Idaho Employment Application for Sole Trader

Description

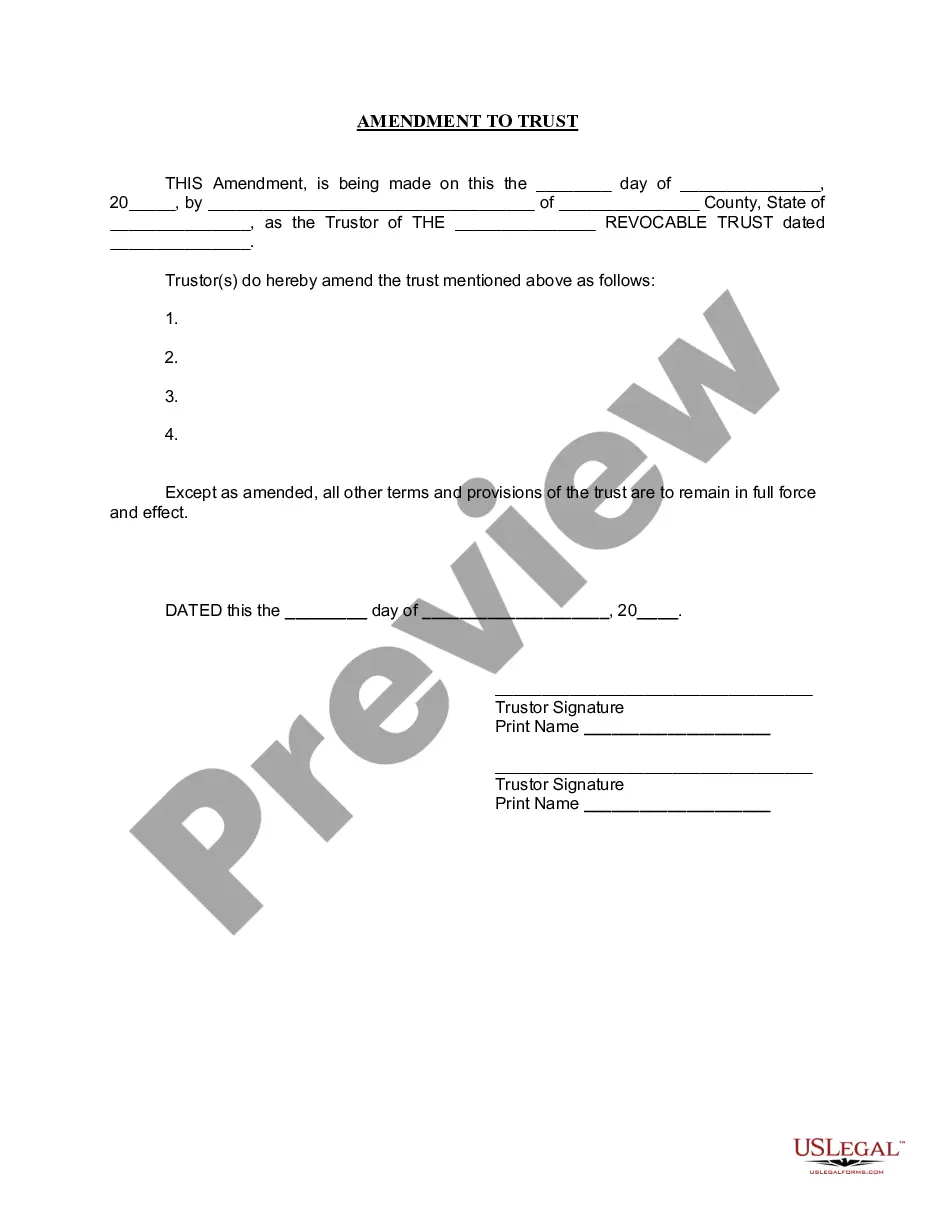

How to fill out Employment Application For Sole Trader?

Locating the appropriate legal document template can be challenging.

Of course, there is an assortment of designs accessible online, but how can you find the legal form you require? Utilize the US Legal Forms website.

The service offers thousands of designs, including the Idaho Employment Application for Sole Proprietor, which you can utilize for business and personal needs.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/county. You can verify the document using the.

- All the documents are reviewed by professionals and comply with state and federal regulations.

- If you are already registered.

- Log In.

- to your account and click on the.

- Obtain.

- button to access the Idaho Employment Application for Sole Proprietor.

- Use your account to browse the legal forms you have previously acquired.

- Visit the.

- My documents.

- section of your account and retrieve another copy of the documents you need.

Select the pricing plan you prefer and input the necessary details.

When you are confident the form is suitable, click the.

Should the form not meet your requirements, use the.

Form popularity

FAQ

It's the most common legal structure for a reason: It requires a minimum of paperwork and, Nolo says, four steps: choosing a business name, filing an assumed business name, obtaining any licenses and permits and securing an Employer Identification Number (EIN).

As a sole proprietor, you are free to choose any name for your business without any obligations to register the name. You can trade under your own name or set up a fictitious name for trading purposes.

How to Apply for Pandemic Unemployment Assistance (PUA)Step 1: Apply for Unemployment Benefits at the Claimant Portal.Step 2: Look for Work.Step 3: Continue to Submit Your Weekly Certifications at the Claimant Portal.Step 4: Submit Proof of 2019 Earnings.Step 5: Verify Your Identity.Step 6: Application Review.

To establish a sole proprietorship in Idaho, here's everything you need to know.Choose a business name.File an assumed business name certificate with the Secretary of State.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

It is also known as a State Unemployment Tax Account number (SUTA). Your account number can be found on your quarterly tax form, by logging in to send a secure message to the Tax Department, or by calling Employer Accounts at (208) 332-3576 or (800) 448-2977.

All businesses, including home based ones, need to register their name and entity type with the Idaho Secretary of State's office before engaging in business.

To establish a sole proprietorship in Idaho, here's everything you need to know.Choose a business name.File an assumed business name certificate with the Secretary of State.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

A Sole Proprietorship form of business organisation is where a business is managed by a single person. Generally, it does not require any registration as such. Any individual who wants to start a business with less investment can choose this type of business form.

To establish a sole proprietorship in Idaho, here's everything you need to know.Choose a business name.File an assumed business name certificate with the Secretary of State.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.