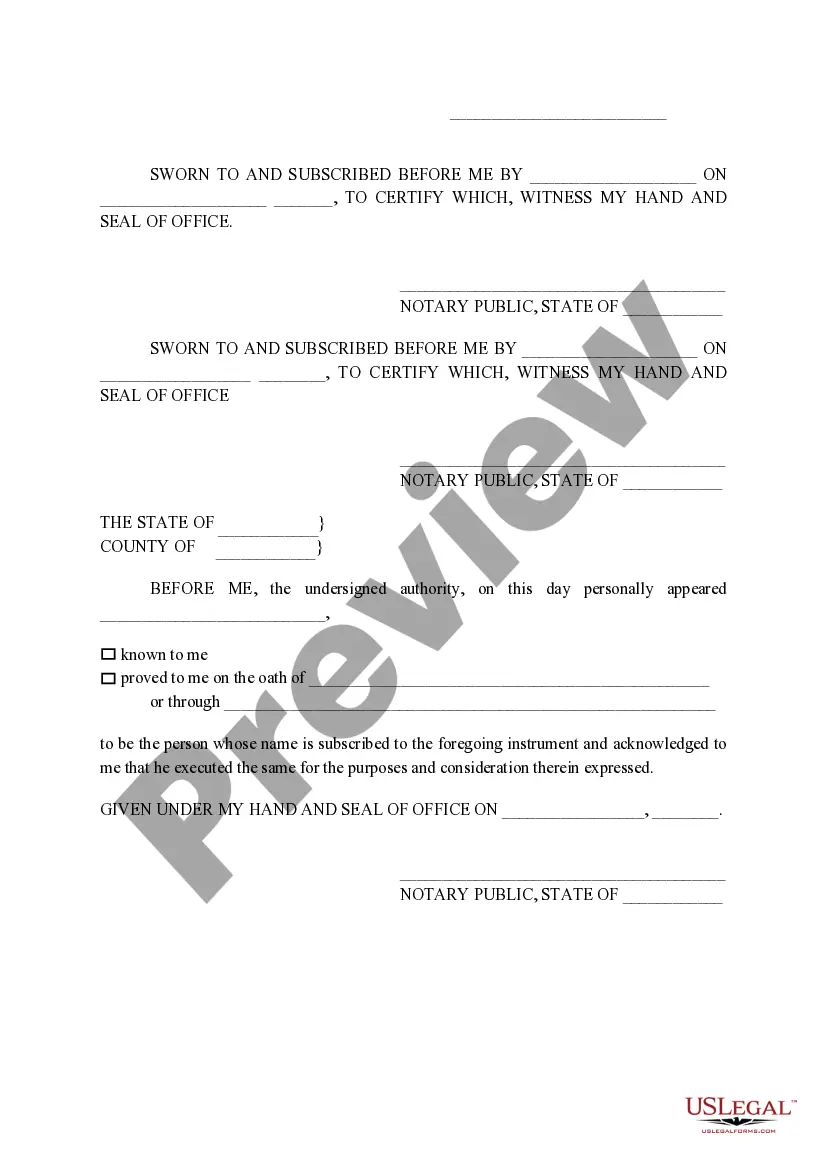

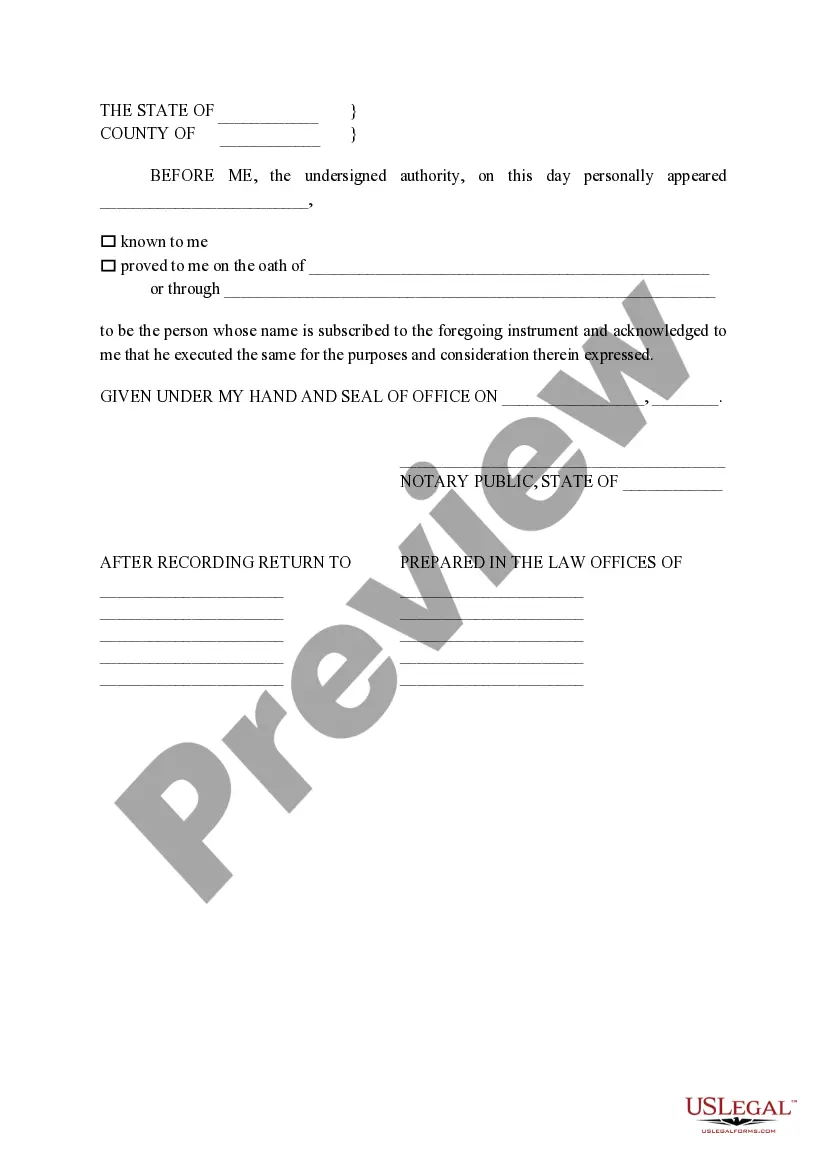

Texas Non- Homestead Affidavit and Designation of Homestead

Description

How to fill out Texas Non- Homestead Affidavit And Designation Of Homestead?

Access to top quality Texas Non- Homestead Affidavit and Designation of Homestead forms online with US Legal Forms. Steer clear of hours of misused time looking the internet and dropped money on files that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Get over 85,000 state-specific legal and tax forms that you could save and complete in clicks within the Forms library.

To receive the example, log in to your account and then click Download. The file will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Verify that the Texas Non- Homestead Affidavit and Designation of Homestead you’re considering is appropriate for your state.

- See the form utilizing the Preview option and read its description.

- Go to the subscription page by clicking on Buy Now button.

- Choose the subscription plan to keep on to sign up.

- Pay by card or PayPal to complete making an account.

- Choose a favored format to download the file (.pdf or .docx).

You can now open the Texas Non- Homestead Affidavit and Designation of Homestead template and fill it out online or print it and get it done yourself. Consider sending the papers to your legal counsel to make sure things are filled in correctly. If you make a mistake, print out and fill application again (once you’ve registered an account every document you download is reusable). Create your US Legal Forms account now and get access to a lot more samples.

Form popularity

FAQ

The Texas Homestead Exemption The homestead exemption is available only for your principal residence. Vacation or rental properties are not covered under the exemption, nor are properties owned by corporations rather than individuals.

You must file an exemption application. Exemptions can also be removed if the district sends a letter requesting reapplication. If an exemption or exemptions are removed the homeowner may reapply with appropriate supporting documentation.

You think your Spring Texas home has a homestead exemption but you are not 100% sure. So how can you easily find out if you have a homestead exemption? At the Harris County Appraisal District website of www.hcad.org you can look up your account and see which if any exemptions have been applied to your account.

In the state of Texas, there are two ways your home qualifies for an exemption.Age 65 or older and disabled exemptions: Individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 homestead exemption for school taxes, in addition to the $25,000 exemption for all homeowners.

How do I apply for a homestead exemption? To apply for a homestead exemption, you need to submit an application with your county appraisal district. Filing an application is free and only needs to be filed once. The application can be found on your appraisal district website or using Texas Comptroller Form 50-114.

A homestead is defined in Texas as the place of residence for a family or individual and is secure from forced sale by general creditors.Texas has two types of homesteads: urban and rural. In most cases Texas homeowners file for homestead exemption as a way to help lower their taxes.

The Property Tax Code sets a limit on the value of a residence homestead, stating that its value for a tax year may not exceed the lesser of the market value of the property; or, The sum of: 10 percent of the value of the property for last year; The value of the property for the last year in which the property was

Under the TEXAS TAX CODE if a homeowner files for and receives a TAX EXEMPTION, they will receive a designation of homestead eventually for free. Designation of Homestead is not and does not affect Homestead Tax Exemption.Recording a "Designation of Homestead" in public records is not required by law.

Once filed a Texas homestead exemption is valid as long as the homeowner lives on the property and is using it as the primary residence. If the homeowner moves out of the property and rents it then the exemption goes away.