Hawaii Employment Application for Sole Trader

Description

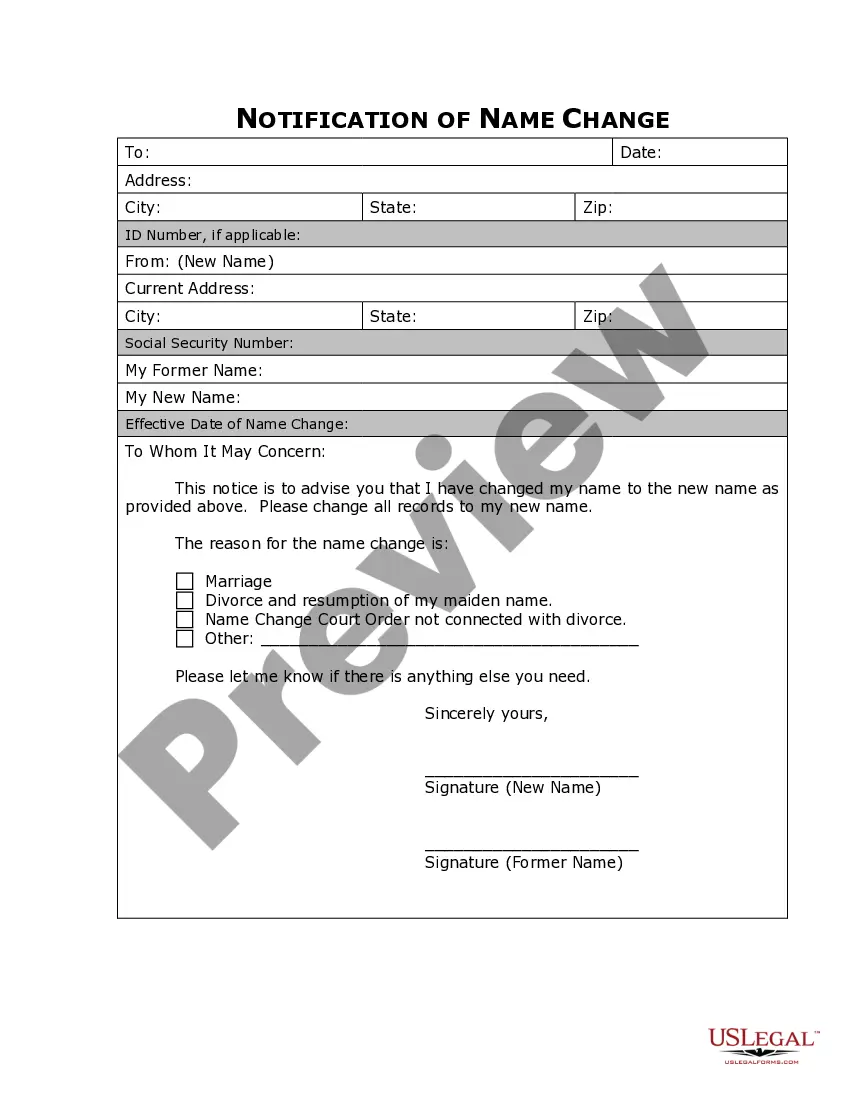

How to fill out Employment Application For Sole Trader?

US Legal Forms - one of the foremost collections of legal documents in the United States - offers a diverse range of legal form templates that you can download or print.

By using the site, you can discover thousands of forms for both business and personal purposes, categorized by types, states, or keywords. You can obtain the latest versions of forms like the Hawaii Employment Application for Sole Trader almost instantly.

If you already possess a subscription, Log In and download the Hawaii Employment Application for Sole Trader from your collection at US Legal Forms. The Download option will be visible on every form you view. You have access to all previously acquired forms in the My documents section of your account.

Make modifications. Complete, edit, print, and sign the downloaded Hawaii Employment Application for Sole Trader.

Every design you add to your account does not have an expiration date and belongs to you indefinitely. Therefore, if you want to download or print another copy, simply head to the My documents section and click on the form you desire. Access the Hawaii Employment Application for Sole Trader with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, follow these simple steps to get started.

- Make sure you have selected the correct form for your city/state. Click the Review button to examine the contents of the form. Look over the form summary to ensure you have picked the right one.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the payment plan that you prefer and provide your information to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

- Select the file format and download the form to your device.

Form popularity

FAQ

BB1 may refer to: BB1, a postcode district in the BB postcode area. USS Indiana (BB-1), a United States battleship which served from 1895 until 1919. Budd BB-1 Pioneer, an experimental flying boat produced by the Budd Company in the 1930s. Peugeot BB1, an electric concept car introduced at Frankfurt Motor Show in 2009.

Any business, whether it's a small business, self-employed, independent contractor, or freelancer, must obtain a general excise license and pay the tax. Businesses headquartered in another state but with a physical presence in Hawaii also have to pay the GET.

PURPOSE OF FORM Use this form to: 1. Register for various tax licenses and permits with the Department of Taxation (DOTAX) and to obtain a corresponding Hawaii Tax Identification Number (Hawaii Tax I.D. No.).

Virtually nothing! You'll have almost no costs to start a sole proprietorship in California. You don't have to register the business or get a license from the state, and you only need to get a business license if your locality or industry requires it.

Documents Required For A Sole ProprietorshipAadhar Card. Aadhar number is now a necessity for applying for any registration in India.PAN Card. You can't file your income tax return until you get a PAN.Bank Account.Registered Office Proof.Registering as SME.Shop and Establishment Act License.GST Registration.

Obtain Business Licenses and PermitsThere isn't a requirement in Hawaii for sole proprietors to acquire a general business license, but depending on the nature of your business you may need other licenses and/or permits to operate in a compliant fashion.

How to start a sole proprietorship: 7 steps to takeChoose a business name.Register your business name.Purchase a website domain name.Obtain a business license and other permits.File for an employer identification number (EIN)Open a business bank account.Get insurance coverage.

There are four simple steps you should take:Choose a business name.File a trade name with the Department of Commerce and Consumer Affairs.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

Form G-49 is a summary of your activity for the entire year. This return must be filed in addition to Form G-45. Schedule GE (Form G-45/G-49) - If you are claiming exemptions on Forms G-45 and G-49, you must complete and attach Schedule GE (Form G-45/G-49) to Forms G-45 and G-49.