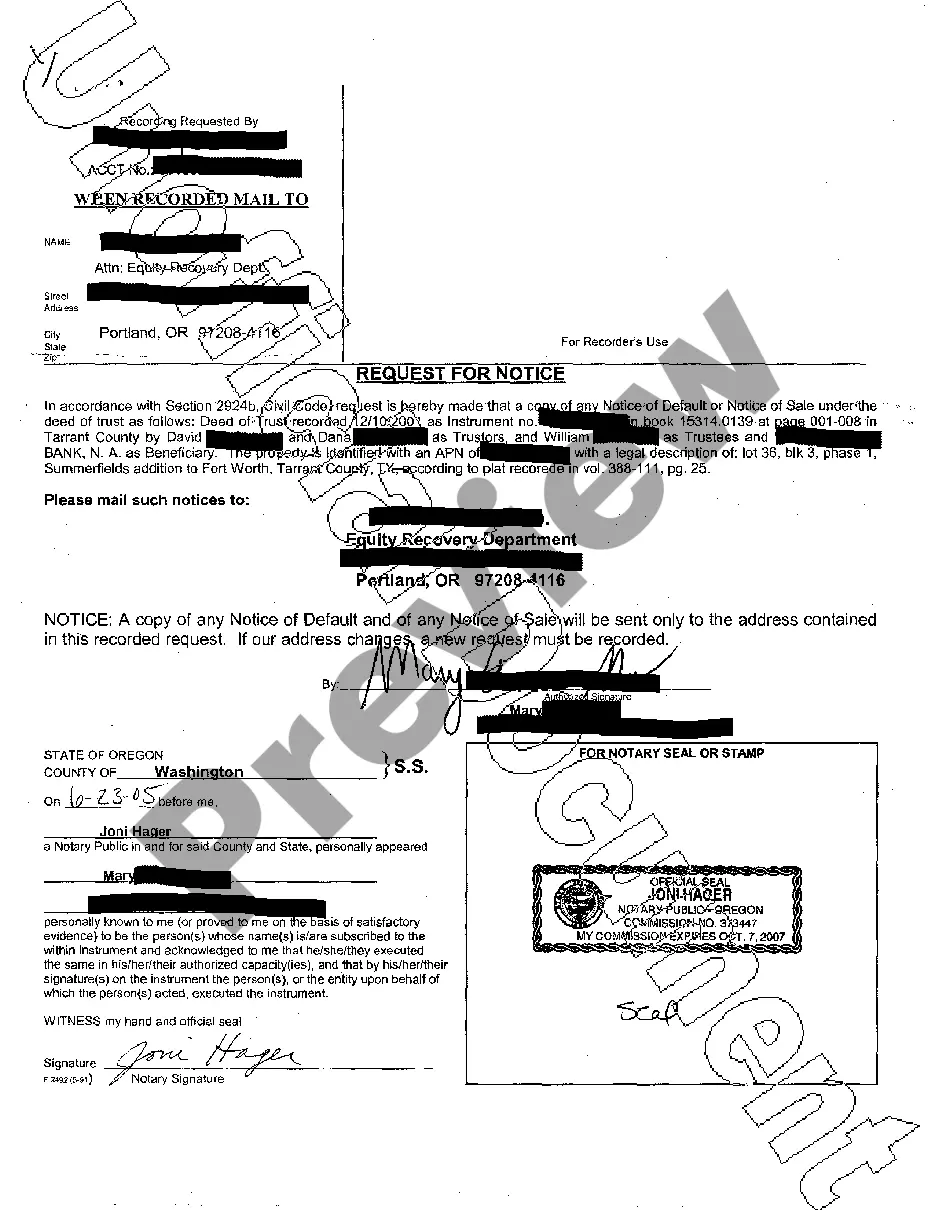

Texas Request for Notice of Default or Notice of Sale

Description

How to fill out Texas Request For Notice Of Default Or Notice Of Sale?

Access to high quality Texas Request for Notice of Default or Notice of Sale templates online with US Legal Forms. Steer clear of days of wasted time browsing the internet and dropped money on files that aren’t updated. US Legal Forms offers you a solution to just that. Find around 85,000 state-specific authorized and tax templates that you can download and complete in clicks in the Forms library.

To find the example, log in to your account and then click Download. The document is going to be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- Verify that the Texas Request for Notice of Default or Notice of Sale you’re looking at is appropriate for your state.

- Look at the form using the Preview option and browse its description.

- Check out the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to register.

- Pay out by card or PayPal to complete creating an account.

- Pick a favored file format to save the file (.pdf or .docx).

You can now open the Texas Request for Notice of Default or Notice of Sale template and fill it out online or print it out and do it by hand. Take into account sending the papers to your legal counsel to ensure things are filled out properly. If you make a mistake, print out and fill application once again (once you’ve registered an account every document you download is reusable). Create your US Legal Forms account now and get access to a lot more forms.

Form popularity

FAQ

Write to the agency making the claim. Present evidence of why the NOD was improperly issued or why you legitimately cannot make payments. Ask the agency in the letter if they will take a lower monthly payment, total settlement or a payment plan. Send a copy of your letter by certified mail.

The notice of default doesn't affect your credit file, but when the account defaults this will be recorded.If the debt is regulated by the Consumer Credit Act, you must be sent a default notice warning letter and have time to act on it before the default is recorded on your credit file.

Foreclosure rules in Texas require that you have at least 21 days' notice in writing, beginning on the day the notice goes into the mail, before the lender sells your home at auction. The lender must also post the Notice of Sale at the door of your county courthouse and file it with the clerk of that county.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

After the judge issues a ruling, the former homeowner has five days to vacate the property or appeal the ruling. If the former homeowner is still living on the premises after five days, the constable will post a notice on the front door giving the former homeowner 24 hours to move out.

The foreclosure process is defined by California civil code 2924 and begins with the filing of a Notice of Default (NOD) with the county recorder. Once a borrower is at least 90 days behind in making mortgage payments, the lender will file a Notice of Default with the court of the county where the property is located.

After the lender files the Notice of Default, you get 90 days to bring your past-due bill current. After the 90 days pass, the lender files a Notice of Sale with the clerk. The Notice of Sale displays the location, date and time of the sale. It lists the trustee's name and contact information.