Nanny Contract

What is this form?

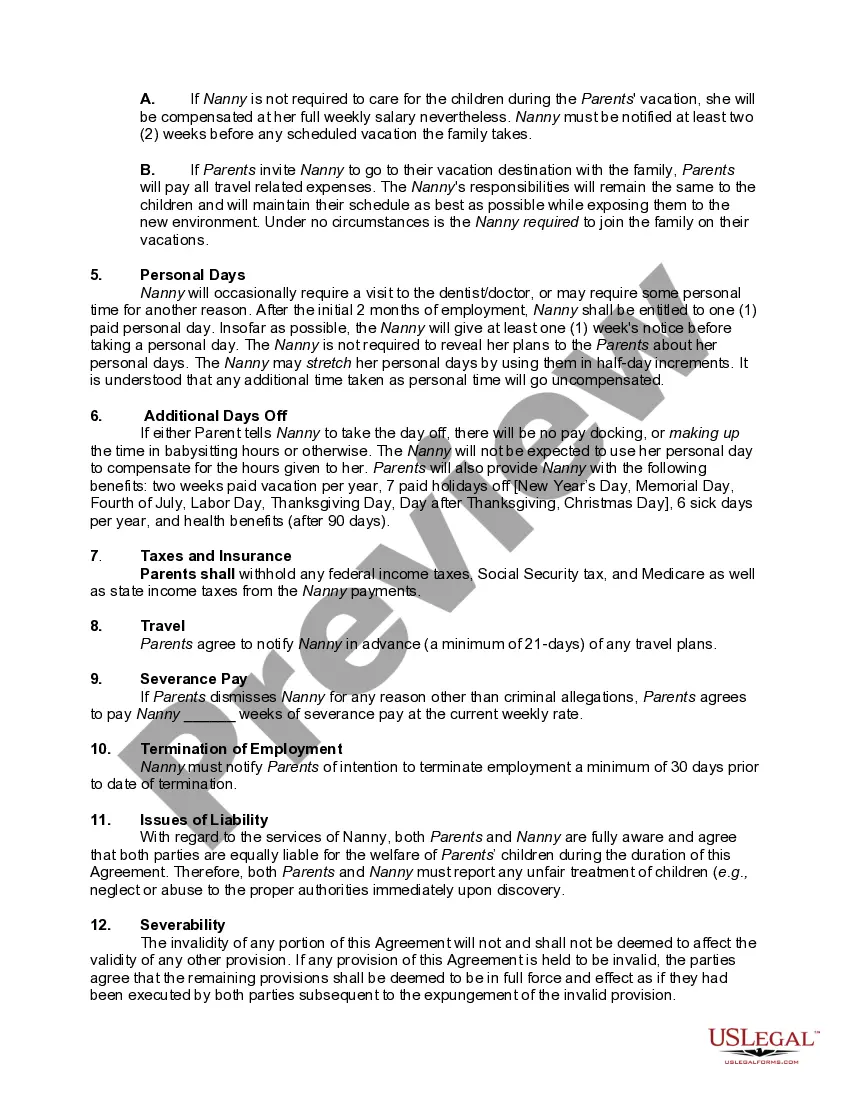

The Nanny Contract is a legal document that establishes the terms and conditions of employment between a family and a nanny. This form specifies the nanny's responsibilities, work hours, payment details, and other essential aspects of the employment relationship. Unlike informal agreements, this contract provides a structured framework to ensure clarity and legal protection for both parties.

What’s included in this form

- General nanny services description, outlining duties and responsibilities.

- Specific nanny services, including childcare tasks and limitations on household chores.

- Work hours and payment details, specifying salary and scheduling.

- Vacation and personal day policies, detailing paid time off and notifications.

- Severance pay conditions in case of termination.

- Liability clauses to ensure child welfare responsibility during employment.

When this form is needed

This form is essential for families who hire a nanny to care for their children, whether on a live-in or live-out basis. Use this contract when formalizing employment terms, particularly when the nanny's responsibilities extend beyond basic childcare or when multiple children are involved. It is also applicable when families want to ensure compliance with tax obligations and clarify vacation or personal day policies.

Who this form is for

This form is intended for:

- Families hiring a nanny for childcare, particularly those seeking a structured agreement.

- Nannies looking for clarity on their roles, responsibilities, and compensation.

- Individuals or families looking to standardize employment practices in childcare settings.

Instructions for completing this form

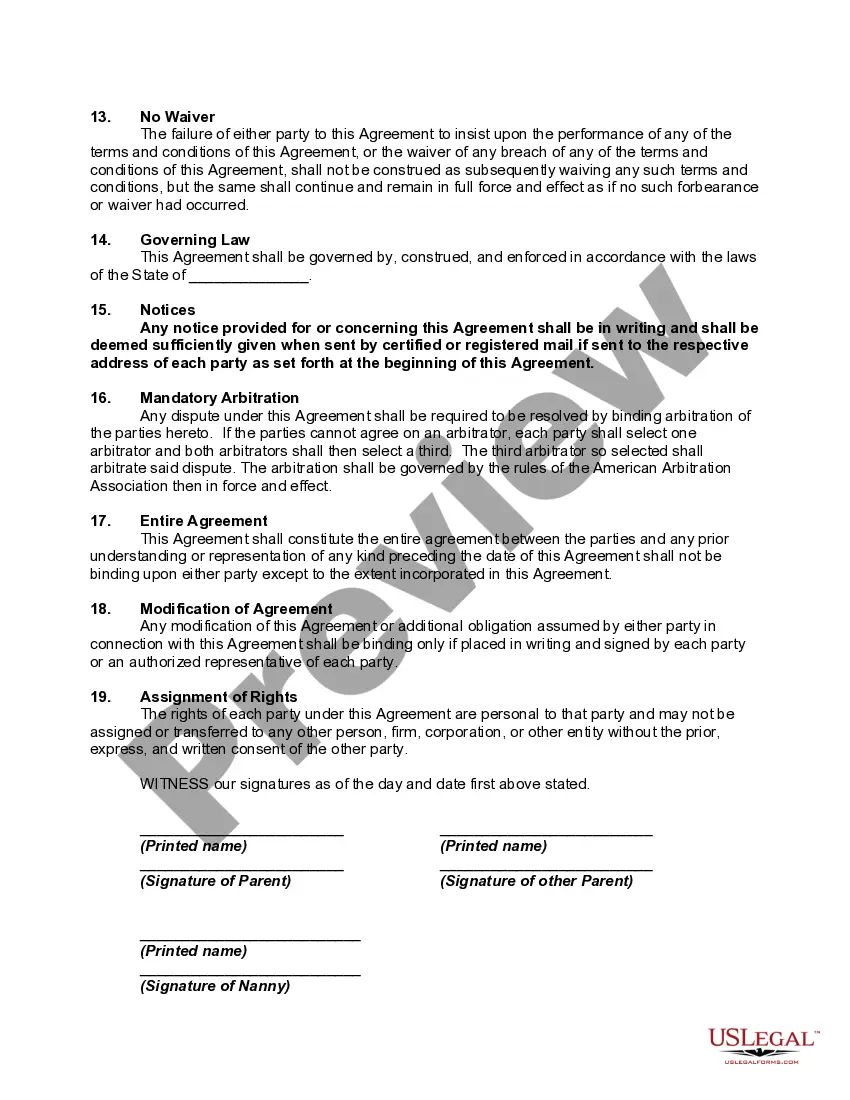

- Identify the parties involved: List the names and addresses of the parents and the nanny.

- Specify the start date of employment and the nanny's work schedule.

- Detail the payment amount and frequency of pay, noting holidays if applicable.

- Outline vacation and personal day policies, including notification requirements.

- Sign and date the agreement to finalize the contract.

Does this form need to be notarized?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to clearly define the nanny's duties and limitations.

- Not specifying the payment schedule or amount accurately.

- Neglecting to include provisions for personal days and vacations.

- Omitting necessary signatures or dates at the end of the contract.

Advantages of online completion

- Convenience of downloading the form immediately for personal use.

- Editability allows customization to fit specific family needs.

- Access to templates created by licensed attorneys, ensuring legal soundness.

- Cost-effective option compared to hiring a lawyer for drafting a contract.

Looking for another form?

Form popularity

FAQ

Name and contact information. Effective start date. Compensation. Benefits. Schedule and time commitment. Termination procedure.

While paid sick days aren't as common as paid holidays and vacation, the INA reports that 67 percent of employers include paid sick days in their nanny benefits. It's most common for families to provide four or five days, but you should agree on an amount that is best for everyone.

Nannies who take their jobs seriously likely won't take your position if you plan to pay them under the table. They know the benefits of being paid on the books even if it means a little less in their paychecks each week. They have verifiable incomes and legal employment histories.

If you have a nanny or sitter who works for you on a full-time basis, it's a good idea to have a written contract so that the salary, responsibilities, and hours are clearly laid out. When someone works for you full-time, you want to be sure there are absolutely no misunderstandings.

When employees are getting paid under the table, taxes aren't withheld from their wages.Because employers who pay cash under the table forego their tax and insurance liabilities, paying employees cash under the table is illegal. Employers who pay employees under the table do not comply with employment laws.

Do I need a nanny contract or work agreement? A nanny contract or work agreement is not legally required under Federal law, but you SHOULD take the time to write one up anyway. It is a best practice that protects the family and provides a point of reference to both parties when there are questions or misunderstandings.

Names and ages of children, parents/guardians and caregiver, as well as contact info for parents/guardians and caregiver. Effective start date and end date (if applicable) Compensation information: The babysitter's commitments: Emergency procedures: Termination procedures:

Babysitting has become quite a lucrative business! The average hourly rate for a babysitter is $16.75 for one child and $19.26 for two kids, according to the 2019 annual study compiled by UrbanSitter. For comparison, that's more than twice the federal minimum wage of $7.25 per hour.

Don't Watch Inappropriate Movies or Shows. Must Be CPR Certified. Watch Your Language! Don't Gossip About The Family. Remember To Clean Up After Yourself (And The Kids!) Follow Bath Time Instructions.