Texas Limited Partnership Formation Questionnaire

Description

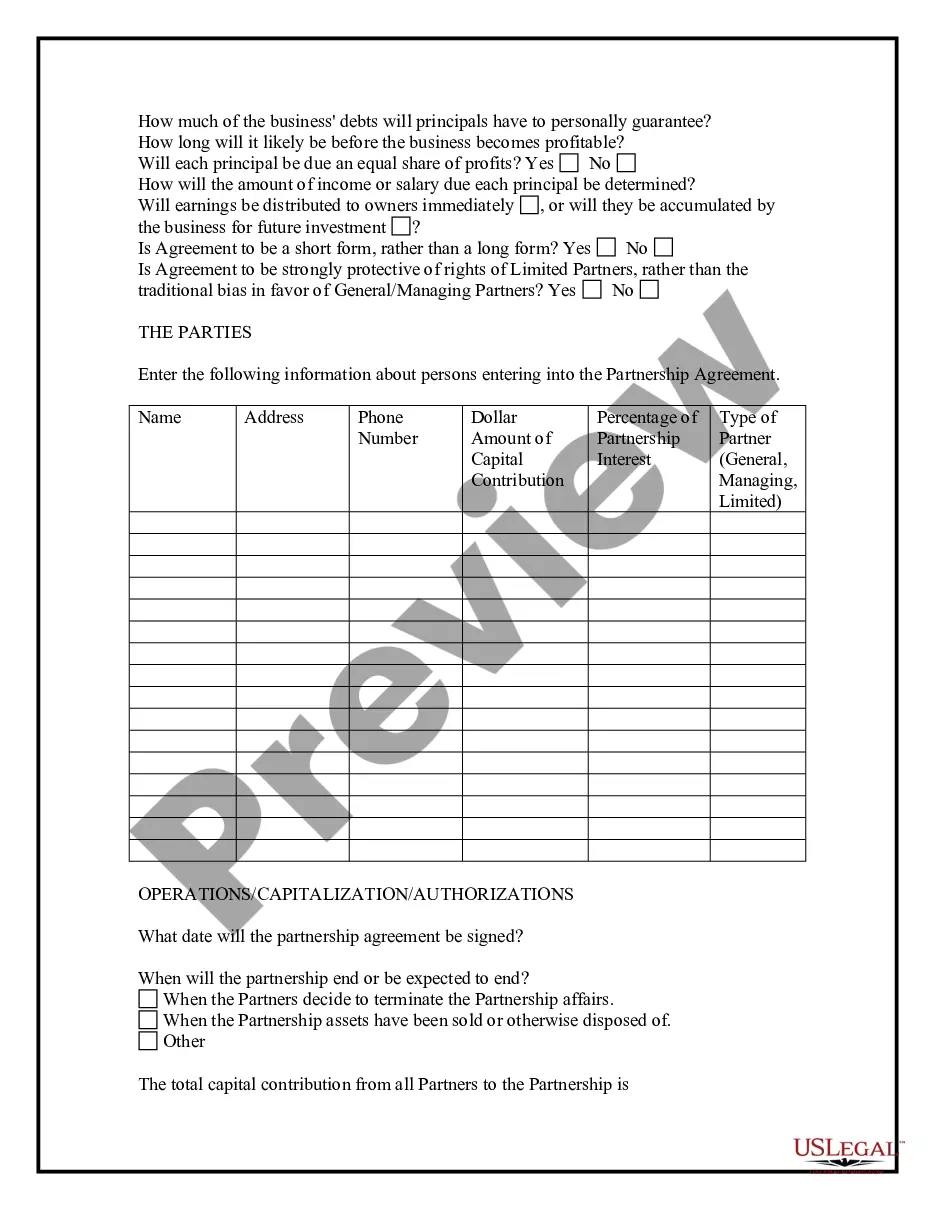

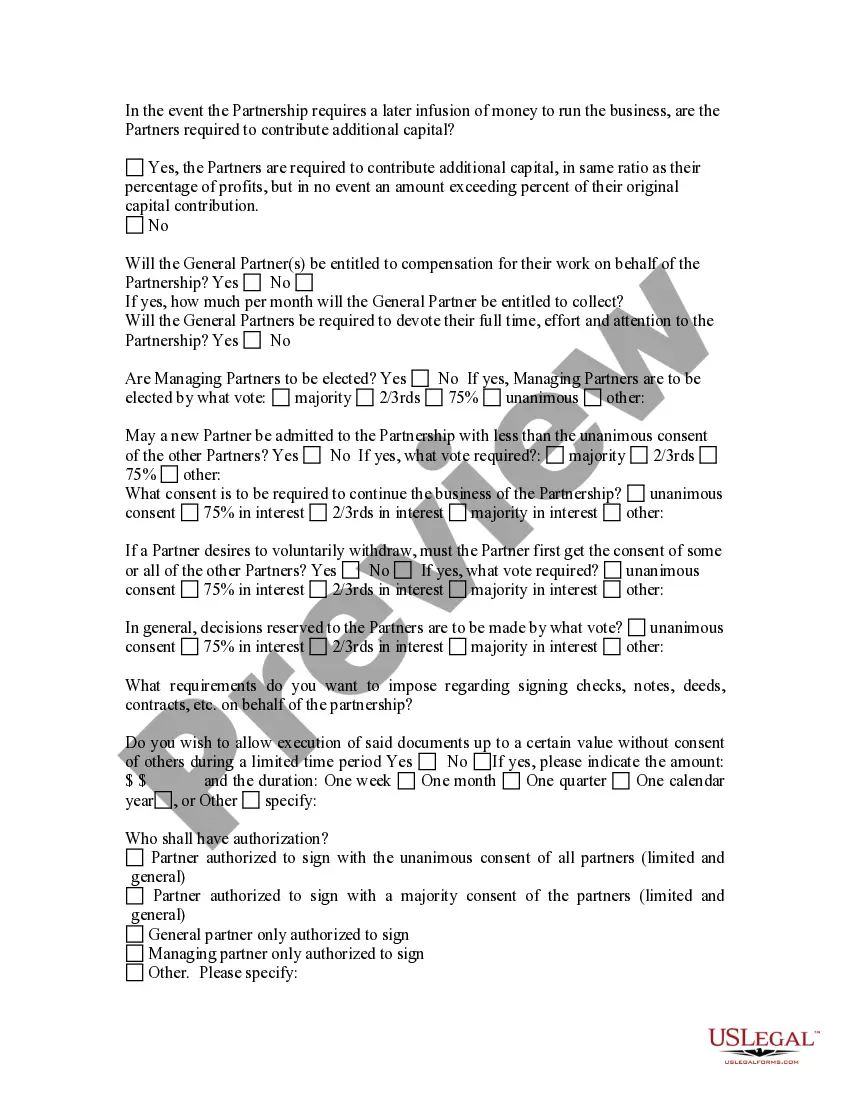

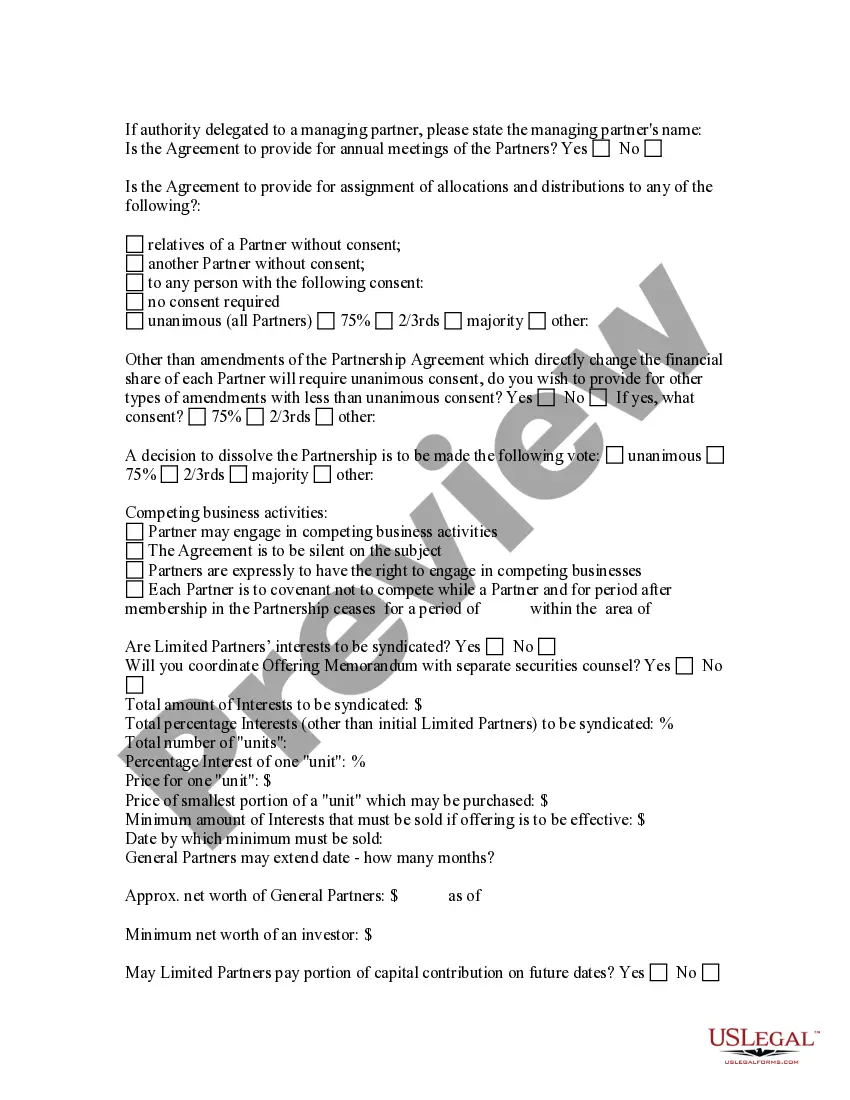

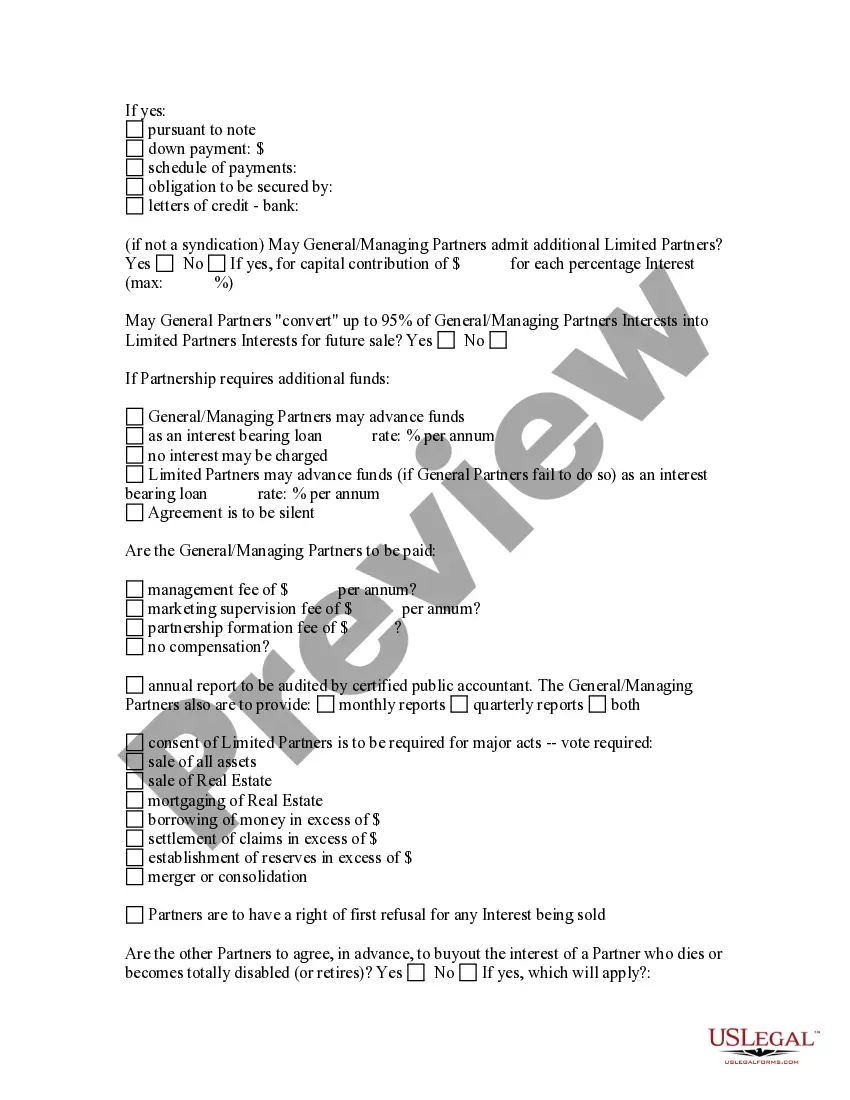

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

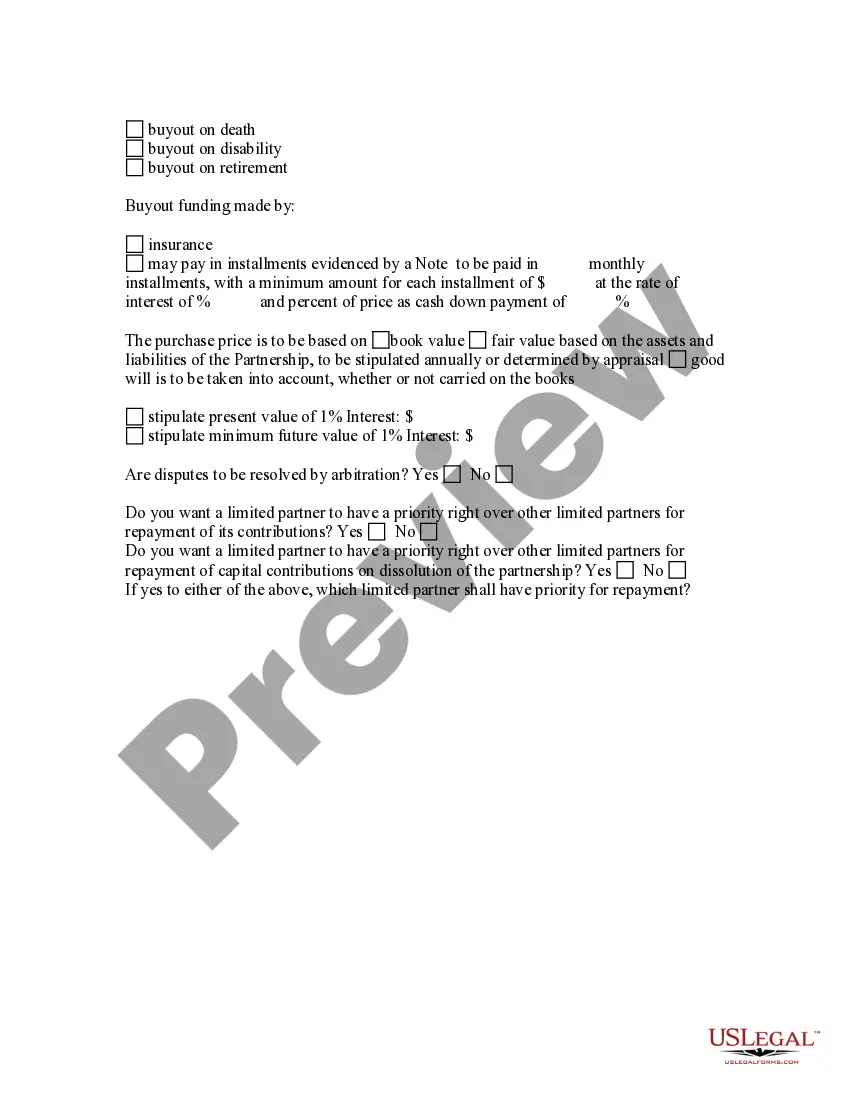

How to fill out Limited Partnership Formation Questionnaire?

Are you in a situation where you will require documents for possibly business or personal activities regularly.

There are numerous legal document templates accessible online, but finding versions you can rely on is not simple.

US Legal Forms offers a multitude of form templates, including the Texas Limited Partnership Formation Questionnaire, which can be tailored to meet federal and state regulations.

Utilize US Legal Forms, one of the most comprehensive collections of legal forms, to save time and avoid errors.

The service provides professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Texas Limited Partnership Formation Questionnaire template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/county.

- Use the Preview button to examine the form.

- Read the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the appropriate form, click on Buy now.

- Choose the pricing plan you prefer, fill out the necessary information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Select a convenient document format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Texas Limited Partnership Formation Questionnaire at any time, if needed. Click on the desired form to download or print the document template.

Form popularity

FAQ

To obtain a certificate of formation in Texas, you need to submit the Texas Limited Partnership Formation Questionnaire along with the required paperwork to the Texas Secretary of State. This document outlines essential details about your limited partnership, such as its name, registered agent, and business purpose. After filing, you can expect to receive your certificate of formation typically within a few business days. Utilizing platforms like US Legal Forms can simplify this process, providing you with templates and guidance to ensure your application meets all necessary requirements.

Required Documents: Limited PartnershipName and address of business.Business tax ID number: Business Employer Identification Number (EIN) provided by the IRS in the following 9-digit format XX-XXXXXXX.Date business was established (month/year)Country and state of legal formation (must be formed in the US)More items...

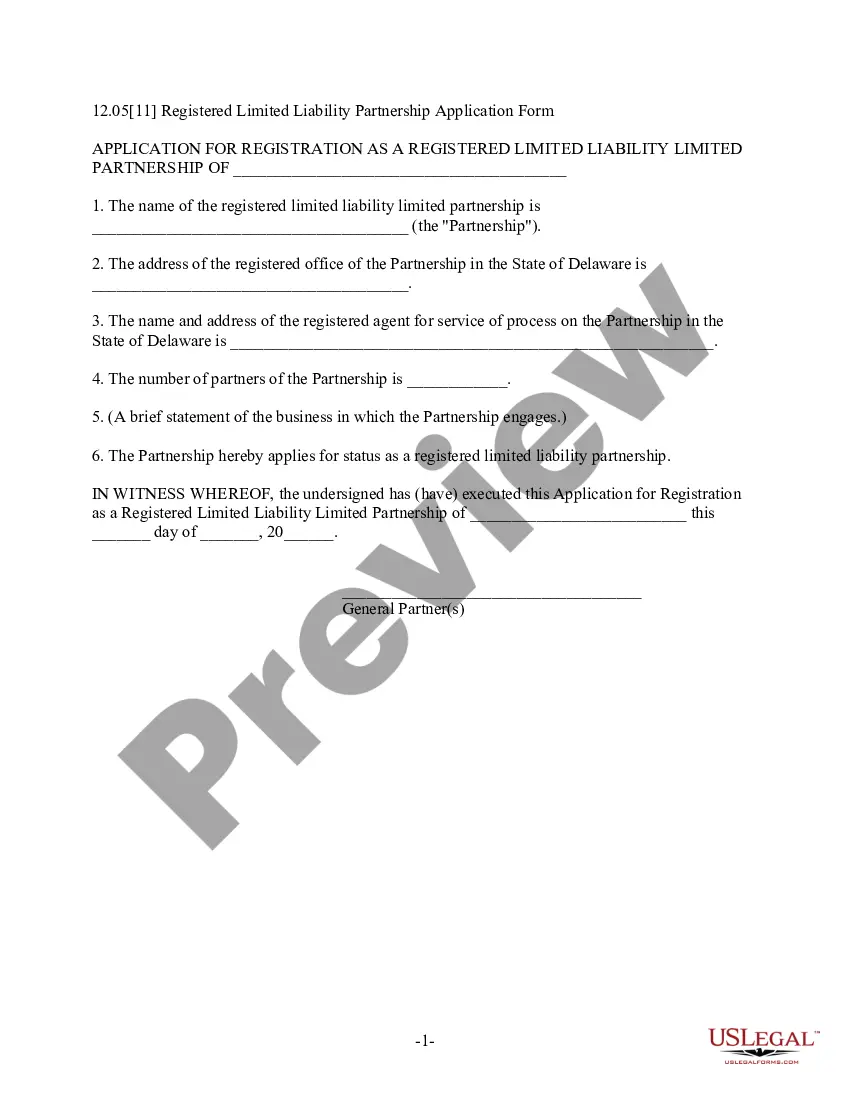

To register a pre-existing general partnership as an LLP, or to register a pre-existing limited partnership (LP) as an LLP, you must file an application for registration with our office. You may use Form 701 (Word, PDF) as your application for registration. The filing fee is $200 per general partner.

Cost to Form an LP: The state of California charges a filing fee of $70 to form a limited partnership. Processing Time: The Secretary of State will generally process your LP formation in around 10 business days.

With an LLC, all of the members obtain limited personal liability. The members may also participate in the management of the business and keep their limitation of liability. In an LP, only limited partners enjoy limited personal liability.

To form a partnership in Texas, you should take the following steps:Choose a business name.File an assumed business name.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

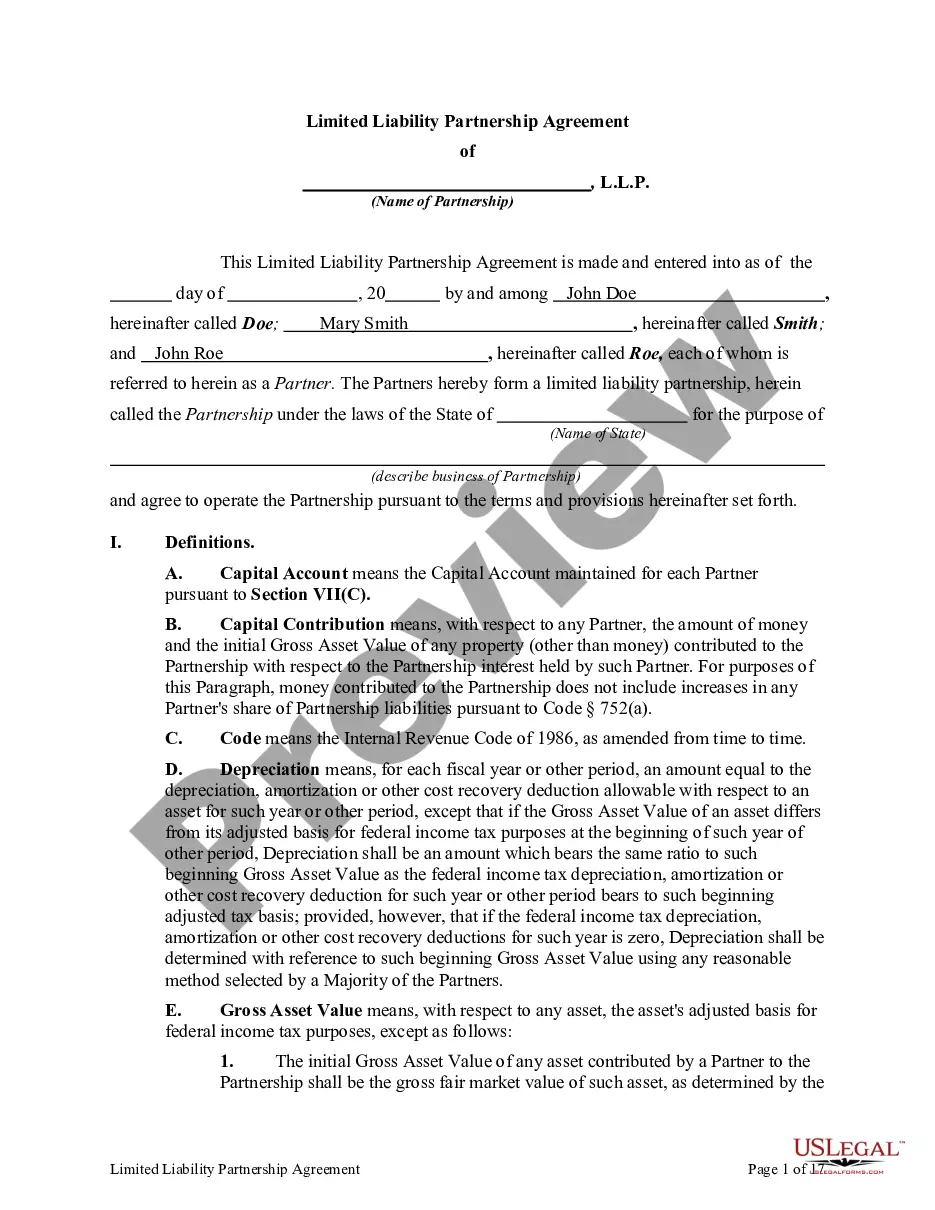

How to Form a Texas Limited Partnership (in 6 Steps)Step One) Choose an LP Name.Step Two) Designate a Registered Agent.Step Three) File the Certificate of Formation.Step Four) Create a Limited Partnership Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.

Limited partnerships must be registered at the Registrar of Companies (Companies House). Until registered, both types of partners are equally responsible for any debts and obligations incurred. It is usual to register immediately after the partnership agreement has been signed.

A Texas limited partnership that also registers with the secretary of state as a limited liability partnership (LLP) must file an annual report with the secretary of state no later than June 1 of each year. The report is due following the calendar year in which the application for registration takes effect.

How to form a limited partnershipName of the business (typically must end in Limited or Ltd.).Registered agent of the business who will accept legal documents on the business's behalf.Name and address of each general partner.Signature of general partner or person filling out the form.