendations above, you'll always be capable of sign in and download whatever document you will need for whatever state you want it in. With US Legal Forms, finishing Disclaimer by Beneficiary of all Rights in Trust templates or other official documents is not hard. Get going now, and don't forget to look at your samples with certified attorneys!

Form popularity

FAQ

In your disclaimer, cover any and all liabilities for the product or service that you provide. You should warn consumers of any dangers or hazards posed by your product. You should list specific risks while at the same time acknowledging that the list is not exhaustive. For example, you could write, NOTICE OF RISK.

A disclaimer trust is a clause typically included in a person's will that establishes a trust upon their death, subject to certain specifications. This allows certain assets to be moved into the trust by the surviving spouse without being subject to taxation.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.

A beneficiary is always free to refuse to accept benefits under a trust or a will.The beneficiary may be willing to sign a disclaimer as she does not wish to accept the bequest. The disclaimer would protect you as Trustee from a breach of a fiduciary duty by distributing the assets to a different beneficiary.

These documents can include the will, death certificate, transfer of ownership forms and letters from the estate executor or probate court.If you received the inheritance in the form of cash, request a copy of the bank statement that reflects the deposit.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.

Specifically, the IRS requires that: You make your disclaimer in writing.You disclaim the assets within nine months of the death of the person you inherited them from. (Note: There's an exception for minor beneficiaries; they have until nine months after they reach the age of majority to disclaim.)