Texas Sample Letter for Stock Purchase

Description

How to fill out Sample Letter For Stock Purchase?

It is possible to spend several hours on-line looking for the legitimate file design that fits the federal and state demands you need. US Legal Forms gives a huge number of legitimate forms that are reviewed by specialists. It is possible to obtain or produce the Texas Sample Letter for Stock Purchase from my support.

If you have a US Legal Forms bank account, you are able to log in and then click the Obtain option. Following that, you are able to full, change, produce, or indicator the Texas Sample Letter for Stock Purchase. Every legitimate file design you purchase is your own property permanently. To have another duplicate of the acquired type, check out the My Forms tab and then click the related option.

Should you use the US Legal Forms website initially, stick to the basic guidelines beneath:

- Very first, make certain you have selected the right file design to the region/metropolis of your liking. See the type description to make sure you have selected the right type. If offered, make use of the Review option to check with the file design as well.

- If you would like get another edition of the type, make use of the Look for industry to find the design that suits you and demands.

- After you have identified the design you need, click on Acquire now to proceed.

- Choose the prices plan you need, enter your credentials, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal bank account to pay for the legitimate type.

- Choose the formatting of the file and obtain it to the device.

- Make adjustments to the file if required. It is possible to full, change and indicator and produce Texas Sample Letter for Stock Purchase.

Obtain and produce a huge number of file templates making use of the US Legal Forms website, that offers the largest selection of legitimate forms. Use expert and express-distinct templates to handle your small business or personal requirements.

Form popularity

FAQ

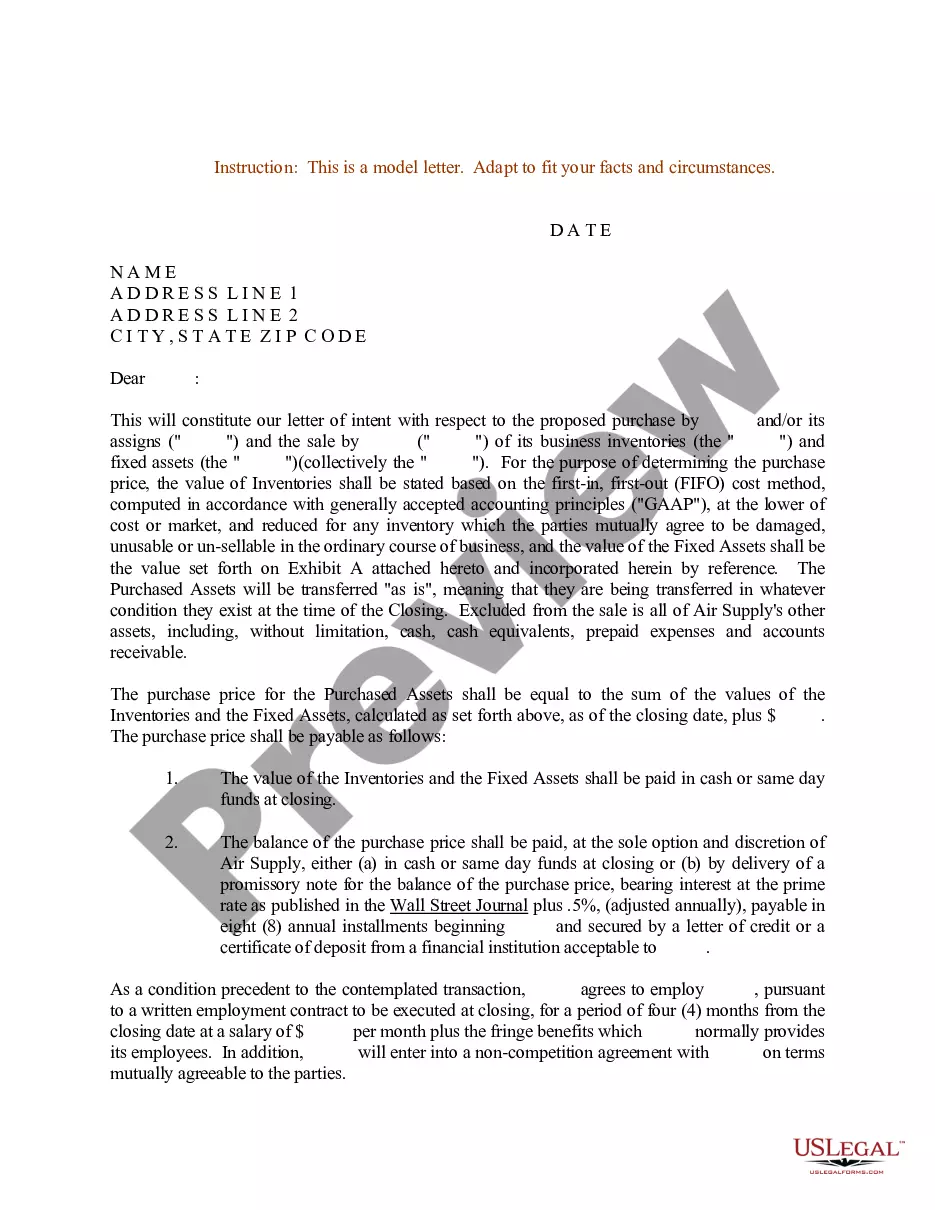

Follow these steps when writing an LOI: Write the introduction. ... Describe the transaction and timeframes. ... List contingencies. ... Go through due diligence. ... Include covenants and other binding agreements. ... State that the agreement is nonbinding. ... Include a closing date.

Identify your letter as a letter of intent to sell shares. Define the company and who is meant by "seller" and "buyer." Include contact information for all the parties. Include the postal and registered address of the company, if they're different. Name every shareholder involved in the sale.

A letter of intent (LOI) is a document written in business letter format that declares your intent to do a specific thing. It's usually, but not always, nonbinding, and it states a preliminary commitment by one party to do business with another party.

A Letter of Intent (LOI) is a short non-binding contract that precedes a binding agreement, such as a share purchase agreement or asset purchase agreement (definitive agreements). There are some provisions, however, that are binding such as non-disclosure, exclusivity, and governing law.

A letter of intent (LOI) is a document declaring the preliminary commitment of one party to do business with another. The letter outlines the chief terms of a prospective deal. Commonly used in major business transactions, LOIs are similar in content to term sheets.

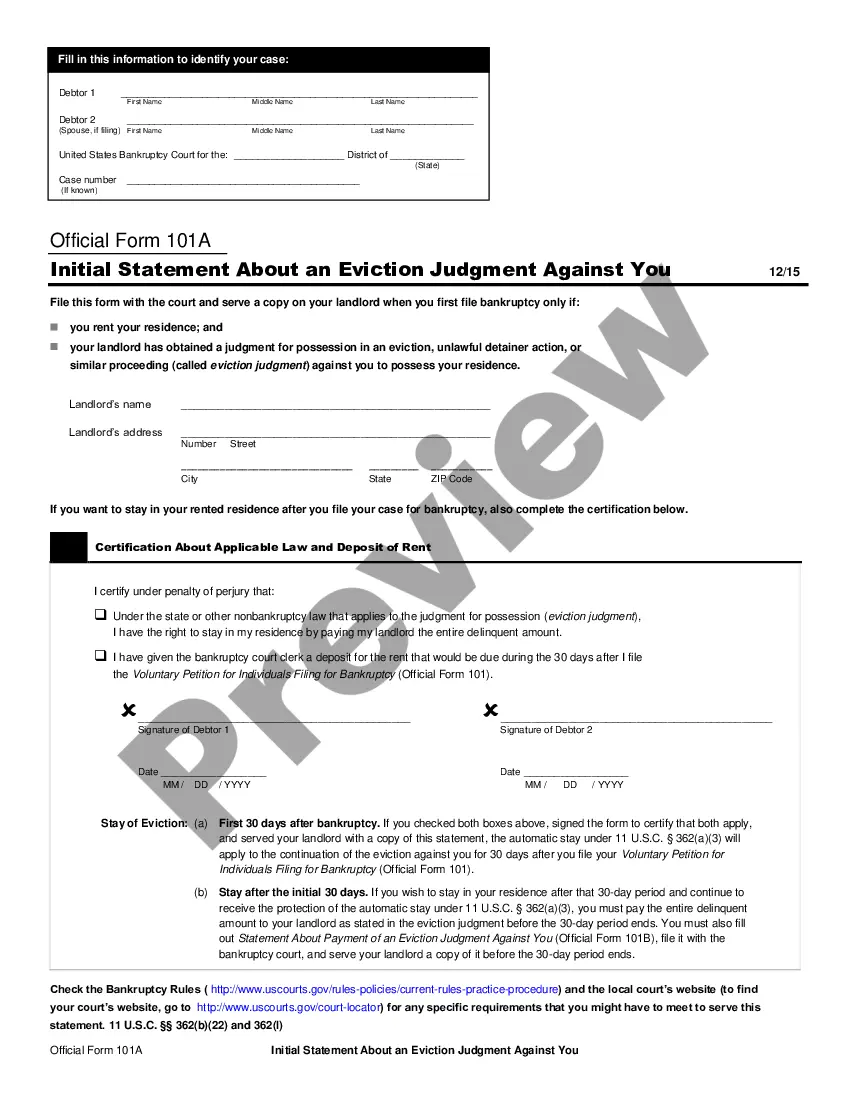

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

A Stock Purchase Agreement is used for the purchase and sale of outstanding stock of a business. The agreement typically includes purchase and sale terms, representations and warranties, covenants, conditions precedent, termination, and indemnification provisions.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

The Letter of Intent to sell a business should contain a breakdown of intended timelines. It should specify proposed dates for closing and may also outline details such as options on real property and when those expire. The LOI should also clearly outline the seller's obligations post-sale.

A stock purchase letter of intent is used for the purchase of a limited number of stocks in a company or corporation from an individual or entity that owns the desired shares. A letter of intent is often non-binding and is instead a preliminary offer prior to the signing of a purchase agreement.