Iowa Employment Application for Sole Trader

Description

How to fill out Employment Application For Sole Trader?

You can dedicate multiple hours online looking for the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal forms that have been reviewed by professionals.

You can easily obtain or print the Iowa Employment Application for Sole Trader from my service.

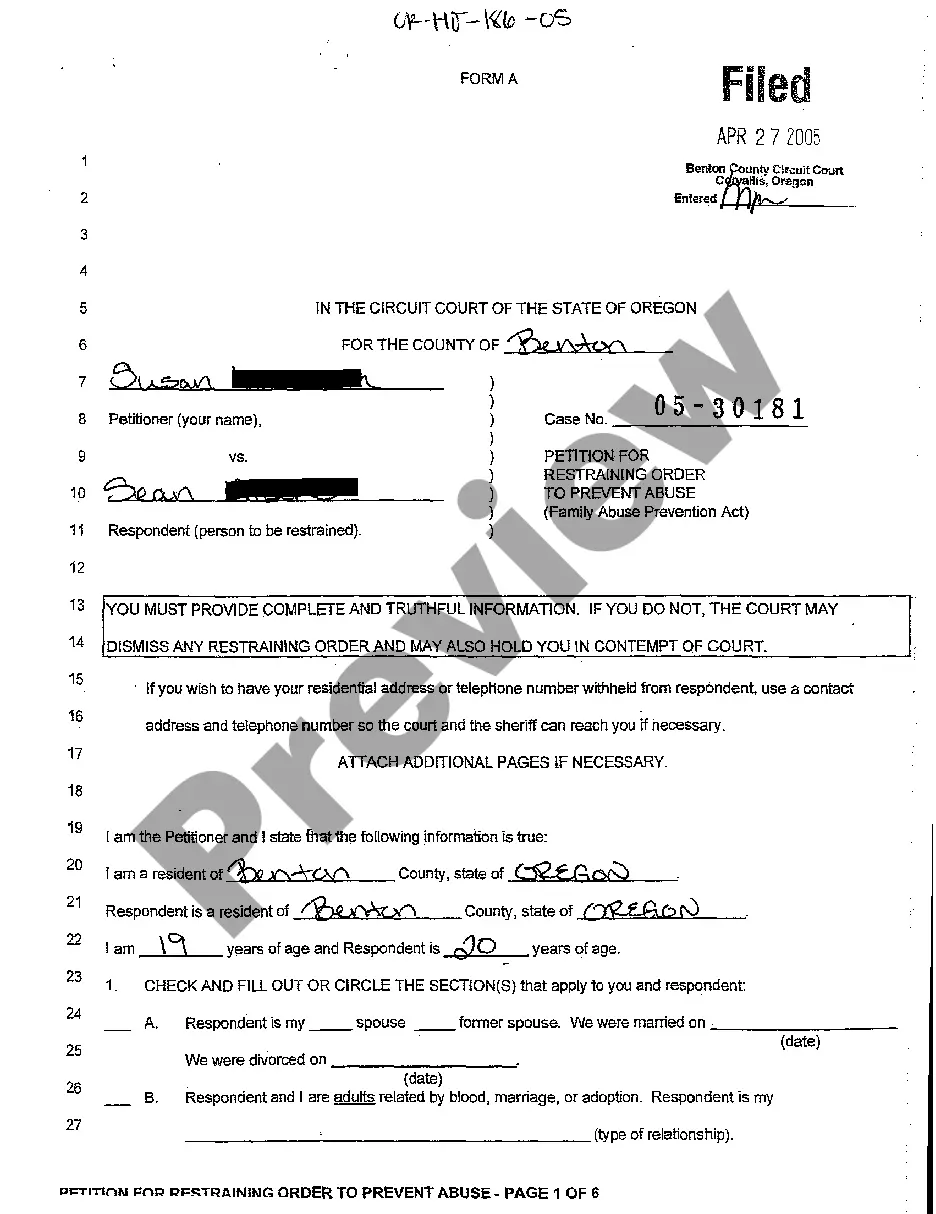

If available, use the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, modify, print, or sign the Iowa Employment Application for Sole Trader.

- Every legal document template you purchase is yours permanently.

- To get another copy of any purchased form, go to the My documents section and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the form description to make sure you have picked the correct form.

Form popularity

FAQ

If you have not received your 1099-G form by January, 31, 2016, please contact the IWD unemployment insurance customer service number at 866-239-0843 or email uiclaimshelp@iwd.iowa.gov to request a duplicate copy be mailed to you.

"Whether you're in the gig economy, whether you're an independent contractor, everyone who is out of work is eligible for unemployment insurance," said Rep.

The UI Customer Service number is 1-866-239-0843 and representatives are available Monday through Friday from 8 a.m. to p.m. Our goal is for all Iowans to submit their unemployment claims filings online, and we thank Iowans for their cooperation, West said.

Any self-employed person, independent contractor, or general partner who meets the requirements can apply for Disability Insurance Elective Coverage (DIEC). It is not required that all active general partners be included in the application.

If you are a business owner, independent contractor, self-employed worker, freelancer, or gig worker and only received a 1099 tax form last year, you are most likely eligible for PUA.

The line is available 24/7 by calling 2-1-1. Employers or claimants with questions can email Iowa Workforce Development at uiclaimshelp@iwd.iowa.gov or call us at 1-866-239-0843.

If you have not received your 1099-G form by January, 31, 2016, please contact the IWD unemployment insurance customer service number at 866-239-0843 or email uiclaimshelp@iwd.iowa.gov to request a duplicate copy be mailed to you.

Note: You must continue to file your weekly claim applications while your identity is verified.AND a copy of one of the following identity documents:Driver's License, a state issued ID, or Military ID.Passport or Passport Card.Permanent Resident Card or Alien Registration Card.Birth Certificate.More items...

Unemployment Insurance is a tax paid entirely by employers who are covered by the Iowa Employment Security Law. Who is Eligible? How much per week and I eligible for? The minimum weekly benefit amount is $87 and the maximum weekly benefit amount is $591.

You must register for work when you apply for Unemployment Insurance (UI) and you are no longer attached to an employer. You can do this at your local IowaWORKS center or online .