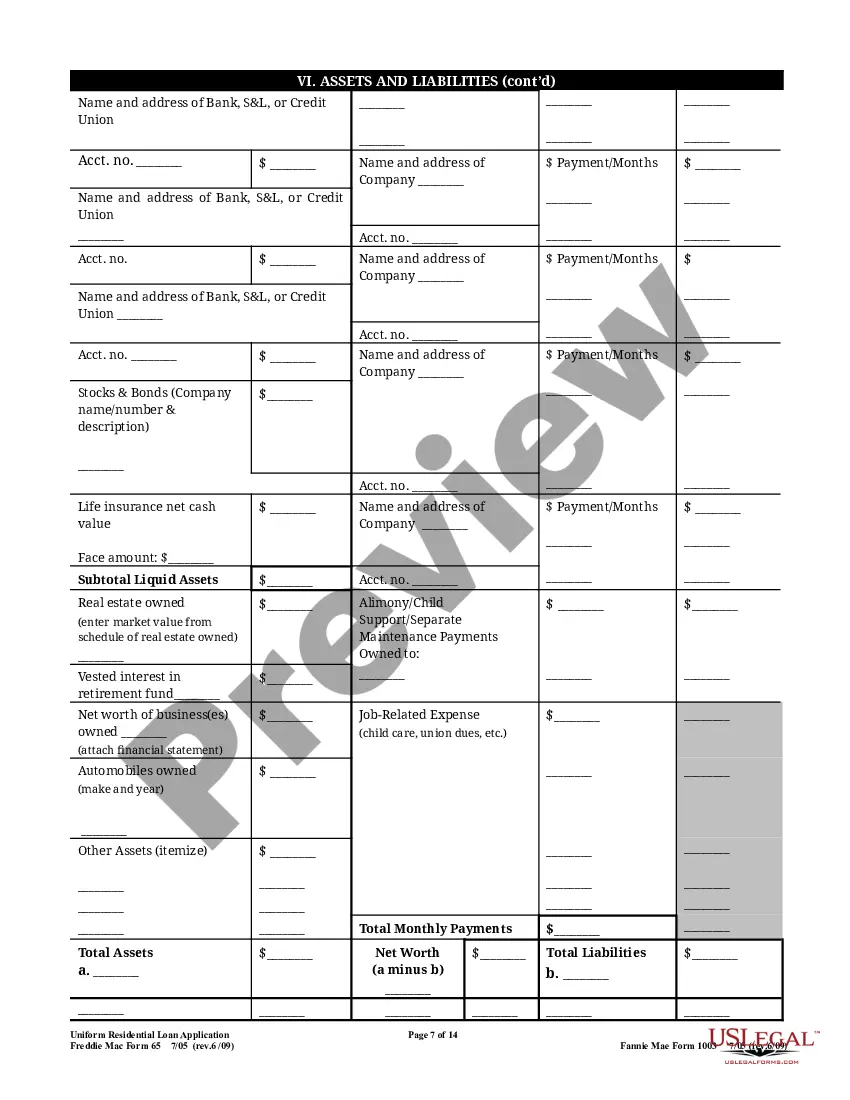

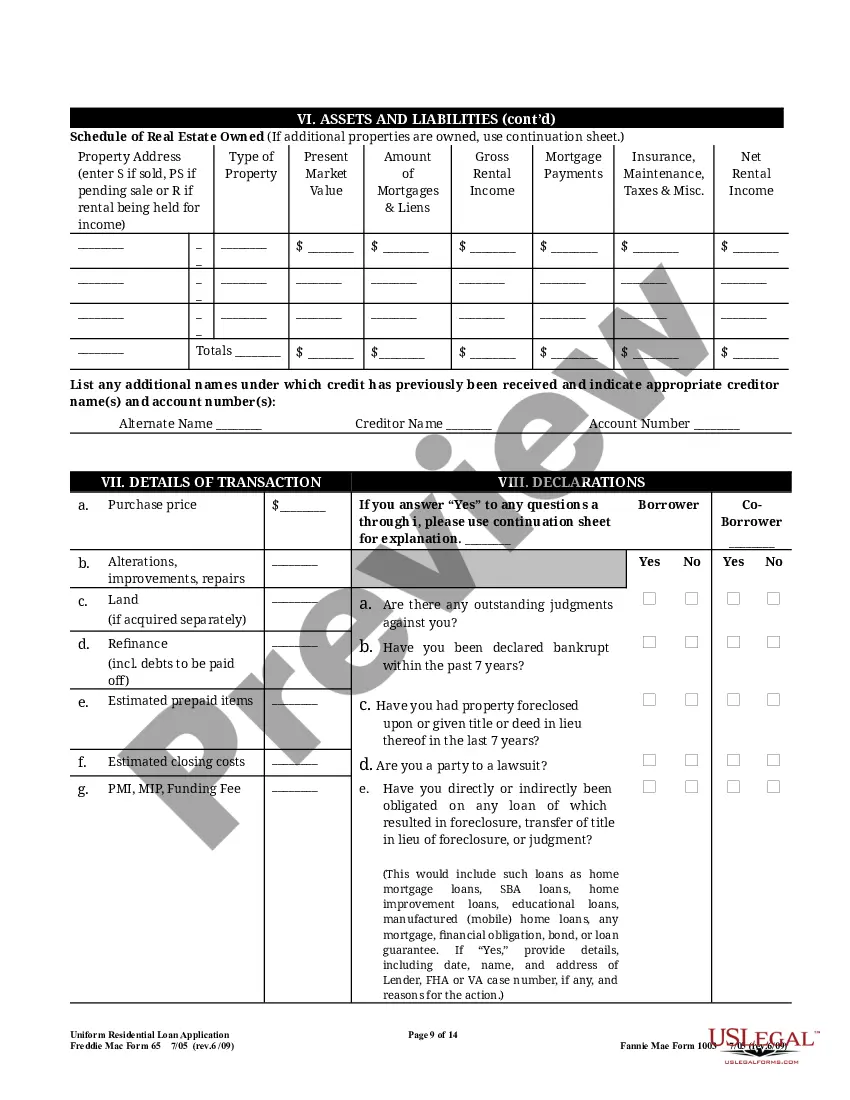

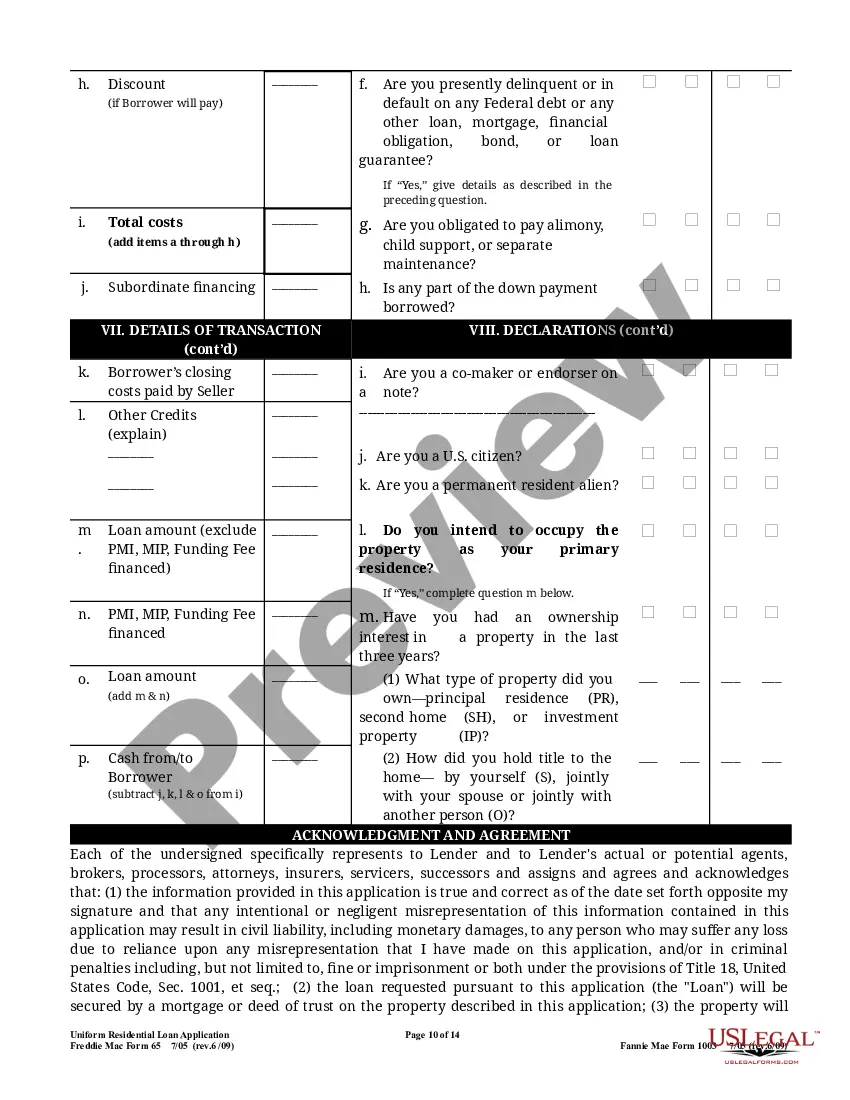

Uniform Residential Loan Application (UCLA) is a standardized form used by lenders to obtain financial and personal information from borrowers who are applying for a residential mortgage loan. The UCLA is used to evaluate a borrower’s creditworthiness and to determine the loan’s terms and conditions. ThUCLALA includes information on the borrower's income, assets, debts, housing expenses, employment history, and other pertinent information. It also includes a variety of disclosures that the lender must provide to the borrower. The UCLA is typically used for conventional loans, FHA loans, VA loans, and other types of residential mortgage loans. It is updated periodically to reflect changes in the mortgage industry and to incorporate new regulations. The UCLA is also available in Spanish for bilingual borrowers.

Uniform Residential Loan Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Uniform Residential Loan Application?

Coping with official documentation requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Uniform Residential Loan Application template from our library, you can be certain it meets federal and state regulations.

Dealing with our service is easy and fast. To obtain the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to find your Uniform Residential Loan Application within minutes:

- Make sure to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another official blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Uniform Residential Loan Application in the format you prefer. If it’s your first experience with our website, click Buy now to proceed.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the Uniform Residential Loan Application you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

A home loan application is a form that is used to get information from a potential borrower to determine if a loan can be approved.

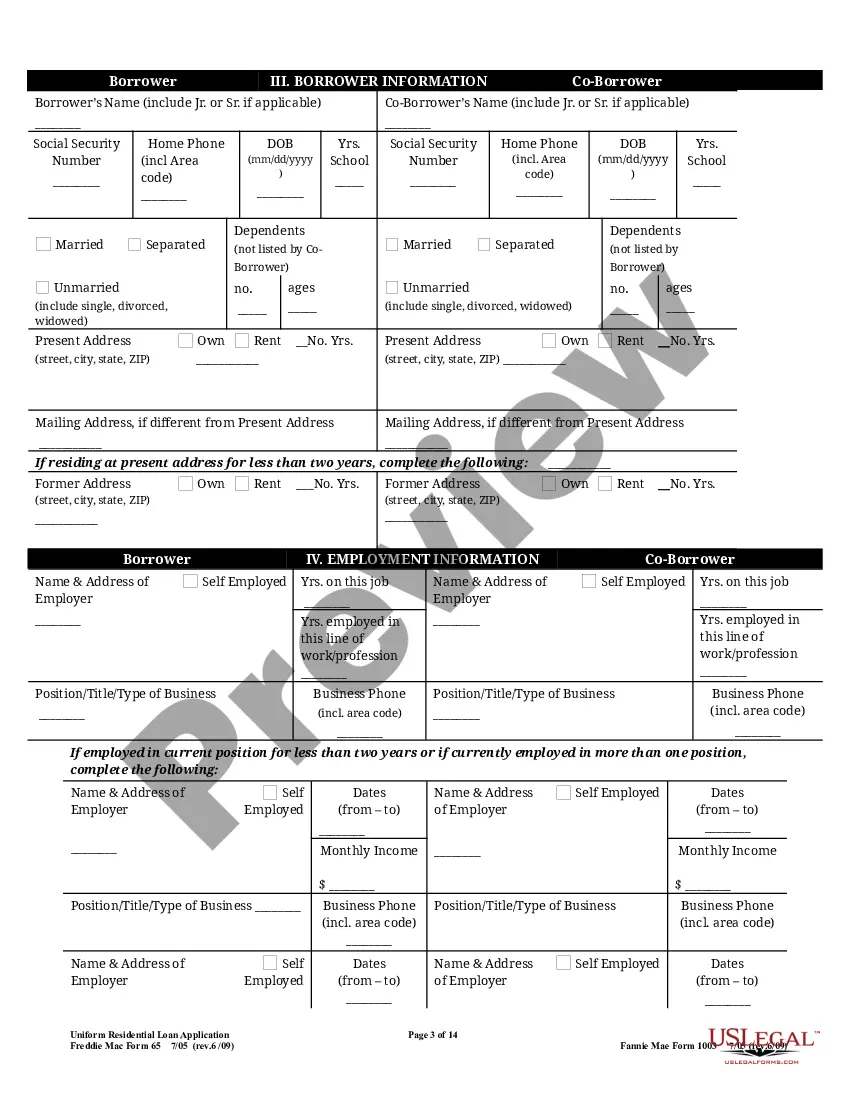

Uniform Residential Loan Application is a standardized loan form used in the mortgage industry. This form is called a 1003 form, it requires that borrowers fill out all necessary information before a loan can be established between a lender and the borrower.

A completed application means an application in connection with which a creditor has received all the information that the creditor regularly obtains and considers in evaluating applications for the amount and type of credit requested (including, but not limited to, credit reports, any additional information requested

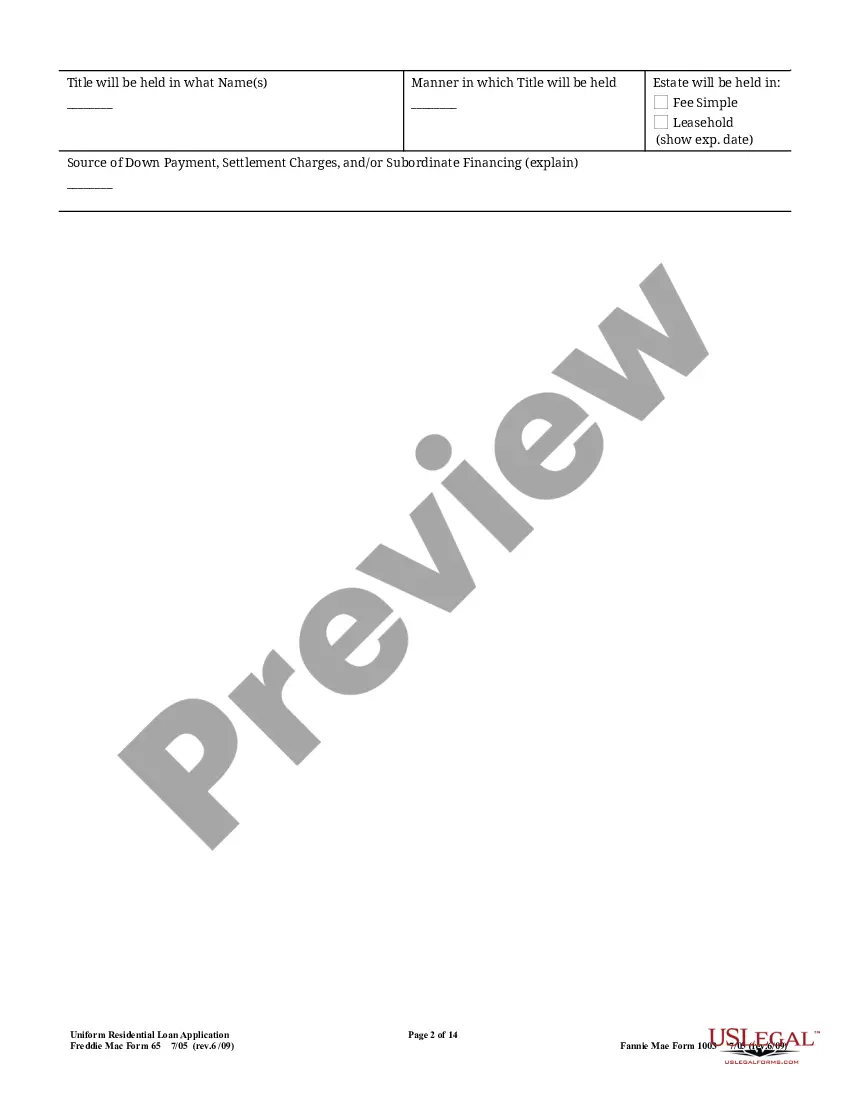

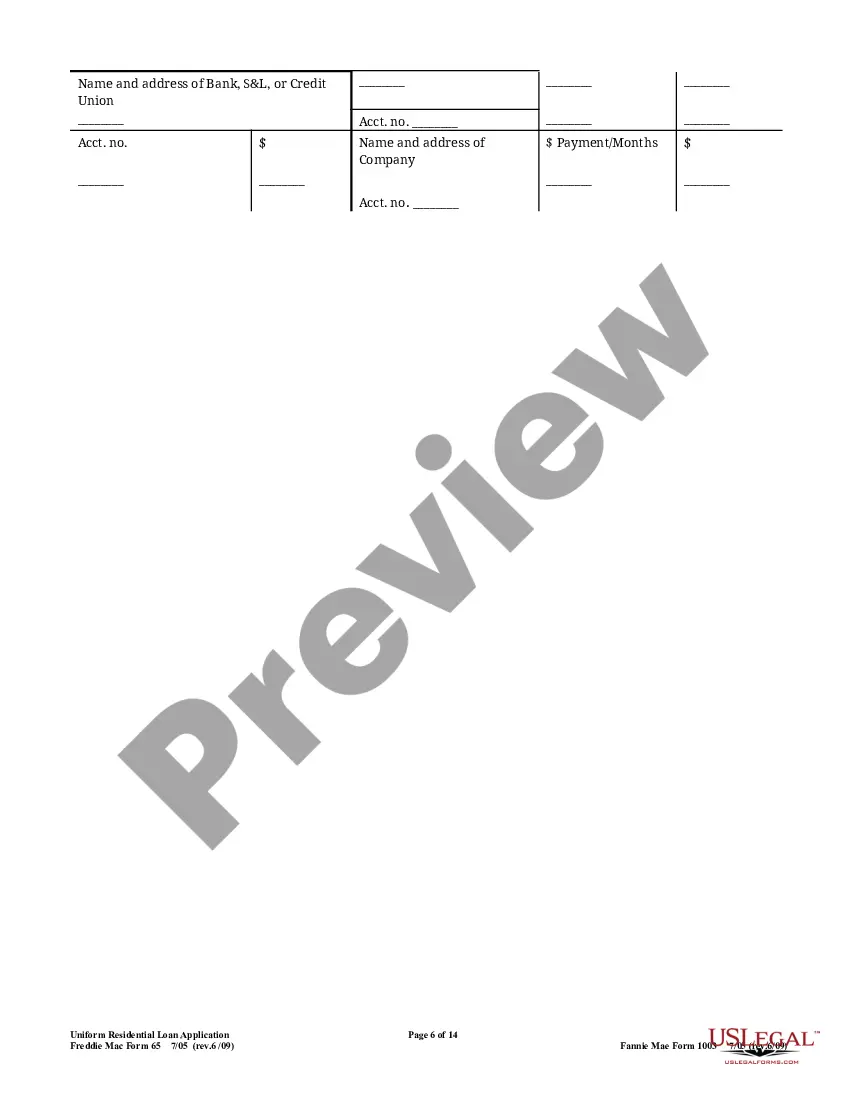

A loan application must be documented on the Uniform Residential Loan Application (Form 1003). A complete, signed, and dated version of the final Form 1003 must always be included in the loan file. The final Form 1003 must reflect the income, assets, debts, and final loan terms used in the underwriting process.

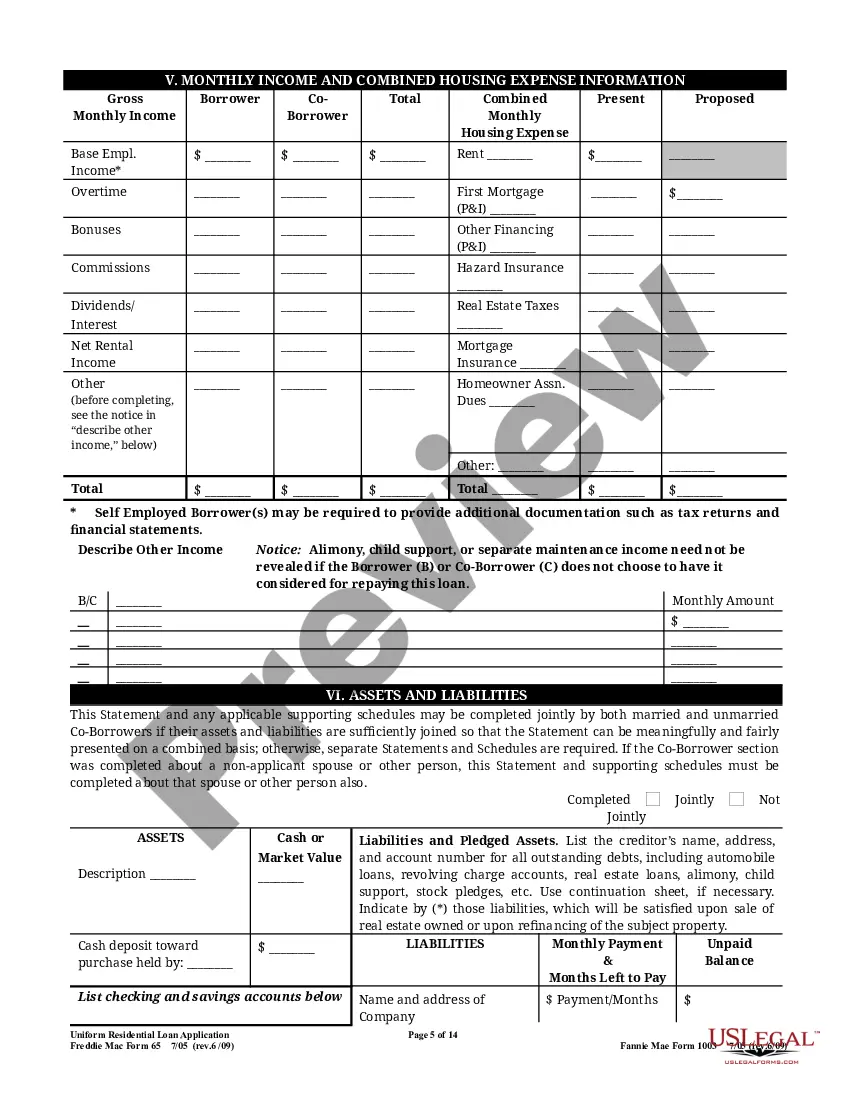

The 1003 loan application, or Uniform Residential Loan Application, is the standardized form most mortgage lenders in the U.S. use. The application asks questions about the borrower's employment, income, assets, and debts, as well as requiring information about the property.

Loan Application Form means the application form and any related materials submitted by the Borrower to the Initial Lender in connection with an application for the Loans under Division A, Title IV, Subtitle A of the CARES Act.

Generally, a creditor such as a lender or broker must evaluate married and unmarried applicants by the same standards. A lender or broker may not treat married joint applicants differently from unmarried joint applicants based on the existence, absence, or likelihood of a marital relationship.

A Closing Disclosure is a five-page form providing final details about the mortgage loan you've selected.