Texas Sample Letter for Update to Estate Closure

Description

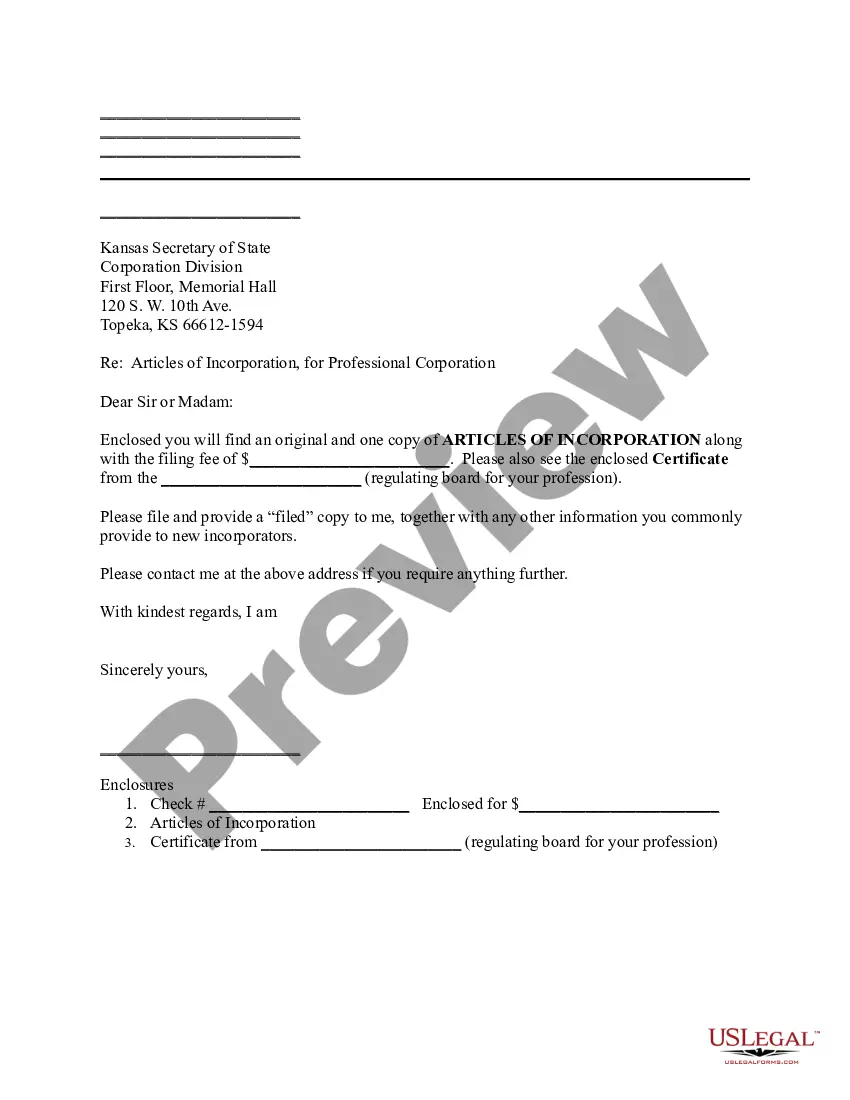

How to fill out Sample Letter For Update To Estate Closure?

Choosing the best legal papers format might be a struggle. Needless to say, there are plenty of web templates available on the Internet, but how do you get the legal type you will need? Make use of the US Legal Forms internet site. The support provides a huge number of web templates, such as the Texas Sample Letter for Update to Estate Closure, that you can use for company and private demands. All the forms are checked by specialists and meet up with state and federal needs.

When you are currently registered, log in to your bank account and then click the Down load switch to have the Texas Sample Letter for Update to Estate Closure. Utilize your bank account to search throughout the legal forms you may have purchased previously. Go to the My Forms tab of your respective bank account and get one more backup in the papers you will need.

When you are a new customer of US Legal Forms, listed below are basic recommendations that you should comply with:

- First, ensure you have chosen the right type to your town/area. You are able to look over the shape making use of the Review switch and look at the shape explanation to make sure it is the right one for you.

- In the event the type is not going to meet up with your preferences, take advantage of the Seach discipline to discover the correct type.

- When you are positive that the shape is acceptable, select the Buy now switch to have the type.

- Opt for the pricing plan you need and enter the required details. Create your bank account and buy the transaction making use of your PayPal bank account or charge card.

- Choose the file formatting and down load the legal papers format to your product.

- Full, change and print out and indicator the attained Texas Sample Letter for Update to Estate Closure.

US Legal Forms will be the biggest collection of legal forms in which you can see a variety of papers web templates. Make use of the service to down load skillfully-produced paperwork that comply with condition needs.

Form popularity

FAQ

Can An Executor Sell Estate Property Without Getting Approval From All Beneficiaries? The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

An executor cannot change beneficiaries' inheritances or withhold their inheritances unless the will has expressly granted them the authority to do so. The executor also cannot stray from the terms of the will or their fiduciary duty.

The executor generally has three years after their appointment to distribute the remaining assets (after debts and disputes are resolved). The Texas probate process can be fairly simple in most cases.

Section 405.006 - Notice of Closing Estate (a) Instead of filing a closing report under Section 405.005, an independent executor may file a notice of closing estate verified by affidavit that states: (1) that all debts known to exist against the estate have been paid or have been paid to the extent permitted by the ...

The most common way of closing an estate in Texas is to file a Notice of Closing Estate with the county court. This document acts as an affidavit and confirms that you have discharged your duties. It must state the following: All known debts have been paid or satisfied as much as the estate assets would allow.

Legal Assets Will Not Transfer If the executor fails to probate a will, all the decedent's assets remain in their name indefinitely. That means the deceased individual's assets, such as their house, car or personal property, cannot transfer over to the appropriate parties without court approval.

Seeking Legal Recourse If you believe that the executor is not living up to their duties, you have two legal options: petition the court or file a civil lawsuit.