Texas Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice

Description

How to fill out Sample Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice?

Are you in a placement that you require files for sometimes business or specific functions nearly every time? There are plenty of legitimate record templates available on the net, but locating types you can rely is not straightforward. US Legal Forms gives thousands of kind templates, much like the Texas Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice, that happen to be published to meet federal and state requirements.

In case you are already knowledgeable about US Legal Forms web site and get your account, merely log in. Following that, you are able to download the Texas Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice web template.

Should you not have an profile and would like to begin to use US Legal Forms, follow these steps:

- Get the kind you will need and make sure it is to the right area/region.

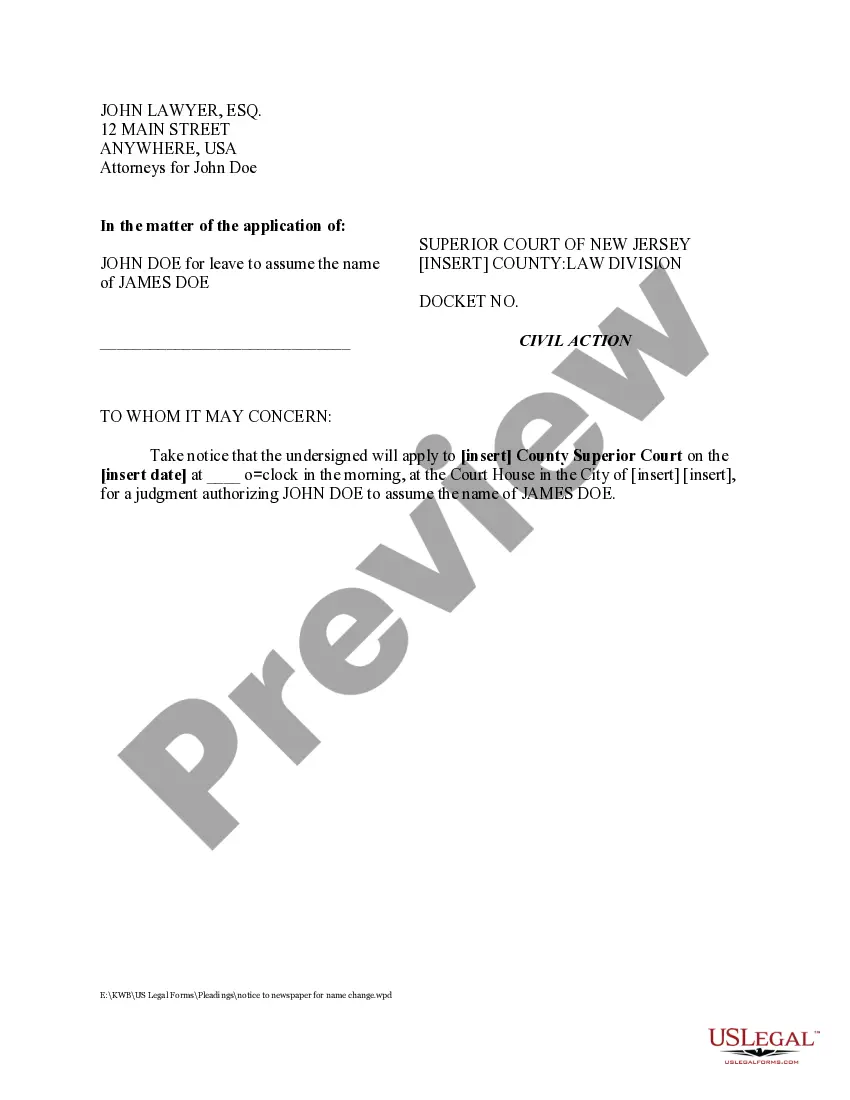

- Utilize the Preview option to review the form.

- See the description to ensure that you have chosen the appropriate kind.

- In case the kind is not what you`re looking for, make use of the Research industry to find the kind that suits you and requirements.

- If you discover the right kind, simply click Purchase now.

- Select the rates plan you would like, fill out the necessary information to generate your money, and buy the order with your PayPal or credit card.

- Select a hassle-free data file format and download your backup.

Find all the record templates you might have bought in the My Forms food selection. You can aquire a further backup of Texas Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice anytime, if necessary. Just select the required kind to download or print the record web template.

Use US Legal Forms, the most considerable collection of legitimate kinds, to save time and steer clear of faults. The service gives professionally produced legitimate record templates that can be used for an array of functions. Generate your account on US Legal Forms and commence producing your way of life a little easier.

Form popularity

FAQ

Texas Civil Practice and Remedies Code Section 16.035 places a 4-year statute of limitations on foreclosure actions though there are some exceptions to this law.

In Texas, to have grounds for a wrongful foreclosure case, your attorney must typically prove one of these two things: That there was a defect in the foreclosure sale process. Maybe the lender failed to give you proper notice about the pending sale. Maybe you were on active duty or deployed with the US Military.

The "right of redemption" refers to one's ability to reclaim the property even after the foreclosure sale takes place. In Texas, the "right of redemption" is only available for specific kinds of foreclosure actions such as foreclosures of certain tax liens and property owners association assessment liens.

Can Texan homeowner's stop foreclosure? Yes. In Texas most loans are non-judicial which means the bank does not have to take a foreclosure to court to be approved. The best way to stop and delay a lender from taking your property is to file a lawsuit and get a restraining order.

Texas homeowners Most foreclosures are non-judicial types. This means court approval isn't required and speeds up the process. Many Texas foreclosures take 160 days. This is much faster than the national average of 922 days in foreclosure for the second quarter of 2021.

In a non-judicial foreclosure, after the 20-day "right to reinstate" period has expired and at least 21 days before the sale, the servicer must provider the borrower with a Notice of Sale, letting them know the date and earliest time of the sale.

Property Code Section 51.016 permits a non-judicial foreclosure sale to be rescinded by a lender, a trustee, or a substitute trustee within 15 days under certain circumstances: if the legal requirements of the sale were not met; if the borrower cured the default before the sale was conducted; if it turns out that a ...

To succeed on a wrongful foreclosure claim in Texas, the homeowner must show three specific elements: A defect in the foreclosure sale proceedings; A grossly inadequate selling price; and. A causal connection between the defect and the grossly inadequate selling price.