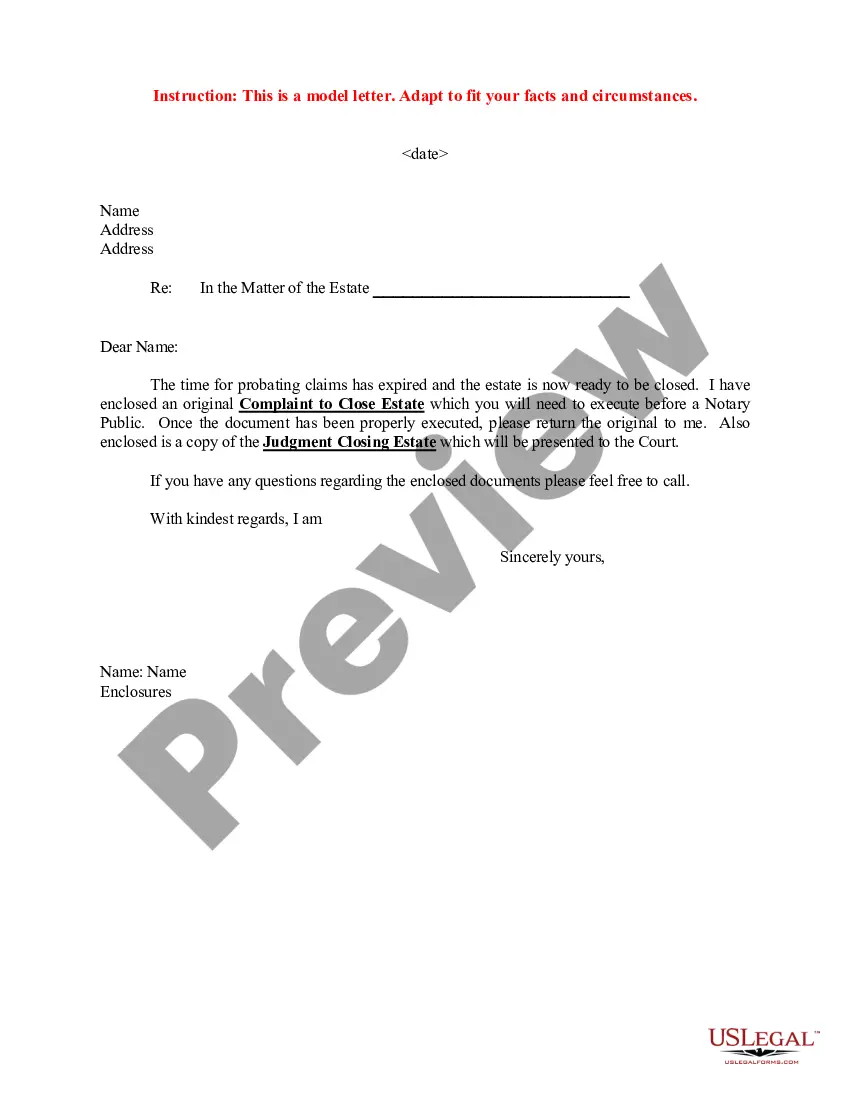

Texas Sample Letter regarding Judgment Closing Estate

Description

How to fill out Sample Letter Regarding Judgment Closing Estate?

US Legal Forms - among the biggest libraries of authorized kinds in the United States - offers a wide array of authorized document web templates you are able to obtain or printing. Utilizing the web site, you can get thousands of kinds for company and personal purposes, categorized by types, says, or key phrases.You will discover the most up-to-date models of kinds like the Texas Sample Letter regarding Judgment Closing Estate in seconds.

If you already possess a membership, log in and obtain Texas Sample Letter regarding Judgment Closing Estate from the US Legal Forms catalogue. The Acquire key will appear on each type you view. You get access to all earlier saved kinds from the My Forms tab of your respective accounts.

If you would like use US Legal Forms the first time, here are easy recommendations to help you began:

- Ensure you have chosen the proper type for your metropolis/region. Select the Preview key to review the form`s information. Look at the type explanation to ensure that you have selected the right type.

- When the type does not satisfy your demands, use the Search area at the top of the display screen to find the one which does.

- In case you are satisfied with the shape, confirm your selection by clicking on the Purchase now key. Then, opt for the pricing program you want and provide your references to register for an accounts.

- Approach the purchase. Utilize your credit card or PayPal accounts to complete the purchase.

- Choose the formatting and obtain the shape on your own gadget.

- Make alterations. Fill up, revise and printing and indicator the saved Texas Sample Letter regarding Judgment Closing Estate.

Every single design you added to your bank account does not have an expiration time and is also your own property for a long time. So, if you would like obtain or printing an additional duplicate, just go to the My Forms portion and then click on the type you will need.

Obtain access to the Texas Sample Letter regarding Judgment Closing Estate with US Legal Forms, probably the most comprehensive catalogue of authorized document web templates. Use thousands of expert and condition-specific web templates that fulfill your organization or personal requires and demands.

Form popularity

FAQ

Secured creditors generally have six months from the executor's appointment, or four months after their receipt of the notice from the executor, to file their claim against the estate. After this time limit, any claim submitted will be barred, meaning that the creditor will be unable to sue the estate.

Generally, under Texas law, a Will must be admitted to probate within 4 years of a person's death.

Texas maintains a four-year statute of limitations on general debts from their original due date. However, all such limitations are suspended for twelve months following the estate owner's death.

Do Judgments Expire in Texas? Judgments awarded in Texas to a non-government creditor are generally valid for ten years but they can be renewed for longer. If a judgment is not renewed, it will become dormant. You can attempt to revive a dormant judgment in order to continue to try and collect the debt.

Section 256.156 of the Texas Estates Code provides that ?A will that cannot be produced in court must be proved in the same manner as provided in Section 256.153 for an attested will or Section 256.154 for a holographic will, as applicable.? Holographic wills are wills made in the decedent's handwriting that do not ...

The most common way of closing an estate in Texas is to file a Notice of Closing Estate with the county court. This document acts as an affidavit and confirms that you have discharged your duties. It must state the following: All known debts have been paid or satisfied as much as the estate assets would allow.

The executor generally has three years after their appointment to distribute the remaining assets (after debts and disputes are resolved). The Texas probate process can be fairly simple in most cases.

The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.