Texas Contract with Independent Contractor for Systems Programming and Related Services

Description

How to fill out Contract With Independent Contractor For Systems Programming And Related Services?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

While navigating the site, you will discover a vast selection of forms for business and personal purposes, organized by categories, states, or keywords.

You can locate the latest editions of documents like the Texas Contract with Independent Contractor for Systems Programming and Related Services in moments.

Review the form summary to confirm that you have selected the appropriate document.

If the form does not satisfy your requirements, utilize the Search field at the top of the screen to find one that does.

- If you currently hold a subscription, Log In and obtain the Texas Contract with Independent Contractor for Systems Programming and Related Services from the US Legal Forms repository.

- The Acquire button will appear on every form you access.

- You have access to all previously received electronic forms within the My documents section of your profile.

- If you are planning to use US Legal Forms for the first time, here are essential steps to get you started.

- Make sure you have selected the appropriate form for your locale/region.

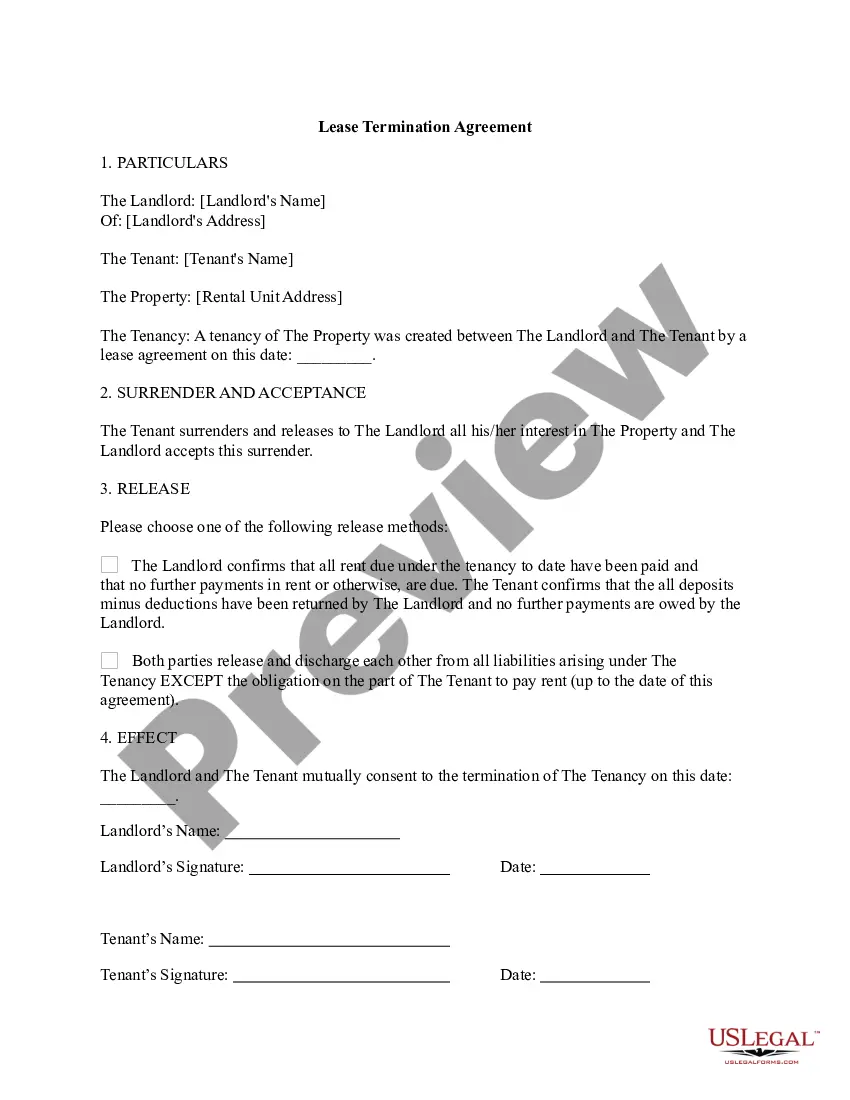

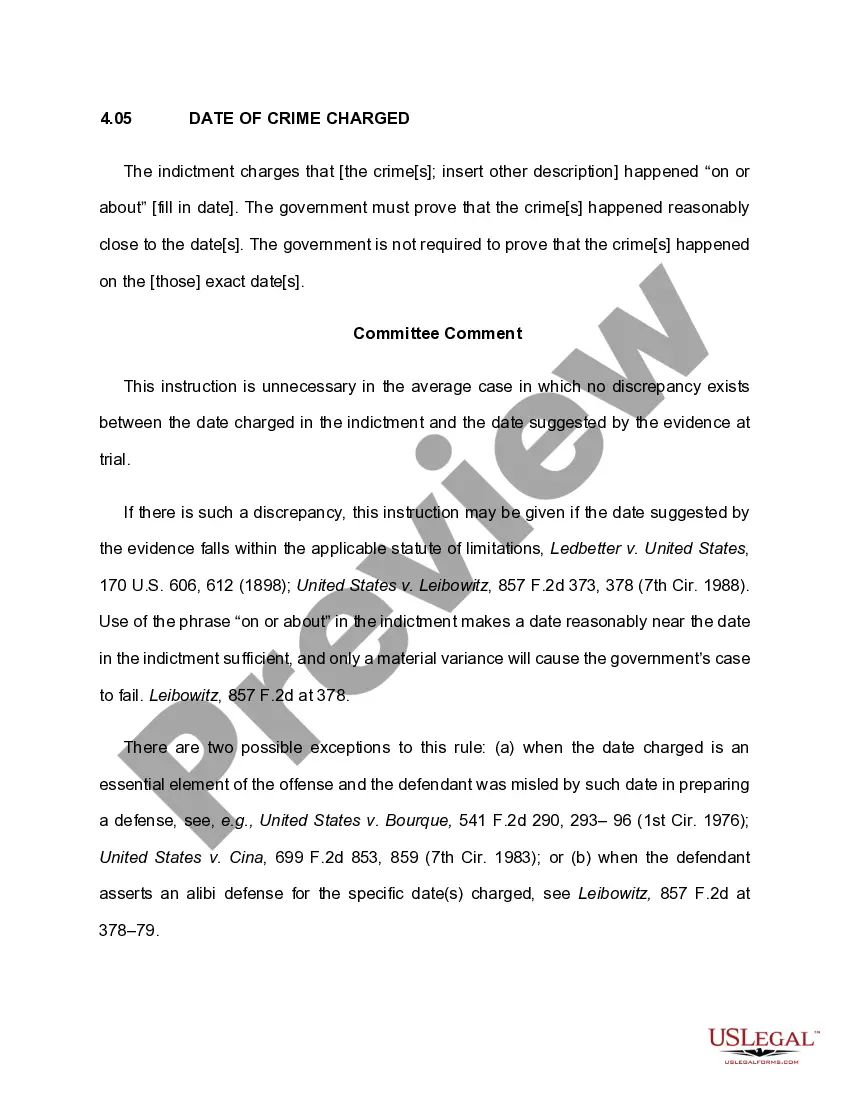

- Click the Preview button to assess the form's content.

Form popularity

FAQ

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

An independent contractor is self-employed, bears responsibility for his or her own taxes and expenses, and is not subject to an employer's direction and control. The distinction depends upon much more than what the parties call themselves.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

How is an independent contractor paid?Obtain the independent contractor's Form W-9, Request for Taxpayer Identification Number and Certification.Provide compensation for work performed.Remit backup withholding payments to the IRS, if necessary.Complete Form 1099-NEC, Nonemployee Compensation.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.