Texas Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool

Description

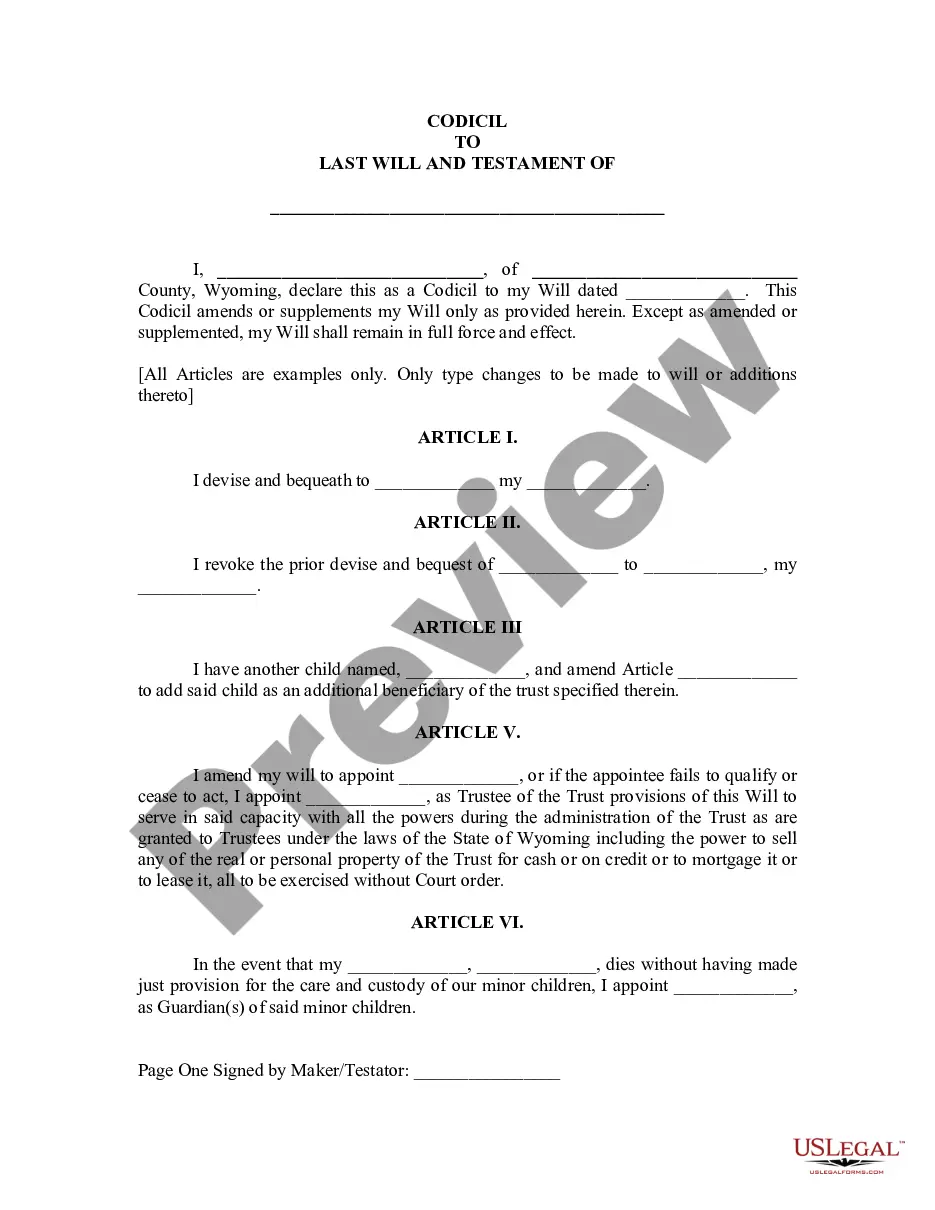

How to fill out Assignment Of Overriding Royalty Interest With Multiple Leases That Are Non Producing With Reservation Of The Right To Pool?

Are you currently inside a place where you need to have documents for both enterprise or specific uses almost every day? There are tons of legal document templates available online, but getting versions you can trust is not effortless. US Legal Forms gives a huge number of type templates, just like the Texas Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool, that happen to be created in order to meet state and federal needs.

Should you be currently knowledgeable about US Legal Forms internet site and also have a merchant account, just log in. Following that, it is possible to acquire the Texas Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool format.

If you do not have an profile and want to begin using US Legal Forms, abide by these steps:

- Find the type you need and ensure it is for the correct area/region.

- Make use of the Preview option to check the shape.

- Browse the description to actually have selected the proper type.

- When the type is not what you are seeking, take advantage of the Search discipline to discover the type that fits your needs and needs.

- Once you get the correct type, click on Acquire now.

- Opt for the costs strategy you would like, complete the desired details to generate your money, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file structure and acquire your backup.

Locate all of the document templates you have purchased in the My Forms food list. You can get a further backup of Texas Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool anytime, if possible. Just click the required type to acquire or produce the document format.

Use US Legal Forms, probably the most substantial selection of legal kinds, to save lots of time as well as stay away from mistakes. The services gives appropriately created legal document templates which can be used for a variety of uses. Create a merchant account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

The owner of a royalty interest receives a portion of the income generated from oil and gas production. Unlike an ORRI, a royalty-interest owner does not have the right to execute leases or collect bonus payments. The RI owner does not bear any operating costs or expenses related to the well.

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

An overriding royalty interest involves a royalty above the royalties paid to the owners via an oil and gas lease and its payment does not affect the owners' interest.

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

1. n. [Oil and Gas Business] Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.